Your Stimulus Payments Wont Be Taxed But There Is One Exception

The IRS doesnt consider stimulus payments to be income, which means you wont be taxed on your stimulus money. That also means a direct payment you get this year wont reduce your tax refund in 2021 or increase the amount you owe when you file your 2020 tax return. You also wont have to repay part of your stimulus check if you qualify for a lower amount in 2021. If you didnt receive everything you were owed this year, you can claim your full stimulus check amount as a Recovery Rebate Credit on your 2020 federal income tax return when you file this month .

However, another big caveat here: If you are filing for any missing stimulus money as a Recovery Rebate Credit on your tax return this year, the IRS can potentially garnish that money to pay for any back taxes you owe. Again, an independent taxpayer advocacy group within the IRS is working with the agency to address this issue to protect those funds for vulnerable taxpayers.

Is the stimulus money really yours? That depends.

How Much Stimulus Money Can I Expect

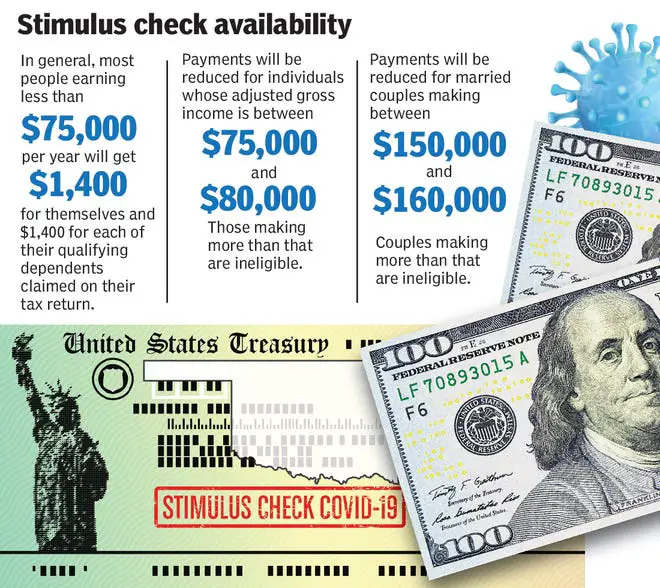

You could receive up to $1,400 per qualifying person, but its important to remember that the amount you get will depend on several factors:

- Your tax filing status

- $120,000 for head of household filers

- $160,000 for married couples filing jointly

If you earn more than these upper limits, you wont get any stimulus money this time.

Hint: This math is complicated, but our third stimulus check calculator can do it all for yousliding scale and all.

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Read Also: Why Have I Not Received My 3rd Stimulus Check

How Much Will The Third Stimulus Check Be

The relief package includes a third round of stimulus checks in the amount of $1,400 per person or $2,800 per married couple filing jointly.

The exact amount and your eligibility will be determined by your most recent tax returns.

Eligible Americans will also receive $1,400 per dependent, which can include college students and adult dependents.

Will People Receive A Paper Check Or A Debit Card

The IRS encourages people to check Get My Payment for additional information the tool on IRS.gov will be updated on a regular basis starting Monday, March 15. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. To speed delivery of the payments to reach as many people as soon as possible, some payments will be sent in the mail as a debit card. The form of payment for the third stimulus payment may differ from the first two.

People should watch their mail carefully. The Economic Impact Payment Card, or EIP Card, will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. More information about these cards is available at EIPcard.com.

Read Also: Are We Going To For Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Don’t Miss: Get My Stimulus Payment 1400

Do I Have To File 2020 Taxes To Get The Third Stimulus Check

No. The Treasury can use 2019 or 2020 tax returns to determine your payment.

It will also send payments to people who don’t file taxes, but who either used the IRS nonfilers tool last year to submit information or receive federal benefits such as Social Security retirement or disability and Supplemental Security Income.

However, if you qualify for more money based on your 2020 income or need to claim additional dependents, you will need to file a 2020 tax return so the IRS can top off your payment.

Third Round Of Stimulus Checks: March 2021

Barely a week after the second round of stimulus payments were completed, new president Joe Biden entered office and immediately unveiled his American Rescue Plan, which proposed a third of round of payments to Americans, including some of those who might have missed out on the first two rounds.

On Thursday 11 March, Biden signed his $1.9tn American Rescue Plan into law. The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800. In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependent’s age this time, there was no limit to the number of dependents that could be claimed for.

The first stimulus payments were issued swiftly – just hours after Biden has signed the bill, the first batch of 164 million payments, with a total value of approximately $386 billion, arrived by direct deposit in individuals bank accounts. Some received their payments on the weekend of 13/14 March 2021. Since then, payments had been sent on a weekly basis including “plus-up” payments until the end of the year. Like before, those who didn’t get all the EPI3 funds in 2021 due to them will be able to claim them when they file their tax returns in the spring of 2022.

You May Like: How Many Federal Stimulus Checks Were Issued In 2021

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

Youre claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

You May Like: How To Check If Received Stimulus Check

Which Tax Return Is Used For My Third Stimulus Check

The IRS uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. The new stimulus plan targets lower income ranges to exclude higher-earning taxpayers from getting a payment.

As we pointed out before, individuals making under $75,000 get the maximum stimulus payment of $1,400 . But payments are capped at $80,000 for single filers and $160,000 for couples. So filing at the beginning of the tax season with a lower income may help you qualify for a bigger check. But, if your income went up in tax year 2020, then you may want to delay filing so that eligibility is determined by your lower 2019 income.

You might also want to file early if the size of your family increased in 2020. The new stimulus plan includes a child tax credit that pays up to $3,600 for each qualifying child under 6 years old, and $3,000 for every child between ages 6 and 17. This means that if you became a parent during the tax year, you could get an additional payment by claiming your child as a dependent earlier.

SmartAssets child tax credit calculator will help you figure out how much you could get for each child.

You can use SmartAssets tax return calculator to figure out your 2021 tax refund or tax bill.

You May Like: What Were The Three Stimulus Payments

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Read Also: Stimulus Check Irs Social Security

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced — above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

What If I Filed My Taxes For The First Time In 2020

First-time taxpayers may face additional delays in receiving their stimulus payments.

Before the IRS can issue these stimulus checks, they must receive and process your 2020 tax return. However, due to new tax codes and more complicated tax filings this year , as well as processing stimulus payments, the IRS is backlogged. There are already 6.7 million returns yet to be processed, which is significantly higher than the nearly 2 million delayed returns at this point last year.

Read More: Best Tax Software of 2021

The IRS has said that it continues to process tax refunds while it processes stimulus payments. If you have not filed your 2020 taxes and anticipate a refund, the IRS recommends filing electronically and providing your direct deposit information. According to the IRS.gov, IRS issues more than 9 out of 10 refunds in less than 21 days.

However, the Washington Post reported that some people who filed on Feb. 12 are still waiting for their returns to be processed.

Don’t Miss: Where My Second Stimulus Check

Why Stimulus Checks Are Still Needed

The economy shrank by 3.5 percent in 2020, the largest single-year decline since the end of World War II. Weekly unemployment figures remain historically high, with approximately 730,000 people initially applying for unemployment insurance in the third week of February. An additional 451,000 sought Pandemic Unemployment Assistance. Another 1 million people received Pandemic Emergency Unemployment Compensation, benefits for those whose unemployment aid has otherwise run out. That group now totals 5 million people.

At the start of February, approximately 19 million people were receiving unemployment benefits of one kind or another. Thats one out of every nine workers. While the official unemployment rate is 6.3 percent, the actual rate is probably closer to 10 percent, given all the people who have dropped out of the labor force.

An economic bounceback depends on the widespread distribution of a COVID vaccine. But efforts to inoculate the public have proceeded sluggishly at times. Shortages and winter weather have forced some areas to temporarily close vaccination centers and scale back administering the vaccine in recent weeks. Many who qualify have faced problems in scheduling appointments. Nevertheless, over 50 million people have received at least one dose of a vaccine.

Originally published at 2:46 p.m. ET on Thursday, February 11, 2021.

Who Is At Risk Of Seeing Smaller Payouts

The latest program creates a sharp drop-off in the households that will receive payments and in the partial payment amounts, said Garrett Watson, senior policy analyst for the Tax Foundation.

The full $1,400 goes to single people earning up to $75,000. But it phases out quickly after that and is completely phased out for those earning more than $80,000.

A full payment of $2,800 goes to a married couple filing a joint federal income tax return earning up to $150,000. The phaseout begins after that and ends at $160,000.

“This creates an implicit marginal tax at the phaseout range,” Watson said.

Someone might be less willing, for example, to pick up an extra $1,500 or more in income this year if they’re already making $75,000 because they’d lose some decent stimulus cash along the way.

Watson said the latest phaseout range isn’t ideal tax policy.

“It can dissuade people around that income range from earning more income this year when looking ahead to their 2021 tax filing,” Watson said.

Also Check: Who Qualify For Third Stimulus Check

Is There A Cap On The Third Stimulus Check

There’s a strict income limit for the third stimulus payment The third stimulus check comes with a $1,400-per-person maximum. To “target” or restrict the third check to lower- and middle-income households, the legislation includes eligibility rules that exclude individuals and families at the highest income levels.

Proposed $1400 Stimulus Calculator

Use details from your 2019 or 2020 tax return

1. Choose your filing status below.

2. What was your adjusted gross income ?

3. How many qualified dependents did you claim in your taxes?

Below we show who will get the full stimulus amount and when you’ll completely phase out of receiving a payment. As an individual or couple’s income goes up, the size of the partial payment gets smaller.

If you think the check size you receive is in error and doesn’t match your below estimate, it’s possible you may need to claim the rest of your payment at a later time.

You May Like: Stimulus Check For Healthcare Workers