First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

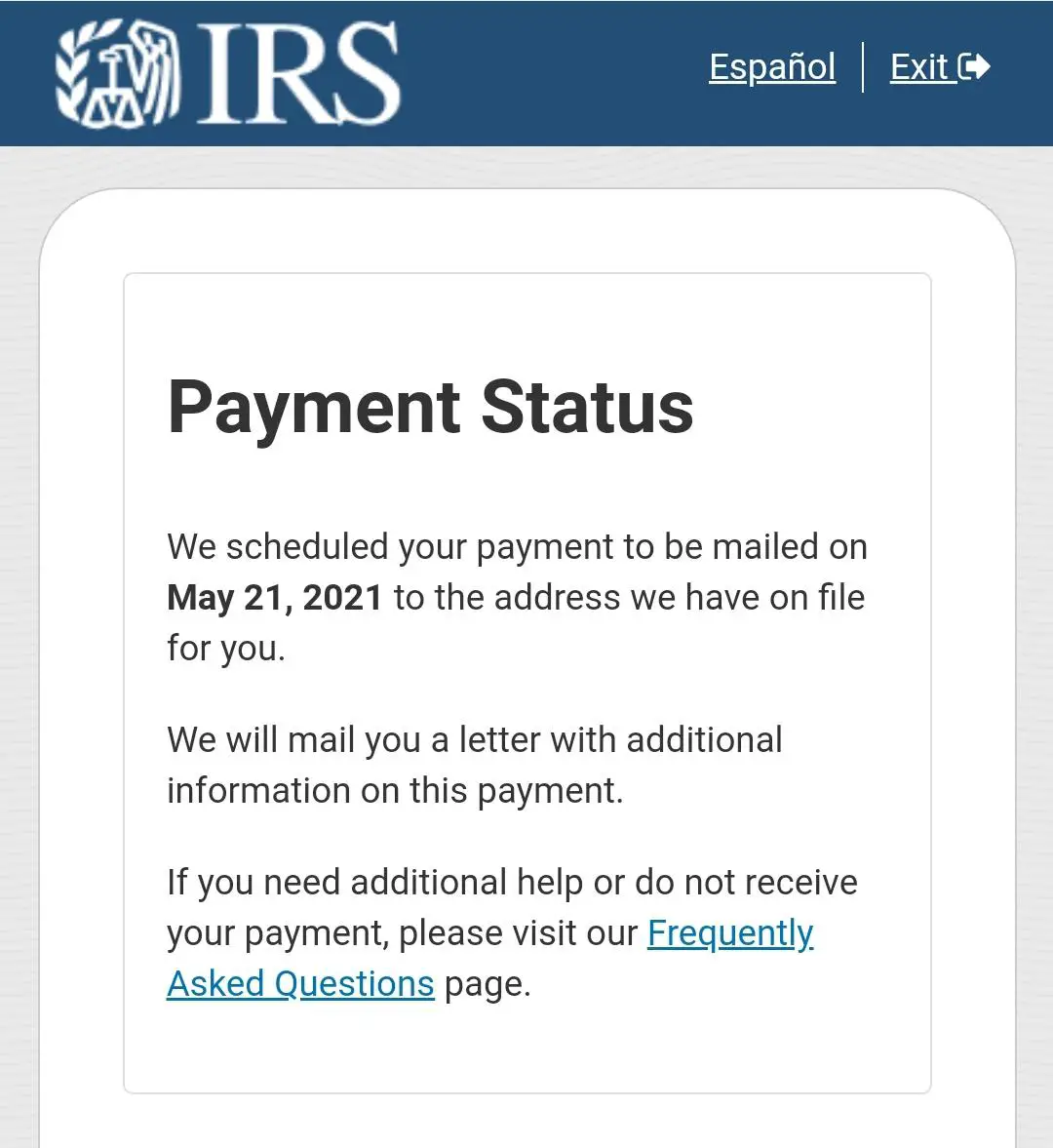

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

When Should You Request An Irs Payment Trace

Since the third stimulus checks are still being sent, you could hold out a little longer before taking action. If you didnt get your first or second check at all, though, its time to do something. This chart shows when you can and should request an IRS payment trace, which is designed to hunt down a stimulus check the agency says it sent. More below on exactly how a payment trace works, how to get started and when to use it.

Read Also: How To Find Out If You Get Stimulus Check

All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Read Also: Check Status Of My Stimulus

You May Like: I Never Received Any Stimulus Check

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

Also Check: Filing 2020 Taxes For Stimulus Check

Stimulus Update: Can I Still Get My 2021 Check

Although most of the Economic Impact Payments made possible by the American Rescue Act have already been sent to eligible recipients, you still have the opportunity to claim the third stimulus payment worth up to $1,400 per person by filing your 2021 tax return.

Find: You Can Still Get Your Stimulus and Child Tax Credit Checks By Filing 2020 Taxes

According to the IRS, there is still time to file to get any missed 2021 stimulus payments. It is too late to use the Get My Payment app to check your stimulus payment status, but you can check your IRS Online Account for any unpaid stimulus payments and for what amount you might be owed.

The IRS also sent information to individuals in March confirming the total amount of their third Economic Impact Payment and any plus-up payments they received for the tax year 2021, via a Letter 6475. The information contained in the letter or in your online account will be needed to submit a 2021 Recovery Rebate Credit on your 2021 federal tax return in 2022. Checks will not be sent.

Third stimulus check payments are based on the most recent taxpayer federal tax return on file with the IRS. That means you could be owed more money if your income dropped or you added new dependents in 2021. If you never filed a tax return in 2019 or 2020, you might be due the full credit. If your income is $73,000 or less, you can file your tax return for free using the IRS tax preparation and filing software Free File.

More From GOBankingRates

How To Make Sure You Receive Your Credits As Soon As Possible

The Recovery Rebate Credit worksheet requires that you know the specific amounts you were supposed to receive, according to the IRS. By doing the investigation and calculation work in advance, youll most likely end up getting your stimulus check and tax refund faster.

To get it correct, that cannot be overemphasized, Steber says. These Recovery Rebate Credits are real cash, and they sent out hundreds of millions in the two tranches. If you did in fact receive it and forget about it, it could add weeks to your tax return timeline.

Your tax refund will be passed more quickly and safely if you electronically file and provide a direct deposit, the IRS says.

Typically, the IRS is good at sending out refunds within a couple of weeks within electronically filing, Bronnenkant says.

Not included in 2020s Recovery Rebate Credit is a third stimulus payment worth $1,400 or more, distributed to Americans beginning in mid-March after President Joe Biden signed the $1.9 trillion American Rescue Plan. Taxpayers will most likely have to wait until 2021 to claim those missing relief payments, Jaeger says.

Recommended Reading: Can I Mobile Deposit Someone Else’s Stimulus Check

Rd Round Of Stimulus Payments

The third stimulus checks were based on your 2019 or 2020 tax information. Individuals qualified for the full stimulus payment if their AGI was $75,000 or lower . The full payment was $1,400 for single individuals, $2,800 for married couples, and an additional $1,400 for each dependent.

If you earned more than the threshold but not more than $80,000 , you received a partial third stimulus payment.

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

Also Check: Do You Have To Pay Back Stimulus Check 2022

What You Need To Know About Your 2020 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

How Do I Receive My Rebate Payments

Also Check: Do I Have To Claim Stimulus Check On 2021 Taxes

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, well also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You May Like: Create Irs Account For Stimulus Check

Nursing Homes And Assisted

Since the payment doesnt qualify as a resource for Medicaid purposes until 12 months after it was first received, nursing homes and assisted living facilities should not require residents to sign over their payment until this period has passed. If you believe a nursing home or assisted living facility has improperly taken the payment from you or a loved one, file a complaint with your states attorney general.

You May Like: Oregon Stimulus Check Round 2

Recommended Reading: Is There More Stimulus Money Coming Out

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that years income, number of dependents and other qualifying information.

Recommended Reading: How Many Stimulus Checks Were In 2021

You May Like: How To Check Stimulus Payments

No Stimulus Check Yet Heres What To Expect

Whether youre checking your account balance or checking your mailbox, waiting for an expected stimulus payment can be frustrating. We help you figure out if a payment might still be on its way, and what you can do to claim any credit due to you.

Katie J. SkipperBECU Community Content Manager Apr 20, 2021 in:COVID-19

Federal stimulus payments have brought a little financial relief to millions of Americans during the COVID-19 pandemic, but some are still waiting to receive their first and second payments while others have already received their third.

Requirements changed with each round, and, if your own financial situation changed, it can be tough to figure out how much of a payment you’ll get and when you’ll get it.

We looked into the details to answer some common questions.

I got the first stimulus payment. Shouldn’t I get the other two or at least part of them?

Just because you received the first round of stimulus payments doesn’t mean you’re a shoo-in for rounds two and three.

The income limits for the maximum stimulus payment were the same in all three rounds. To receive the maximum payment , your adjusted gross income couldn’t exceed:

- $150,000 if married and filing jointly with your spouse

- $112,500 if filing as head of household

- $75,000 for eligible individuals using any filing status

Payments phased out at lower amounts with each round. If you earned more than these amounts, you didn’t qualify for a partial payment:

How does the IRS figure out how much to pay?

Tax Rebates: Frequently Asked Questions

Idaho is giving eligible taxpayers two rebates in 2022:

- 2022 Special Session rebate: On September 1, 2022, a Special Session of the Idaho Legislature passed and Governor Brad Little signed House Bill 1 authorizing a tax rebate to full-year residents of Idaho.

- 2022 rebate: On February 4, 2022, Governor Little signed House Bill 436 that provided a tax rebate to full-year residents of Idaho.

You May Like: Where’s My Stimulus Check 2021 Tracker