Are Stimulus Checks Taxable Income

Neither of the two previous stimulus checks delivered in 2020 are considered taxable, according to the Economic Impact Payment Information Center on the IRS website:

the Payment is not includible in your gross income. Therefore, you will not include the Payment in your taxable income on your Federal income tax return or pay income tax on your Payment. It will not reduce your refund or increase the amount you owe when you file your 2020 Federal income tax return.

The payment will also not impact your income level for purposes of determining eligibility for federal government assistance or benefit programs.

If you havent received your stimulus money it will like come in the form of a tax credit, which means it will be wrapped up with your tax refund.

Read Also: What Percentage Of Your Paycheck Goes To Taxes

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Recommended Reading: Is Maine Getting Another Stimulus Check

Some Worry The Money Will Get Reported As Income On 2020 Or 2021 Tax Returns

| The Internal Revenue Service is sending out millions of checks in the third round of stimulus payments. As people start to spend their money, some wonder: Is my stimulus payment taxable?

The short answer: No. In the somewhat longer words of the IRS: No, the payment is not income and taxpayers will not owe tax on it. The payment will not reduce a taxpayer’s refund or increase the amount they owe when they file their 2020 or 2021 tax return next year. A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs.”

How To Best Use Your Stimulus Money

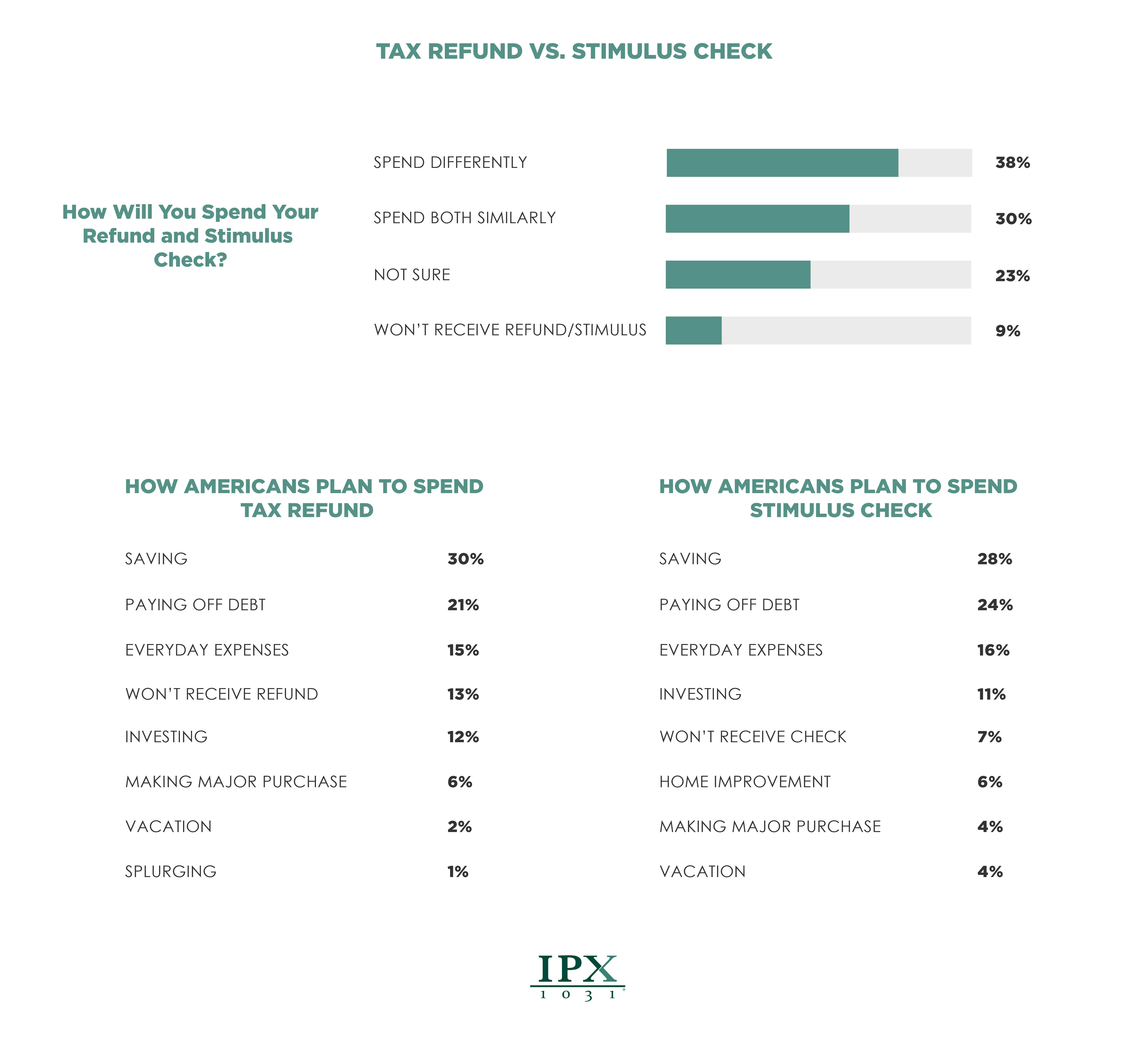

If youve been waiting for your stimulus check for this long, you might already have plans for your tax refund. Taking care of overdue bills, high-interest credit card balances and immediate needs like food and shelter should be your first priority when deciding what to do with the money.

But if you have all your basic needs covered and feel secure in your job, there are additional ways you might want to use your tax refund.

This could be a good time to start your emergency fund. A high-yield savings account that earns a better interest rate than the national 0.05% average could help you stretch your money a little further and save more for future needs.

The Vio Bank High Yield Online Savings Account offers one of the highest APY rates for high-yield savings accounts right now . There is a minimum $100 deposit required to open an account, which is low enough that you could use a portion of your tax refund and still have money left over for other expenses.

There are no monthly charges to open a Vio savings account, as long as you opt to go paperless.

-

Annual Percentage Yield

-

None, if you opt for paperless statements

-

Maximum transactions

Up to 6 free withdrawals or transfers per statement cycle *The 6/statement cycle withdrawal limit is waived during the coronavirus outbreak under Regulation D

-

Excessive transactions fee

Read Also: How To Get My 3rd Stimulus Check

Additional Information About Stimulus Payments

If you have questions, the IRS website hasdetailed information about stimulus payments readily available for individuals, families, and businesses. You can even calculate the amounts of your entitlement to stimulus payments through links the IRS provides. If you need personal assistance, the IRS providestelephone help for some types of issues.

If you prefer not to contact the IRS directly, you should contact a tax professional for assistance. Legal issues relating to the stimulus payments can be extremely complex in some circumstances, so its not advisable to try to resolve them without some type of help.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Also Check: 4th Stimulus Check For Veterans

Is My Stimulus Payment Taxable And Other Tax Questions

With tax filing season about to begin, heres what you need to know.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The tax filing season opens on Friday,and with it comes a question different from other tax years: How will the stimulus payments and unemployment income affect taxes?

Because of the pandemic and the governments relief program, millions of people received both types of payments but they are treated differently for tax purposes.

The good news is that you dont have to pay income tax on the stimulus checks, also known as economic impact payments.

The federal government issued two rounds of payments in 2020 the first starting in early April and the second in late December. If you got the full amount in both rounds, and your income and family circumstances havent changed, youre all set. You dont need to include information about the payments on your 2020 tax return, the Internal Revenue Service says.

If they dont owe you any more money, you dont have to do anything, said Kathy Pickering, chief tax officer at the tax preparation company H& R Block.

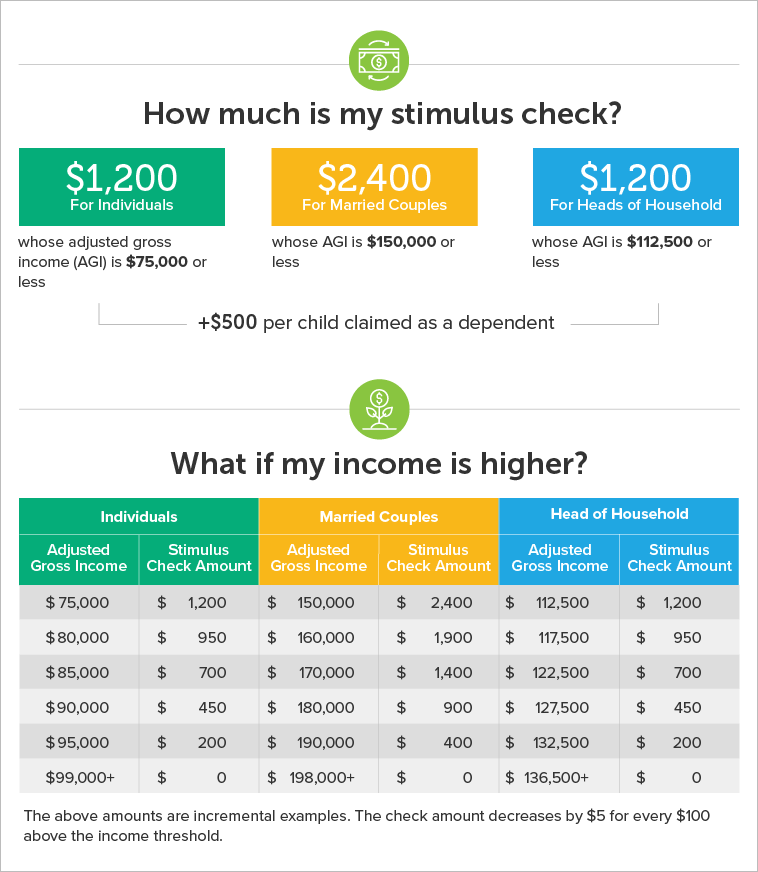

A refresher: The first payment was for up to $1,200 per person, plus $500 for each child. The second was up to $600 per person, plus $600 for each child.

You should receive a form, 1099-G, detailing your unemployment income and any taxes that were withheld, which you enter on your tax return.

Stimulus Checks And Your 2020 Taxes: All The Important Things You Need To Know

Information Provided by Cnet.com

Tax season begins in just 10 days, when on Feb. 12 the IRS starts accepting tax returns, and the more organized youve been, the less painful filing your income taxes will be especially since stimulus checks could be a part of your taxes this year. Taxes and your direct payments were tied together for the first two rounds, and your filing status will be critical for the third stimulus check, too even if youre a nonfiler. IOTexample, knowing how the IRS calculates the amount of money youre due can tell you if you should expect a whole or partial check or none at all.

This years tax season will also be a little different because the IRS is using this years return to make good on missing stimulus payments. Anyone who didnt get a second stimulus check soon after the Jan. 15 deadline can claim the money as a Recovery Rebate Credit, which the agency has built directly into the tax return process. And when you file, its a good idea to sign up for direct deposit with the IRS, if you havent yet.

With layers of complications to navigate and tax season 2020 just around the corner, you have time to collect the paperwork youll need to claim a payment. We explain how tax returns and your stimulus checks go together, how your dependents figure in, whether the payment counts as taxable income and everything else you need to know. By the way, heres the status of a third stimulus check for up to $1,400 per qualified adult.

Read Also: What To Do If I Never Got My Stimulus Check

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

How To Prepare For The 2021 Tax Season

Taxpayers should approach the 2021 tax season differently this year especially if they expect a tax refund. According to the survey, about 40% of respondents expect to receive a tax refund, and 68% said they expect their refund to remain the same or be more than last year.

First and foremost: File early.

For faster processing, opt for electronic filing and direct bank deposit . Filing early also helps prevent identity theft, Pino says.

Read more:6 Tips to Get a Head Start on Your 2020 Tax Return

You should also consider creating an online IRS tax account. Setting up an account is a great way to obtain tax documents without contacting the IRS by phone or mail. This feature allows you to check your payment balances, set up payment arrangements, and view prior-year tax returns and reported tax forms.

You May Like: Second And Third Stimulus Checks

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How To Check If You Received Stimulus Check

Do I Need To Claim My Stimulus Check On My 2021 Taxes

Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring. The 2021 stimulus checks were disbursed to eligible recipients starting in March of last year. They are worth up to $1,400 per qualifying taxpayer and each of their dependents.

Recommended Reading: Are We Getting More Stimulus Money

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Read Also: Is Ny 529 Tax Deductible

Don’t Miss: All Stimulus Checks So Far

Child And Dependent Care Tax Credit

If you paid for childcare so you can work or look for work, you can claim the Child and Dependent Care Tax Credit. You can also claim this credit if you pay for the care of an adult dependent who is unable to care for themselves so that you can work or look for work.

This tax credit usually can reduce the amount of federal taxes you owe. For 2022 only, the tax credit is worth more than ever and is fully refundable. This means that if you dont owe any taxes, you can get the money as part of your tax refund.

To get the credit, you will need to know how much you spent on childcare in 2021. You can refer to bank account statements, receipts, or any documentation that tracked your expenses.

Read Child and Dependent Care Credit to learn more about your eligibility, the amount of money you can get, and how to get it.

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Also Check: Stimulus Check In April 2022

What If Someone Owes Back Taxes Child Support Or Student Loan Debt What If Someone Is On A Payment Installment Plan With The Irs

Economic Impact Payments will not be intercepted if someone owes back taxes or student loan debt or is on an installment plan. If someone owes child support, their payment may be intercepted to collect child support arrears. The Bureau of the Fiscal Service will send a notice if this happens.

Financial institutions receiving directly deposited payments can deduct the payment for any outstanding overdraft fees. Private creditors may be able to garnish stimulus payments deposited in bank accounts for amounts owed on outstanding court judgments.

Recovery Of Missed Stimulus Payments

If you were eligible for the 2020 stimulus payments but did not receive them, or received less than you were entitled to, the 2020 tax form includes a place to claim arecovery rebate credit. Completing the section on the tax form enables a person to receive missed stimulus payments or recover the amount of underpayment as an increase in their tax refund or a decrease in the amount of tax owed.

The due date for 2020 tax returns was May 17, 2021, on account of an extension from April 15th granted to everyone by the IRS. If you already filed your 2020 return, you may need to wait until you file your 2021 return to recover missed payments or underpayments. While its too early to know if the 2021 tax form will include a recovery rebate credit, it seems likely that it will. If you filed a request for an automatic extension for filing your 2020 return, you have until October 15th to file and claim your stimulus payments by completing the recovery rebate credit section on the form.

Read Also: How To Check Eligibility For Stimulus Check

Also Check: Track My Golden State Stimulus 2