When Was The Third Stimulus Check Approved

By now, youve heard the history of how a third stimulus check happened: Just as most Americans received their $600 second stimulus check from the U.S. Treasury during the coronavirus pandemic, President Joe Bidens $1.9 trillion American Rescue Plan included a third stimulus payment of $1,400.

The American Rescue Plan passed first in the House and then Senate and was signed by President Biden on March 11, 2021. Lawmakers wanted the bill to go into effect before some COVID-19-related unemployment benefits expired in mid-March 2021.5And they hit their deadline just in the nick of time.

Read Also: How Much Was Last Stimulus Check

Stimulus Check Missing Payment Issues Or Errors

The IRS will also be mailing Stimulus Payment letters to each eligible recipients last known address 15 days after the payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment. Note that the IRS or other government departments will not contact you about your stimulus check payment details either.

Why didnt I get a stimulus check? Remember that the IRS has to have your direct deposit details, which is normally only provided if you received a 2018 or 2019 refund. If you file a return and they cannot use their portal to add direct deposit details, then your payment will come via check which could take several weeks. At this checks will likely start arriving at your IRS registered address from the end of April.

Finally you will also likely be able to claim any missing payments in your 2020 tax return as a tax credit. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

When Is The Next Stimulus Check Released

- 10:13 ET, Dec 3 2021

MILLIONS of Americans have gotten stimulus payments in the past two years, but is a fourth check on the way?

The short answer â probably not.

The direct payments were intended to help struggling citizens and stimulate the economy by giving them more money to spend during the financial downturn.

As a result of the pandemic, we saw multiple stimulus check packages passed across the nation.

Since federal stimulus seems to be over, states have stepped up and offered rebates and other direct payments to help those struggling.

Almost 20 states have sent or will be sending checks to offset rising inflation.

You May Like: Get My Payment Stimulus Checks

Stimulus Checks: Round 3

The third round of stimulus checks was created and authorized by the American Rescue Plan, which was signed into law by President Biden on March 11, 2021. This was the third major piece of federal legislation focused on COVID-related relief for struggling Americans.

The American Rescue Plan covers a variety of programs including the third round of stimulus checks, extended weekly unemployment benefits, expanded tax credits, and more. While promoting this bill, President Biden declared that it would send stimulus checks to 85% of American households.

The third stimulus check is worth up to $1,400 for each eligible person. For a single filer, the maximum amount they can get is $1,400. For a married couple that files jointly, the maximum amount they can get is $2,800. Additionally, if you have a qualified dependent, you can qualify for an extra $1,400 for each eligible dependent.

RELATED: $1400 Stimulus Checks 3rd Round of Direct Payments Are on the Way

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Read Also: Who Receives The Third Stimulus Check

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

You May Like: How Much 2021 Stimulus Check

Wheres My Stimulus Check

The IRS describes these as supplemental payments for people who received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns.

The trigger for these getting sent out, in other words, is a big change in someones income picture revealed by their 2020 federal tax return. The plus-up payments could include a situation where a persons income slipped in 2020 compared to 2019. Or if a person had a new child or dependent listed on their latest tax return, among other situations.

As with most of the stimulus checks weve gotten over the course of this year, recipients dont have to do anything to get one of the plus-up payments. Well, aside from filing a 2020 federal tax return . The IRS automatically makes note of any triggering events, and it sends out these checks accordingly.

Recommended Reading: Who Are Getting Stimulus Checks

Idaho: $75 Rebate Payments

In February, Idaho Gov. Brad Little signed a bill that allocated $350 million for tax rebates to Idahoans. There were two criteria for eligibility:

- Full-time Idaho residency and filed 2020 and 2021 tax year returns, OR

- Full-time Idaho residency and filed grocery-credit refund returns.

The payments began in March. Each taxpayer received either $75 or 12% of your 2020 Idaho state taxes, whichever is greater . The rebate was applicable to each individual taxpayer and each dependent.

The tax commission first issued rebates to taxpayers who received refunds via direct deposit, then sent paper rebate checks.

In a special session on Sept. 1, Idaho lawmakers voted to authorize another tax rebate for all residents who filed state tax returns in 2020. Individual filers will receive $300, and couples filing jointly will get $600.

The funds come from the states $2 billion budget surplus. The payments are slated to roll out within weeks, according to a report by the Idaho Press.

State residents can also check the status of their rebate online.

Here Are Some Key Things To Know About This Tool And Who Can Use It

- Before using the tool, people must verify their identity by answering security questions.

- If the answers do not match IRS records after multiple attempts, the user will be locked out of the tool for 24 hours. This is for security reasons. Those who can’t verify their identity won’t be able to use Get My Payment. If this happens, people should not contact the IRS.

- If the tool returns a message of “payment status not available,” this may mean the IRS can’t determine the person’s eligibility for a payment right now. There are several reasons this could happen. Two common reasons are:

- A 2018 or 2019 tax return is not on file and the agency needs more information or,

- The individual could be claimed as a dependent on someone else’s tax return.

Read Also: Spectrum Stimulus Internet Credit Application

Heres What We Know About A 4th Stimulus Check

While many Americans are still awaiting the arrival of third stimulus checks, many lawmakers are pushing for recurring direct payments throughout 2021 as part of a fourth stimulus package.

STATEN ISLAND, N.Y. — While many Americans are still awaiting the arrival of third stimulus checks, many lawmakers are pushing for recurring direct payments throughout 2021 as part of a fourth government package.

The third stimulus payments of up to $1,400 per American are still being dolled out by the Internal Revenue Service.

In fact, the IRS, the U.S. Department of the Treasury, and the Bureau of the Fiscal Service announced this week that more than two million supplemental stimulus checks are being delivered in the fifth batch of Economic Impact Payments .

So far, a total of 159 million disbursements with a total value of $376 billion has been dolled out as part of the $1.9 trillion American Reduce Plan, according to the IRS.

However, for many Americans still suffering amid the coronavirus pandemic, the third stimulus isnt enough.

According to U.S. Census Bureau data collected in March 2021, nearly 30% of Americans came up short when trying to cover household expenses.

Direct stimulus payments have helped suppress poverty in the U.S. In fact, a fourth stimulus check alone would help 6.6 million people out poverty in 2021, according to a report from the Urban-Brookings Tax Policy Center.

FOURTH STIMULUS?

But Biden has yet to say whether he supports a fourth stimulus payment.

Child Tax Credit Survey

Wednesday, meanwhile, marked the distribution of the final child tax credit payment. The IRS has said that Congress needs to pass President Bidens $1.9 trillion spending plan thats currently languishing in the Senate by the end of this month in order for the tax agency to have time to get set up for more child tax credit checks come January 15.

Along these lines, ParentsTogether, a national parents advocacy group with more than 2 million members nationwide, has released the results of a new survey of parents. Its findings, among other things:

- When asked what would happen to their familys finances if the child tax credit payments stopped after this month? 50% of respondents said it will be more difficult for them to meet their familys basic needs. And 36% said they will no longer be able to meet their familys basic needs.

- 1 in 3 respondents said if the child tax credit checks stop, they wont be able to afford enough food.

- 76% of respondents said the monthly checks have made them less anxious about their finances.

- 81% of respondents said its extremely important for their families that the checks continue past this year. Thats up from 73% in September.

Read Also: Status On 4th Stimulus Check

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Second $600 Stimulus Check Details

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers like Turbo Tax and Tax Act have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

Don’t Miss: Information About The Second Stimulus Check

Heres What Else You Should Know

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependentâs age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRSâs site to determine if you qualify.

Tax returns can also be completed and submitted through CTCâs site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

Donât Miss: When Is The 3rd Stimulus Check Coming

Find The Status Of Your Economic Impact Payment Using The Irs Get My Payment Tool

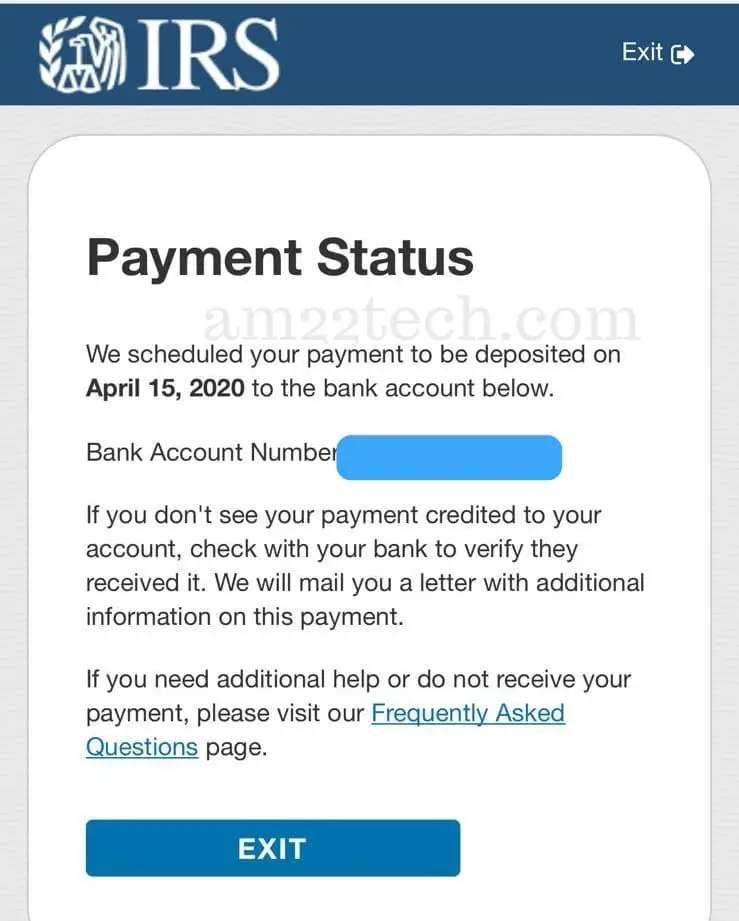

Eligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail.

In certain situations, this tool will also give people the option of providing their bank account information to receive their payment by direct deposit. Information is updated once a day, usually overnight, so there’s no need to check it more than once a day.

Don’t Miss: Is Another Stimulus Check Coming In 2022

Are We Getting Another Stimulus Check In 2021

Whether we get another stimulus check in 2021 depends on how much momentum the proposals for more checks gain.

There are still some people who’ve not yet received the third stimulus check, but we’ve got a handy guide for what to do if you’re missing your stimulus check payment. It’s worth checking if you’re eligible for most recent stimulus check as it’s worth up to $1,400 per person.

The IRS has reported that taxpayers whose direct-deposit information is on file should have seen their payments reach their bank accounts in April. Those who are waiting on paper checks and debit cards can expect to receive their funds in the coming weeks.

If you have received the third stimulus check and feel it’s too low, then take a look at our guide to the stimulus check calculator as that can show you what your own eligibility looks like. Keep in mind that there are a few factors that will affect the amount you are due or have received.

How Many Stimulus Checks Have There Been

If youre like most people, everything thats happened since March 2020 is a blurincluding how many stimulus checks there were and when the checks went out. Heres a quick reminder.

First stimulus check: March 2020 $1,200

Second stimulus check: December 2020 to January 2021 $600

Third stimulus check: March 2021 $1,4004

Donât Miss: Are There Any New Stimulus Checks Coming Out

Also Check: Was There Any Stimulus Checks In 2021

Will Senior Citizens Receive A Stimulus Check

- 8:47 ET, Aug 9 2022

SINCE the outbreak of the Covid-19 pandemic, federal and state lawmakers have pushed for direct payments to Americans to alleviate financial hardship.

The federal government successfully sent three rounds of stimulus checks while various states were able to legislate cash to citizens as well.

However, as inflation soars, higher monthly expenses are draining out the bank accounts of Americans.

Add that to the fact that most stimulus programs are ending or have expired.

Prices are up more than 9% compared to the same time last year, as categories including groceries, gas, utilities, and more have been affected.

In particular, inflation has hit older Americans hard.

Recommended Reading: Criteria For Stimulus Check 2021