How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

How Can I Get My Stimulus Payment Faster

The quickest way to get your payment is through direct deposit. Beware of scams! The IRS will not contact you by phone, email, text message, or social media to request personal information especially banking details or ask you to provide a processing fee. They will send written correspondence with instructions on steps to take and the timeframe for action. Remember, you do not need to pay to get this money.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Hang up on phone calls you receive and delete email or text messages that seem too good to be true. You can report scams to the Better Business Bureau to helps protect others.

How Will I Get My Payment If I Got A Refund Anticipation Check Or Refund Anticipation Loan When I Filed My Taxes

The IRS will attempt to deliver your payment to the account information provided on your tax return. Some RALs and RACs are issued through debit cards. If the card is still active, you will receive your payment on the card. If the account or card is no longer active, the deposit will be rejected, and the IRS will send a paper check to the address on the tax return.

You can request a payment trace to track where and how your payment was delivered. You should only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check. See Question 24 to learn more about how to request a payment trace.

Don’t Miss: Amending Taxes For Stimulus Check

What Gaos Work Shows

1. IRS can use data to tailor outreach efforts.

It was challenging for IRS and Treasury to get payments to some peopleespecially nonfilers, or those who are not required to file tax returns. These people were eligible for the payments for a couple of reasons:

- first, there was no earned income requirement, so Americans with no or very little income could receive economic relief and

- second, the payments were refundable tax credits, so eligible individuals can claim the full amount even if it exceeds what they owe in taxes.

In 2020, Treasury and IRS used other data to identify and reach out to around 9 million potentially eligible nonfilers. In May 2021, TIGTA identified potentially 10 million individuals eligible for payments, but IRS has no further plans to reach out to these individuals.

We recommended that Treasury and IRS use available data to develop an updated estimate of total eligible individuals which they could use to better tailor and redirect their ongoing outreach and communications efforts for similar tax credits.

2. Improved collaboration will also help outreach to underserved communities.

We recommended that Treasury and IRS focus on improving interagency collaboration and use data to assess the effectiveness of their efforts to educate more people about refundable tax credits and eligibility requirements.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Recommended Reading: Will There Be Another Stimulus Check In 2020 To

Progress Towards An Evaluation Of Economic Impact Payment Receipt By Race And Ethnicity

President Bidens first executive order directed agencies to examine their policies and programs to identify whether and how they perpetuate barriers to equal opportunity.1 As part of this work, Treasury and the Census Bureau are working together to perform aggregated, statistical analyses of the Economic Impact Payments paid under the CARES Act in 2020 to examine potential disparities in the receipt of these payments by race and ethnicity. For todays Freedmans Bank Forum, we are providing an update on this project.

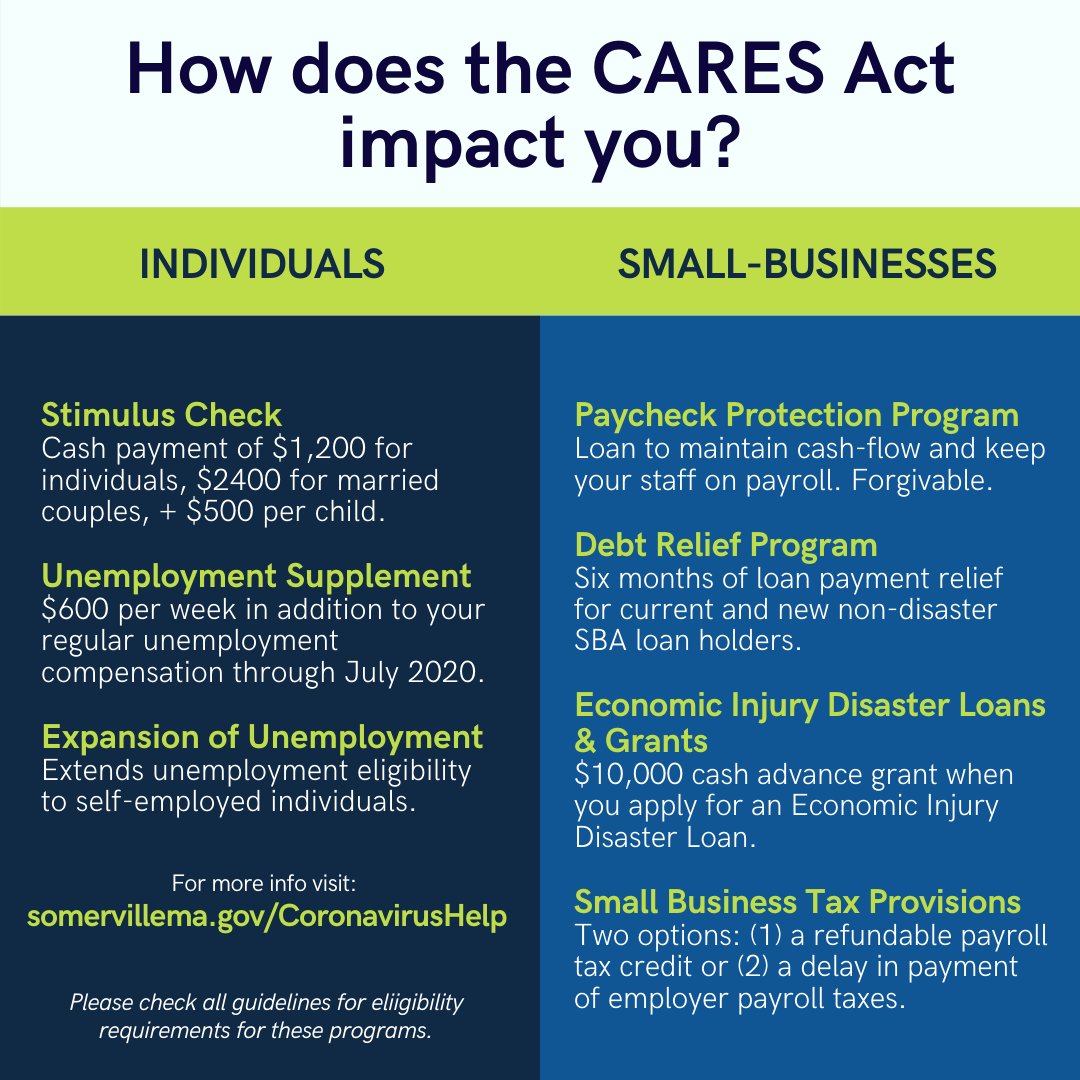

The Coronavirus Aid, Relief, and Economic Security Act , signed into law in March 2020, provided Economic Impact Payments to blunt the economic effects of the COVID-19 pandemic. This payment was worth up to $1,200 per adult plus $500 per child under age 17.2 For a family of four, this payment could provide up to $3,400 in direct financial relief. Subsequent legislation in 2020 and 2021 provided a second and third round of EIPs.

A challenge in studying the distribution of EIP receipt by race and ethnicityand one reason for the close collaboration between Treasury and Censusis that a persons race and ethnicity is not collected on tax forms. As a result, to examine the experiences of different groups, information about first-round EIP receipt maintained by the IRS was combined with demographic information microdata maintained by the Census.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Read Also: Where Is My Stimulus Refund

What Can I Do If The Amount Of My Stimulus Payment Is Wrong

If you didnt get the additional $500 for your children or didnt get the full payment amount that you expected based on your eligibility, you can get the additional amount by filing a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, and didnt get the first stimulus check or the full amount you are eligible for, you will also have to file a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Also Check: Irs.gov Stimulus Check 4th Round

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

My Small Business Needs Help

My small business needs help.

The Treasury Department is providing critical assistance to small businesses across the country.

* How to file your taxes with the IRS: Visit IRS.gov for general filing information. Havent filed your taxes? Heres information for non-filers. If your income is less than $72,000 you may be eligible to file your taxes for free, or call 829-1040.

You May Like: When Were All The Stimulus Checks Sent Out

Stimulus Payment Use By Income And Other Demographic Characteristics

Chart 2 identifies whether a respondents household received or expected to receive a stimulus payment and its expected use by household gross income. In line with the CARES Act guidelines, respondents with household incomes $200,000 or greater were most likely not to receive the payments .9 In the lowest income group, 88 percent reported receiving or expecting to receive a payment. Of these respondents, 77 percent reported using the payment for expenses. The rate of respondents reporting that they did not receive or did not expect to receive a payment was higher for incomes below $25,000 than for incomes between $25,000 and $99,000. The increase in this percentage is likely due to higher rates of respondents not expecting to receive a stimulus payment rather than simply not receiving a payment. Analysis of the third wave of the CFI COVID-19 Survey of Consumers revealed respondents with lower incomes were more likely to be unaware of the CARES Act relief programs.10 Additionally, there was confusion around the extra steps non-filers needed to take in order to receive a stimulus check.11 Both of these reasons could be contributing to the increase in reporting did not receive or do not expect to receive a stimulus payment for incomes below $25,000.

|

Note: Not all rows sum to 100 due to rounding. |

|

Note: Not all rows sum to 100 due to rounding. |

|

Note: Not all rows sum to 100 due to rounding. |

|

Note: Not all rows sum to 100 due to rounding. |

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Recommended Reading: Social Security Disability Stimulus Check 2022

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didn’t get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Don’t Miss: Irs Sign Up For Stimulus

Who Will Receive The Stimulus Check Automatically Without Taking Additional Steps

Most eligible U.S. taxpayers will automatically receive their Economic Impact Payments including:

- Individuals who filed a federal income tax for 2018 or 2019

- Individuals who receive Social Security retirement, survivors, or Social Security Disability Insurance benefits

- Individuals who receive Railroad Retirement benefits

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Don’t Miss: How Many Stimulus Payments Were There In 2021

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Student Grants Student Loans And Work

- Creates a 14-billion-dollar higher education emergency relief fund to provide cash grants to college students for costs such as course materials, technology, food, housing, and child care. Each college will determine which of its students receive cash grants. This was divided into three pieces: $12.5 billion in formula funds, at least half of which must be given directly to students, $1 billion for institutions serving minorities, and $350 million in supplemental funds for small institutions with unmet needs. Though the Department of Education issued guidance that international and undocumented students are ineligible for these funds, this was challenged in a lawsuit.

- Payments of student loan principal and interest of by an employer to either an employee or a lender is not taxable to the employee if paid between March 27, 2020, and December 31, 2020. The maximum amount that is tax-free is $5,250 per employee.

- For college students in a Federal Work-Study Program, allows a school to continue to pay a student if the student is unable to fulfill their work-study obligation due to the COVID-19 public health emergency.

- Gives students and colleges flexibility regarding the requirements for federal student financial aid during the COVID-19 pandemic.

- Suspends payments and accrual of interest on federal student loans through September 30, 2020. Suspends garnishments and tax refund interception related to federal student loans through September 30, 2020.

Don’t Miss: Are We Getting Another Stimulus Pay