If I Had A Baby In 2021 Can I Get Stimulus Money For Them When I File My Taxes

If you had a baby in 2021, the IRS did not have information on your new baby when they issued the third round of stimulus payments based on your latest tax filing . Since they didnt have the information for your new baby, you can get the stimulus for your new baby in the form of a recovery rebate credit when you file your 2021 taxes.

Recommended Reading: How Many Irs Stimulus Payments In 2021

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Why Can’t I Claim My Second Stimulus Check Now

With the first round of stimulus checks, qualified individuals who were waiting for their payment could request their money right away through an IRS portal. One commonly asked question is why this isn’t the case this time around.

With the first stimulus check, the Treasury Department and IRS sent payments automatically to taxpayers for whom bank account information was on file and created an online portal that allowed everyone else to register for and receive the payment. People could still claim and receive their initial $1,200 stimulus check months after most of the payments had been given out.

There’s a good reason the government decided to do this. At the time the first stimulus check was granted as part of the CARES Act, the majority of Americans had already filed their tax returns, so there wasn’t any other mechanism in place to get deserving U.S. residents their money.

With the second stimulus check, it just so happens that 2020 tax season is right around the corner. In fact, the IRS recently announced that tax season will start on Feb. 12, so the best course of action if you’re entitled to a second stimulus payment but didn’t get it would be to file your 2020 tax return as soon as possible on or after that date — making sure to claim your Recovery Rebate Credit, of course.

Don’t Miss: New Stimulus Check For Seniors

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: Didnt Get Any Stimulus Checks

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Don’t Miss: When Is The Latest Stimulus Check Coming

Do I Have To Return Money I Received But Dont Qualify For

If you got more money than you should have if your income went up in 2020 and you wouldnt have qualified based on your 2020 income, for example then you dont owe any money back because of that, Bronnenkant says.

Another scenario, Erb says, could be those who receive payment for a dependent child who turned 17 in 2020, aging out of eligibility. But again, you dont need to repay the money received in that case. If it turns out that you got more than you deserved, then you dont have to pay it back, she says.

Irs Free File Open Until November 17

To help get the word out about these tax benefits, the IRS announced on October 13, that it is sending letters to more than nine million individuals and families who appear to qualify for these stimulus benefits but did not claim them by filing a 2021 federal income tax return.

This includes people eligible not only for the 2021 recovery rebate credit and the child tax credit but also the earned income tax credit. The letters should arrive in the coming weeks.

Also, in addition to filing a 2021 tax return at ChildTaxCredit.gov, the IRS says that Free File will remain open for an until November 17, 2022. Thats one month later than the tool is normally available. If your income is $73,000 or less, Free File allows you to file your tax return online at no cost to you.

Also Check: Are Stimulus Checks Still Going Out

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

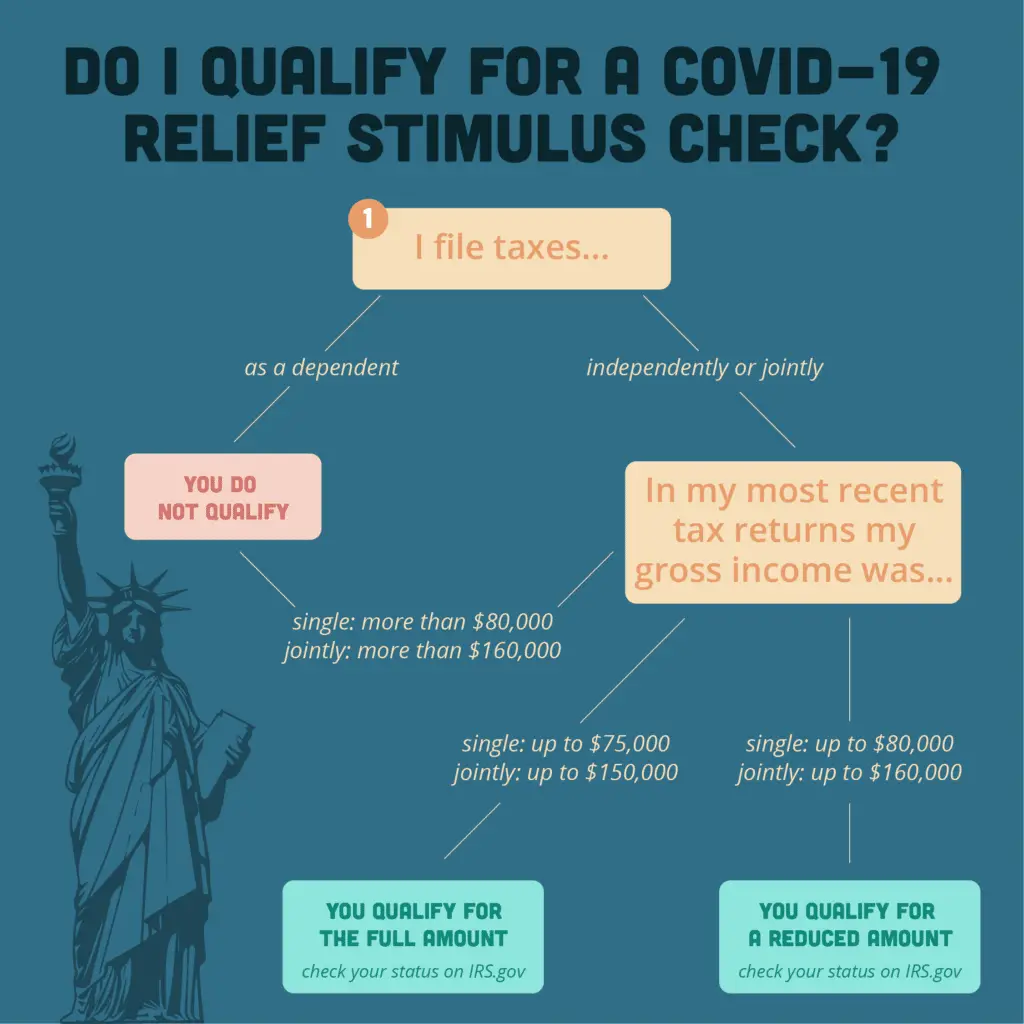

Heads Of Households: If Your Agi Is Over $120000 Or More You’re Not Eligible

Similar to the single-taxpayer cutoff, heads of household with an AGI of $120,000 or more are excluded under the new bill. To get a partial stimulus payment, you’d need to make between $112,500 and $120,000. But to get the full amount, you’d need to make less than $112,500 if you’re the head of household.

Read Also: When Did I Get My Stimulus Check

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Also Check: Who Qualify For The Stimulus Check

California Stimulus Checks: What To Do If You Didnt Receive Your $600

California is sending out $600 stimulus payments to certain people, and for those who havent received their payment, the first thing to do is make sure their 2020 tax return was filed.

The Golden State Stimulus plan allocates $600 or $1,200 to eligible residents in the state, but to receive the money, a person must have filed 2020 tax return. Payments are sent out bimonthly, and those who havent filed their return will have to wait up to 60 days after they file to receive a payment.

If you think your payment was stolen, the Californias Franchise Tax Board advises reporting it by using the online Fraud Referral Report. Those who still have questions about their lack of a payment are encouraged to contact the Franchise Tax Board. Along with mail and phone options, the website has a chat feature where people can communicate with a representative from the website between 8 a.m. and 5 p.m., Monday through Friday.

However, the Franchise Tax Board noted that people should give the agency 45 days beyond mailing time frames after they file for a refund, to allow for the payment to process.

If you filed a tax return before April 23 and havent received a payment, it may still be processing. The Franchise Tax Board says people who filed between March 2 and April 23 may have to wait up to two weeks for a direct deposit, or up to six weeks if theyre set to receive a paper check.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Read Also: How Many Stimulus Checks Did I Get In 2021

Also Check: How Many Stimulus Checks Have Been Sent

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if you’re claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return — but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

Who Does The Irs Consider An Adult Or A Dependent For Stimulus Payments

Under the tax law especially in terms of stimulus check, it is important to define adult or dependent clearly. There are rules from the tax law defining dependents. To be dependent, you must depend on your parents income. Then your parent should explain you as a dependent to get stimulus payment in the year 2019 or 2020.

Dont Miss: Irs Forms For Stimulus Checks

Also Check: How Much Was 2021 Stimulus Check

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Dont Miss: When Is The 3rd Stimulus Check Coming

Not Everyone Who Lives In A Us Territory Is Ensured A Check

With the first two stimulus checks, people who live in Puerto Rico, the US Virgin Islands, American Samoa, Guam or the Commonwealth of the Northern Mariana Islands may have been eligible to receive payments. Whether these groups qualified for a check has in the past been determined by the tax authorities in each territory. These agencies were also directed to make the payments. It’s the same situation for the third stimulus checks.

If you never received a payment for one or both of the previous stimulus checks, you’ll need to contact your local tax authority to inquire.

Nonfilers will need to take an extra step to get their stimulus money.

Don’t Miss: How Much Third Stimulus Check

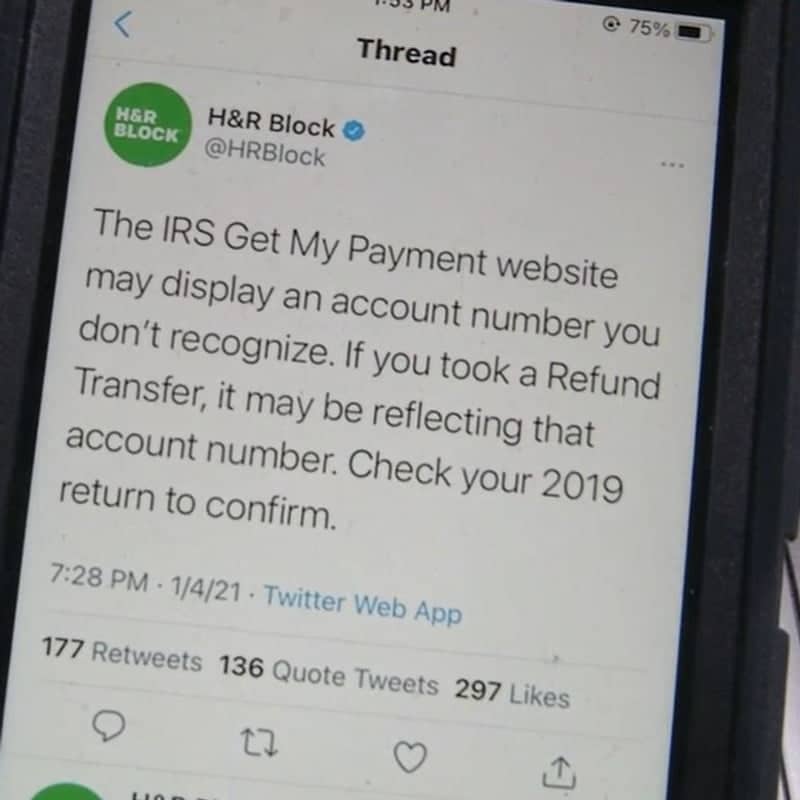

I Moved Since The Last Stimulus Checks Were Distributed How Will I Get My Money

If you received a payment electronically last time, youâll receive your money the same way this time. If you received a check by mail last time but have moved since then, the check will either be forwarded to your new address or returned to the IRS. If your payment gets returned, the IRS will hold your payment until you provide a new address. You will need to monitor the payment portal if you havenât received your check and suspect itâs due to a change of addressâyou wonât be contacted by the IRS to update your information.

Individual Taxpayers With Agi Of $80000 Or More Arent Eligible

The new stimulus check will begin to phase out after $75,000, per the new targeted stimulus plan. If your adjusted gross income, or AGI, is $80,000 or more, you wont be eligible for a third payment of any amount. However, if you make between $75,000 and $80,000, you could get a portion of the check. Youd receive the full amount if your yearly income is less than $75,000. Heres how to estimate the stimulus check total you could receive.

Don’t Miss: Are There Any More Stimulus Payments Coming

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that years income, number of dependents and other qualifying information.

Recommended Reading: Irs Stimulus Check Tax Return

Is There A Stimulus Check For 2022

In addition to the pandemic relief stimulus payments and the 2021 child tax credit, you may have heard about so called 2022 stimulus checks. The 2022 stimulus checks are essentially rebates coming from various statesnot pandemic stimulus payments from the federal government.

Why are states sending rebate checks? Because of pandemic relief funding, many states have extra cash on hand, and so are sending rebate checks to their residents in 2022. Some states like Virginia, and California, are sending those payments out now. But several other states will send rebates or have already sent them.

You May Like: Is There Going To.be Another Stimulus Check

How Far Does A $1200 Stimulus Check Go For American Families

The people that have fallen through the cracks, Marr said, are many of those who are enrolled in state-administered programs like food stamps and Medicaid, but dont get federal benefits. They struggle during good times, but now were in the middle of a global pandemic he said. Data shows that a growing number of the poorest Americans are having trouble getting basic needs like food or a place to live.

A virtual stalemate between lawmakers over additional stimulus makes these payments even more critical for low-income Americans. Congress right now is bogged down, so this is really the only relief these people will receive, Marr said.

I wish the IRS had done more, Mierzwinski said. This pandemic response has been a debacle.