Talk With A Kansas Attorney

Our experiencedfamily law andbusiness attorneys at Sloan Law Firm assist clients with questions relating to taxes, including coronavirus economic impact assistance and stimulus payments, as well as the child tax credit. With offices in Topeka and Lawrence, we help clients throughout Kansas. We invite you to contact us by calling or using our online contact form.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Read Also: Will Social Security Get The Fourth Stimulus Check

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

Do I Need To Claim My Stimulus Check On My 2021 Taxes

Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring. The 2021 stimulus checks were disbursed to eligible recipients starting in March of last year. They are worth up to $1,400 per qualifying taxpayer and each of their dependents.

Recommended Reading: Are We Getting More Stimulus Money

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

Should I File My 2020 Taxes Now

The IRS already began issuing stimulus payments based on your latest filed tax return between 2018 and 2019. If you are required to file a tax return and havent filed your 2020 taxes, you may want to consider filing since you may be eligible for a tax refund. Last tax season about 72% of taxpayers received a tax refund and the average tax refund was close to $3,000.

Recommended Reading: Get My 2nd Stimulus Payment

Will I Lose Out If I Didnt Sign Up In Time To Get A Payment On July 15

No. Everyone can receive the full Child Tax Credit benefits they are owed. If you signed up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.

What You Need To Know About Your 2021 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief will be taking many shapes over the coming months, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Letâs take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

Also Check: Stimulus Checks Gas Prices 2022

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Read Also: Filing For Stimulus Check 2021

What Is Cuny Asap

The City University of New Yorks Accelerated Study in Associate Programs , launched in 2007 with funding from the New York City Center for Economic Opportunity, is an uncommonly comprehensive and long-term program designed to help more low-income students graduate and help them graduate more quickly.

Do I Qualify For The Stimulus Payments

You can receive stimulus payments if you have a Social Security Number, even if you make little or no money.

Generally, the children in your family qualify for the first two stimulus payments too if they are under 18 and live with you most of the year. You can receive the third stimulus payment for any family member who is your dependent, even if they are not a child.

Recommended Reading: What’s The Update On The 4th Stimulus Checks

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Are Stimulus Checks Taxable

- 8:35 ET, Aug 8 2022

TAX season is in the rearview mirror, but many Americans took an extension that will allow them to file a 2021 tax return by October 17.

And many are wondering if stimulus checks received last year are subject to being taxed.

In 2021, millions of Americans received a stimulus check worth up to $1,400.

That was the third round of stimulus issued amidst the ongoing Covid pandemic.

The payment was in addition to the child tax credit payments that began in July 2021, offering up to $300 per month per child to qualified parents.

Some individual states also issued aid to residents and more states rolled out relief refund programs this year to help compensate for surging inflation.

Don’t Miss: Contact Irs About Stimulus Payment

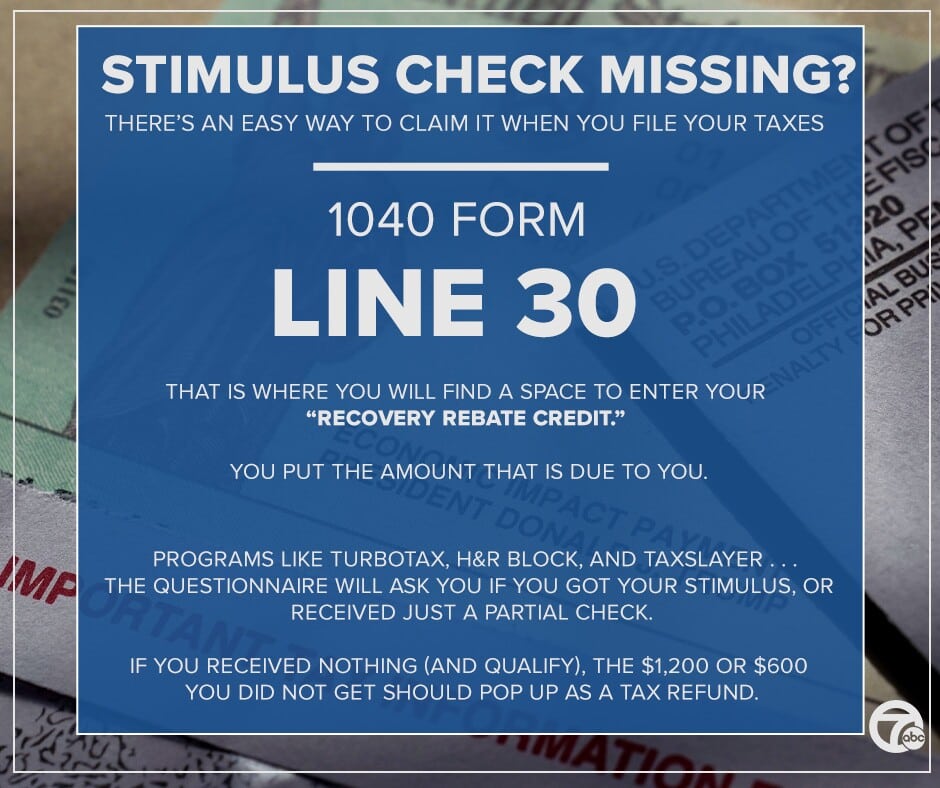

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

“Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,” the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency’s website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRS’ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

Recovery Rebate Credit Topic C: Eligibility For Claiming A Recovery Rebate Credit On A 2021 Tax Return

These updated FAQs were released to the public in Fact Sheet 2022-27PDF, April 13, 2022.

If you didn’t get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don’t usually file taxes – to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card or mobile app and will need to provide routing and account numbers.

If you didn’t get the full amount of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t usually file taxes – to claim it. DO NOT include any information regarding the first and second Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

Q C1. Eligibility Requirements: What are the eligibility requirements for the credit?

You received the full amount of your third Economic Impact Payment if the total amount was:

No credit is allowed when AGI is at least the following amount:

Also Check: Track My Golden State Stimulus 2

Who Is Eligible For The Rebate Credit Parents Of Babies Born In 2021 And More

Plenty of things could have changed in your life since you filed 2019 or 2020 federal income tax returns. If a new child joined the family in 2021, for example, youd want to claim the Recovery Rebate Credit to claim up to $1,400 owed for that child.

The parents would need to be able to claim the child as a dependent on their 2021 income tax return and qualify based on income limits for the credit.

What To Know About Free Government Money

Economic stimulus payments are designed to help citizens pay their bills and increase consumer spending to improve the economy. Those stimulus payments arent taxable they are a gift from the government. There is no need to claim stimulus checks since stimulus payments arent considered part of your income. That also means that the additional payments dont affect your income tax bracket, so its essentially free money.

Everyone should have received two stimulus payments in 2020a payment of $1,200 per adult and then a second payment of $600 per adult. To be eligible for the 2020 stimulus checks you needed to earn less than $75.000 per year if you are single or less than $150,000 per year if you are married and file a joint tax return.

Government stimulus payments are considered an advance payment of a tax credit, and tax credits arent taxable income. Since stimulus money is considered a tax credit, you may even qualify to get money back. If you pay taxes and arent considered a dependent on someone elses income tax, then you are eligible to claim the tax credit.

There is a distinct difference between a tax deduction and a tax credit. A tax deduction is an expense that you can subtract from your taxable income. Once you calculate your total income, you subtract any deductions and that amount becomes your taxable income. A tax credit, on the other hand, is taken after you calculate your taxable income, so it is a dollar-for-dollar reduction in your tax bill.

You May Like: The First Stimulus Check Amount

State Stimulus Payments : These States Are Sending Out Checks In September

Numerous states are issuing tax refunds and stimulus payments this fall. Find out if yours is one of them.

Dan Avery

Writer

Dan is a writer on CNETs How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

After a soft launch on Friday, the Virginia Department of Taxation began sending out some 3.2 million tax rebates worth up to $500 this week. At the same time, Illinois residents should start receiving income tax rebates worth up to $100 and a property tax refund of up to $300.

Hawaiians who earned under $100,000 got a $300 rebate earlier this month, while many Colorado taxpayers should get a $750 refund check by Sept. 30, thanks to the states Taxpayers Bill of Rights Amendment.

Which other states are issuing payments in September and beyond? How much money can eligible taxpayers get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

What If Someone Filed A Joint 2019 Tax Return And Is Now Separated Or Divorced And The Payment Went To An Account Or Address Belonging To The Former Partner

If the IRS delivers the payment to a bank account or address that belongs to a former partner, it will be a lengthy process for the person to get their payment. The IRS currently does not have a process to address this situation and views it as a civil matter. For assistance, contact your local Low Income Taxpayer Clinic, local Taxpayer Advocate Service, or community legal aid office.

One thing a person can do in the meantime is to document everything and request an EIP trace for their records. This will show that the payment went to the former spouses account. if the IRS develops procedures to address this issue, the person will have proof that they did not receive their EIP and could perhaps request a replacement payment from the IRS. Learn more on how to request an EIP trace here .

Also Check: What Is Congress Mortgage Stimulus Program

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.