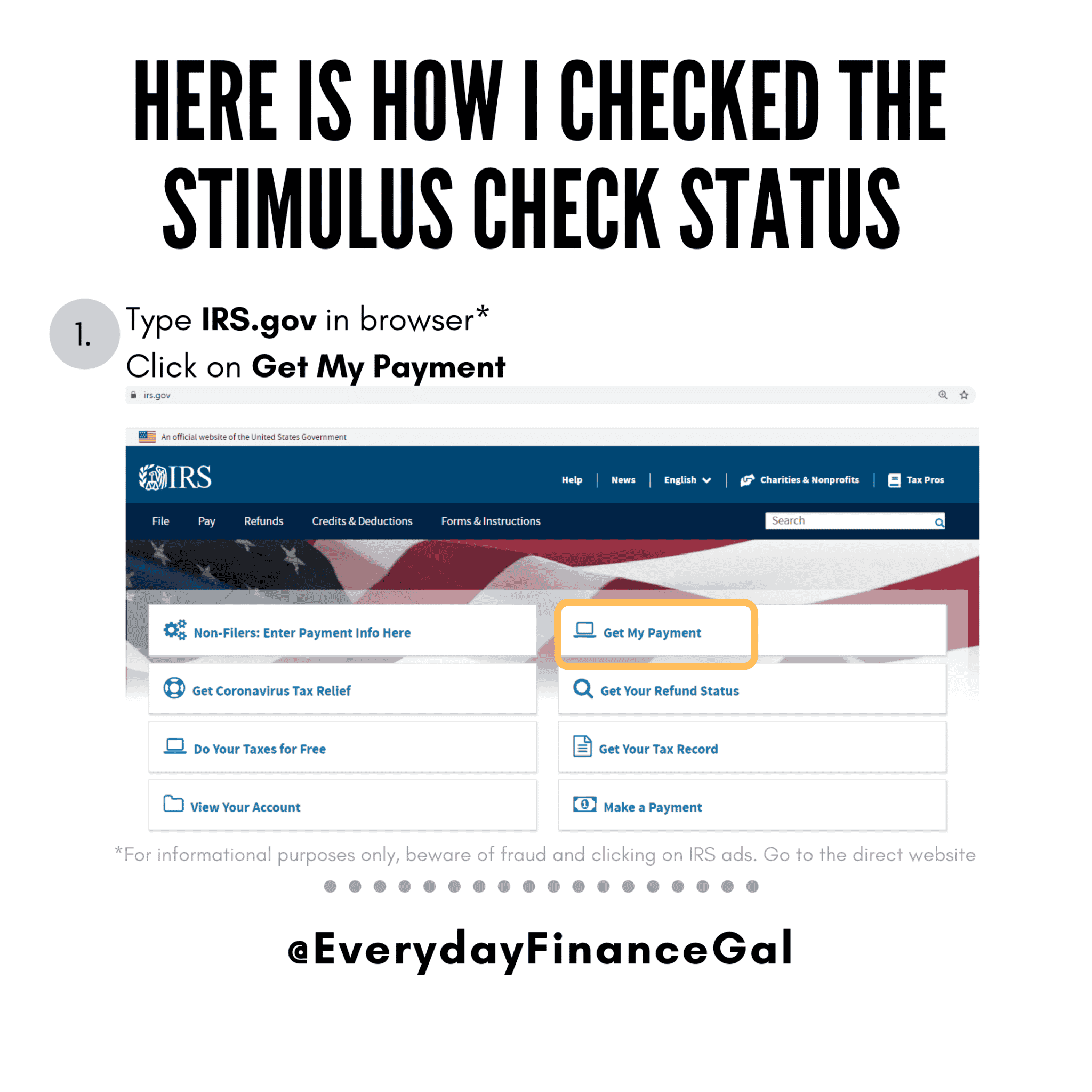

Find The Status Of Your Economic Impact Payment Using The Irs Get My Payment Tool

Eligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail.

In certain situations, this tool will also give people the option of providing their bank account information to receive their payment by direct deposit. Information is updated once a day, usually overnight, so there’s no need to check it more than once a day.

When You’ll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you don’t have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

When Youll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you dont have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

Recommended Reading: Where Is My3rd Stimulus Check

What To Know About Adding Your Direct Deposit Details

You can’t use the Get My Payment tool to sign up for a new account or correct details about your payment. Even if the IRS is unable to deliver your payment to a bank account and the money is returned to the government, you won’t be able to correct the details online — the IRS says it will send the money again by mail.

The extended tax deadline was May 17. With the agency’s delay in processing tax returns, trying to register for a new direct deposit account with your 2020 tax return won’t get you into the system quickly enough. However, if you haven’t submitted your taxes yet, signing up for a new direct deposit account could still get you IRS money faster in the future, such as tax refunds or the upcoming child tax credit.

Whether To File Another Irs Form

As was the case with the first and second check, if you filed a 2018, 2019 or 2020 tax return or receive government benefits, the IRS should automatically send your third check without you having to do anything.

If, however, you’re a nonfiler, a US citizen or permanent resident, had a gross income in 2019 under $12,200 — or $24,400 as a married couple — and didn’t file a return for 2018 or 2019, you may need to give the IRS a bit of information before it can process your payment. Since the IRS’ Non-Filers tool is now closed, you may need to file for that money on a 2021 tax return in the form of a recovery rebate credit, described above.

Here’s more information about who should file an amended tax form and who shouldn’t.

Receiving your stimulus check money isn’t always easy.

Read Also: Where Is My 600.00 Stimulus Check

What You Need To Know About Your 2020 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

How Much Will I Receive In Childctc Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit :

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people will qualify for at least $2,000 of Child Tax Credit , which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

Also Check: Taxes On Stimulus Check 2021

Eligibility For A Plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending plus-up payments to make up the difference. If you dont get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

Recommended Reading: I Got My First Stimulus But Not My Second

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a Recovery Rebate Credit on your 2021 federal tax return if you didnt get a third Economic Impact Payment or got less than the full amount.

In early 2022, well send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021. You will need this information to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Dont Miss: Ww.irs.gov Where My Stimulus

Recommended Reading: Oregon Stimulus Check Round 2

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Read Also: Can Unemployed Get Stimulus Check

Debt Collectors Could Take Some Of Your Covid Stimulus Check

The tool may show some taxpayers a Need More Information message, which means the Postal Service was unable to deliver your payment. Those people can use Get My Payment to submit bank account information to the IRS.

The Get My Payment tool wasnt the only source of grief for taxpayers awaiting their stimulus funds.

JPMorgan Chase and Wells Fargo customers slammed the banks on social media after they said the funds would not be available until at least Wednesday even though the first checks arrived this weekend.

Thats because March 17 is the official payment date on the first batch of checks, according to the banks. The IRS says some people may see the direct deposits show up as pending or provisional payments before that date.

This also isnt the first batch of complaints about Get My Payment. The tool told some people earlier this year that their $600 stimulus checks had been sent to unfamiliar bank accounts as the result of a snafu involving tax-preparation firms.

As the IRS distributed the first $1,200 checks last spring, some people who owed no tax and didnt get a refund on their most recent tax return were temporarily unable to expedite their payments before the feds fixed a bug in the Get My Payment tool.

Th Stimulus Check Update: Last Payments Of 2021 Coming This Week

From California to West Virginia, states all across the USA are providing financial support to help Americans at this difficult time. Whether through a fourth stimulus check or other benefits, our guide will explain more.

- IRS Plus-Up payment dates.How to receive the new checks before the New Year

Stimulus checks have been incredibly helpful for millions of people in the United States of America during the COVID-19 pandemic, but with these payments from federal government having now stopped, state governments are now responsible for providing their citizens with financial aid packages. Many people are left wondering what benefits are on offer where they live, as some states are offering a fourth stimulus check while other states have alternative options.

The financial support available in the USA goes beyond stimulus checks thanks to tax breaks, extended benefits programs, unemployment benefits increases, Child and Dependent Care Tax Credit and other creative initiatives in certain states.

Our comprehensive guide of all of the aid available in each of the United States 50 states will make life slightly easier, as youll be able to quickly see where stimulus checks are being prepared and how much money is being given out. We will also tell you how to qualify and apply for the payments.

Read Also: Who Is Not Eligible For Stimulus Checks

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Read Also: Didn’t Get 2021 Stimulus Check

Ways To Find The Amount Of Your First And Your Second Stimulus Checks

Hint: If you lost the letter on your payment the IRS sent you, you have options. Well tell you what you need to know.

How much stimulus money did I get again?

The first and second stimulus payments still havent arrived for some folks. If this is the case for you, you can claim a Recovery Rebate Credit when you file your 2020 tax return oh, and dont worry, the IRS extended the filing deadline. Taxes are now due on May 17, so you and the IRS have a bit more time.

If you want to check the amount of your first and second payments for a jog to your memory, your records or for taxes you can no longer view it in the Get My Payment tool. But we can help. Here are two ways to find out the amounts of your first two stimulus checks.

Also Check: Am I Going To Get A Stimulus Check

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Senior Citizens Stimulus Check 2021

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

How Do I Claim My Stimulus Check Step By Step Guide

- 8:35 ET, Sep 8 2022

AN estimated 10million Americans had not received a stimulus check that they were entitled to, a March report found.

The Treasury Inspector General for Tax Administration conducted the report, revealing several factors as to why payments may be delayed.

Most people received their stimulus checks by check or direct deposit.

Others received them in the form of prepaid debit cards, and some mistook these cards as junk mail and regrettably threw them out.

The report by TIGTA said that manually verifying the stimulus claims and debit card policies has delayed the payments for as many as 10million people.

If you missed out on your payments, you can go to GetYourRefund.org to claim the funds.

You May Like: When Was 3rd Stimulus Check Mailed

Read Also: When Will The Stimulus Check Come Out

Payment Status Not Available: What Should You Do

The IRS Get My Payment tool will only let you input new direct deposit or bank account information if youre seeing a Need More Information status, breaking with tradition from previous stimulus check rounds. That works either by submitting a financial product that includes a routing and account number with it, whether it be a bank account or prepaid debit card.

The easiest way to make sure that the IRS has the most accurate picture of your financial situation and personal whereabouts is by submitting your 2020 tax return. You now have until May 17 to submit your 2020 tax return, after the IRS on March 17 announced it was delaying the deadline by a month.

However, given the unprecedented and unconventional nature of the current tax season, the Treasury Department and IRS may have already attempted to send out your payment before your tax information was processed.

You could also update your mailing address by submitting a Form 8822, Change of Address, or notifying the IRS orally of your move. But be prepared: You might experience delays waiting for confirmation, given that the IRS has already begun distributing these stimulus checks. As always, a direct deposit is the fastest way to guarantee you receive a payment.