If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

More Details About The Third Round Of Economic Impact Payments

FS-2021-04, March 2021

The Internal Revenue Service, on behalf of the Treasury Department, worked to quickly begin delivery of the third round of Economic Impact Payments authorized by Congress in the American Rescue Plan Act in March 2021. Here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two sets of stimulus payments in 2020, referred to as EIP1 and EIP2.

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Read Also: Is Economic Impact Payment Same As Stimulus

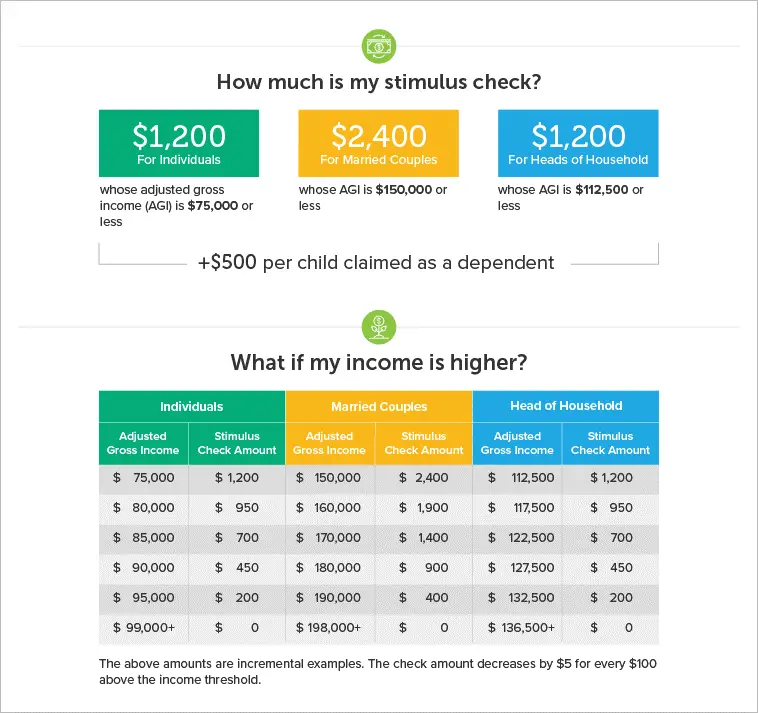

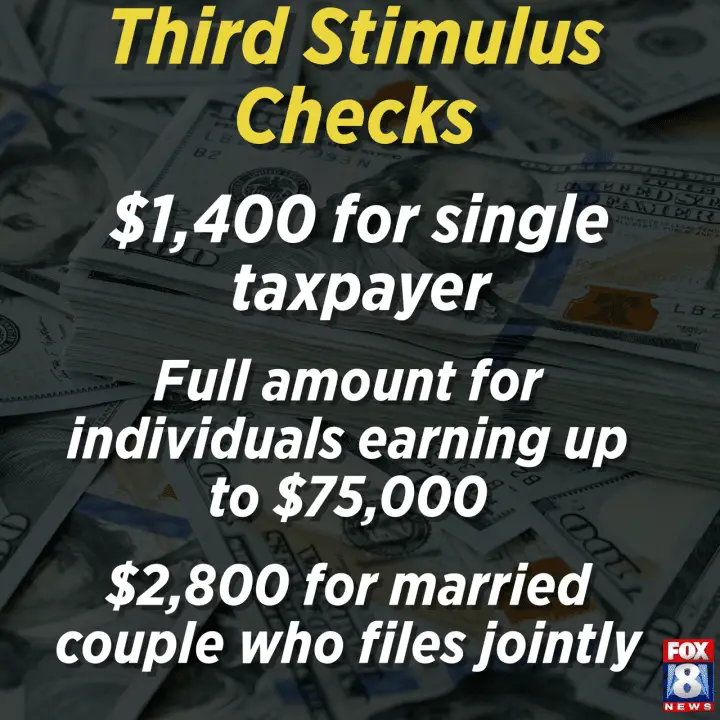

How Much Is The Third Economic Impact Payment

Those eligible will automatically receive an Economic Impact Payment of up to $1,400 for individuals or $2,800 for married couples, plus $1,400 for each dependent. Unlike EIP1 and EIP2, families will get a payment for all their dependents claimed on a tax return, not just their qualifying children under 17. Normally, a taxpayer will qualify for the full amount if they have an adjusted gross income of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household and up to $150,000 for married couples filing joint returns and surviving spouses. Payment amounts are reduced for filers with incomes above those levels.

How Much Stimulus Money Can I Expect

You could receive up to $1,400 per qualifying person, but its important to remember that the amount you get will depend on several factors:

- Your tax filing status

- $120,000 for head of household filers

- $160,000 for married couples filing jointly

If you earn more than these upper limits, you wont get any stimulus money this time.

Hint: This math is complicated, but our third stimulus check calculator can do it all for yousliding scale and all.

Don’t Miss: Can Unemployed Get Stimulus Check

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

When Is The Third Stimulus Check Coming

Third checks cant come fast enough for the millions of Americans still out of work. More than a third of respondents to a recent survey from Money and Morning Consult say their situation is somewhat or much worse now than it was in February 2020 .

Biden signed the plan into law Thursday afternoon. Last time, it took just days for Americans to start seeing stimulus payments in their bank accounts after the relief package was signed.

Read Also: Can You Still Claim Stimulus Check

When Should I Receive The Stimulus Check

For those who have e-filed tax returns with the IRS in the past or otherwise provided the IRS with their direct deposit information, the IRS started to direct-deposit stimulus money last weekend.

Other individuals will receive their payments by mail. The IRS will start mailing some checks in mid-March. If you received the first or second stimulus check by direct deposit, there’s no guarantee you’ll receive the third check by direct deposit, especially if you filed your tax return after your first or second stimulus payment and didn’t use direct deposit for your tax refund.

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Don’t Miss: How Many Stimulus Checks Should I Have Received

When You’ll Get Your Ssdi November Payment

Here’s when your payment will arrive, based on your date of birth:

SSDI payment for those with birthdays falling between the 1st and 10th of any given month.

Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

For more details, here’s how to see your Social Security COLA benefits increase online. Also, here are the prices for Medicare premiums and deductibles in 2023.

Get the So Money by CNET newsletter

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Don’t Miss: How Do I Apply For The 4th Stimulus Check

What Are The Eligibility Requirements For A Third Stimulus Check

The details are still being discussed in House committees this week while the Senate is in recess. However, these are the likely basic eligibility requirements based on Bidens American Rescue Plan, which is serving as the template, and the House Ways and Means Committee Recovery Rebates proposal.

All estimates are based on the most recent AGI on file with the IRS and, like the last two checks, up to a maximum ceiling will gradually phase out.

Maximum available amounts for lowest earners

- $1,400 for qualifying individuals

- $2,800 for qualifying couples who file a joint tax return

- $1,400 for each dependent child under the age of 17

- $1,400 for each qualifying adult dependent

Qualifying income thresholds and phase out limits

- Single filers: under $75,000 gets full amount, phase-out begins thereafter. AGI of $100,000 and over gets no check.

- Joint filers: under $150,000 gets full amount, phase-out begins thereafter. AGI of $200,000 and over gets no check.

- Head of household: under $112,000 gets full amount, phase-out begins thereafter. AGI of $150,000 and over gets no check.

Head of household includes those who are single, widowed or divorced and claim a child as a dependent, for instance.

Get Your Stimulus Check: File With The Irs

As part of the Coronavirus Aid, Relief and Economic Security Act Americans will be receiving economic impact payments to provide some financial relief during the COVID-19 pandemic.

The IRS has begun to distribute these payments. However, in order to receive these payments individuals and couples must have filed with theInternal Revenue Service .

Read Also: How Many Stimulus Checks Did I Get In 2021

Recommended Reading: Where Is My $600 Dollar Stimulus Check

How Are Married Couples Affected If Only One Spouse Has A Social Security Number

As with EIP2, joint filers where only one spouse has a Social Security number will normally get the third payment. This means that these families will now get a payment covering any family member who has a work-eligible SSN.

For taxpayers who file jointly with their spouse and only one individual has a valid SSN, the spouse with a valid SSN will receive up to a $1,400 third payment and up to $1,400 for each qualifying dependent claimed on the 2020 tax return.

Active Military: If either spouse is an active member of the U.S. Armed Forces at any time during the taxable year, only one spouse needs to have a valid SSN for the couple to receive up to $2,800 for themselves in the third stimulus payment.

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

Also Check: Where Do I Put Stimulus Money On Tax Return

Reconciling Your Covid Stimulus Payment On Your Tax Return

The COVID stimulus payment provided earlier this year brought financial relief to many who were struggling near the beginning of the pandemic. But it also brought some confusion to tax payers about how this stimulus check would be handled when it was time to file taxes. While we have touched on this topic in the past, we wanted to provide you with some more specific information regarding how this income is reported on your return, as well as addressing some other common questions about the stimulus payments.

Do You Need to Report Your Stimulus Payment?

Because your COVID stimulus check was non-taxable income, you do not need to report it on your 2020 tax return. The amount you received was not an advance on your tax refund, and will not reduce any refund you get in 2021 or increase any amount you may owe.

There will be an additional worksheet available for some tax filers this year for reporting your total Economic Impact Payment. However, the IRS has advised that this worksheet is only for those who did not receive a stimulus payment or who received less than the maximum payment amount.

Receiving Additional Stimulus Payments

Fill out the new worksheet and submit it along with Notice 1444. If you qualify for any additional stimulus payments, the Recovery Rebate Credit will be applied to your tax return. Note that, if you owe taxes, this may simply reduce your tax bill otherwise, any extra amount you qualify for will be distributed with your tax refund.

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

You May Like: When Were The Three Stimulus Checks Sent Out

Incarcerated Individuals And Mixed Status Families Eligibility For Third Stimulus Checks

For the third stimulus check, anyone with a Social Security number can receive the stimulus check for themselves and their family members. This is different from the last bill and ensures that mixed families will receive the third stimulus checks too.

Its important to note that if you are incarcerated, you can still receive your check. And if you lost work or wages in 2020, you could get a higher amount than you did with the first or second stimulus checks.

And if you normally arent required to file taxes, either because of your income level or for other reasons, you are probably eligible for a stimulus payment.

Reminder: File your taxes by April 15!

Tip: If you havent yet filed your taxes, read about how to file your taxes for free and whether you should take a Refund Anticipation Loan.

The intention behind this stimulus check, as with the last two, is to support Americans during this difficult time. This may also be a good time to consider establishing savings habits to create a financial buffer for you and your family.

At SaverLife, our mission is to make saving money easier and more rewarding. We receive donations to give you cash rewards and prizes for building up your rainy day fund.

We invite you to visit our Forum, where you can raise questions, share experiences, and connect with SaverLife members. And !

How Much Will The Third Stimulus Check Be

The relief package includes a third round of stimulus checks in the amount of $1,400 per person or $2,800 per married couple filing jointly.

The exact amount and your eligibility will be determined by your most recent tax returns.

Eligible Americans will also receive $1,400 per dependent, which can include college students and adult dependents.

Read Also: Will There Be Another Stimulus Check In California

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

You May Like: Federal Mortgage Relief Stimulus Program