How To Claim Stimulus Checks

If you didnt receive the full amount you were due from the government stimulus program, you may be eligible for a tax credit.

There is a new entry on line 30 of forms 1040 and 1040-SR for 2020 for a Recovery Rebate Credit. If you were eligible and didnt receive the full amount of the 2020 stimulus payments, then you can ask for the money you didnt receive. You can use line 30 to request a rebated tax credit for what you didnt receive, and you can subtract that amount from the taxes you owe.

Note that eligibility for all stimulus payments is based on 2019 income. So, if your 2019 income shows more than $75,000 if you are single or $150,000 if you are married and filing jointly, then you wont be eligible for stimulus payments.

The same rules will apply when it comes time to file your 2021 taxes. A third stimulus payment was authorized earlier this year as part of the American Rescue Plan Act. This money also isnt part of your taxable income, and if you are eligible and didnt receive payment, you can claim the Recovery Relief Credit next year when you file your taxes for 2021.

Where’s The Line For The Stimulus Tax Breaks

This tax season, don’t look for a spot to claim stimulus cash or the recovery rebate credit on a federal income tax return. That credit is gone. Line 30, where the “Recovery rebate credit” was listed on the 2021 return, simply states “Reserved for Future Use” on the 2022 tax return. Leave it blank.

Another tip: The child tax credit won’t be as generous as it was in 2021. Those who got up to $3,600 per dependent for 2021 for the child tax credit will, if eligible, get up to $2,000 for the 2022 tax year.

How Much Is The Stimulus Check In Florida

After the pandemic, the government sent many stimulus checks to Florida. Stimulus checks for $1000 and $600 were given to help people. The money is given to people so that they can spend them in the market and it will help in stimulating the economy. This way it will be beneficial to both as people were facing a shortage of money and also had difficulty in survival.

Recommended Reading: Amount Of Stimulus Checks 2021

Don’t Miss: Who Qualifies For Stimulus Check

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income

How Does The Family Leave Credit Work

Self-employed people can take paid caregiving leave if their childs school is closed or their usual child care provider is unavailable because of the outbreak. This works similarly to the smaller sick leave credit 67 percent of average daily earnings , up to $200 a day. But the caregiving leave can be taken for 50 days.

Read Also: How.many Stimulus Checks In 2021

Other Features Of The Bill

How does the aid for small businesses and nonprofits work?

Good news here, as you may be eligible for forgivable loans. Our colleague Emily Flitter covered the details in a separate article. Aides to Senator Marco Rubio, Republican of Florida, also wrote a one-page summary of those provisions.

Will there be damage to my credit report if I take advantage of any virus-related payment relief, including the student loan suspension?

No. There is not supposed to be, at least.

The bill states that during the period beginning on Jan. 31 and continuing 120 days after the end of the national emergency declaration, lenders and others should mark your credit file as current, even if you take advantage of payment modifications.

If you had black marks in your file before the virus hit, those will remain unless you fix the issues during the emergency period.

Credit reporting agencies can make errors. Be sure to check your credit report a few times each year, especially if you accept any help from any financial institution or biller this year.

What if I find black marks anyway?

File a dispute with the credit bureau, but it may take a while to fix them. The Consumer Financial Protection Bureau has told credit bureaus and others that during the pandemic they can take longer than the usual 30 to 45 days to meet the dispute-response deadline, as long as they are making good faith efforts.

Is there any relief for renters in the bill?

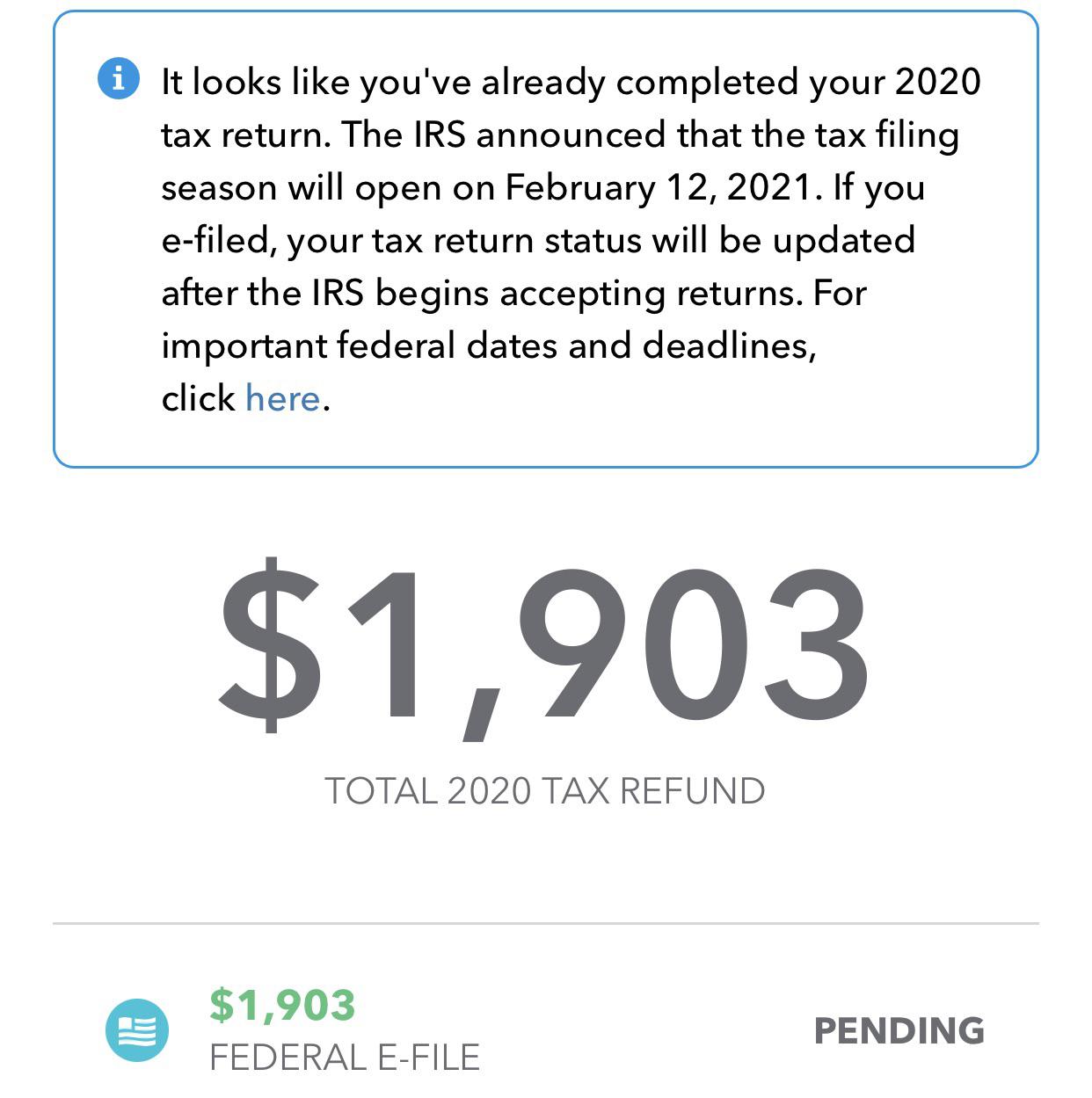

Will Tax Refunds Be Delayed Longer For Americans As The Irs Tries To Implement Tax Code Changes In The Midst Of Tax Season

Roughly 7.6 million returns havent been processed yet so far this tax season, according to IRS filing statistics through the week ended March 12. Thats nearly three times the number in the same period last year, when 2.7 million faced delayed processing.

Experts say that most Americans shouldnt expect a major delay in their refunds.

IRS has said there are no delays in tax refunds, unless tax returns trigger a closer look with information that warrants additional consideration as with significant changes from prior returns on information different than on IRS systems, says Steber.

Still, some Americans who made sure to file electronically on Feb. 12 when tax season kicked off contacted USA TODAY this month and said they were still waiting for the IRS to process their returns.

The IRS has said that the typical turnaround time for refunds is 21 days.

Some tax professionals are worried that millions of filers could face significant processing delays, especially those who already filed their taxes if they end up having to file an amended return to take advantage of new tax breaks on unemployment and dependent children from the latest relief package passed last week.

Also Check: $1 400 Stimulus Check When Is It Coming

Who Should Apply For A Recovery Rebate Credit

The IRS has prepared a special worksheet for Americans who think they might be eligible for a Recovery Rebate Credit on their 2020 tax return. Youll have to fill that out when claiming your credit. But there are a few groups of people who might want to pay close attention in particular.

The 2020 tax return is the great corrector for all changes, issues or lost money that you didnt receive with your stimulus check, says Mark Steber, senior vice president and chief tax officer at Jackson Hewitt. You may be due $1,200, $1,800 or $2,400. The skys the limit if youve got three children and are married and havent gotten your payment.

Also Check: Can I File Past Years Taxes Online

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Recommended Reading: What Were The Three Stimulus Payments

St And 2nd Rounds Of Stimulus Payments

The first two payments were based on your 2018 or 2019 tax information. Individuals qualified for full stimulus payments if their adjusted gross income , which is income minus certain deductions, was $75,000 or less . The IRS reduced the stimulus payments by $5 for every $100 earned above the income thresholds.

The first full stimulus payment was $1,200 for single individuals, $2,400 for married couples and $500 per qualified dependent. The second full stimulus payment was $600 for single individuals, $1,200 for married couples and $600 per dependent.

If you earned more than $99,000 , you got no first stimulus payment. With the second stimulus check, your payment was reduced to $0 once your AGI reached $87,000 for individuals and $174,000 for married couples.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally dont file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Also Check: Is There Any Stimulus Check Coming

Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

An Example 2020 Recovery Rebate Credit

Alex and Samantha each filed as single on their 2019 tax returns. They got married in January 2020 and had a child named Ethan in November 2020. Alexs 2019 adjusted gross income was $100,000 and Samanthas was $25,000. Neither had qualifying children in 2019.

Alex s income in 2019 kept him from receiving any of the economic impact payments. Samantha received the full amount for both the $1,200 and $600 stimulus payments for a total of $1,800 total.

Alex and Samantha file their 2020 tax return as married filing jointly claiming Ethan as their child and have a combined AGI of $125,000. Assuming that all three meet all of the requirements for the credit, their maximum 2020Recovery Rebate Credit is $4,700.

- This is made up of $2,900 for the first stimulus payment and $1,800 for the second stimulus payment.

- Their $4,700 maximum credit is reduced by the $1,800 Economic Impact Payments that Alex received. They are able to claim a 2020 Recovery Rebate Credit of $2,900 on their 2020 tax returns.

TurboTax has you covered with up-to-date information on stimulus checks and your taxes. Our COVID-19 Tax Center and Stimulus Check resources have the latest information on changes to taxes, stimulus check eligibility, tax breaks and more so you can feel confident in your taxes, no matter what situation youre in.

Don’t Miss: Haven’t Received Any Stimulus Checks

How To File A Simple Tax Return In 5 Steps

You can easily file a tax return in just a few minutes that gives the IRS the information it needs to get you your payment .

Youre just going to have to provide some basic info, and its stuff you know, said Logan Allec, a CPA and owner of the personal finance site Money Done Right. Your name, your dependents names, your address, your Social Security number.

The one piece of information you might not know off the top of your head: the Social Security numbers of your dependents.

As long as you have all that information, youre ready to get started. Heres what to do.

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Don’t Miss: Create Irs Account For Stimulus Check

What Are All These New Lines For Income

This tax season, filers will spot a new area on the front of the 1040 that spells out several specific lines to list various sources of your income.

But he noted that the front of the 1040 for 2022 now starts with Line 1a for wages that are listed on a W-2 and then lists lines for 8 other sources of income, such as Line 1b for household employee wages not reported on a W-2 form and Line 1c for tip income not reported on Line 1a.

There is no change in what’s considered taxable income. But the new lines give the IRS more information and better clarity on whether you’re reporting all of the income that you should, Luscombe said.

When it comes to household employees, for example, an employer isn’t required to provide a W-2 form to list your wages if they paid you less than $2,400 in 2022. But you’d use Line 1b to enter the total wages you received as a household employee that were not reported on a W-2.

The IRS notes that you should use Line 1c to report any tip income that you didn’t report to your employer and the value of any “noncash tips” that you received last year, including tickets or passes to events. “Although you dont report these noncash tips to your employer, you must report them on line 1c,” according to the IRS instruction booklet for 2022.

More:Ann Arbor man wonders about $933 IRS said he was owed

Consumer Protections And Scams: What Should I Know About The Economic Impact Payment Or Stimulus Check If I Do Not Regularly File Taxes

Who does NOT regularly have to file taxes and is considered a non-filer for purposes of the stimulus payments?

Non-filers include all of the following groups of people:

- Anyone who receives IRS Form SSA-1099

- Anyone who receives Form RRB-1099

- Anyone whose only income is Supplemental Security Income

- Anyone who receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs and did not file a tax return for the 2018 or 2019 tax years

- Anyone who earned income under $12,200 if single or $24,400 if married during the 2019 tax year

What is the purpose of the economic impact payment, also knows as a stimulus check?

On March 27, 2020, the Coronavirus Aid, Relief and Economic Stimulus CARES Act became law. This law created a one-time payment to many people in the United States from the federal government. The reason for the payment is to help people financially who face economic hardships caused by the coronavirus pandemic. The government also wants to boost spending power and spur economic activity.

Who is eligible for the economic impact payment?

Any individual in the United States is eligible for the payment except someone who is a nonresident alien or a person who can be claimed as someone elses dependent.

How much is the payment?

- Individuals who report adjusted gross income up to $75,000 on their tax returns will receive $1,200.

- Parents or caregivers may receive up to $500 for each qualifying child claimed as a dependent.

Recommended Reading: Stimulus Check I Didn’t Get It