Stimulus Check: Economic Impact Payment

A federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check under the Coronavirus Aid, Relief, and Economic Security Act . In order to receive a check, an incarcerated person must fill out an IRS Form 1040 with EIP 2020 written at the top and mail it to the IRS. Additional information on how to obtain an IRS Form 1040 or the Economic Impact Payment has been posted in housing unit wings and the offender library.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

How Much Should I Have Received

The first economic impact payment was worth $1,200 per adult earning up to $75,000 in 2019 and $500 per child under age 17. The second was valued at $600 per adult earning up to $75,000 and $600 per child. After those income limits, the payments phase out.

There are many calculators you can use to estimate how much money you should have received total. Additionally, the IRS is including a Recovery Rebate Credit Worksheet in the instructions for Form 1040.

If you received the proper payment amounts for each check, then you don’t need to do anything on your tax return.

Read Also: Where’s My 3rd Stimulus Payment

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

With tax season approaching, those who have not received their stimulus payments or think the IRS deposited the wrong amount can finally take action to get the money theyre owed.

The IRS has already distributed the vast majority of economic impact payments to households without issue. But some people either fell through the cracks or received the wrong amounts. Those people can claim their missing money on their 2020 tax returns.

If you believe youre owed money from the IRS, heres what to know about stimulus payments and your taxes.

More 1040 Tax Form Help

Want more 1040 tax form guidance? View H& R Blocks tax filing options to fit with your unique tax situation.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you complete your Form 1040.

Related Topics

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

Read Also: Netspend All Access Stimulus Check 2021

Do I Qualify For The Recovery Rebate Credit

The Recovery Rebate Credit is figured like the EIPs, except that the credit eligibility and the credit amount are based on the IRSs most recent information for you on file.

Generally, you are eligible to claim the Recovery Rebate Credit if:

- You were a U.S. citizen or U.S. resident alien in 2021.

- You are not a dependent of another taxpayer for tax year 2021.

- You have a Social Security Number valid for employment that is issued before the due date of your 2021 tax return .

You wont qualify for the Recovery Rebate Credit if you already received your full amount for EIP3.

When Can I File

The tax season was pushed back a few weeks to Feb. 12 this year to give the agency time to program systems to reflect tax law changes implemented late in 2020, including the second round of stimulus checks.

Tax preparation companies are already accepting returns. Assuming you have all the paperwork you need, you can prepare your return now to be filed on Feb. 12. And remember: If your income was $72,000 or less in 2020, you can use the IRS’s Free File Program to file your federal return for free.

Also Check: Senior Citizens 4th Stimulus Check

Who Should File A 1040 Tax Form

If you receive these types of income or losses, you may need to file a 1040 tax form:

- Beneficiary of an estate or trust

You must file a Form 1040 if you have any of these:

- Tips you didnt report to your employer.

Look Through Possible Taxes And Credits

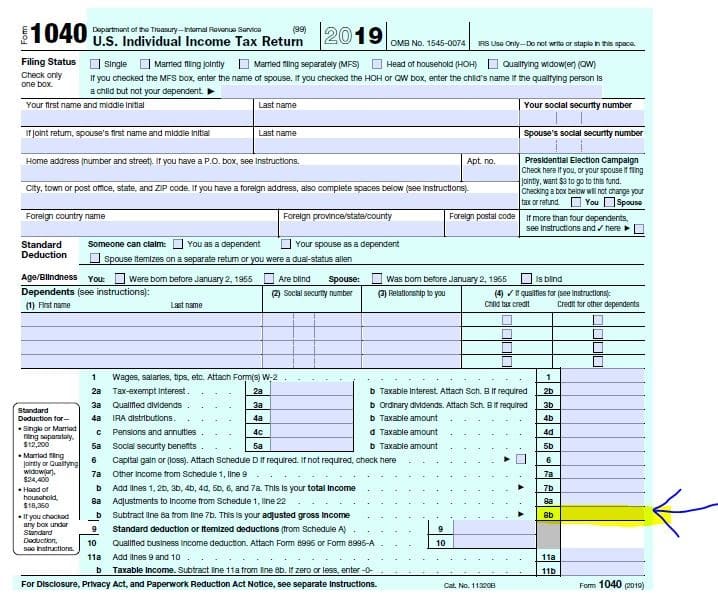

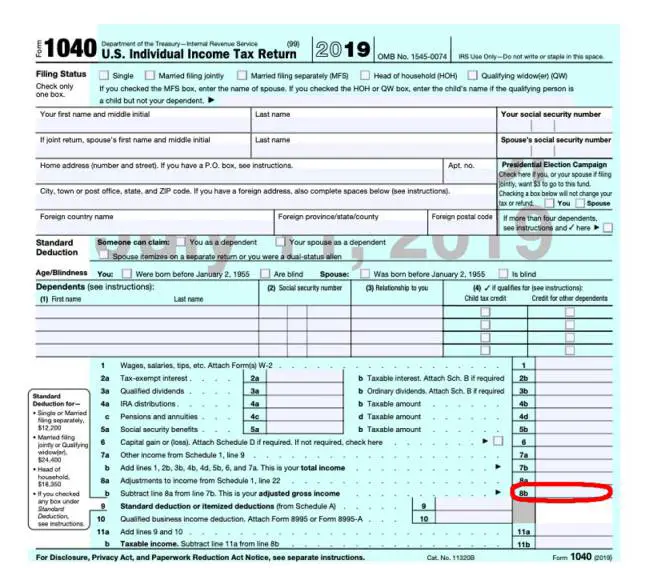

Once youve made necessary adjustments and found your AGI, there are some other taxes and credits to consider. First of all, you need to enter on Line 9 either your standard deduction or the amount of your itemized deductions. If you have a qualified business income deduction, you will enter that on Line 10.

Lines 11 through 14 allow you to enter the amounts of certain credits if you qualify for them. For instance, you can enter the amount of your child tax credit on Line 13a.

If you already had some federal tax withheld from your income, you can enter that amount on Line 17. You will also need to attach Schedule 4 if you have paid other taxes.

You May Like: Status On 4th Stimulus Check

What Is The Recovery Rebate Credit

The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment to claim the missing amount on the following tax return.

When you file your 2021 tax return, you can use the Recovery Rebate Credit to claim any missing amounts from the third EIP.

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Read Also: When Did I Receive My Stimulus Check

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

What Is The Purpose Of A 1040 Form

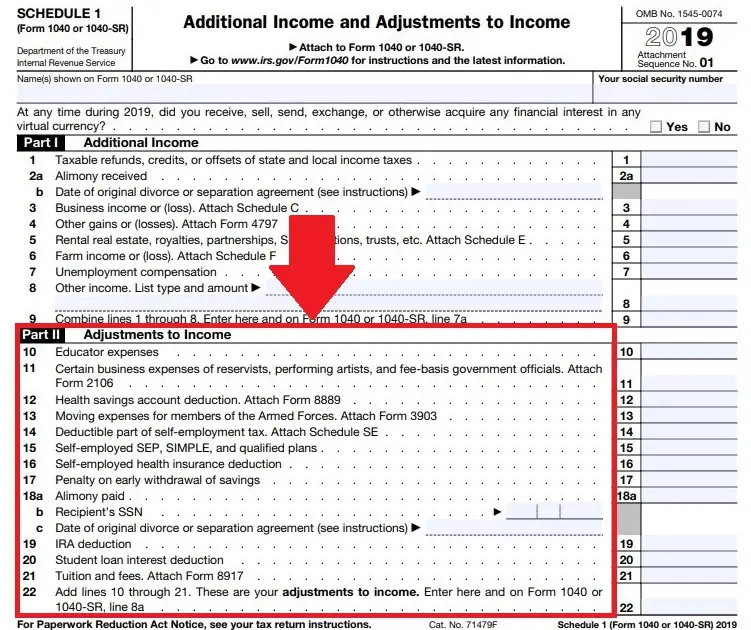

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many credits and deduction limitations are affected by it.

On line 11 of the tax year 2021 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

Recommended Reading: How Can I Cash My Stimulus Check

Why Are There Different Versions Of The 1040 Form

There are now four variations of the 1040 form :

- Form 1040: This is the one the majority of taxpayers will use to report income and determine their tax for the year and any refund or additional tax owed.

- Form 1040-SR: This version is for senior taxpayers . Form 1040-SR is nearly identical to Form 1040, but is printed using a larger font and includes a chart for determining the taxpayer’s standard deduction.

- Form 1040-NR: This form is for non-resident aliens, and it’s several pages longer than the other 1040 form versions.

- Form 1040-X: This form is for taxpayers who need to make amendments to their tax return after previously filing a Form 1040.

Where To Find Form 1040

The IRS offers a PDF version of Form 1040 that you can fill out manually, but dont go looking for the 2021 version the one youll use to file your tax return in 2022 just yet. The 2021 Form 1040 is still in draft form and probably wont be finalized until mid-January 2022. This gives Congress time to make last-minute changes to tax law and gives the IRS time to update tax forms to reflect those changes.

To fill out Form 1040, you can also:

- Use the IRSs Free File Fillable Forms

- Pick up copies of tax forms at an IRS Taxpayer Assistance Center

- Request copies by calling 1-800-829-3676

- Use one of the popular tax software programs like TurboTax, TaxAct, or H& R Block

No matter which method you choose, tax forms typically arent available until mid-January.

Also Check: How Can I Get My Second Stimulus Check

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

What Is An Irs 1040 Form

OVERVIEW

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040. Well review the differences and show you how file 1040 form when it comes to tax time.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules.

Heres a guide to all of the 1040 variations you may come across. to begin preparing your tax documents.

You May Like: Is The Homeowners Stimulus Real

Fill In Your Basic Information

The first half of Form 1040 asks some basic questions about your filing status, identification, contact information, and dependents.

When entering your name and the names of your spouse and dependents, be sure to enter them exactly as they appear on their Social Security cards. Using a nickname or married name can result in your tax return being rejected for electronic filing and processing delays for paper returns.

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

“Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,” the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency’s website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRS’ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

Recommended Reading: Filing 2020 Taxes For Stimulus Check

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online To read, print, or download your transcript online, youll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Also Check: How Do I Claim My Third Stimulus Check

How To Fill Out Stimulus Rebate Form

How To Fill Out Stimulus Rebate Form Youve come to the right site if youre unsure how to complete a stimulus rebate form. You will learn more about this forms requirements in this post, along with instructions on how to determine your recovery rebate credit. Samantha Hawkins, a certified public accountant and the owner of Hawkins CPA Solutions in Upper Marlboro, Maryland, is the author of this article.

Electronic Filing Now Available For Form 1040

You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR. For more details, see our on this topic.

Paper filing is still an option for Form 1040-X.

File Form 1040-X to:

- Correct Form 1040, 1040-SR, or 1040-NR .

- Make certain elections after the deadline.

- Change amounts previously adjusted by the IRS.

- Make a claim for a carryback due to a loss or unused credit.

Read Also: Get My 2nd Stimulus Payment

What If My Income Or Household Size Changed From 2019 To 2020

The payments were based off 2019 income and household size. If your income and/or household size changed in 2020, then you might qualify for more money.

Here’s an example: A single person made $150,000 in 2019, but lost her job at some point in 2020 and only made $50,000 for the year. She wouldn’t have qualified initially for either payment, but can now claim the full amount on her 2020 tax return, and expect a total of $1,800. This also applies to people who received a partial payment, but their income fell enough in 2020 that they became eligible for the full $1,200 and $600.

Another situation in which a taxpayer may be owed money is if, for example, he had one child in 2019, and then another in 2020. He only received payments for one of the dependents, but can claim the second on his tax return now and expect to receive $1,100.

Finally, many low-income individuals who do not normally file taxes may not have gotten their payments. While they can file a return in 2020, President Joe Biden has directed the Treasury Department to take additional measures to finally deliver payments to anyone who has not received them yet.