Free Online Tax Software

Online free tax preparation offers a convenient and reliable way to file your taxes.

If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software.

MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through an online chat. Tax filing is free for both federal and state tax filing.

MyFreeTaxes offers a broader range of tax forms than most VITA sites. However, you cannot use this site if you have self-employment income. If youre not comfortable using the website on your own, ask someone you trust to help you.

Another free online option is Free File Alliance, a suite of programs in partnership with IRS. You can find Free File programs on the IRS website. If you choose to use one of these programs, read the fine print carefully. Each program has slightly different criteria for their software. In addition, some companies offer free state tax returns, while others dont.

How To Claim Your Money

The easiest way for a taxpayer to get a stimulus payment, or additional payment, if they are, in fact, due more, is to apply on their 2020 tax return, explained Mark Steber, chief tax officer for Jackson Hewitt Tax Services.

“There will be a schedule and line on the tax return to reconcile what they have received so far, and the amount actually due to them based on their 2020 tax return,” continued Steber.

The IRS says that eligible individuals can claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit.

If you are, indeed, due more money, it will show up on the 2020 tax return as an additional refund. Conversely, however, if you received too much cash via a stimulus payment, you do not have to pay it back.

And for those concerned about how this might complicate the filing process this year, Greene-Lewis tells filers not to worry.

“TurboTax has guidance related to stimulus payments and other impacts of Covid-19,” explained Greene-Lewis. “It will ask up front if the filer received a stimulus payment and then calculate the recovery rebate credit based on actual 2020 income.”

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

Also Check: What Stimulus Was Given In 2021

Stimulus Checks For Dependents Va Beneficiaries

Payments to Department of Veterans Affairs beneficiaries who dont normally file taxes and who didnt use the IRS online Non-Filers tool last year started going out April 9, with a payable date of April 14. The batch of 2 million stimulus payments, worth more than $3.4 million, also went to eligible people who had not filed a tax return until this year and didnt use the IRS Non-Filers Tool last year. Some of these payments were what the IRS calls plus-up payments to those who got stimulus payments based on their 2019 returns and then filed 2020 returns.

The third round of stimulus checks, authorized by the American Rescue Plan Act, provides a maximum of $1,400 to eligible individuals, $2,800 to couples and $1,400 to dependents. Unlike the previous two rounds, theres no age limit on stimulus checks for dependents, so its possible to get a check for a dependent college-age student or an aged parent. Because dependents are claimed on tax returns, the IRS can use that information to send out stimulus payments for dependents to tax filers.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes.

This year, Americans were only required to file taxes if they earned $24,800 as a married couple, $18,650 as a Head of Household, or $12,400 as a single filer. If you had total income in 2020 below those levels, you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America.

If you believe that your income in 2020 means you were required to file taxes, its not too late. In addition to missing out on monthly Child Tax Credit payments in 2021, a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. For help filing a past due return, visit the IRS website.

Also Check: Get My 2nd Stimulus Payment

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

What If I Dont Have A Bank Account

If you dont have a bank account, a paper check will be sent to the address you listed on your tax return.

Direct deposit is the quickest and safest way to get payments. Alternatives to receiving a paper check are opening a bank account or using a prepaid debit card. Once you get a card, you may need to contact the company directly to find the account and routing numbers needed for direct deposit. To find a bank, you can view this list of accounts offered by financial institutions that meet national standards. You can also use payment apps like CashApp, Venmo, or PayPal.

Do not provide the bank account information for someone else. Different names on the tax return and bank account will trigger a reject of the deposit, causing the IRS to send you a paper check which will delay the delivery of your payment.

Recommended Reading: What To Do If I Never Got My Stimulus Check

Should I Hold Off On Filing My 2020 Tax Return And What Happens If The Irs Uses 2019 Tax Information

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Recommended Reading: When Were The First Stimulus Checks Sent Out

When Will Your Stimulus Check Arrive

The stimulus payments are being distributed to taxpayers either by direct deposit or by paper checks or debit cards arriving by mail. If youve been paying your taxes via direct deposit, the IRS should already have your banking information on file and will make the payment directly to your bank account.

For direct deposit, the IRS uses data already in its system to determine which bank account to send the payment to. That most likely happens by attaching a routing and account number to your 2020 or 2019 tax filing, as well as inputting one earlier in 2020 for receiving your first stimulus check. Those receiving payments by mail will have to wait a little longer.

This round, the Treasury Department is also working with the Bureau of the Fiscal Service to identify federal records of recent payments to and from the government to find a possible bank account alternative for delivering stimulus payments as a direct deposit. The move helped accelerate the stimulus check delivery timeline, the IRS said in a statement.

In most cases, individuals arent required to take action to receive their checks and are discouraged from contacting the IRS, according to a Treasury Department release.

The IRS and Treasury Department anticipate sending out more tranches on a weekly basis moving forward.

Getting A Missing Check Can Be Difficult But Worth The Trouble

by Adam Shell, AARP, February 4, 2022

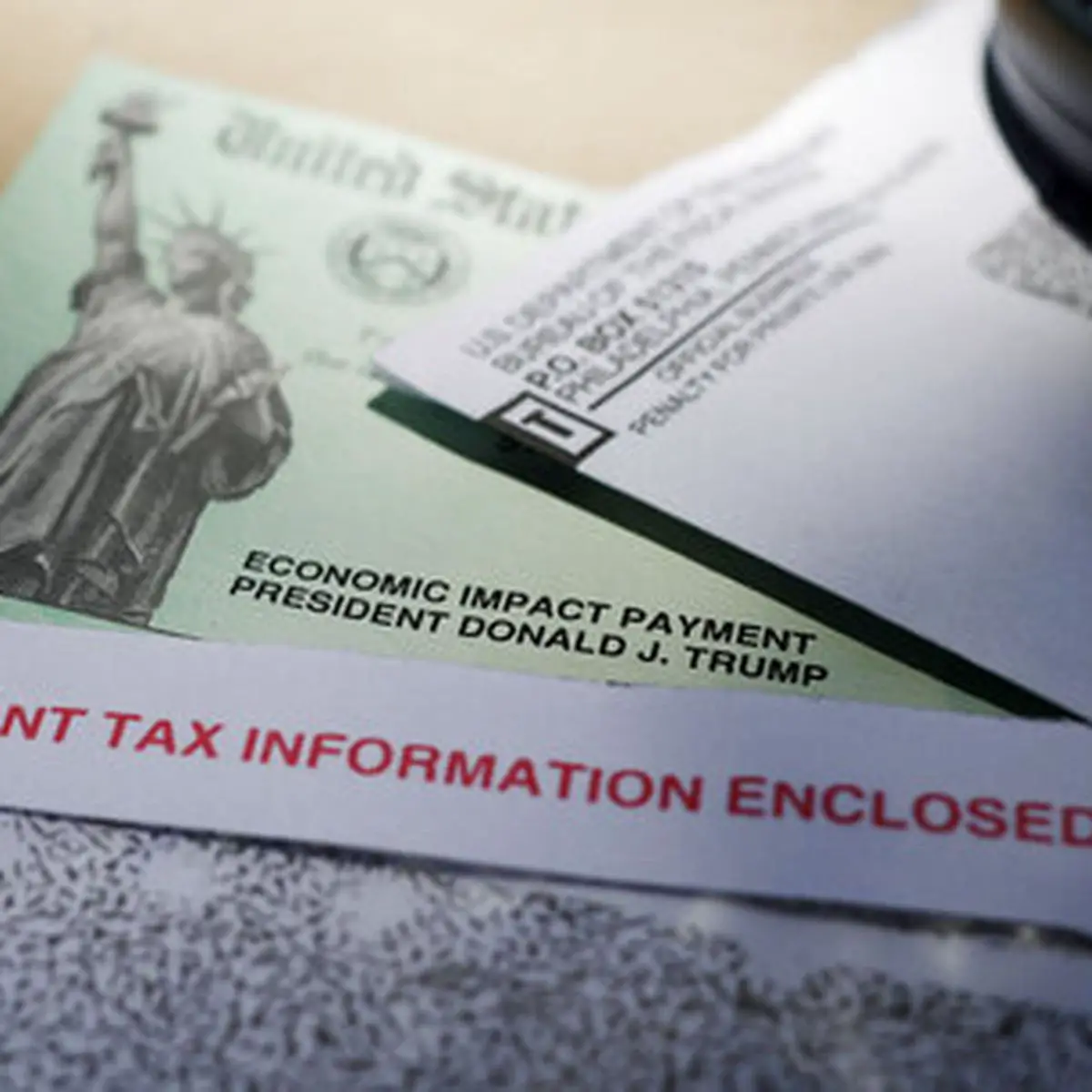

Nobody wants to leave money on the table, especially a stimulus payment from the U.S. government that theyre eligible for but didnt receive. In late January the Internal Revenue Service announced that all third-round stimulus checks had been sent. But the IRS also noted that not all eligible Americans received the full amount theyre entitled to.

The good news? Theres still time to get whats owed to you.

Uncle Sam which issued 175 million third-round payments, totaling over $400 billion, through the end of 2021 reminded people that they can claim any remaining stimulus money theyre entitled to but didnt get by claiming the Recovery Rebate Credit on their 2021 income tax return.

The rebate, which comes as a tax credit of up to $1,400 per eligible person on your 2021 return, will either lower the amount of tax you owe or boost the size of your refund. The golden prize of a tax return is a tax credit, says Mark Steber, chief tax information officer at Jackson Hewitt, a tax preparation service. The Recovery Rebate Credit is a dollar-for-dollar tax-liability offset.

You May Like: When Was The First Round Of Stimulus Checks Sent Out

How Can You Check On The Status Of A Missing Stimulus Payment

Its easy to check the status of your third stimulus check through the Get My Payment tool. Youll need to request a payment trace if the IRS portal shows your payment was issued but you havent received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

Dont Miss: Contact Irs About Stimulus Payment

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

Recommended Reading: How Can I Check My Stimulus Payment History

Free Virtual Tax Filing Service

Code for America, in partnership with VITA, has created a fully virtual intake process for free tax assistance. In light of COVID-19, Code for Americas Get Your Refund service is a free and safe alternative to prepare your tax return without the risk of in-person interaction.

Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

Code for Americas Get Your Refund service is free for those who earn less than about $66,000. This is a good option if you are comfortable using technology, including sending pictures or documents electronically.

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that years income, number of dependents and other qualifying information.

Recommended Reading: How Many Stimulus Checks Were In 2021

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You May Like: Create Irs Account For Stimulus Check

Other Payments You Can Claim Using The Tool

Additionally, by visiting GetCTC.org, you can claim the Child Tax Credit and Earned Income Tax Credit along with the third stimulus check.

To file for Child Tax Credit, you may e-file online.

To receive your payment, users must answer the questions provided truthfully and accurately.

Filling out the form only takes 15 minutes to complete.

If you would like to claim additional money with EITC, you may contact your employer for your W-2.

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

You May Like: Student Loan Forgiveness Stimulus Check

Penalty Relief For Certain 2019 And 2020 Returns

To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36PDF, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. To qualify for this relief, eligible tax returns must be filed on or before September 30, 2022. See this IRS news release for more information on this relief.