How Could My 2020 Taxes Affect The Amount Of A Third Stimulus Check I Could Get

The amount of your third stimulus check is based on your 2019 or 2020 taxes, whichever the IRS has on file at the time it determines your payment. If your situation changed dramatically between the two years, you could potentially get the full amount, even if the IRS bases the check it sends on your 2019 taxes. You may need to wait till 2022, however, to claim the difference on next years taxes. Heres everything to know about how tax season could affect your third check.

Also Check: How Can I Check For My Stimulus Payment

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Child And Dependent Care Tax Credit

If you paid for childcare so you can work or look for work, you can claim the Child and Dependent Care Tax Credit. You can also claim this credit if you pay for the care of an adult dependent who is unable to care for themselves so that you can work or look for work.

This tax credit usually can reduce the amount of federal taxes you owe. For 2022 only, the tax credit is worth more than ever and is fully refundable. This means that if you dont owe any taxes, you can get the money as part of your tax refund.

To get the credit, you will need to know how much you spent on childcare in 2021. You can refer to bank account statements, receipts, or any documentation that tracked your expenses.

Read Child and Dependent Care Credit to learn more about your eligibility, the amount of money you can get, and how to get it.

You May Like: When Did Stimulus 3 Go Out

Irs Free File Open Until November 17

To help get the word out about these tax benefits, the IRS announced on October 13, that it is sending letters to more than nine million individuals and families who appear to qualify for these stimulus benefits but did not claim them by filing a 2021 federal income tax return.

This includes people eligible not only for the 2021 recovery rebate credit and the child tax credit but also the earned income tax credit. The letters should arrive in the coming weeks.

Also, in addition to filing a 2021 tax return at ChildTaxCredit.gov, the IRS says that Free File will remain open for an until November 17, 2022. Thats one month later than the tool is normally available. If your income is $73,000 or less, Free File allows you to file your tax return online at no cost to you.

Theres A Glitch With Your Bank Tax Prep Software Or The Irs

This explanation may be the most frustrating of all for people wondering where the heck their stimulus checks are. But a mistake made by your bank, the IRS, or the tax-prep software you used to file returns could screw up your stimulus payment.

As the Washington Post reported, the stimulus payments for millions of taxpayers may be delayed because of a glitch with tax-prep software firms, such as TurboTax, H& R Block, and Jackson Hewitt. The IRS might not have direct deposit information for you if you used one of these services and received an advance on your tax refund, or if you paid for the service by deducting the fee from your tax refund. And if the IRS doesnt have your direct deposit info, your stimulus check will be delayed. If you think this situation applies to you, use the IRS Get My Payment app to provide the agency with your direct deposit details.

Also Check: Create Irs Account For Stimulus Check

When Do I Need To File A Stimulus Credit On My Taxes

According to the IRS, you’ll be able to claim a missing payment on your taxes now with any payments going out after you file. You can prepare your taxes now — through the IRS’ Free File tax preparation service, if you qualify to use it — or through a tax-preparation service. The tax-filing deadline is April 15 this year, but you can file a tax extension if you can’t make the deadline.

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

Read Also: Irs Tax Stimulus Checks 4

Who Qualifies For The Third Stimulus Payments

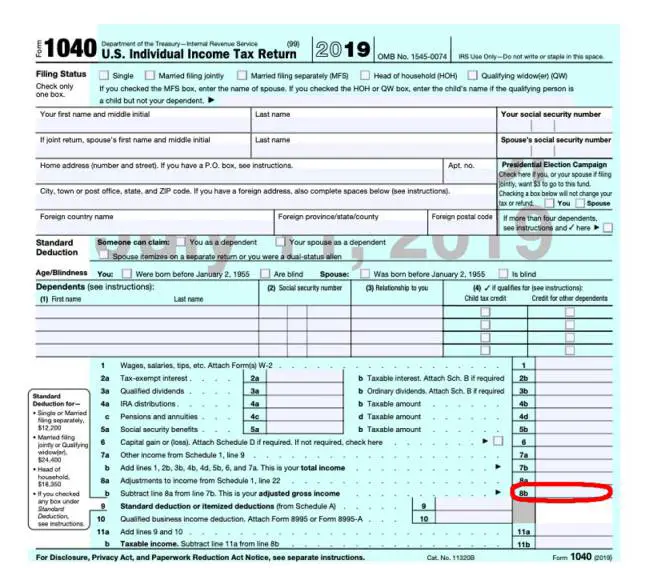

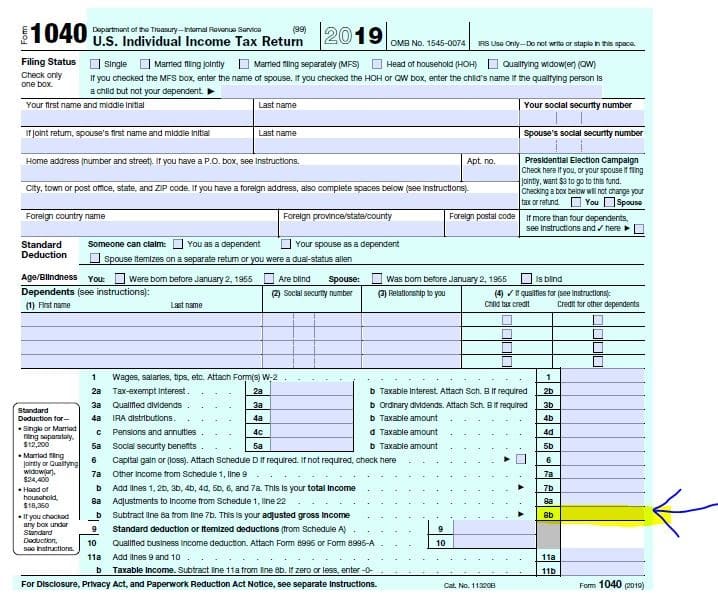

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Also Check: How To Apply For Homeowners Stimulus Package

What To Do If A Deceased Family Member Received A Stimulus Check

If a deceased family member has received a stimulus check in their name, the IRS has issued guidance stating that the money should be returned immediately. More specifically, anyone who died before payment was received does not qualify for a check. The only exception to this is if a payment was made to joint filers and one of the spouses is still alive. If this describes your situation, you only need to return the decedents half of the money.

According to the IRS, if you need to return payment for a deceased loved one, here are the steps to follow:

- Direct deposit payments, and paper check payments that have not been cashed

- Step 1: Mail a personal check or money order for the correct amount to your states IRS refund inquiry unit.

- Step 2: Make the check or money order payable to U.S. Treasury and write 2020EIP and the decedents Social Security number or individual taxpayer identification number.

- Step 3: In the envelope, include a note that explains why the check is being returned.

Its Not Too Late To File Your Tax Return

Although the regular tax season is over, you can still file a late tax return until October 15, 2022. If you do not file you may miss out on a refund or any tax credits for which you may be eligible.While theres no penalty for filing late if you do not owe taxes, you could face fees and penalties if you do owe for 2021. The information below can help you navigate this process and complete your return before the final deadline.

You May Like: Amount Of All Stimulus Checks

Also Check: Stimulus Checks Direct Deposit Date

I Didn’t File My Taxes In 2019 Can I Still Get A Stimulus Check

If you weren’t required to file a 2019 tax return because you were below income limits or you receive federal benefits such as Social Security , you may still qualify for a payment. Up to 9 million people who fell into this nonfilers category were owed a first stimulus payment as of last fall.

Though many people in this category should have received their second payment automatically, if the IRS doesn’t send your money by the start of tax-filing season, you’ll need to file a federal tax return this year to claim your missing payment as a Recovery Rebate Credit, the Tax Foundation said.

Do I Qualify For The Child Tax Credit

Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with high incomes may receive a smaller credit or may not qualify for any credit at all. For more detail on the phase-outs for higher income families, see How much will I receive in Child Tax Credit payments?

If you have any questions about your unique circumstances, visit irs.gov/childtaxcredit2021.

Read Also: Can Stimulus Check Be Taken For Back Taxes

You May Like: State Of Maine Stimulus Check

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Will The Amount Of My Stimulus Checks Be Reduced If I Have Overdue Prison Debts Or Other Unpaid Debts

Yes, if you are claiming the first, second, and/or third stimulus check as part of yourRecovery Rebate Tax Credit, the payments are not protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . This means that if you receive your stimulus checks as part of your tax refund instead of as direct checks, they arenotprotected from garnishment and may be reduced.

There used to be protections on stimulus checks, but they no longer apply when claiming them on your tax return.

Read Also: Havent Got My Stimulus

Recommended Reading: How Much Was Stimulus Check

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Read Also: When Was The 3rd Stimulus Payment Issued

Go To The Irs Free File Website

Head to the IRS Free File website, where youll find a number of online tools that let you file a return for free. These tools will ask you a few questions to choose the right filing status for you and determine whether you can claim anyone as a dependent.

You can also fill out the forms yourself online, or even print them out and mail them. Trust us, though: Its way easier to do this using one of the free filing tools.

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Also Check: Are We Receiving Another Stimulus Check

Q How Will I Get My Third Stimulus Check If Im An American Living Overseas

A. There are two ways overseas Americans can get their third stimulus payment: Direct deposit or through the mail.

You should get your check via direct deposit if you received your latest tax refund through direct deposit or if the IRS has your direct deposit info from the last round of stimulus checks and you havent filed yet this year.

You need to have an account with a U.S. bank in order to get direct deposit.

We recommend you update your address if you:

- Dont know what address is on file

- Have moved to a different address

- Want your check sent somewhere other than the address they have on file

In addition to Form 8822, Change of Address, you may be able to update your address via phone, through a written statement, or on your tax return. You can see the IRS most up-to-date address change info on the IRS website.

Q. What happens if I live abroad and my direct deposit payment is returned by my U.S. financial institution?

A. Once your payment is returned, the IRS will issue your payment by mail as a check or U.S. Treasury-issued debit card. Typically, IRS will reissue the payment by mail within two weeks. Once the payment is reissued, the IRS Get My Payment tool will update to reflect your payment status.

Q. What if my third stimulus check was for the wrong amount?

A. If you didnt receive the full amount of the third payment you were owed , there are two times when you may receive additional stimulus money:

Tools To Help File Your Taxes

If you make $72,000 or less, you can file your federal tax return for free using the IRSFree File program. The IRS provides more information on its website on how to claim your stimulus checks if you are not usually required to file a tax return.

The IRS also offers tax preparation programs including Tax Counseling for the Elderly, as well as Volunteer Income Tax Assistance, or VITA. The VITA program is available to people who have $57,000 or less in income, or who have disabilities or limited ability to speak English. Although many sites offering those services are temporarily closed due to Covid-19, the IRS offers a locator tool on its website.

Dont Miss: Irs.gov Stimulus Check 4th Round

You May Like: Get My Stimulus Check Payment