Inflation Relief: When Are The Next Stimulus Checks Arriving

California is ready to send millions in stimulus money

California is sending 2.1 million direct deposits worth a maximum of $1,050 to several families two Fridays ago.

The state of California helps the economic inflation impact with millions of dollars gathered for a single stimulus check payment.

Even when California delivered the first deposits one week ago, several beneficiaries are asking why they haven’t received their stimulus check money.

California Stimulus Checks: What To Do If You Didnt Receive Your $600

California is sending out $600 stimulus payments to certain people, and for those who havent received their payment, the first thing to do is make sure their 2020 tax return was filed.

The Golden State Stimulus plan allocates $600 or $1,200 to eligible residents in the state, but to receive the money, a person must have filed 2020 tax return. Payments are sent out bimonthly, and those who havent filed their return will have to wait up to 60 days after they file to receive a payment.

If you think your payment was stolen, the Californias Franchise Tax Board advises reporting it by using the online Fraud Referral Report. Those who still have questions about their lack of a payment are encouraged to contact the Franchise Tax Board. Along with mail and phone options, the website has a chat feature where people can communicate with a representative from the website between 8 a.m. and 5 p.m., Monday through Friday.

However, the Franchise Tax Board noted that people should give the agency 45 days beyond mailing time frames after they file for a refund, to allow for the payment to process.

If you filed a tax return before April 23 and havent received a payment, it may still be processing. The Franchise Tax Board says people who filed between March 2 and April 23 may have to wait up to two weeks for a direct deposit, or up to six weeks if theyre set to receive a paper check.

Who Does The Irs Consider An Adult Or A Dependent For Stimulus Payments

Under the tax law especially in terms of stimulus check, it is important to define adult or dependent clearly. There are rules from the tax law defining dependents. To be dependent, you must depend on your parents income. Then your parent should explain you as a dependent to get stimulus payment in the year 2019 or 2020.

Dont Miss: Irs Forms For Stimulus Checks

Don’t Miss: When Are We Getting Another Stimulus Check

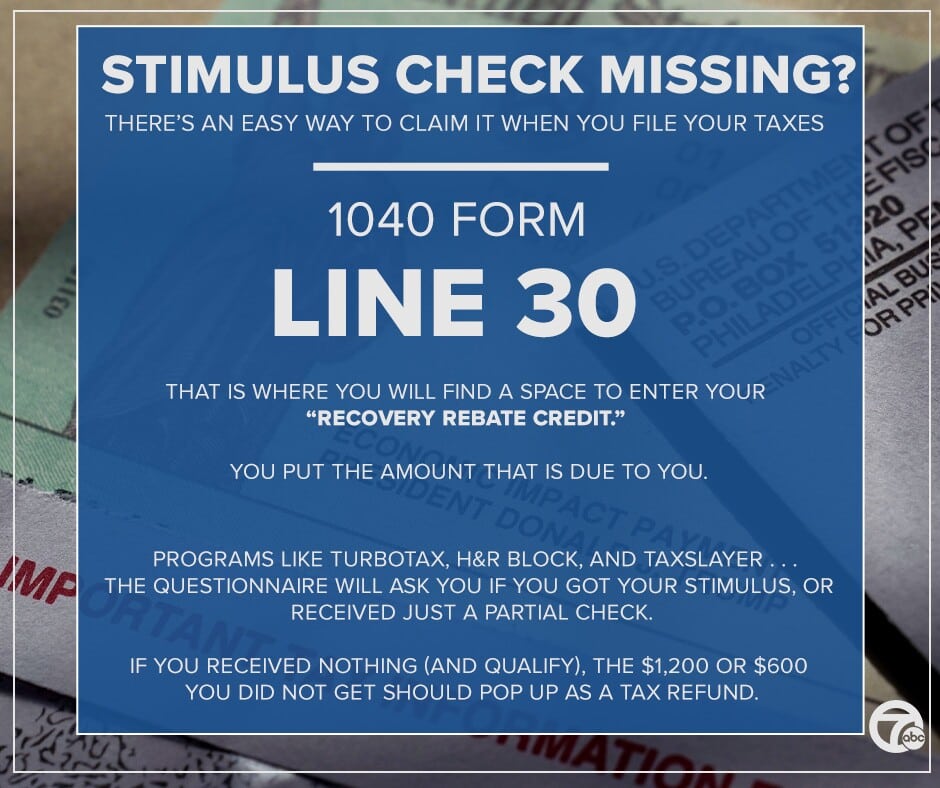

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

When Will I Get My Payment Who Gets Paid First

The state is sending out the payments in waves. When you get paid depends on the method with which youre getting paid .

The earliest direct deposits will go out Friday, Oct. 7, to people who received a Golden State Stimulus payment last year by direct deposit.

The last payments should be sent out by Jan. 15, 2023, at the latest, according to the Franchise Tax Board.

Use the chart below to see when you can expect your payment:

| Payment date |

| Taxpayers who dont fall into above categories |

Recommended Reading: Irs 1044 Form For Stimulus Check

What Is The Recovery Rebate Credit

The Recovery Rebate Credit is a taxcredit you can get if you were eligible for stimulus checks and didnt receive them or got less than the full amount. You can claim the credit for the first and second stimulus checks when you file a2020 tax return.To get the third stimulus check you must claim the credit when you file a 2021 tax return.

Will I Still Receive A Direct Deposit If I Haven’t Gotten It Already

The short answer yes. But it depends on a few factors.

Californians who received a Golden State Stimulus check should receive a direct deposit by Tuesday, Oct. 25.

If you did not receive the Golden State Stimulus, but are still eligible for the inflation relief payment, you should see the direct deposit between Oct. 28 and Nov. 14, according to the state,

Read Also: Could There Be Another Stimulus Check

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return.

- Received your Golden State Stimulus payment by check.

- Received your tax refund by check regardless of filing method.

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number.

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

How Can I Get My Stimulus Checks

The IRS has sent out all first, second, and third stimulus checks. If you didnt receive one or more of your stimulus checks, you can still get them.

First and second stimulus checks

You can get your first and second stimulus check by claiming them as the Recovery Rebate Credit when you file a2020federal tax return .. You can file your taxes virtually by going to GetYourRefund.orgthrough October 1, 2022.

Third stimulus check

To get your third stimulus check, you will have to file a2021federal tax return and claim the third stimulus check as the 2021 Recovery Rebate Credit. Note that this is a different tax year than you must file for the first and second stimulus checks..

Recommended Reading: When Was The Second Stimulus Check Sent Out

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

Also Check: When Will South Carolina Receive Stimulus Checks

You Requested An Itin But Havent Received One Yet

Californians who applied for an Individual Taxpayer Identification Number by Oct. 15 but didnt get one yet will have an additional four months to file their tax returns and still be considered for a GSS II payment, as well as the Golden State Stimulus I program from earlier this year.

The deadline to file a 2020 return for these individuals is Feb. 15, 2022, according to the state.

More information on Golden State Stimulus payments can be found here.

Also Check: How To Get California Stimulus

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally dont file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Your 2020 Tax Return Hasnt Been Processed Yet

Eligible individuals who submitted their 2020 taxes on time but whose returns have not yet been processed by the state yet should expect a delay in their payment, according to the Franchise Tax Board.

Taxpayers who filed after Sept. 1 and typically get their refund via direct deposit likely wont get the payment until up to 45 days after their return has been processed.

For those anticipating a payment by mail, expect a longer delay up to two months if the return hasnt been processed prior to their ZIP codes scheduled payment date.

On top of that, Some payments may need extra time to process for accuracy and completeness, the state notes.

You May Like: How To Get The 1400 Stimulus Check

California Inflation Relief Payments: Final Batch Of Dates Announced

Posted: Nov 22, 2022 / 07:13 AM PST

Posted: Nov 22, 2022 / 07:13 AM PST

Still havent received your California inflation relief check? The Franchise Tax Board, the agency responsible for disbursing state tax refunds, has finally released its full payment schedule.

Over the past few months, the FTB has slowly been releasing more and more information about when it plans to issue the Middle Class Tax Refund direct deposits and debit cards. The state has been working its way through the roughly 18 million payments, which range from $200 to $1,050, in order of payment type and last name.

To see when you will receive your inflation relief payment, you first need to determine how youll be receiving it. Once youve done that, look for the row relevant to you on the charts below.

California Stimulus Check Summary

Heres the bottom line:

The state of California will provide the Golden Status Stimulus payment to families and people who qualify.

There is Golden State Stimulus I and Golden State Stimulus II.

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

You May Like: Income Limit For 3rd Stimulus Check

You May Like: Stimulus Checks For Soc Sec

You Receive Social Security Or Other Benefits But No Extra Income

People who receive Social Security, CalWorks and CalFresh benefits, Supplemental Security Income/State Supplementary Payment/and Cash Assistance Program for Immigrants, State Disability Insurance and VA disability benefits, or unemployment income generally do not qualify for a GSS II payment if those benefits are their only income source, according to the state, noting that those forms are not included in AGI.

However, if the recipient has other sources that do count as adjusted gross income, they may qualify to receive a stimulus check.

California Mctr Scams Increasing In Frequency

In related news, according to ABC7 Los Angeles, city attorney Mike Feuer has issued a warning to MCTR recipients to be wary of scam texts with links to activate or reactivate refund debit cards. These messages are often sent by criminals looking to steal personal information and funds.

Californians are so eager at this time of year to get this tax relief, said Feuer in an interview. It would be a fairly automatic gesture to simply click onto a link, when youre asked to activate a California prepaid debit card. Any of us could be vulnerable to this.

More From GOBankingRates

Don’t Miss: Update On 4th Stimulus Check For Social Security Recipients

How Much Will My Check Be For

- Single taxpayers who earned less than $75,000 and couples who filed jointly and made less than $150,000 will receive $350 per taxpayer and another flat $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050. This is the largest bracket, KCRA reported, representing more than 80% of beneficiaries.

- Individual filers who made between $75,000 and $125,000 — and couples who earned between $150,000 and $250,000 — will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with any children could receive $750.

- Individual filers who earned between $125,000 and $250,000 and couples who earned between $250,000 and $500,000 would receive $200 each. A family with children in this bracket could receive a maximum of $600.

Claim Your Golden State Stimulus

The COVID-19 pandemic created tough financial challenges for working families all across California.The Golden State Stimulus programs provides rapid cash support to millions low and middle income Californians.

There are two different Golden State Stimulus. You may qualify for one or both. Visit the page below for more on Golden State Stimulus I & II.

Do I Qualify for the Golden State Stimulus I?

You may qualify for the Golden State Stimulus I if you are a California resident, not claimed as a dependent, and either of the following apply:

-

Claim the CalEITC on your 2020 California tax return be October 15, 2021 to receive $600 or

-

File your 2020 tax return with an Individual Tax Identification Number and up to $75,000 to receive $1,200.

Do I Qualify for the Golden State Stimulus II?

You may qualify for the Golden State Stimulus II if you are a California resident, not claimed as a dependent, and all of the following apply:

-

File your 2020 California tax return by October 15, 2021 and

-

Have a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year

The Golden State Stimulus II provides $600 to taxpayers that did not qualify for GSS I and an

additional $500 – $1,000 if there is a child dependent and reported up to $75,000 for the 2020 tax year.

Recommended Reading: South Carolina Stimulus Check 2021

Golden State Stimulus I

California will provide the Golden State Stimulus payment to families and individuals who qualify. This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit or file with an Individual Taxpayer Identification Number .

The Golden State Stimulus aims to:

- Support low-income Californians

- Help those facing a hardship due to COVID-19

For most Californians who qualify, you dont need to do anything to receive the stimulus payment.

The GSS I payment is a different payment than the Golden State Stimulus II .

California Inflation Relief Payments: When Will I Get My Check

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

California residents have started receiving onetime “Middle Class Tax Refund” payments.

Why it matters

Eligible taxpayers will receive between $200 and $1,050, either through direct deposit or debit cards.

Inflation-relief payments started going out to California taxpayers this month. The Middle Class Tax Refund, as it’s being billed, can be for as much as $1,050, depending on your income, residency, filing status and household size.The payout is part of Gov. Gavin Newsom’s $12 billion relief effort, which he said “prioritizes getting dollars back into the pockets of millions of Californians grappling with global inflation and rising prices.” As of Oct. 20, nearly 3.5 million Californians already received their payments through direct deposit, according to the Franchise Tax Board.

Here’s what you need to know about California’s inflation relief checks, including who’s eligible, how much they can get and how payments are being distributed.

For more on tax relief, find out which other states are issuing tax refunds and pausing their gas tax.

Read Also: Are They Sending Out Stimulus Checks

What Are The Requirements

For Social Security recipients who reported earnings of $1 to $75,000 on their 2020 tax return, there are additional requirements.

You must have been a California resident for most of last year and still live in the state.

You must have a Social Security number or an Individual Taxpayer Identification Number.

You cannot be claimed as a dependent by another taxpayer.

The state expects to continue issuing stimulus checks through the beginning of 2022.

Plus, California has a Golden State Stimulus II estimator to find out if you qualify.

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income that’s on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Also Check: Qualifications For 3rd Stimulus Check