Filing A Payment Trace To Find Missing Stimulus Money

You can request an IRS payment trace if you received the confirmation letter from the IRS that your payment was sent , or if the Get My Payment tool shows that your payment was issued but you have not received it within certain time frames. This is the case for all three checks. Check out our guide to requesting an IRS Payment Trace here.

Dont Miss:

I Should Have Received More What Do I Do

File your tax return! The sooner you file your taxes, the sooner the IRS will pay out the difference.

Pay particular attention to line 30 of your Form 1040, which asks about a Recovery Rebate Credit.

The IRS is looking for you to calculate the difference between what you did receive and what you should have received. Full instructions for how to do that are available on Page 58 of this document, but here is an example:

A couple who received $3,600 in stimulus money , but had their first child in 2020, would be able to claim the dependent supplements they didnt get. One line 30, they would claim a credit of $1,100 .

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: Didnt Get Any Stimulus Checks

Recommended Reading: How Do I Know If I Received My Stimulus Check

I Received A Second Payment But My Spouse Didn’t

There have been cases where a couple submit their tax returns as “married filing jointly,” and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRS’s part. Unfortunately, the spouse who didn’t receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Will The Stimulus Affect My Taxes For This Year Or Next Year

None of the three stimulus checks are considered income, and therefore arent taxable. They wont reduce your refund or increase what you owe when you file your taxes this year, or next. They also wont affect your eligibility for any federal government assistance or benefits.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

You May Like: When We Getting Stimulus Checks

Recap Of First And Second Rounds Of Stimulus Payments

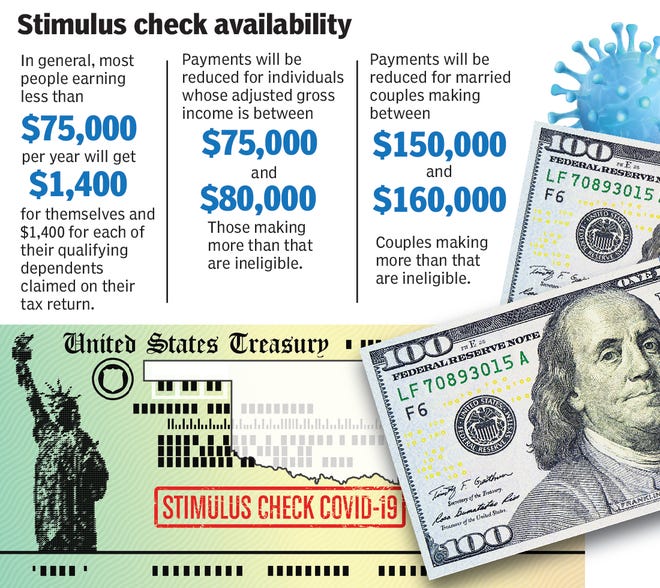

Most Americans have received their initial $1,200 stimulus checks, or economic impact payments , as the Internal Revenue Service calls them. The first round of stimulus money, which was approved under the $2.2 trillion CARES Act in March 2020, also included $500 payments for eligible dependent children under age 17. Payments were sent via direct deposit, paper check and prepaid debit card.

Congress included a second round of stimulus checks in a $900 billion coronavirus relief bill in December 2020 that offered most Americans payments of up to $600 for themselves and their dependent children under age 17. It was a way to put more money directly in the pockets of families still struggling to manage the economic fallout of the pandemic. By law the IRS had until January 15, 2021, to issue the bulk of the second-round stimulus checks.

If you didnt get the first two rounds of payments, or thought you didnt get as much as you deserved, you can collect your missing stimulus money by filing a 2020 tax return and claiming the Recovery Rebate Credit.

John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter forKiplinger’s Personal FinanceandUSA Todayand has written books on investing and the 2008 financial crisis. Waggoner’sUSA Todayinvesting column ran in dozens of newspapers for 25 years.

Also of Interest

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if youre claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

Read Also: When Did We Get Stimulus Checks In 2021

Youre Getting A Paper Check Instead Of Direct Deposit

Most stimulus checks will be distributed directly into your bank account through direct deposit. If you dont have a bank account or havent provided your bank account information to the IRS, then you may get a paper check or debit card. You can track your stimulus check with the Get My Payment tool, which can tell you whether your stimulus check has been sent and how you will get paid.

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Recommended Reading: Irs Tax Stimulus Checks: Social Security

Heres How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they dont usually file taxes, and claim whats called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the personowes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though its a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

What If The Irs Sends The Incorrect Amount

The IRS has said that the third stimulus payments will be based on 2020 income. So if you receive a payment before the agency processes last year’s return but you qualify for more money based on your 2020 income, the agency will top off your stimulus payment at some point this year.

Taxpayers won’t have to do anything to get all of the money they are eligible for, except file their 2020 returns. If you qualify for less money in 2020, you will not owe any money back.

This is also true for people who have a child during the year, or who receive an incorrect payment amount.

The agency has so far not given a date for when it expects to make these additional payments.

Read Also: When Did The Stimulus Checks Go Out In 2021

What To Do If One Of The Three Stimulus Checks Hasnt Arrived

About 15 days after the IRS sends out your check, you should receive a letter from the agency confirming the payment. When the first round of stimulus checks went out last year, that letter included two hotline phone numbers because thousands of agents were available to help. But with the second and third rounds of checks, the IRS changed its tune, and these phone numbers may be disconnected.

Here are common scenarios that might indicate you need to look into your stimulus payment:

- If youre one of the millions of people who qualified for the first stimulus check but never got it.

- If your second stimulus check has still not arrived.

- If you got a letter from the IRS saying your third check was sent, but never received the payment. Or, if the IRS Get My Payment portal said your payment was sent, but you didnt get it.

- If you got some of your stimulus money from any payment, but not all of it.

You should also confirm youre qualified to get the stimulus payment, since not everyone who received a previous check is qualified this time. If you think its time to take action, read for more options.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Recommended Reading: When Will The $1400 Stimulus Checks Be Mailed Out

I Got A Payment Status Not Available Message

Many checking on their second stimulus check were seeing a message that said Payment Status #2 Not Available. The IRS has indicated that these individuals will not receive a stimulus check by direct deposit or mail and they will have to file their 2020 tax return to claim their Recovery Rebate Credit. See below for instructions on claiming the rebate on your tax return.

These messages have now disappeared and will be replaced by information about the third payment.

When To Request A Payment Trace

If the Get My Payment tool says that your third stimulus payment was issued as a direct deposit into your bank account, you should first check with your bank before submitting a payment trace request to make sure they didnt get a deposit. But wait at least five days after the estimated delivery date. Otherwise, the bank might not have the necessary information. After five days, you can request a payment trace if the bank still hasnt received your payment.

If you were scheduled to get a third-round paper stimulus check in the mail, the IRS cant initiate a payment trace unless it has been:

- Four weeks since the check was mailed to a standard address

- Six weeks since the check was mailed if you have a forwarding address on file with the local post office or

- Nine weeks since the check was mailed to a foreign address.

and check with your local consulate for more information.)

You May Like: Haven’t Got My Stimulus

How To Claim Your Recovery Rebate Credit

If you never received your third stimulus check, you can still get your funds. Rather than free money, this check was actually an advance on a tax credit called the Recovery Rebate Credit. People who received the third stimulus check arent eligible to receive the credit on their taxes. If you have never received your third stimulus check, however, you may be able to claim the Recovery Rebate Credit on your taxes. Similarly, many parents received advance payments on their Child Tax Credit throughout 2021.

If you didnt get your check by the time youre ready to file taxes for 2021 in 2022, you could claim the 2021 Recovery Rebate Credit on your taxes. The IRS stopped issuing the third stimulus check in December 2021. Keep in mind that filing for the tax credit doesnt automatically mean youll get an extra $1,400 in your refund. Rather, the tax credit reduces your taxable income by the number of dollars the credit is worth. If you were eligible for $2,800 in third stimulus payments and your taxable income was $50,000, for example, you could subtract the $2,800 from the $50,000 to be taxed on $47,200 instead.

Although its not the same as getting a check, it has a similar financial impact to putting the amount of the check back in your pocket. The reduction in taxable income lowers the amount of taxes youll owe. If you owe money on your taxes, youll owe less by claiming the rebate credit. If you receive a refund, itll become higher.

How To Request A Payment Trace

There are two ways to request a payment trace for a third stimulus check:

- Mail or fax a completed Form 3911 to the IRS.

Pick only one method . Also remember that you cant request a payment trace before the timeframes described above the IRS cant process a request until after the appropriate time period has passed.

If youre using Form 3911, make sure you:

- Write EIP3 on the top of the form to identify the payment you want to trace

- Complete the form answering all refund questions as they relate to your third stimulus payment

- When completing item 7 under Section 1, check the box for Individual as the type of return, enter 2021 as the tax period, and dont write anything for the date filed and

- Sign the form .

Mail or fax the form to the appropriate address or fax number according to the chart below. Dont send anything other than a Form 3911 to the fax numbers listed.

You May Like: Is There Going To Be Anymore Stimulus Checks

Missing Stimulus Money Claim The Recovery Rebate Credit

Technically, stimulus payments are an advance on a tax credit for the 2020 tax year. The IRS calls this credit the Recovery Rebate Credit. Unlike a tax deduction, which reduces your taxable income , a tax credit reduces the amount of tax you owe, dollar for dollar. Even better, and unlike most credits, the Recovery Rebate Credit will give you money back even if its more than the tax you owe or paid. For example, if you owe $700 in federal income taxes for 2020, a $1,200 stimulus tax credit would net you a $500 tax refund.

You need to file federal tax form 1040 or 1040-SR for 2020 to claim your Recovery Rebate Credit. Youll also need your IRS Notice 1444, the letter the IRS should have sent to you a few days after you got your first stimulus check, and IRS Notice 1444-B, which you would have gotten after your second stimulus check. If you didnt get a stimulus check, you dont need either notice.

Use the Recovery Rebate Credit worksheet on page 59 of the IRS instructions for the 1040 or 1040-SR to calculate how much stimulus money youre entitled to for the credit.

Also of Interest

Also Check: Are We Getting Another Stimulus Pay

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couples total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individuals online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Recommended Reading: Where’s My Stimulus California