Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

Also Check: File For Missing Stimulus Check

Will You Have To Pay Taxes On Your Stimulus Checks

In response to the economic devastation caused by the coronavirus pandemic, Congress authorized a series of stimulus payments for Americans in 2020 and 2021.

As they were sent out in the midst of global upheaval, many Americans gladly accepted them without fully understanding the ultimate ramifications. The good news is that Congress sent out the payments with no strings attached. Heres what youll need to know when you file your return for tax year 2021.

More Advice:How To Itemize Deductions Like a Tax Pro

Read Also: Irs Phone For Stimulus Checks

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Is The Boosted Child Tax Credit Gone For Good

Not necessarily. Lawmakers are still fighting to bring back some version of the boosted credit one that pays families on a monthly basis rather than forces them to wait to receive their money in the form of a tax refund.

But while lawmakers on different sides of the political spectrum seem to agree about the importance of making a boosted Child Tax Credit available, they disagree on how the rules should work. Some, for example, think there should be an income requirement attached to the credit. But that requirement might prevent some of the people who need that money the most from getting it.

Meanwhile, the Child Tax Credit itself has not gone away for 2022. Rather, it simply reverted to its former version. That means it will have a lower maximum value and only partial refundability, and it means those who want that money will have to claim the credit on a 2022 tax return thats filed in 2023.

But for many families, having to file a tax return is a barrier to getting that money. And while the IRS does have tools and assistance programs available for lower earners who need help filing a return, we could see a lot of people miss out on this years Child Tax Credit because they find the process and idea of filing taxes too daunting.

Also Check: Who Qualified For Stimulus Check 2021

Read Also: When Is The Latest Stimulus Check Coming

Recover Missed Stimulus Payments On 2020 Tax Returns

If, for some reason, you didn’t get any stimulus payment last year, but you’re owed one, you can get it this year when you file your 2020 tax return by claiming the Recovery Rebate Credit. If you don’t get the full amount that you were entitled to from the first or second stimulus payments you could also get that from your 2020 tax return.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

What if it turns out that your stimulus payment was more than you were actually allowed? For example, suppose the IRS based your stimulus payment on your 2018 or 2019 tax return, when your income was lower, but your income is much higher for 2020? If someone has income in 2020 that is higher than the tax return to calculate the advance rebate, they will not have to pay the credit back, says Garrett Watson, senior tax policy analyst for the Tax Foundation, an independent, nonprofit tax policy organization. In other words, any adjustments to a taxpayer’s rebate on 2020 tax returns will be in the taxpayer’s favor.”

More on money

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

AARP VALUE &

What Did Biden Say About Passing The Bill

Signing the bill on March 11 last year, President Biden said: “This historic legislation is about a fighting chance.

“Tonight, and the next couple of days, I’ll be able to take your questions,” he told reporters.

“But in the meantime, what I’m going to do is sign this bill and make the presentation tonight.

“Then there will be plenty of opportunities to be on the road not only talking about what I’m talking about tonight, which is the impact the virus and how to end this pandemic.

On Twitter, Biden went on to say that 85 percent of American households would get direct checks from the American Rescue Plan.

A survey a year out found roughly 84 percent of Americans received the checks.

“For so many Americans, that means they can pay the rent. That means they can put food on the table.”

To offset the current inflation, millions of Californians will be receiving checks from an October date.

Plus, relief checks are going out to West Virginians.

Recommended Reading: Who Qualified For Stimulus Check 2021

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, well also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Is My Stimulus Payment Taxable And Other Tax Questions

With tax filing season about to begin, heres what you need to know.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The tax filing season opens on Friday,and with it comes a question different from other tax years: How will the stimulus payments and unemployment income affect taxes?

Because of the pandemic and the governments relief program, millions of people received both types of payments but they are treated differently for tax purposes.

The good news is that you dont have to pay income tax on the stimulus checks, also known as economic impact payments.

The federal government issued two rounds of payments in 2020 the first starting in early April and the second in late December. If you got the full amount in both rounds, and your income and family circumstances havent changed, youre all set. You dont need to include information about the payments on your 2020 tax return, the Internal Revenue Service says.

If they dont owe you any more money, you dont have to do anything, said Kathy Pickering, chief tax officer at the tax preparation company H& R Block.

A refresher: The first payment was for up to $1,200 per person, plus $500 for each child. The second was up to $600 per person, plus $600 for each child.

You should receive a form, 1099-G, detailing your unemployment income and any taxes that were withheld, which you enter on your tax return.

You May Like: $1 400 Stimulus Check When Is It Coming

You May Be Wondering If You Have To Pay Taxes On Your Third Stimulus Check The Answer May Surprise You

Getty Images

I’ve heard the question many times: Will I have to pay tax on my stimulus check? The federal tax code says you must pay taxes on “all income from whatever source derived,” unless it’s specifically exempted or excluded. That’s a pretty broad definition that seemingly would include money from the government. And, strictly speaking, there’s no specific exemption or exclusion for stimulus check money. So, third stimulus checks are taxable right?

Wrong! There’s a loophole in the law that prevents you from having to pay taxes on the third-round stimulus check money you got from Uncle Sam last year. As it turns out, your third stimulus check isn’t “income” after all, according to the law. Instead, it’s simply an advance payment of a tax credit. And tax credits aren’t taxable income.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Don’t Miss: What Were The Three Stimulus Payments

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

When Can I Expect My Tax Refund In 2021

The IRS delayed their normal start day for processing tax returns to This means that getting refunds will also be delayed compared to previous years. The IRS indicates that using electronic filing will speed up processing.

The IRS also notes that those who have the Earned Income Credit and Additional Child Tax Credit can expect refunds to start being issued the first week of March for those who file their tax return as soon as processing starts in February.

Most taxpayers will receive their refund within 21 days of filing electronically, assuming there are no errors or other issues with their return.

It is important to note that although the start date for processing returns was pushed back, the end-date to file your return has not changedit is still April 15 for most taxpayers.

Also Check: Apply For Stimulus Check Indiana

Do I Have To File My 2020 Taxes To Get The $1400 Stimulus Check

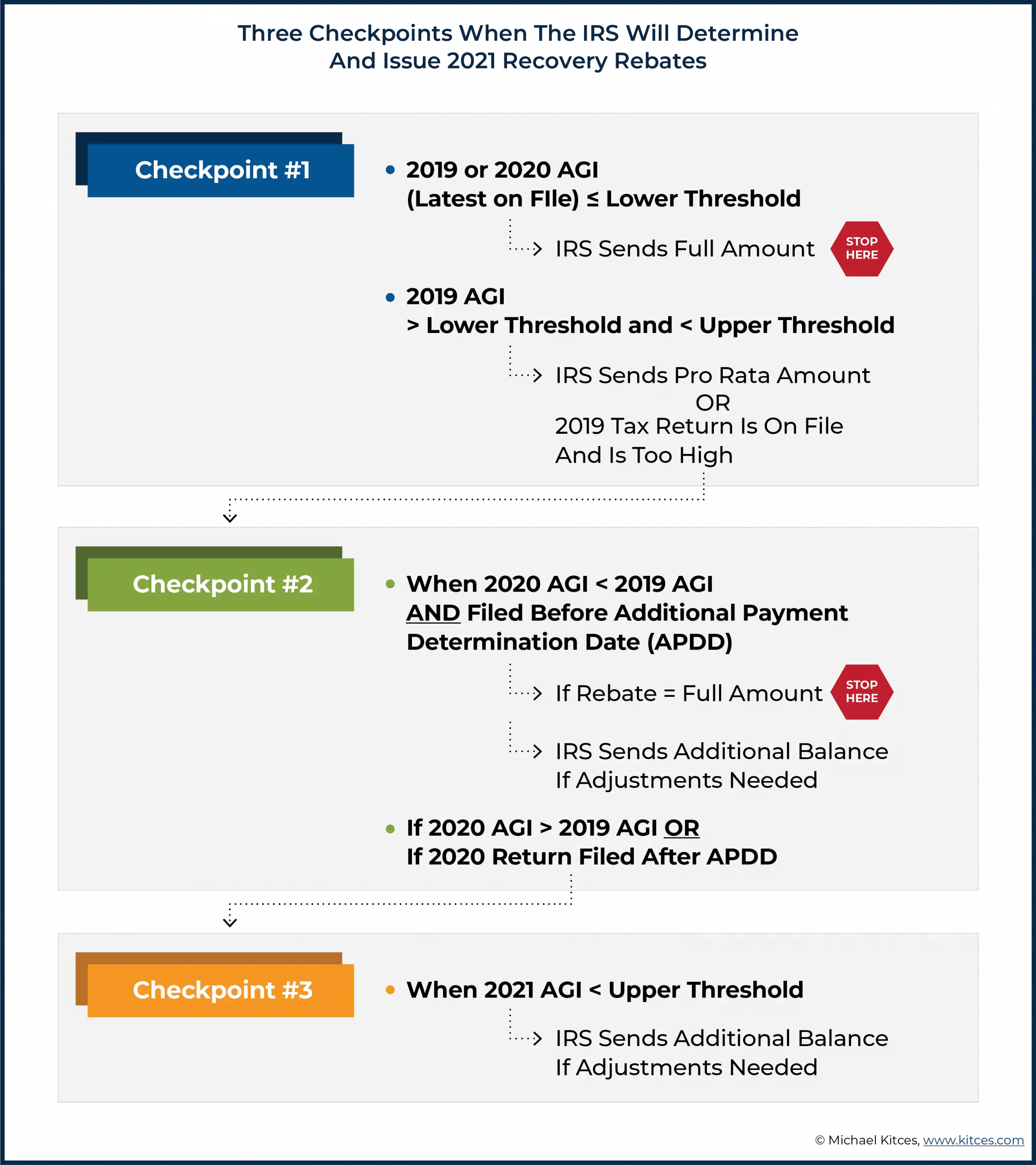

Democratic leaders are actively trying to pass an economic aid bill including a $1,400 stimulus check. Drafts indicate the IRS would use the most recent tax filing you submitted, either 2019 or 2020.

So no, its unlikely youd have to file your 2020 taxes before the checks are sent if you qualified for previous rounds.

What Is The Child Tax Credit

The enhanced Child Tax Credit increased this benefit as high as $3,600 a child in 2021, up from its normal amount of $2,000 per child. The tax credit is aimed at helping parents pay for the cost of raising children.

The IRS sent monthly checks to parents with eligible children for the last six months of 2021, which represented half of the annual credit. The IRS said that families can claim the other half of the credit now even if they received monthly checks in the second half of 2021.

Don’t Miss: How Can I Apply For Stimulus Check

You Could Be Due More Stimulus Money

The 2020 tax return will allow people to claim more money if they didnt receive the full amount they were due.

The stimulus payments were based on either 2018 or 2019 income. That means people who experienced a reduction in pay or lost their job during the pandemic are likely owed more money.

The Internal Revenue Service is adding a Recovery Rebate Credit Worksheet to the 2020 tax return forms to help taxpayers determine if they are eligible for more money.

Those who havent gotten their second check because they changed their bank account or address since the first one was sent can also claim the money on their tax return.

Are There Ways Someone Can Get Their Economic Impact Payment Faster

No, as long as they have direct deposit. Beware of scams! Some people are spreading information through phone calls, emails, text messages, and social media posts suggesting that people can get their payment quicker by sharing personal information and paying a processing fee. It is unnecessary to spend money to get this payment. The IRS will not contact anyone through these platforms. They will send written correspondence with instructions on steps to take and the timeframe for action. The IRS will never ask someone to share personal information especially banking details in a non-secure method.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Encourage people to hang up on phone calls they receive and delete email or text messages that have any of these characteristics of a scam. One can report scams to the Better Business Bureau which helps protect others.

Recommended Reading: How Much Was The Stimulus Payments In 2021

You May Like: Who Is Eligible For 4th Stimulus Check

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

I Didnt Receive My Stimulus Checks Last Year Or They Were Less Than I Was Expecting Can I Still Get One

If you were eligible for a stimulus payment last year but did not receive it , you might be eligible to get those funds via the Recovery Rebate Credit.

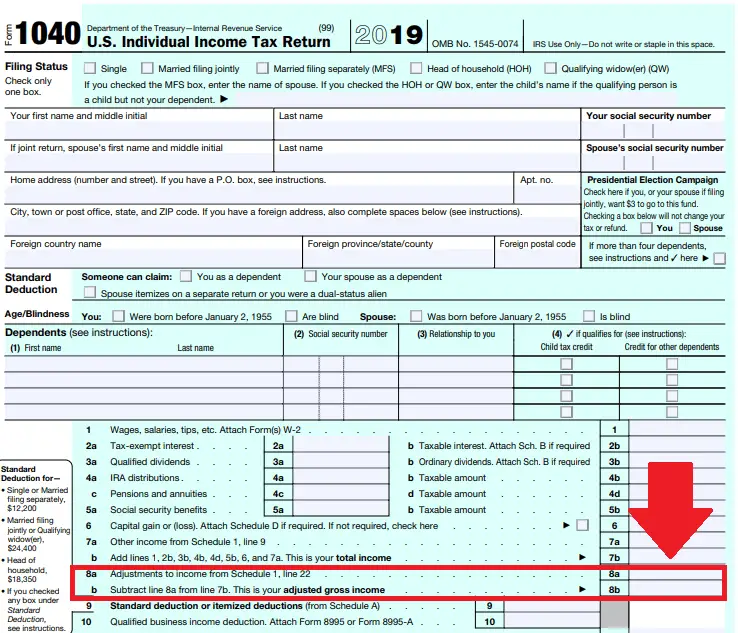

Phillips says that since the ultimate eligibility for the Recovery Rebate Credit is based upon the items on your 2020 tax return, and the IRS used 2019 tax returns to determine eligibility, they may have not had the information to determine you were eligible for an additional amount. The good news is when you file your 2020 tax returns, youll be able to get those amounts either through a bigger refund or reducing your balance due, he says.

Here are a few reasons you may be owed a check, or more money than you received: You had a child in 2020 you had a big change in income during 2020 or you became a new independent filer in 2020 who meets the qualifications.

If you believe youre eligible, Phillips says you can complete the Recovery Rebate Credit Worksheet found in the Form 1040 instructions, which looks at your income, the amount of payments you got as an advance, and then determine if you should be eligible for any more, he notes. Any extra stimulus money you qualify for should be reported on Line 30 of your tax return.

Per the IRS, you have to file a 2020 tax return to claim the Recovery Rebate Credit, even if dont usually file a tax return. The rebate credit is based on your 2020 information given to the IRS, instead of the 2018 or 2019 tax returns that were used for the prior two stimulus checks.

Also Check: Stimulus Checks For Grocery Workers