You May Not Have To Pay Back Your Stimulus Checks But There Are More Tax Changes Coming

Posted: Jan 27, 2021 / 11:34 PM EST

Posted: Jan 27, 2021 / 11:34 PM EST

FORT WAYNE, Ind. Tax season is starting late this year, and there are a number of changes to the tax laws in addition to stimulus checks and the continuous spread of COVID-19.

A lot of people wont be happy, said Managing Partner for Apple Tree Financial Group Keith Layman. I know a lot of clients use it to save up so then its their savings, their vacation money, their house remodel money, whatever may be. So there are going to be some unhappy people become filing time.

This year one of the biggest changes is how taxes will be prepared. Instead of making an appointment with a CPA or tax professional in person, several places are asking clients to email in their materials, leave them in the mailbox and then do a conference over Zoom.

Luckily you can prepare your taxes early even though the IRS wont begin accepting returns till Feb. 12. The pushed start date is due to the IRSs need to do programming and testing of IRS systems following the tax law changes. The last day to file has yet to be pushed back from April 15. However, that could change due to the pandemic.

Layman says the best way to file taxes is electronically. The main reason is that that is the way the IRS is asking for taxes.

If you havent received your stimulus check, it is possible that you sent your tax returns in the mail. So far a majority of Americans have received two stimulus checks.

But will we have to pay it back?

Stimulus Update: Fourth Stimulus Check

11 Minute Read | September 24, 2021

By now, youve heard the history of how a third stimulus happened: Just as most Americans received their $600 second stimulus check from the U.S. Treasury in early January, then president-elect Joe Biden unveiled his $1.9 trillion American Rescue Plan that includedyou guessed itthe third stimulus payment.

But there have been a few new twists and turns since March 2021 when all the details of legislation were worked out, passed, and signed into law. The latest stimulus update is thissome states in America are giving out a fourth stimulus check. Curious? Yep, we are too. Lets dive in.

You May Like: Will I Get My Second Stimulus Check

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Read Also: Latest News On The Stimulus Checks

Not Your Average Tax Credit

The stimulus payment or economic impact payment, as the IRS calls it is technically a tax credit. But this isn’t widely understood. Some people assume that the IRS will add the amount to your income, generating a bigger tax bill, or reduce your future tax refund when you file your tax return next year. Neither is the case, but this bears some explaining.

In the tax world, a tax deduction is a good thing. It reduces your income, which reduces the amount of tax you owe. If you had $50,000 in income and had a $5,000 tax deduction, your deduction would reduce your taxable income by $5,000. If you were in the 12 percent tax bracket, you’d reduce your taxes owed by $600 .

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

A tax deduction is good, but a tax credit is very good. A tax credit reduces your tax bill dollar for dollar. If you owe $1,500 in federal income taxes and you get a $1,000 tax credit, your tax bill sinks to $500.

A refundable tax credit is a thing of wonder. A garden-variety tax credit can reduce your tax bill to zero, but it can’t turn a tax bill into a tax refund. Refundable tax credits can. For example, if you owed $1,000 in taxes but had a refundable tax credit of $1,200, you’d get a $200 tax refund check from Uncle Sam.

You Don’t Have To Pay Back Your Stimulus Check Because It’s A Refundable Tax Credit

Your stimulus payment is technically a refundable tax credit, which reduces your 2020 tax bill on a dollar-for-dollar basis. It’s like having store credit at your favorite clothing shop: When you apply it to your total bill, it reduces what you owe. In this case, even if you have no tax liability, the government is “refunding” your credit back to you as a cash payment.

You usually can’t claim a tax credit until you file your taxes, since you don’t know what you owe until the year is over. Because of the severity of this national crisis, the government is giving qualifying taxpayers their credit early in the form of a cash payment. It’s an advance of a refundable tax credit not an advance of your tax refund itself. It will not lower your tax refund this year or next year.

Even though the credit is technically offsetting your 2020 tax liability, the payments for most people are calculated based on the adjusted gross income reported on their 2019 tax return, or 2018 if they haven’t filed yet, because that’s the most readily available income data.

What all this means is that you could get more than what you qualify for based on your 2020 income and the government isn’t going to come after you to settle the score. For example, if your 2020 AGI is too high $99,000 for individuals and $198,000 for married couples who file jointly but your 2018 or 2019 income is within the limits, you’ll receive a payment.

- Read more on managing your money in this tumultuous time:

You May Like: Sign Up For Fourth Stimulus Check

You Dont Have To Pay Back Your Stimulus Check Because Its A Refundable Tax Credit

Your stimulus payment is technically a refundable tax credit, which reduces your 2020 tax bill on a dollar-for-dollar basis. Its like having store credit at your favorite clothing shop: When you apply it to your total bill, it reduces what you owe. In this case, even if you have no tax liability, the government is refunding your credit back to you as a cash payment.

You usually cant claim a tax credit until you file your taxes, since you dont know what you owe until the year is over. Because of the severity of this national crisis, the government is giving qualifying taxpayers their credit early in the form of a cash payment. Its an advance of a refundable tax credit not an advance of your tax refund itself. It will not lower your tax refund this year or next year.

Even though the credit is technically offsetting your 2020 tax liability, the payments for most people are calculated based on the adjusted gross income reported on their 2019 tax return, or 2018 if they havent filed yet, because thats the most readily available income data.

What all this means is that you could get more than what you qualify for based on your 2020 income and the government isnt going to come after you to settle the score. For example, if your 2020 AGI is too high $99,000 for individuals and $198,000 for married couples who file jointly but your 2018 or 2019 income is within the limits, youll receive a payment.

- Read more on managing your money in this tumultuous time:

Why Tax Refunds In 2023 Could Be Smaller

In general, tax refunds are available when taxpayers overpaid their taxes or withheld more than the amount they owe. This year many taxpayers received hefty refunds because, along with the tax refund, they also got the stimulus check and the child tax credit.

In 2023, however, tax refunds could be smaller than in 2022. This is because there were no federal stimulus checks issued in 2022 and most taxpayers already claimed their federal payments.

Refunds may be smaller in 2023, the IRS said in a November press release. Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no economic impact payments for 2022.

According to the IRS, the average refund for the 2022 filing season was $3,176 , compared to $2,791 in 2021.

Another reason tax refunds in 2023 could be smaller is that it will be harder to claim a deduction for charitable gifts on the 2022 return. Following the COVID-19 pandemic, Congress offered charities a tax incentive for cash gifts in 2020.

Lawmakers extended the same benefit for 2021 as well. However, the tax break wasnt extended for 2022. It means that benefits for charitable gifts are no longer available to taxpayers if they are taking the standard deduction.

In 2021, the IRS allowed individuals to deduct $300 per person, or up to $600 per family, in charitable gifts if they didnt itemize other deductions. Now, this benefit isnt available anymore.

Read Also: Stimulus Checks For Soc Sec

If You Already Cashed Or Deposited The Stimulus Payment You Got Here’s How The Irs Wants You To Return It

If you’ve already cashed or deposited your check, here’s what to do.

1. Use a personal check or money order and make the check payable to the US Treasury. You’ll also need to write “2020 EIP” and include the taxpayer identification number or Social Security number of the person whose name is on the check.

2. On a separate piece of paper, let the IRS know why you’re sending the check back.

3. Mail the check to the appropriate IRS location — that depends on which state you live in.

Make sure you know if you got the right amount.

Stimulus Check Payout Schedule

The IRS has confirmed that the distribution of economic impact payments has started and millions of Americans should have their stimulus check payment by now. Note that this will likely only apply to those receiving the payment via direct deposit . You can see the status of your stimulus check payment on the IRS Get My Payment portal.

- Direct Deposit payments will generally be deposited 2 to 3 days after the IRS confirms income eligibility for the payout.

- Physical checks will take at least 6 to 8 weeks to be mailed out.

Social Security Retirees and Disability recipients who are eligible for the payment will get the stimulus checks/payments deposited the same way they currently get their payments.

Given over 120 million Americans could be eligible for the payment, it will take a while to process the stimulus checks.

You May Like: Pa.gov Stimulus Check Status

Myth : The Stimulus Checks Are Taxed

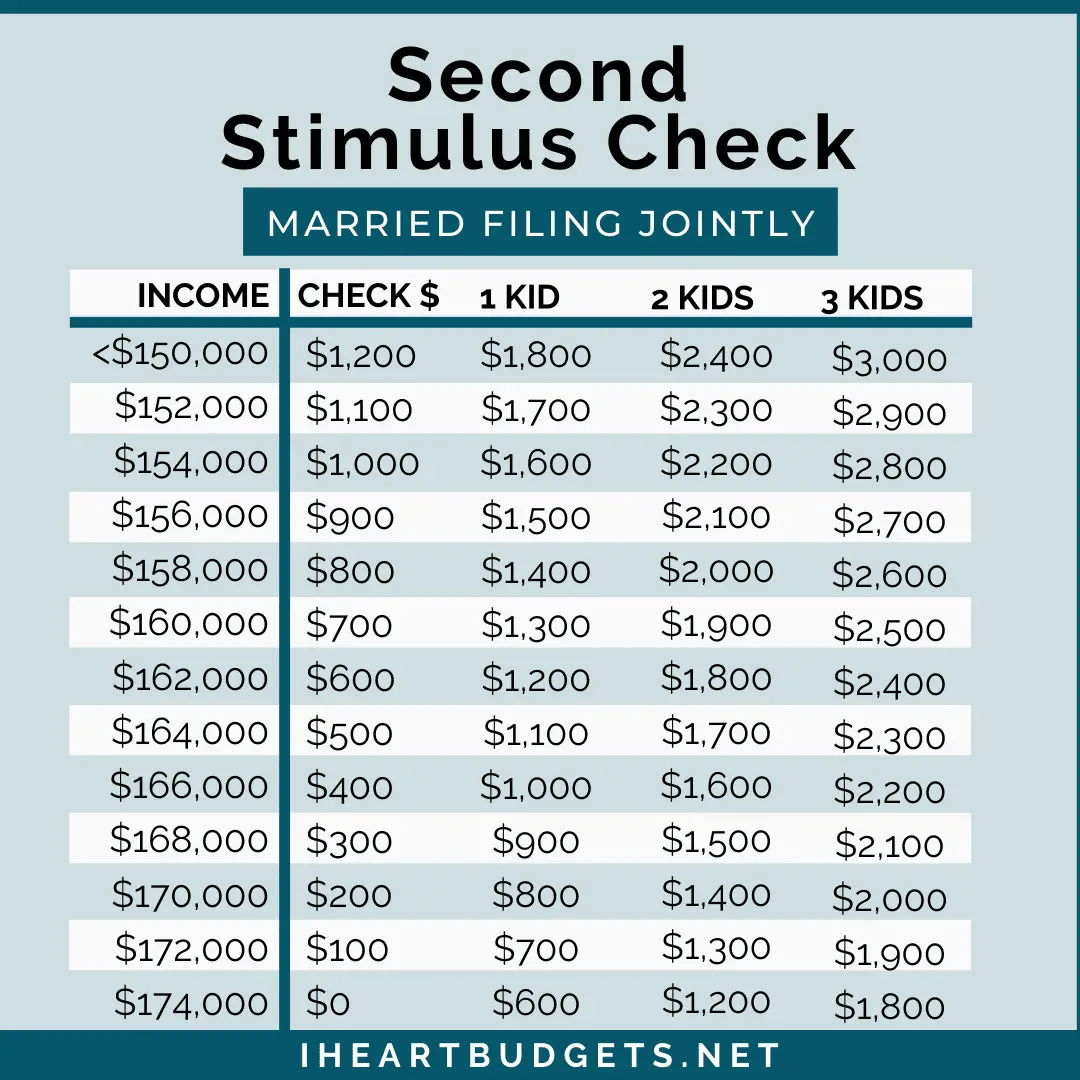

The stimulus checks are not taxable income. The checks which are worth $1,200 for individuals earning up to $75,000 and $2,400 for couples earning up to $150,000, plus $500 for dependents under 17 are structured as refundable tax credits. That is why even people who do not typically file tax returns qualify for these payments, according to the Tax Foundation, an independent think tank.

You Can Still Claim Missed Checks

Millions of people who may have been eligible didn’t receive stimulus checks from either round of relief. This could have been for reasons like:

- Making too much money in prior years despite losing a job in 2020

- Not having a Social Security number

- Receiving stimulus money through participation in federal benefit programs but not receiving money for dependent children

- Not entering payment information correctly to the IRS after not filing a 2018 or 2019 tax return

If you think that you are owed stimulus money, you still have a chance to claim it. However, you will need to file a 2020 tax return to claim your Recovery Rebate Credit. You must do this even if you did not make enough money to have to file. A tax professional can help you determine whether you are eligible.

Don’t Miss: Check On Status Of Stimulus Check

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Some Worry The Money Will Get Reported As Income On 2020 Or 2021 Tax Returns

| The Internal Revenue Service is sending out millions of checks in the third round of stimulus payments. As people start to spend their money, some wonder: Is my stimulus payment taxable?

The short answer: No. In the somewhat longer words of the IRS: No, the payment is not income and taxpayers will not owe tax on it. The payment will not reduce a taxpayer’s refund or increase the amount they owe when they file their 2020 or 2021 tax return next year. A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs.”

You May Like: Contact Irs About Stimulus Check

Child Or Dependent Qualification For The $500 Payment

Several readers have asked questions around the $500 child dependent additional stimulus payment. To get this payment you must have filed a 2018 or 2019 tax return and claimed the child as dependent ANDthe child must be younger than 17-years-old at the end of 2020. They must also be related to you by blood, marriage, or adoption . There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This age limit is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year. Hence the confusion being caused by this. So just remember if your child or eligible dependent is 17 or over you cannot claim the stimulus payment for them.

College Kids and High School Seniors

The younger than 17 yr old requirement has ruled out several thousand college students and high school kids who are older than 17, but still being claimed as a dependent by their parents on their federal tax return.

However if you are a college student AND filed a recent tax return you can qualify for a standard/adult stimulus check per the above eligibility rules. But note as soon as you file a return you cannot be claimed as a dependent by others, which means they lose certain other tax benefits and credits.

Irs Stimulus: Do You Have To Pay Back The $1400

As Americans wait for the latest $1,400 IRS stimulus checks to hit their bank accounts, many are left with one major question. That is whether or not they will have to pay back however much they receive in relief funds.

The Internal Revenue Service announced on Friday that the first rounds of stimulus checks would be going out this weekend via direct deposit. In fact, it was just hours after that announcement that some people reported having already received their money. But the IRS says that some people may be waiting until next week to get their stimulus.

Its been a quick turnaround from President Joe Biden signing the bill into law on Thursday. The $1.9-trillion relief package is set to translate into an estimated 159-million payments.

The latest stimulus payments are without a doubt the most generous yet. Individuals can get as much as $1,400, while married couples can get up to $2,800, plus an extra $1,400 per dependent. That means that a family of four can expect up to $5,600 in stimulus help.

Also Check: Did Not Receive California Stimulus Check