The Federal Cares Act Changed The Rules For Claiming Certain Net Operating Losses Will New York State Follow The Federal Treatment Of Nols

New York State does not follow the CARES Act changes to NOLs. New York State personal income taxpayers must recompute their federal NOL deduction using the rules in place prior to any CARES Act or subsequent federal changes. For example:

- a federal NOL deduction for losses incurred in tax year 2018 or later is limited to 80% of the current year federal taxable income

- there is no carryback of losses incurred in tax year 2018 or later and

- excess business losses disallowed will be treated as a net operating loss carryforward to the following tax year.

For New York State income tax purposes, an NOL deduction is limited to the lesser of:

- the federal NOL deduction computed using the rules in place prior to any CARES Act or subsequent federal changes, or

- the federal taxable income computed:

- using the rules in place prior to any CARES Act or subsequent federal changes, and

- without the federal NOL deduction.

For New York State business corporation tax purposes, New York had its own rules for NOLs pre-CARES Act. These rules were not impacted by the federal changes. See Form CT-3.4, Net Operating Loss Deduction.

Q How Much Was The Second Stimulus Check For

A. Your second stimulus check depended on your 2019 income. The full amount was $600 per individual, $1,200 per couple, and $600 per qualifying child under the age of 17. For expats to qualify for the full second stimulus check, you must have had $75,000 or less in income if you filed as single, $112,500 or less if you filed as head of household, or $150,000 or less if you filed jointly with your spouse or as a qualifying widow. Youd also then qualify for a $600 payment per qualifying child.

For those above this income level, your stimulus check amount would lower $5 for each $100 your AGI exceeded the above thresholds.

Q. Did I have to pay back the amount I get?

A. No.

Q. Will this affect my 2020 tax return?

A. It could only help your 2020 return. If you are eligible for more stimulus than you were awarded, you may be able to claim it as a credit on your return that either decreases your tax liability or increases your refund. If youre eligible for less or received the full amount, you dont have to pay it back and it wont affect your return.

Q. Will I owe tax on this second stimulus check in 2021 or have to pay it back?

A. No, this is considered a tax credit, not income, so you will not need to pay taxes on it in 2021 or pay it back.

Q. Im retired overseas and dont file a tax return did I qualify for the second stimulus check?

Q. What if I didnt have an SSN but filed a U.S. return. Did I get to take advantage of the second stimulus check?

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Don’t Miss: Sign Up For Stimulus Check 2022

Requesting A Filing Extension

If youre unable to file a 2021 tax return by the April 18 deadline , theres an easy way to buy some more time. Simply request an automatic six-month extension to file your return. That will give you until October 17 to submit your Form 1040 but youll still have to pay any tax that you expect to owe by April 18.

To get a filing extension, either submit Form 4868 or make an electronic tax payment to the IRS before the tax return filing deadline. There are also special rules that apply to Americans living abroad and people serving in a combat zone. See How to Get More Time to File Your Tax Return for more information about federal tax filing extensions.

If youre getting an extension for your federal tax return, you might want to get one for your state tax return, too . Check with your states tax agency for information about state tax return filing extensions.

Dont Miss: Telephone Number For Stimulus Check

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Read Also: Did I Qualify For The Third Stimulus Check

H& r Blocks Expat Tax Advisors Are Here To Help You With Your Stimulus Taxes No Matter Where You Are

We understand this is a stressful, confusing time, and thats why our Expat Tax Advisors will be standing by ready to help. No matter where in the world you are, weve got a tax solution for you whether you want to be in the drivers seat with our DIY online expat tax service designed for U.S. citizens abroad or want to let one of our experienced Tax Advisors take the wheel. Head on over to our Ways to File page to choose your journey and get started.

At H& R Block, were committed to providing information you can trust and use to help navigate the changing tax landscape for Americans abroad. Visit our Expat Coronavirus Tax Impact page for the latest information on how the Coronavirus has affected expat taxes in 2020 and 2021.

Was this article helpful?

Is The Boosted Child Tax Credit Gone For Good

Not necessarily. Lawmakers are still fighting to bring back some version of the boosted credit one that pays families on a monthly basis rather than forces them to wait to receive their money in the form of a tax refund.

But while lawmakers on different sides of the political spectrum seem to agree about the importance of making a boosted Child Tax Credit available, they disagree on how the rules should work. Some, for example, think there should be an income requirement attached to the credit. But that requirement might prevent some of the people who need that money the most from getting it.

Meanwhile, the Child Tax Credit itself has not gone away for 2022. Rather, it simply reverted to its former version. That means it will have a lower maximum value and only partial refundability, and it means those who want that money will have to claim the credit on a 2022 tax return thats filed in 2023.

But for many families, having to file a tax return is a barrier to getting that money. And while the IRS does have tools and assistance programs available for lower earners who need help filing a return, we could see a lot of people miss out on this years Child Tax Credit because they find the process and idea of filing taxes too daunting.

Read Also: When Is The Latest Stimulus Check Coming

Recommended Reading: How Many Stimulus Checks Were Issued In 2021

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Whos Eligible For The 2022 Massachusetts Tax Refund

If you paid personal income taxes in Massachusetts in 2021 and filed your 2021 Massachusetts tax return by October 17, 2022, you are eligible to receive a 2022 Massachusetts tax rebate by the end of the year.

However, if you haven’t filed your Massachusetts tax return, you still have time to do so. As long as you file by September 15, 2023, you can still receive the 2022 Massachusetts tax refund,according to state officials.

Read Also: Who Gets The Stimulus Checks

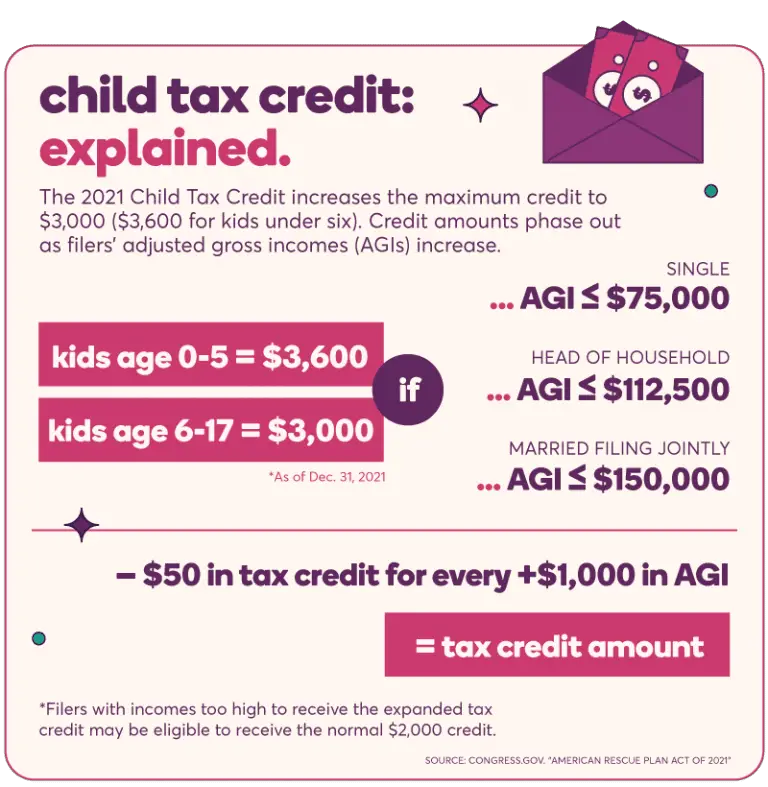

Child Tax Credit Expansion For 2021

- For tax year 2021, the ARPA significantly expands the federal credit from a partially-refundable $2,000 per eligible child up to a fully-refundable $3,000 per child . The age limit for qualifying children is also increased from 16 to 17. Families can receive advanced monthly installments of the credit throughout the year. Vermont has no state version of the Child Tax Credit.

What Did Biden Say About Passing The Bill

Signing the bill on March 11 last year, President Biden said: This historic legislation is about a fighting chance.

Tonight, and the next couple of days, Ill be able to take your questions, he told reporters.

But in the meantime, what Im going to do is sign this bill and make the presentation tonight.

Then there will be plenty of opportunities to be on the road not only talking about what Im talking about tonight, which is the impact the virus and how to end this pandemic.

On Twitter, Biden went on to say that 85 percent of American households would get direct checks from the American Rescue Plan.

A survey a year out found roughly 84 percent of Americans received the checks.

For so many Americans, that means they can pay the rent. That means they can put food on the table.

To offset the current inflation, millions of Californians will be receiving checks from an October date.

Plus, relief checks are going out to West Virginians.

Also Check: Where My Golden State Stimulus

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Recommended Reading: How To Find Out If You Get Stimulus Check

When Was The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline to claim missing stimulus or child tax credit money was for those using the IRS Free File tool. The Free File tool is for those who are not typically required to file taxes due to lower income.

If you filed a tax extension earlier this year or haven’t filed yet, your deadline to submit your tax return if you’re required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until , to file. But if you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, Tuesday, was the last day to file.

You can still get your stimulus and child tax credit money — just not this year.

Do The 62f Tax Refunds Favor Wealthy Bay Staters

There has been some criticism and concern that the Massachusetts 62F tax refunds favor high income residents. Thats in part because the refund amounts are based on a flat percentage.

A Massachusetts Budget and Policy Center analysis puts the likely average amount of the tax refund at about $529 for an average Massachusetts taxpayer. However, data from 2018 indicate that lower income taxpayers could receive tax refunds that are less than $10, while 2020 data show that taxpayers with incomes over $1 million could receive more than $28,000, on average.

Overall, the Massachusetts Budget and Policy Center concluded that almost 75% of the nearly $3 billion in tax refunds will go to people whose incomes are in the top twenty percent of Massachusetts income distribution.

Also Check: When Did The Third Stimulus Check Go Out

Read More On Stimulus Checks

Most recently, states like Connecticut, Hawaii and New Mexico have offered one-time payments that will be issued sometime in August.

Some have specifically used their surplus, while others are offering the payments as a tax rebate.

Also, the second round of California’sGolden State Stimulus program, for example, provided residents with 8.1million payments worth more than $5.8billion, a spokesperson for the California Franchise Tax Board told The Sun.

Below, we explain whether these stimulus checks are subject to taxation if you’re still preparing to file a return in 2022.

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Recommended Reading: Federal Stimulus Package For Homeowners

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.