Will I Get An Eip Card

For the first and second stimulus checks, the Treasury Department sent millions of taxpayers an economic impact payment debit card. For the first stimulus check, EIP cards were sent to individuals who had not received a tax return by direct deposit in the past and who had their tax returns processed by certain IRS service centers. For the second stimulus check, the Treasury Department sent EIP cards to a majority of taxpayers.

If you received an EIP card for the second stimulus payment, you will probably receive a new EIP card for the third stimulus payment. If you receive an EIP card, read the material that comes with it carefully they come with fees for checking your balance, using a teller for withdrawals, or using an out-of-network ATM.

Whos Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

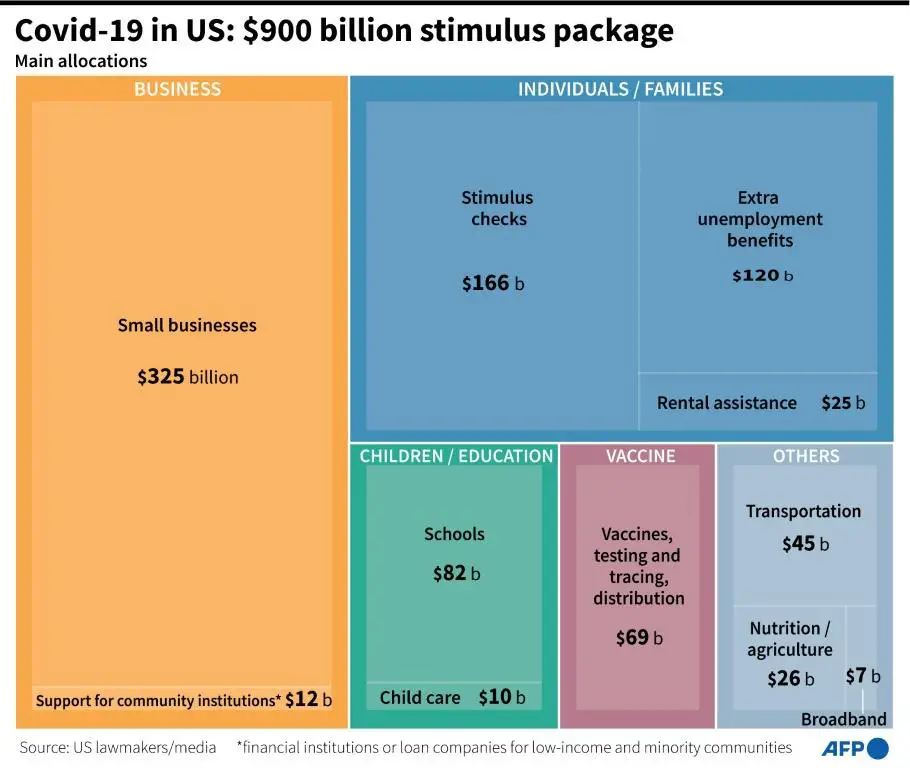

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Don’t Miss: Spectrum Stimulus Internet Credit Application

What If I Don’t Receive A Third Stimulus Check

Those who don’t file tax returns, including those who earn little income and recent college graduates, may have to wait until they file a tax return in April 2022 to get their stimulus rebate if they didn’t file a tax return for 2020 taxes or submit “non-filer” information to the IRS last year. Married couples with incomes below $24,400 and individuals with incomes under $12,200 fall into this category.

The IRS is still updating its Get My Payment tool with new payment information. Once it’s loaded with up-to-date information, individuals can check when their stimulus payment went out. If you have any issue with getting your second or third payment, see our article on what to do if you haven’t received your stimulus check.

Filing a tax return for 2020. If you don’t receive government benefits, and you didn’t file a tax return for 2019 or 2020 taxes or submit “non-filer” information to the IRS by November 21, 2020, you may not automatically get a third stimulus check. You might need to wait to file a tax return for the 2021 tax year and request a “Recovery Rebate Credit.” You will fill in the amount you are owed on line 30 of IRS Form 1040 .

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Read Also: How Much Was Second Stimulus Check

This Article Talks About:

Andy Meek is a reporter who has covered media, entertainment, and culture for over 20 years. His work has appeared in outlets including The Guardian, Forbes, and The Financial Times, and hes written for BGR since 2015. Andys coverage includes technology and entertainment, and he has a particular interest in all things streaming. Over the years, hes interviewed legendary figures in entertainment and tech that range from Stan Lee to John McAfee, Peter Thiel, and Reed Hastings.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Do I Even Really Need Irs Letters 6475 And 6419 To File My Taxes

You certainly need to keep any letters received for your records, and the amounts received need to match what you put on your 2021 tax return. Having these official documents makes accurate information much easier to access.

While you could probably find or calculate those amounts on your own, using the letters themselves reduces the risk of mismatched info, which could cause your return to be rejected.

Also Check: When Is The Third Stimulus Checks Coming Out

Don’t Miss: News On 4th Stimulus Checks

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

What To Do If The Irs Needs More Information

If the Get My Payment tool gave you a payment date but you still havent received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports Need More Information, this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

Read Also: How Do I Go About Getting The Stimulus Check

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

How Much Are The Payments Worth

The third economic impact payment is worth up to $1,400 per individual and dependent.

Single filers earning an adjusted gross income up to $75,000 and heads of household earning up to $112,500 will receive $1,400, and married couples earning up to $150,000 are eligible for $2,800. Those taxpayers will also receive $1,400 for each dependent.

After that, there is a steep income phase out: The payments decrease to zero for single filers at $80,000, for heads of household at $120,000 and for married couples at $160,000 AGI. Taxpayers will receive the same amount for each dependent.

The phase out rate is not uniform for the third round of direct payments, according to the Tax Foundation. It will depend on a taxpayers filing status and the number of dependents.

Single filers, for example, will experience a 28% phase out rate, meaning that they will receive $280 less for every $1,000 over $75,000 they earn, says Garrett Watson, a senior policy analyst at the Tax Foundation. An individual with an AGI of $77,000 would receive $840.

At the same time, while a married couple with no dependents would also see a 28% phase out rate, a couple with one dependent would see a 42% phase out rate. A couple with one dependent and an AGI of $155,000 would receive $2,100 total.

To see how much relief you may receive, use this calculator.

Dont Miss: Apply For Stimulus Check Online

You May Like: How Much Were The Stimulus Payments In 2021

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

You Need This Document To Claim Your Third Stimulus Check When Filing Your 2021 Taxes

FILE – This May 8, 2008, file photo shows blank checks on an idle press at the Philadelphia Regional Financial Center, which disburses payments on behalf of federal agencies in Philadelphia. AP

The third round of stimulus checks was delivered to millions of Americans throughout 2021, but even so, some may not have received their payment.

Hence, the IRS recommends claiming it as Recovery Rebate Credit on their 2021 taxes. Though, theres an important tax document in the mail these taxpayers will need in order to claim the missing payment.

According to AS USA, Letter 6475 should arrive in the mail at the end of January. Letter 6475 will provide taxpayers who are eligible to claim a missing third-round stimulus check will vital information on the matter to include when they file their 2021 taxes.

Not only are eligible Americans who didnt recieve the stimulus check able to claim it on their taxes, but people who received the incorrect amount can also calim the correct amount on their taxes.

The third round of stimulus checks was an economic benefit part of the American Rescue Plan, signed into effect by President Joe Biden in March 2021. Millions of Americans started receiving the stimulus check in March, while delays and errors occur for many others. The stimulus checks were worth up to $1,400 for eligigble indidvuals, making $75,000 or under.

READ MORE:

Also Check: How Many Stimulus Checks Were In 2021

When Should I Receive The Stimulus Check

For those who have e-filed tax returns with the IRS in the past or otherwise provided the IRS with their direct deposit information, the IRS started to direct-deposit stimulus money last weekend.

Other individuals will receive their payments by mail. The IRS will start mailing some checks in mid-March. If you received the first or second stimulus check by direct deposit, theres no guarantee youll receive the third check by direct deposit, especially if you filed your tax return after your first or second stimulus payment and didnt use direct deposit for your tax refund.

Expect Delays Especially If You Had Previous Payment Issues

Like the previous round of stimulus/economic impact payments, there will likely be payment issues given the expanded eligibility and dependent groups now able to get this payment . Also if you had issues in the past, and I know many are still waiting for the prior payments or had to claim them as a recovery rebate credit, expect some delays with the coming round of payments.

The good news is that the weekly batches will keep happening till the end of the year as the IRS aims to make payments to all eligible recipients . They are also actively sending payments to individuals for whom information was not earlier available but who recently e-filed a tax return.

Don’t Miss: Didn’t Get Stimulus Payment

Get Your Stimulus Check: File With The Irs

As part of the Coronavirus Aid, Relief and Economic Security Act Americans will be receiving economic impact payments to provide some financial relief during the COVID-19 pandemic.

The IRS has begun to distribute these payments. However, in order to receive these payments individuals and couples must have filed with theInternal Revenue Service .

Recommended Reading: Where Is My $600 Dollar Stimulus Check

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Read Also: How To Cash My Stimulus Check

Will I Receive A Paper Check Or A Debit Card

Like the prior EIP1 and EIP2, most people will receive their payment by direct deposit, but some people will get either a check or debit card. The best way to find out which is to check the Get My Payment tool, available only on IRS.gov. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. Treasury is issuing some payments using debit cards to speed delivery of the payments and reach as many people as soon as possible. The form of payment people receive for this third stimulus payment may differ from the prior EIP1 and EIP2.

How Does The Stimulus Check Calculator Estimate Reduced Payments

Once the AGI for a filer hits the income limit for the full stimulus check, the amount of the payment is reduced. The payment amount phases out completely once a filers AGI exceeds the maximum AGI for the filing status. Our calculator uses the rate of reduction provided by the IRS to calculate your estimated stimulus check based on the information you provide.

Don’t Miss: Did They Pass The Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Reconciling Your Covid Stimulus Payment On Your Tax Return

The COVID stimulus payment provided earlier this year brought financial relief to many who were struggling near the beginning of the pandemic. But it also brought some confusion to tax payers about how this stimulus check would be handled when it was time to file taxes. While we have touched on this topic in the past, we wanted to provide you with some more specific information regarding how this income is reported on your return, as well as addressing some other common questions about the stimulus payments.

Do You Need to Report Your Stimulus Payment?

Because your COVID stimulus check was non-taxable income, you do not need to report it on your 2020 tax return. The amount you received was not an advance on your tax refund, and will not reduce any refund you get in 2021 or increase any amount you may owe.

There will be an additional worksheet available for some tax filers this year for reporting your total Economic Impact Payment. However, the IRS has advised that this worksheet is only for those who did not receive a stimulus payment or who received less than the maximum payment amount.

Receiving Additional Stimulus Payments

Fill out the new worksheet and submit it along with Notice 1444. If you qualify for any additional stimulus payments, the Recovery Rebate Credit will be applied to your tax return. Note that, if you owe taxes, this may simply reduce your tax bill otherwise, any extra amount you qualify for will be distributed with your tax refund.

You May Like: Is There Another Stimulus Check Coming For Seniors