Parents Are More Likely Than Non

Although there’s little appetite in Washington D.C. for a fourth stimulus check to be distributed to everyone, there is some bipartisan support for an expanded Child Tax Credit.

The last stimulus bill, the American Rescue Plan Act, made more money available to parents by changing the current rules for the existing Child Tax Credit. Parents were eligible to receive up to $3,600 for children under age 6 and up to $3,000 for kids aged 6 to 17.

While Republicans aren’t in favor of doing exactly what the American Rescue Plan Act did for parents, those on the right have put forth various proposals to also expand this tax credit. And there’s broad support on the left for more financial help to parents.

Stimulus Check Update: Why Arent We Receiving Another Check

Half of the population in the country have started querying their requests for another stimulus check, as the delta variant surges on. And yet, there have been claims that another stimulus payment wont come to fruition. Just last week, several new cases ravaged the nation- numbering around 120,000 per day.

Interestingly, the last time the country was devastated by the pandemic to this extent was in February 2021- just a few weeks before the third stimulus package was sent to citizens as a part of the pandemic rescue package of President Biden.

For the larger part of the country, the money from the stimulus check payments has long expired. But, it hasnt necessarily implied that the population doesnt suffer in the pandemic anymore- for that would be a straight line.

Also, massive certainty has been injected into the slowly recovering economy by the delta surge that has suddenly covered massive ground in the country. Despite all that, a stimulus payment wouldnt be on the top of the priority list of the federal government.

Child Tax Credit: December End

Some families received another form of stimulus aid when the IRS in July deposited the first of six monthly cash payments into bank accounts of parents who qualify for the Child Tax Credit . Families on average received $423 in their first CTC payment, according to an analysis of Census data from the left-leaning advocacy group Economic Security Project.

Eligible families received up to $1,800 in cash through December, with the money parceled out in equal installments over the six months from July through December. The aid was due to the expanded CTC, which is part of President Joe Biden’s American Rescue Plan.

Families who qualify received $300 per month for each child under 6 and $250 for children between 6 to 17 years old. Several families that spoke to CBS MoneyWatch said the extra money would go toward child care, back-to-school supplies and other essentials.

While progressives and some Democrats urged lawmakers to continue the enhanced CTC, it appears stalled at the moment. That means families won’t receive a CTC payment in January or beyond.

Read Also: Gas Stimulus Checks 2022 Ohio

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Don’t Miss: Qualifications For 3rd Stimulus Check

When To Expect Your Third Stimulus Check

The US treasury and the IRS already started making the transactions starting on March 12. However, even if you can see the money as pending in your account, that money will not be accessible until March 17 which is the official release date.

With that in mind, the IRS set a deadline for later in the year to finish sending all the checks which means that there is still the possibility that the money will arrive much later into your account. Considering the number of people living in the United States, this is understandable.

How Will The Stimulus Check Payments Be Made By The Irs

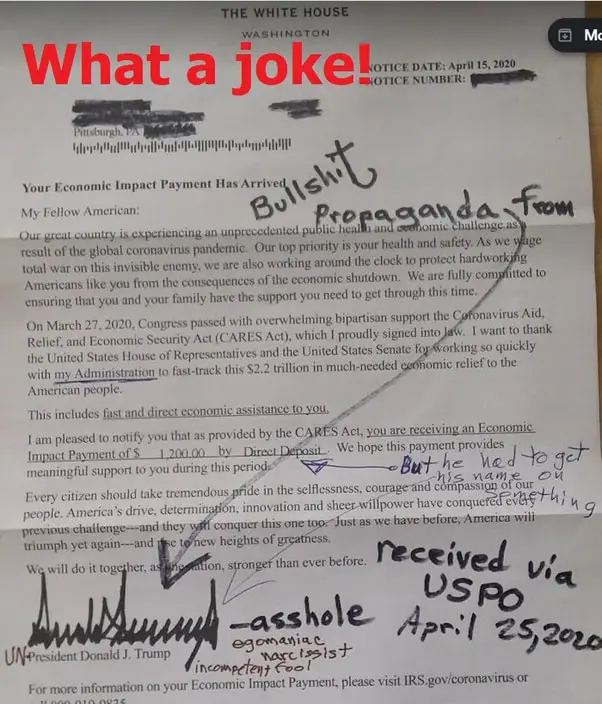

The IRS has confirmed that payments for most working Americans are expected to be calculated and deposited or mailed via check based on 2018 or 2019 federal tax filing payment details. Most people wont need to take any action and the IRS will calculate and automatically send the economic stimulus payment to those eligible. The Treasury department, under which the IRS falls has also created a website/portal for those who are not required to file U.S. income taxes or who have to change payment information .

For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the last valid return filed. So if your 2018 information is out of date or your income situation changed in 2019, make sure you file, even if you have no taxes due .

Read Also: Is North Carolina Getting Another Stimulus Check

Th Stimulus Check Update And Payment Status In 2022 Latest News And Developments

This article provides updates, income qualification thresholds and FAQs on the approved and proposed COVID relief stimulus checks, also known as Economic Impact payments.

While multiple rounds of payments have been made over the last two years, many are asking if the government will make another of payments to help folks cope with high inflation and the rising costs of basic goods and services.

Each round of stimulus check payments had slightly different rules so please ensure you review each payment round separately. Click the links below to jump to the relevant stimulus payment.

If you have not received one or more of your stimulus payments, then you will need to claim this as a recovery rebate in your tax return filing this year.

Stimulus Check Missing Payment Issues Or Errors

The IRS will also be mailing Stimulus Payment letters to each eligible recipients last known address 15 days after the payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment. Note that the IRS or other government departments will not contact you about your stimulus check payment details either.

Why didnt I get a stimulus check? Remember that the IRS has to have your direct deposit details, which is normally only provided if you received a 2018 or 2019 refund. If you file a return and they cannot use their portal to add direct deposit details, then your payment will come via check which could take several weeks. At this checks will likely start arriving at your IRS registered address from the end of April.

Finally you will also likely be able to claim any missing payments in your 2020 tax return as a tax credit. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Recommended Reading: How Can I Get My 3rd Stimulus Check

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

How Are Social Security Payment Dates Determined

The Social Security Administration sends out payments on three different Wednesdays of each month — the second, third and fourth. On which Wednesday you receive your money depends on your birth date. Payments for SSI recipients generally arrive on the first of each month . We’ll break it down.

- If your birthday falls between the 1st and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Your payment date depends on your birthday and when you started receiving benefits.

You May Like: How Do I Apply For The 4th Stimulus Check

Stimulus Checks 202: Your State Could Still Owe You Hundreds Of Dollars

Numerous states are issuing special one-time tax rebates.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Millions of South Carolinians are expected to receive a one-time income tax rebate of up to $700. Payments started going out via at the start of November and will continue through the end of the year, according to the state Department of Revenue.But South Carolina is hardly the only state giving taxpayers a reason to rush to the mailbox: Massachusetts began refunding $3 billion in surplus tax revenue to residents this month and Illinois is still issuing $50 and $100 income tax rebates.

Is your state sending out tax refund checks this month? See if you qualify below, and find out how much money you could be getting. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Recommended Reading: Claiming Stimulus Check On Taxes 2021

Will Social Security And Ssi Claimants Get A Fourth Stimulus Check

- 9:00 ET, Aug 9 2022

IF youâve been holding out hope for a fourth stimulus check â donât hold your breath.

Despite inflation hitting a fresh 41-year high and the price of groceries and gas soaring, Congress has not moved yet to cut older Americans more slack.

However, a petition trying to convince lawmakers to send senior citizens a fourth, $1,400 stimulus check, continues to circulate.

Social Security and supplemental security income beneficiaries had been hoping Congress will consider a fourth stimulus check.

The Senior Citizens League, a non-partisan advocacy group, has been calling for the one-time $1,400 stimulus check for Social Security claimants, who are among the hardest hit by higher prices.

The group sent a letter to Congress last year, stating the cost-of-living adjustment, combined with inflation, will hit hard for many older Americans who are on a fixed income.

You May Like: How Much Stimulus Check Are We Getting

When Will You Get Your Money

The exact date you’ll receive your money depends on your circumstances, but the IRS has already begun sending electronic payments to millions of Americans.

The speed with which you’ll receive your payment largely depends on how you filed your taxes. The IRS can distribute electronic payments quickly, but they must print and mail paper checks for some recipients, which takes additional time.

On April 15th, the IRS launched a portal to track the status of your stimulus payment. To track your payment, you’ll need your social security number, your birthday, your address and your zip code provided you filed your 2019 or 2018 tax return. If you are a qualified non-filer, there are additional links on the IRS’s website to input your information so you can still receive your check.

On April 2, Treasury Secretary Steve Mnuchin said that eligible Americans who have signed up for direct deposit payments should receive them within two weeks, a process which is already underway. A spokesperson for the Treasury Department expects 50 million to 70 million Americans to receive their checks via direct deposit by April 15, according to The Washington Post.

However, if you didn’t sign up for direct deposit when filing your tax return and require a paper check, you might experience some delays. In fact, because the government lacks banking information for millions of Americans, $30 million in paper checks won’t begin distribution until April 24, or longer.

You May Like: Where Do I Put Stimulus Money On Tax Return

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Stimulus Check 2022 Fourth Payment: Is Every State Getting One

Another stimulus check is arriving to United States citizens in 2022. Here is everything you need to know.

A fourth stimulus check is being made available at the beginning of the new year. The $1400 payment is a part of the Biden administrations new American Rescue Plan, which hopes to help individuals impacted by COVID-19 and other economic factors.

The question is, will all 50 states be receiving these stimulus checks?

While the answer is yes, it is a bit more complicated than that. Every state will receive a budget from the Federal government to distribute the funds to citizens. However, it is up to each State government on where and how to allocate the money.

Don’t Miss: When Was The Second Stimulus Check Sent Out

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Don’t Miss: Can I Still Get Stimulus Check