What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

First Change Your Address With Mymove And Usps

Updating your new address with the USPS is pretty straightforward. You can change your address quickly and securely online or fill out a change-of-address form in-person at your local post office.

An online change-of-address is much faster and convenient since you can do it from the comfort of your home.

Recommended Reading: Where Do I Put Stimulus Money On Tax Return

How To Set Up Direct Deposit With Irs

Keep Uncle Sam off your back

If youve hit working age and pay taxes every year, youll need to know how to go about paying any taxes you owe to the IRS.

In the past, paying taxes meant completing the 1040 income tax return every year, and if you owed the IRS anything, youd simply write a paper check and send it in. If you owed more than you could pay, then the IRS would set up a payment plan and youd have to send in a check every month.

In the past few years, times have changed. The IRS has caught up with the rest of the world and now everything is electronic. You can make the one payment each year, or set up your installment payments all electronically.

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

You May Like: How Do I Apply For The 4th Stimulus Check

How To Set Up Direct Deposit With The Irs

One thing thats important to know if youre trying to set up direct deposit with the IRS for things like stimulus checks, thats handled in different ways depending on your tax situation.

Direct Deposit for IRS Stimulus Checks

If youve filed taxes in the past and havent moved or otherwise needed to change your address or bank information, the direct deposit details you provide in the IRS Direct Pay system when you pay your taxes is all you need. The IRS will get your direct deposit information from there.

If you are a first-time filer and the IRS doesnt have your information yet, then you need to provide it manually at the IRS Get My Payment page.

Youll need to provide your social security number, birthday, street address, and zip code. The IRS will then tell you if you qualify for a stimulus payment, and youll be prompted for direct deposit information if they dont already have it on file.

Direct Deposit for IRS Direct Payments

To set up a direct deposit payment via the IRS Direct Pay system, log into your IRS account and go to the Account Home tab on your dashboard. Select the Go To Payment Options button.

Scroll down the page and select Go To IRS Direct Pay under the Pay by Bank Account section.

On this page youll see a couple of options halfway down the page. Select the Make a Payment button to continue.

This will take you through the IRS Make a Payment wizard. This consists of several steps where you need to enter information about yourself and your payment.

Why You May Be Missing Stimulus Money

The first round of stimulus checks, mandated by the Coronavirus Aid, Relief, and Economic Security Act, was signed into law in March 2020. The CARES Act gave a maximum $1,200 per person and $500 per eligible dependent child under 17. Payments were limited by 2019 or 2018 income as reported on federal income tax forms. Individuals who had more than $75,000 in adjusted gross income had their stimulus check reduced by $5 for every $100 of income, and the same was true for married couples filing jointly with income above $150,000. Individuals who earned more than $99,000 and couples who earned more than $198,000 jointly did not receive checks.

The second round of stimulus checks gives a maximum $600 per eligible person and dependent child. Married couples who filed jointly in 2019 receive $1,200 total . Families get an additional $600 for each eligible dependent child under 17. The income limits are the same for the second round of stimulus payments as they were for the first, though the phaseout amounts are lower since the maximum payment is $600 vs. $1,200 during the first round. Individuals who earned more than $87,000 and couples who earned more than $174,000 jointly wont receive second-round checks. The deadline for the IRS to issue second-round payments is Jan. 15.

Other reasons for not getting a stimulus check

You May Like: Where’s My Stimulus Money 2021

Payment Plan Application And Management

Youre required to register for an IRS account before you apply for a payment plan. So if you create an IRS account now, you can make it easier to apply for one in the future.

Once youve created your account and have been approved for a payment plan, you can use your account to view the details of your plan. This is a great and simple way to see how much youve paid and how much you owe.

Fill Out The Information To Create An Account

You will need:

- Email address: Use an email address that you have access to. If you dont have an email address or dont remember or have the password to your account, you can create a new email address for free through a website like Gmail, Yahoo! Mail, or AOL. You will need to check your inbox to confirm your email address to successfully create an account.

- Password: requires both upper- and lower-case letters, 8 characters, and a number. Choose a phrase that you can remember or write down your password in a secure place.

Check the box I accept the ID.me Terms of Service and Privacy Policy after reviewing the links. Then click the blue Create an ID.me account.

Terms of Service

Privacy Policy

Read Also: Irs.gov Stimulus Check Sign Up

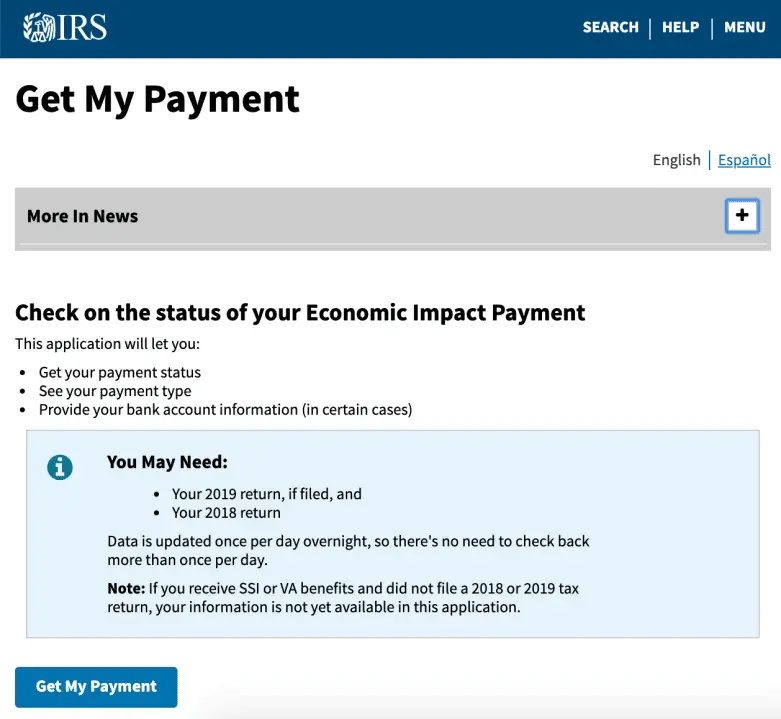

Irs To Create Online Tool For People To Track Stimulus Checks

The Treasury Department and Internal Revenue Service announced Friday that it would release an online tool for people to track their stimulus checks.

The free Get My Payment tool located on the IRS.gov website is expected to be operational by Friday. It will allow taxpayers who filed their returns in 2018 or 2019 without providing their banking information on their tax returns to enable direct deposit information, WDAF reported.

Having direct deposit information on file with the IRS ensures that users will get stimulus money faster than waiting for a check in the mail.

Those who use the tool will be able to track the status of payments by entering a Social Security number, date-of-birth, and mailing address.

Those who want to add bank account information for direct deposit will need to provide, according to WDAF:

- Their Adjusted Gross Income from their most recent tax return submitted, either 2019 or 2018

- The refund or amount owed from their latest filed tax return

- Bank account type, account, and routing numbers

If a user did not file a tax return in 2018 or 2019 with direct deposit information on file, the IRS has released a separate tool for non-filers to submit their personal information to receive stimulus payments.

What Do I Need To Register For An Online Irs Account

Creating an IRS account online takes about 15 to 30 minutes, if everything goes smoothly. Before you start the process, you’ll need to collect a few documents and information. Here’s what you will need:

- A valid email address

- A US passport, passport card or state driver’s license

- Your Social Security number or tax identification number

- A mobile phone registered to you

If you don’t have a mobile phone or don’t want to connect your number to your IRS account online, you can request an activation code by mail. The code will take about 10 days to arrive and will be valid for 30 days.

You May Like: Sign Up For Fourth Stimulus Check

Use Your Phone Or Webcam To Take A Selfie

For instructions on taking a selfie using your computers webcam, see ID.mes guide, How do I take a selfie using a webcam? This option is available if you uploaded your identification photos by computer.

You will need to verify your identity by using your phone camera to scan your face.

When youre ready, click the blue Start button and then the blue Scan my face button.

On your phone, you will be taken to this page where the scan will take place.

Once the scan is completed, you can put aside your phone and continue verifying your identity on your computer.

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Don’t Miss: How Many Economic Stimulus Payments Have There Been

When Did Eip1 From The Cares Act Arrive

The IRS began sending economic impact payments in April of 2020 most taxpayers did not need to take any action to receive their payment.

The Department of the Treasury used info from 2019 tax returns to determine AGI, qualifying children, and whether to send payments by check or direct deposit. If you hadnt filed your 2019 taxes, your 2018 tax return information was used.

The Get My Payment tool allowed taxpayers to choose how to receive their EIP, and the tool also helped track stimulus payments. Get My Payment no longer has information for EIP1, but you can access your EIP1 info via an Online Account at IRS.gov.

Note: You may need to set up an ID.me account to get an Online Account, but the IRS will be transitioning away from facial recognition technology by the end of February 2022.

Who Received The Second Stimulus Check

Individuals who earn $75,000 or less per year will receive $600. Couples who earn less than $150,000 per year will receive $1,200. Children under age 17 will receive $600 each. If you don’t receive the full payment you’re entitled to, file and claim the Recovery Rebate Credit on your 2020 tax return.

You May Like: When Should I Get My Stimulus Check

Social Security Recipients Will Automatically Receive Payments

On April 1st, the U.S. Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

Social Security recipients who are not typically required to file a tax return do not need to take any action, and will receive their payment directly to their bank account.

The IRS says it will begin sending electronic payments to those who qualify and have direct-deposit information on file on April 9th. Those who qualify but havent provided the IRS with bank information through a tax return, TurboTaxs online stimulus check web portal, Social Security or railroad retirement benefits tax form will begin receiving paper checks beginning April 24th.

When Did Eip2 From The Consolidated Appropriations Act Arrive

The Consolidated Appropriations Act EIPs were sent in January, 2021. Direct deposits generally occurred within the first two weeks of January. Mailed payments generally arrived before February 24, 2021.

Get My Payment no longer has information for EIP2, but you can access your EIP2 info via an Online Account at IRS.gov.

Note: To access an Online Account, you will need an ID.me account to verify your identity. .

Also Check: Sign Up For Stimulus Check 2022

A: Verify Your Identity By Either Computer Or Phone

After you press the blue Continue button, you will be taken to the Verify Your Identity page.

You have two options. You can verify using your computer or phone. These instructions focus on the phone option.

Choose the blue Take a photo with my device button. Be sure that your cell phone has a camera and access to the Internet. This option requires you to use both your computer and your phone. For the following steps, this guide will let you know when to use your computer or your phone.

How Do I Get My Stimulus Check If My Bank Account Changed

The IRS states that if your bank account information has changed or was incorrect, you will not be able to simply update it in the Get My Payment tool. Instead, the bank will return your payment to the IRS, and then the IRS will mail you the payment by check at the address it already has on file for you.

Also Check: Amending Taxes For Stimulus Check

How Much Will I Get

The payments are based on income and family size.

Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer.

Taxpayers with dependents will receive an extra $350, regardless of the total number of dependents.

In other words, a couple that earns a combined $125,000 and has two children would qualify for $350 per adult plus $350 for their children, for a total of $1,050.

How To Set Up Direct Deposit For Your Stimulus Check From The Irs

Over 80 million Americans will receive their coronavirus stimulus checks via direct deposit by Wednesday, April 15, according to Treasury Secretary Steven Mnuchin.

But the estimated 20 percent of Americans who haven’t set up direct deposit with the IRS may want to do so in order to receive their stimulus funds more quicklyit beats waiting around for a mailed check.

Those who set up an electronic funds transfer with the IRS when filing their taxes in 2018 or 2019 will have the funds automatically deposited into their accounts using whatever bank information they previously providedno further action necessary. This also applies to those who already receive Social Security retirement, disability or survivor benefits or Railroad Retirement payments through direct deposit as well.

People who filed taxes in 2018 or 2019 but who didn’t set up a direct deposit will have to wait until the government completes an app called “Get My Payment” where they can enter bank information and track their payment.

Although the app is supposed to work on phones, tablets and desktops, the webpage where the app will be available currently says “coming mid-April.” The government has said it will be active starting April 17.

Those who haven’t filed taxes in the last two years or who haven’t set up a direct deposit with the IRS in the past can do so using this web portal.

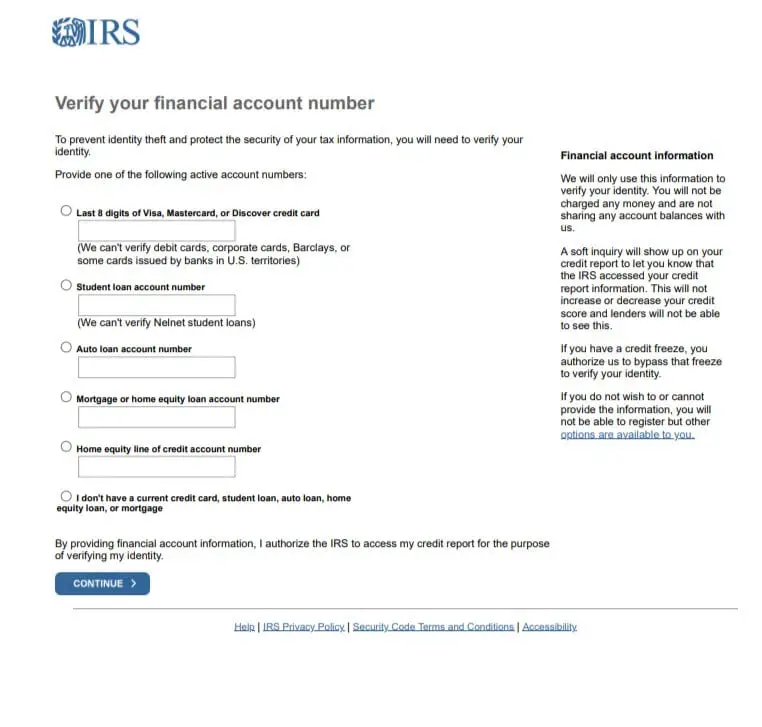

After creating an account, the website will ask you for the following personal information:

Read Also: Stimulus Check For Expecting Mothers 2022