Important: Make Sure You Have Your Agi

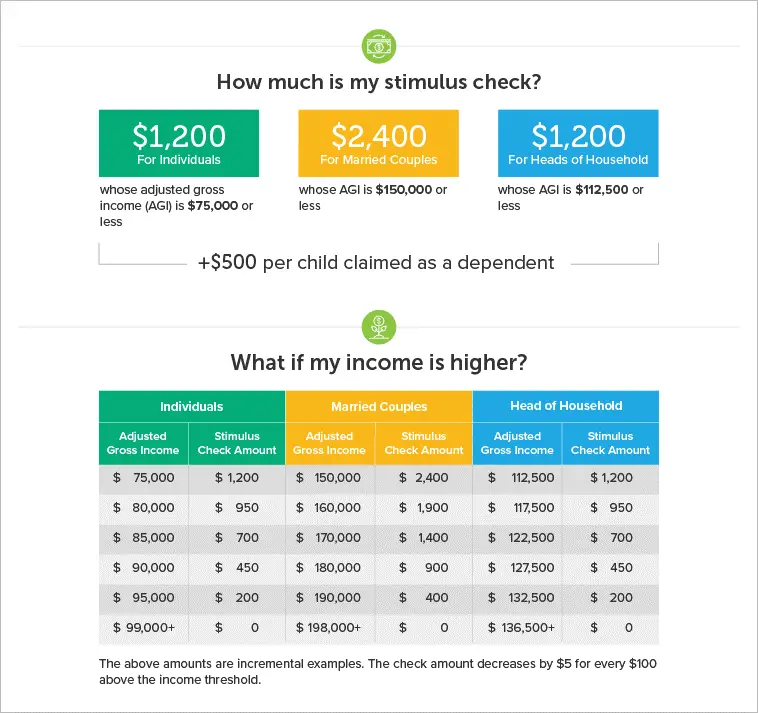

CNETs stimulus check calculator tool is based on rules from the CARES Act that was passed in March, 2020. Its intended to give you an estimate of what you should have received in your first stimulus check. To use the tool, youll need your adjusted gross income, or AGI, from your 2019 or 2018 tax information. You can find that figure on line 8b of the 2019 1040 tax form and line 7 on the 2018 1040 tax form.

Read Also: Are We Getting Another Stimulus Pay

What If I Get Government Benefits Will These Payments Count Against Eligibility Or Unemployment Insurance

Economic Impact Payments dont count against means-tested programs like SNAP, TANF, or Medicaid. The payments are not counted as income during the month they are received and the following month and they are not counted as a resource for 12 months.

You will receive the check regardless of your employment status. The check will not impact your eligibility for unemployment payments.

Dont Miss: How Can I Apply For Stimulus Check

Irs Begins Delivering Third Round Of Economic Impact Payments To Americans

IR-2021-54, March 12, 2021

WASHINGTON The Internal Revenue Service announced today that the third round of Economic Impact Payments will begin reaching Americans over the next week.

Following approval of the American Rescue Plan Act, the first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week.

Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

No action is needed by most taxpayers the payments will be automatic and, in many cases, similar to how people received the first and second round of Economic Impact Payments in 2020. People can check the Get My Payment tool on IRS.gov on Monday to see the payment status of the third stimulus payment.

“Even though the tax season is in full swing, IRS employees again worked around the clock to quickly deliver help to millions of Americans struggling to cope with this historic pandemic,” said IRS Commissioner Chuck Rettig. “The payments will be delivered automatically to taxpayers even as the IRS continues delivering regular tax refunds. We urge people to visit IRS.gov for the latest details on the stimulus payments, other new tax law provisions and tax season updates.”

Recommended Reading: How To Get California Stimulus

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What If My Stimulus Check Is Too Small

Married people whose tax return includes an injured spouse claim may be getting their payment in two installments, the New York Times reported. An injured spouse claim protects one person’s portion of the tax refund from the other’s outstanding debts. Both payments should generally arrive in the same manner, whether by direct deposit or mail, but may not in some cases, the IRS told the Times.

If your stimulus check is too small for other reasons i.e. it doesn’t include all your current dependents or reflect your current income then you should file your 2020 tax return ASAP.

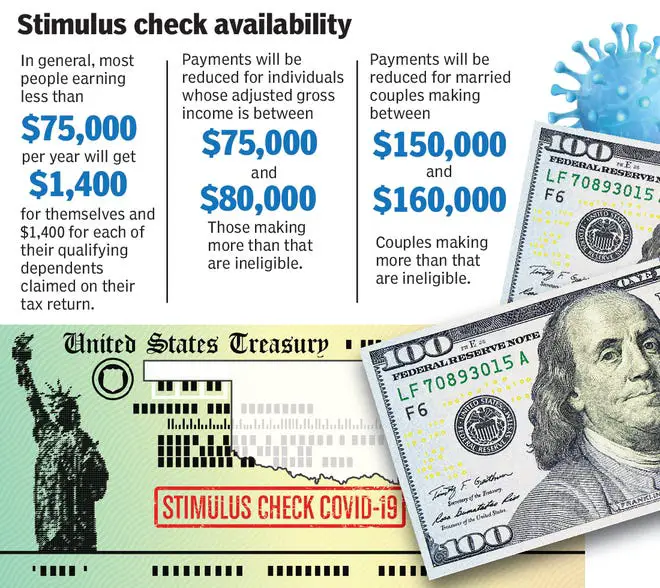

You can get up to $1,400 as an individual and $2,800 as a married couple if you file taxes jointly. Up to $1,400 will be added to your check for each dependent with a Social Security number.

The payments going out right now are largely based on 2019 income since we’re still in the middle of the 2020 filing season. If your 2020 income qualifies you for a bigger check, you’ll be able to get the rest of your money later this year after you file your 2020 return. According to the legislation, to be considered for additional payment you need to file within 90 days of the federal tax deadline, which is now May 17.

Also Check: How Many Stimulus Checks In 2020

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Don’t Miss: New Round Of Stimulus Check

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

The Irs Is Currently Distributing The Third Round Of Stimulus Checks But Many Will Miss Out Due To The New Eligibility Requirements And Income Thresholds

The $1.9 trillion stimulus bill signed into law earlier this month includes a new round of Economic Impact Payments as President Joe Biden looks to get direct relief to those in need.

These will be the third stimulus checks provided by the federal government since the start of the pandemic and are the largest to date. The first, coming nearly exactly a year ago, were worth $1,200 while a second round worth $600 was included in Decembers emergency relief bill.

Crucially, there is nothing that prevents those who received either or both of the previous payments from getting the third stimulus check, although there have been some crucial changes to the eligibility requirements.

New eligibility requirements will see millions miss out on stimulus checks

Although Biden managed to get his American Rescue Plan through Congress largely unscathed, he was forced to make some concessions to his Partys moderate wing. Key amongst them was some changes to the eligibility requirements for the new stimulus checks which were intended to make the support more targeted.

The IRS says nearly 7M tax returns have not been processed, which is 3 times the total from last year. @NBCNews‘@SRuhle breaks down reasons why many eligible Americans have not received their IRS tax refunds or third round of stimulus checks – @NBCNewsNow

NBC News

Adult dependents will receive stimulus checks for the first time

You May Like: Stimulus For 65 And Older

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the Recovery Rebate Credit. You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds youre owed.

Its possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldnt submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Also Check: Irs Stimulus Check Tax Return

My Stimulus Payment Was Too High

Some individuals whose income increased too much in 2019 were not eligible for a full stimulus payment, but they got one anyway since the IRS based the payment on their 2018 taxes. Those individuals will not have to pay back the payment.

In other cases, families were paid an extra $500 or $600 for children who were 17 or older . This could happen if the IRS took the number of children who qualified for the child tax credit in 2018 without updating children’s ages for 2019. But in other cases, it looks like the IRS took the number of dependents from a family’s 2018 tax return, without regard to their age. The IRS has said that those who received such overpayments will not have to pay them back.

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

Recommended Reading: Are We Going To For Stimulus Check

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Recommended Reading: When Did We Get Stimulus Checks In 2021

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

You May Like: What Is The Third Stimulus Check

Get My Payment Says Payment Issued But I Haven’t Received It

The IRS says that it may take three to four weeks to receive a check after it’s mailed. If it has been weeks since the Get My Payment tool says the payment was mailed, and you haven’t received it, you can request a payment trace. The IRS will research what happened to your check if the check wasn’t cashed, you will need to claim the “Recovery Rebate Credit” on your next tax return. If the IRS finds that the check was cashed, you’ll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

Similarly, if the Get My Payment tool says your payment was direct-deposited, but the money doesn’t show in your bank account after five days, first check with your bank. If the bank says it hasn’t received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.