What Is The New Child Tax Credit Amount

Heres how the numbers break down: The American Rescue Plan bumps the Child Tax Credit up to $3,000 for children ages 617 and $3,600 for children under age 6.3 Expecting a baby in 2021? First of all, congrats! And heres some more good news for youbabies born in 2021 will qualify for the full $3,600. Have a college student? Parents can receive a one-time payment of $500 for each full-time college kid ages 1824.4

So, for a family that has three children , heres how it all breaks down:

Lets say they have three kids that are ages 12, 7 and 4 and a household income of $72,000 a year. Their new Child Tax Credit would be $9,600.

But remember, instead of applying the full amount of the credit to income taxes they might owe or getting a refund after they file their taxes, parents can get the credit up front in monthly payments of $250 for each qualifying child .5 So that family of three in our example would get $800 a month from July through December. Wow!

Right now, this change would be only for 2021but theres talk in Congress and the White House to make it a permanent thing for the next five years under Bidens American Families Plan. Yep, there are a lot of plans and acts to keep straight these days.

Will You Have To Pay Back Money From A Previous Stimulus Check

You might. Heres why: Some people were sent stimulus checks by accident. Whoops! We knowimagine the government making a mistake, right? Heres why you might need to send your money back:

- You make more than the income limit required to receive the stimulus money.

- You were given a check for someone who has died.

- Youre a nonresident alien.

- You dont have a Social Security number.

- You were claimed as a dependent on someone elses tax return.

If you know one of these applies to you, the IRS expects you to find the error and send the money back to them.14 So go ahead and be honest . You dont want any surprises when you go to file your taxes.

States That Have Approved Stimulus Check:

California: Couples filing jointly and earning less than $150,000 yearly will benefit from $700 of stimulus check under Californias proposed budget. Individual taxpayers whose income falls within this ceiling will receive $350.

Colorado: This summer, Colorado will issue stimulus check totaling $750 to single filers and $1,500 to joint filers. Residents of Colorado who turned 18 or older and submitted their 2021 statewide income tax return are qualified for the payout for the entire 2021 tax year. To combat fraud, they are only actual checks will be sent.

Delaware: Delaware began delivering $300 relief rebate payments to taxpayers who submitted their 2020 state tax return in May. Due to a budget excess, a one-time payment is available. Couples who file jointly will each receive $300.

Florida: As a part of the Department of Children and Families Hope FloridaA Pathway to Prosperity program, some Florida people with kids will receive a one-time payment of $450 for each child.

Hawaii: Gov. David Ige suggested in January that every taxpayer in Hawaii receive a tax rebate. Taxpayers who make less than $100,000 a year would receive $300 of stimulus check, while those who make more would receive $100. The reimbursement is also available to dependents.

Also Check: I Never Received Any Stimulus Check

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Indiana: $125 Rebate Payments

Like Georgia, Indiana found itself with a healthy budget surplus at the end of 2021. In Dec. 2021, Gov. Eric Holcomb announced that Indiana taxpayers will get a $125 one-time tax refund after they file their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by Jan. 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May and are expected to continue through mid-summer, according to a state information page.

Taxpayers who file jointly will receive a single deposit of $250.

Most taxpayers will receive their additional refund by direct deposit. If you changed banks or dont have direct deposit information on file, youll receive a paper check in late summer.

For more information, visit the state Department of Revenue website. More information will be added for taxpayers who dont receive their payment by Sept. 1.

In June, Holcomb announced a plan to send additional payments of about $225 to taxpayers, but it hasnt yet been approved by the state legislature.

Read Also: Federal Mortgage Relief Stimulus Program

New Jersey: $500 Rebate Checks

In fall 2021, Gov. Phil Murphy and the New Jersey state legislature approved budget measures to send one-time rebate checks of up to $500 to nearly 1 million families.

Now, Murphy has proposed earmarking an additional $53 million to send $500 payments to those who file taxes using a taxpayer identification number instead of a Social Security number. These newly eligible people would include nonresident and resident aliens, their spouses and dependents.

Cons Of Taking The Monthly Child Tax Credit Payments

- Youll only get half of the money at tax time. If you take this advance payment of the Child Tax Credit now, just know that youll only see the other half after you file your taxes next yearand not the full amount. Remember, this is an up-front payment of the regular amount you get.

- You might have to pay some of it back. Now listen up: This is only if your income went up from 2020 to 2021. Lets say you lost your job like so many Americans did in 2020, but then you got a new job in 2021. The tax credit is taking the info it has from your 2020 taxes, so your new income might push you over the limits and start to phase out .

- Your payment will be sent to whoever claimed the kids on the 2020 tax returns. If youre divorced or separated, these advance Child Tax Credit payments will go to the parent who had the kids listed on their taxes that year.

- You might need that full amount of money at tax time. If youre self-employed, making quarterly payments, or usually owe money to the IRS, you might want to opt out of monthly payments here. Youll probably need that full amount to help bring down the amount youll pay at tax time.

Don’t Miss: Are We Getting More Stimulus Money

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July, 1 2022.

The Oregon Department of Revenue website contains FAQs for residents with concerns about receiving their payment.

Read Also: How Much Was All The Stimulus Checks

Stimulus Checks: Is Your State Giving Out Money This Year

The federal government is no longer sending out stimulus money, but some states have stepped up to send residents a fourth stimulus check in 2022. Four states are currently preparing more stimulus payments and while everyone may not be eligible, these payments stand to benefit 87 million residents in total, Marca reported.

Social Security Trend: Stimulus Money Allowed Seniors To Retire Early and Receive Full Benefits

Can My Stimulus Check Be Garnished

In most cases, no. Most individuals and families should have received a stimulus payment, even if you owe back taxes or other debts to the government or creditors. Ohio law also protects your stimulus check from being garnished by creditors and private debt collectors.

If you owe back child support, the CARES Act allowed a reduction or offset to your first stimulus payment for back child support. However, your second and third stimulus payments can’t be garnished for back child support.

Read Also: Get My Stimulus Payment 1400

Where You Can Get Us Stimulus Checks In September 2022

Wondering if you’ll be getting another stimulus check? If you live in one of these states, the answer could be yes.

- Some qualifying U.S. residents are about to receive another stimulus check.

- Six states, including, Alaska and Hawaii, will mail them out in September.

- However, certain residents may not receive the actual payments until next month.

More stimulus checks are on the way, at least for people in select states. The federal government has not discussed any plans for nationwide payments. Its unlikely that the U.S. will see another round for the entire country as many experts have attributed the cash influx to rising inflation. But six state governments have confirmed that they will be dolling out further payments over the coming month, though amounts, dates and conditions vary. A few states, such as New Mexico, have already issued fourth-round payments. Others, including Massachusetts, are still awaiting updates on further payments. But for residents in six states, stimulus checks are coming this month, or at least being sent out. Some payments may not be received until October.

Lets take a look at which states are preparing to start mailing out payments.

State Tax Rebate Update 202: These States Are Sending Out Checks This Week

Starting this week, Coloradans are getting refunds of up to $1,500. Is your state sending out a check?

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

To address ongoing inflation, many states are issuing tax rebates and stimulus payments: Illinois will start cutting refund checks for as much as $400 in mid-September and California will issue a “middle-class tax refund” worth as much as $1,050 beginning in October. Colorado Gov. Jared Polis signed legislation speeding up the release of 2023 rebates so they should start getting to taxpayers as early as this week.

‘Why should the government sit on your money for a year?'” Polis told KKTV of the checks, which are for up to $1,500. “Let’s get it back quick, easy, as quick as possible.”

In all, at least 18 states have issued or will send out inflation relief payments. Read on to find out which ones they are, how much eligible taxpayers can expect to get and when they should arrive.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Recommended Reading: Irs Phone Number For Stimulus Check 2021

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

How Do I Get It

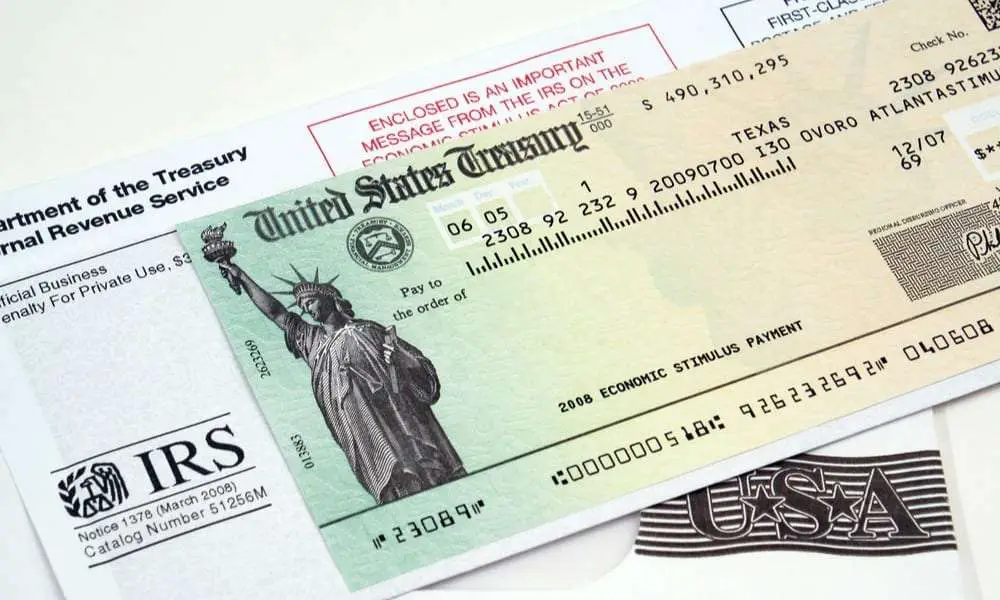

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Recommended Reading: Who Are Getting Stimulus Checks

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Fourth Stimulus Check Update

Biden’s American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. That’s similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a “Silver” health-insurance plan for six months under the Affordable Care Act, aka Obamacare. You’re eligible for this if you filed for unemployment benefits at any time in 2021, and if you don’t currently get health insurance through Medicare, Medicaid or someone else’s health plan.

Biden’s American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.

Also Check: Get My Stimulus Payment Phone Number

Hawaii: $300 Rebate Payments

In January, Gov. David Ige proposed sending a tax rebate to every Hawaii taxpayer. Taxpayers earning less than $100,000 per year would receive $300, and those earning more than $100,000 per year would receive $100. Dependents are eligible for the rebate, too.

The Hawaii legislature has approved the rebate, but details for distribution havent been released. Payments may begin processing in late August, per the state Department of Taxation.

These States Are Sending Stimulus Check To Millions: Check Out The List

Millions of people have received stimulus check and refund checks thanks to the use of state money. Billions of dollars are currently being distributed to people, and some have already done so. These states are listed along with information on who will receive them. Check out this stimulus check situation to determine if you are eligible to receive some of this money.

These states have decided to provide payments or refunds based on surpluses they have accrued or through federal funding they have received. If you reside in these states, you might receive such a stimulus check this month.

In June, New York State distributed its version of this, giving households up to $1,050 at the time. Various variations of it have also been carried out by other states, some using funds provided by the federal government and others using surpluses.

Recommended Reading: Are We Going To For Stimulus Check