How To Claim Your Cash

Eligible Americans will be able to request a Recovery Rebate Credit at tax time to get their money they are owed from the IRS.

To be eligible for the full amount on the third round of checks, individuals need to have an adjusted gross income of $75,000 or less and married couples filing jointly need to have an AGI of $150,000 or less.

Those who qualify will be able to claim the child on your 2021 tax return – which will be filed in 2022.

How Do I Sign Up For Health Insurance

If you dont already have health insurance but would want it if the price was right, an open enrollment period is already in effect through May 15. You can also switch plans to try to lower the price youre paying already or get more generous coverage. The Kaiser Family Foundation maintains a calculator that estimates your premiums based on your income and any available government subsidies.

What To Do If The Irs ‘needs More Information’

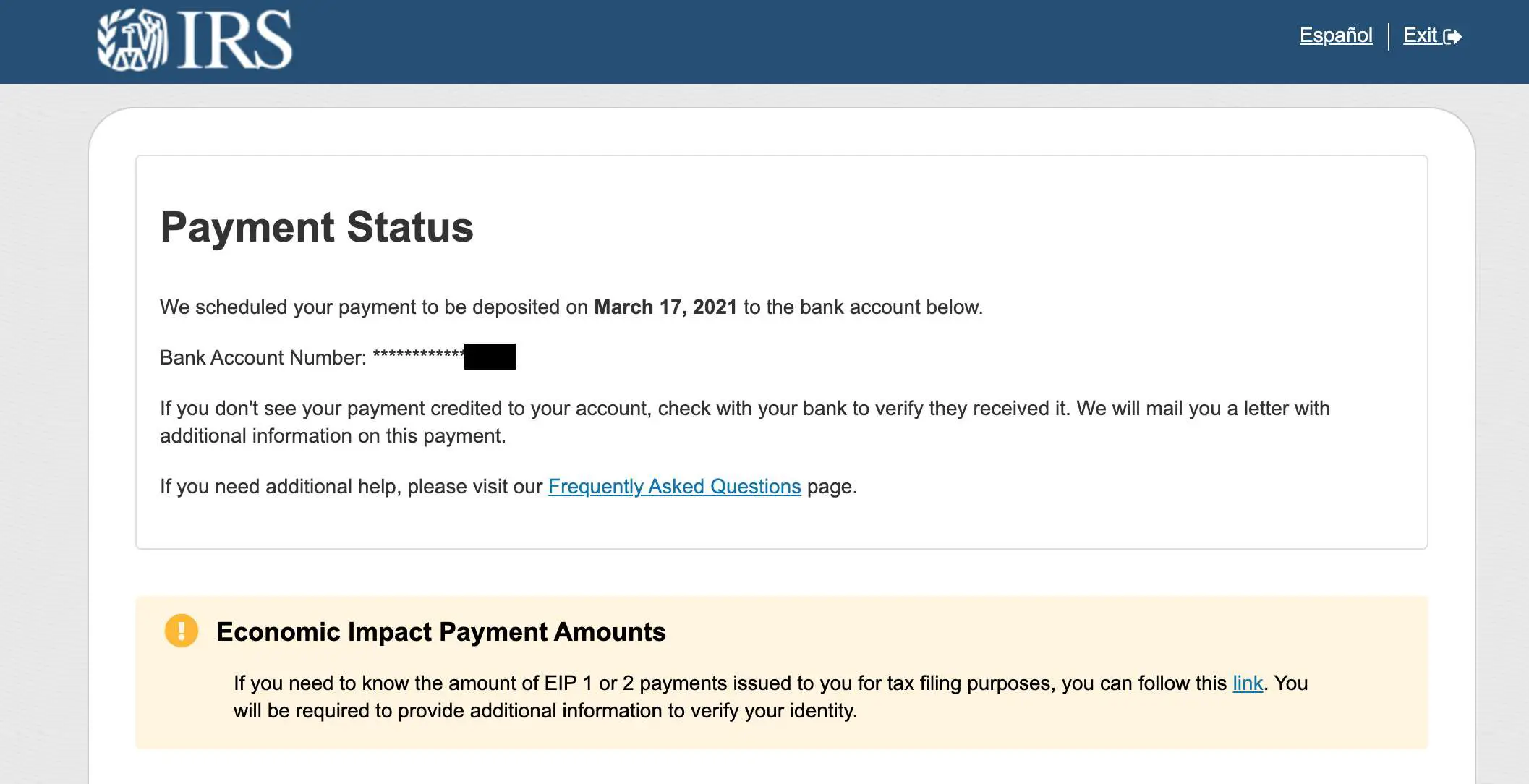

If the Get My Payment tool gave you a payment date but you still haven’t received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports “Need More Information,” this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Which Tax Return Is Used For My Third Stimulus Check

The IRS uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. The new stimulus plan targets lower income ranges to exclude higher-earning taxpayers from getting a payment.

As we pointed out before, individuals making under $75,000 get the maximum stimulus payment of $1,400 . But payments are capped at $80,000 for single filers and $160,000 for couples. So filing at the beginning of the tax season with a lower income may help you qualify for a bigger check. But, if your income went up in tax year 2020, then you may want to delay filing so that eligibility is determined by your lower 2019 income.

You might also want to file early if the size of your family increased in 2020. The new stimulus plan includes a child tax credit that pays up to $3,600 for each qualifying child under 6 years old, and $3,000 for every child between ages 6 and 17. This means that if you became a parent during the tax year, you could get an additional payment by claiming your child as a dependent earlier.

SmartAssets child tax credit calculator will help you figure out how much you could get for each child.

You can use SmartAssets tax return calculator to figure out your 2021 tax refund or tax bill.

When Will The New Stimulus Payments/checks Be Made

The IRS will be responsible for making these stimulus payment checks and Treasury Secretary Mnuchin, whose department oversees the IRS, said that payments go out within a week of the bill being formally approved. This means payments could hit bank accounts before the end of the year. Payments would be made in multiple batches and if all goes according to plan the first round of payments would begin on 12/28 . Processing will go until January 15th for Direct Deposit payments. Checks and Debit Cards will take until the end of January 2020 to get processed. See more on the IRS Stimulus Check Payment Schedule.

The inclusion of the one-time stimulus payment however has also meant a cut in extra unemployment benefits that are also part of the overall package. More to come as the bill gets finalized and I will post updates. See this $600 stimulus update video for a quick summary as well.

What About On Social Security Or Ssdi

Social Security recipients, disability , Survivor Beneficiaries and Railroad Retirees who are not otherwise required to file a tax return will also be eligible for the stimulus payments, as long as their total income does not exceed the eligibility income limits above. The IRS in conjunction with the Treasury and Social Security Administration announced that recipients of Supplemental Security Income will automatically receive the $1200 Stimulus Check . See details here. This group of recipients will receive the stimulus check the same way they currently get their federal benefits in early May with no further action needed on their part.

However note that because the IRS has no information regarding dependent data for this group of recipients, the $500 kid dependent stimulus payment would not be automatically paid to this group. They need to use the non-filers tool on the IRS website to claim this.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

When Will Your Bank Post The Stimulus Check

It varies. Check your bank’s website for details or scroll through this Reddit thread to see anecdotal data. Here’s a sample of what some of the major financial institutions have said about their direct deposit dates for the third stimulus.

Ally: “We dont know when payments will be sent to customers accounts. When the payment is received, it will be posted to their account and the funds will be available.”

Bank of America: “The Internal Revenue Service has stated that payments will be distributed to eligible individuals over multiple weeks.”

Capital One: “Funds from Economic Impact Payments made through direct deposit will be available for customers to access on the effective date as long as the account is open and there are no restrictions on the account.”

Cash App: “Cash App customers with account and routing numbers on file with the IRS began receiving a third set of stimulus payments from the U.S. Treasury Department on March 12th.”

Chase: “We expect most of the electronic payments to be available as soon as Wednesday, March 17, 2021. Please go to the IRS site for the latest information.”

Fifth Third Bank: “We expect ACH stimulus deposits to start as soon as March 17. We will be providing the stimulus payments as they are provided to us from the IRS.”

H& R Block: “All stimulus payments to the H& R Block Emerald Prepaid Mastercard® will be processed as they are received. This first batch will be deposited on clients Emerald Cards by March 17.”

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Are My Dependents Eligible With This Check

As a rule, dependents are not eligible for their own checks, but they do contribute to the total your household can receive. In many cases, it can multiple your family’s total.

In the third stimulus check, dependents of every age count toward $1,400. If you’re a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments for your new dependent last year. You can also get $1,400 for a baby born in 2021. Note that if your household exceeds the strict income limits, you won’t receive any stimulus check money, even if you have dependents.

With the second stimulus check approved in December, each child dependent — age 16 and younger — added $600 each to the household payment. There was no cap on how many children you could claim a payment. That was an increase in the amount per child from the $500 that was part of the first check approved last March as part of the CARES Act, even as the per-adult maximum decreased from $1,200 per adult to $600 in the December stimulus plan.

The final qualifications for a third stimulus check have been settled.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

A Fourth Stimulus Check In 2022 To Deal With Inflation Pressures

There has plenty of talk of a fourth stimulus check in 2022, originally as a relief payment in Bidens build Back Better Bill and now as a way to offset higher costs many consumers are seeing due to record inflation.

However progress on a 4th stimulus check has stalled in Congress due to lack of agreement among Democrats and Republicans and what they can sell to their constituents ahead of the upcoming mid-term elections.

A 2022 Gas Stimulus?

With rising gas prices, many states are providing gas tax holidays which save drivers a few cents at the pump. Some states and even Congress are also considering a 2022 gas relief stimulus check which will pay families up to $400 p/month through 2022.

With the economy rebounding strongly, higher inflation and unemployment claims falling, it was hard for most Democrats in Congress to justify spending billions of dollars on even more stimulus payments.

Some states like California however, are making state specific stimulus payments to provide inflation relief for lower income workers which may be replicated in other states.

There is also the expanded monthly Child Tax Credit stimulus payment for families who have qualifying dependents. While this is not technically a fourth dependent stimulus and rather more of an advanced tax credit it will act like a stimulus payment because it is being paid directly by the IRS to nearly 70 million dependents and their families. This has provisions for another 12 month extension under the BBB.

Still Waiting For Your $1400 Stimulus Payment Here’s How To Request An Irs Trace To Track It

We’ll show you how to find your missing stimulus check from the IRS.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

Is it time to start worrying about the missing stimulus check that you qualify for? The IRS has made more than 167 million payments since March — with a new batch of checking going out each week. If you think your $1,400 payment is lost or never sent — maybe you received a letter telling you the IRS sent your payment but you’ve not received it — you may need help trying to track it down. The same goes for the first and second payments from 2020.

It’s possible there’s an issue with your check, or the IRS could have the wrong mailing address on file. Another reason why you may want to track down your payment is if you received less than the amount expected and you’re owed a “plus-up” payment. By the way, in that case, you do not need to file an amended tax form.

Fourth Stimulus Check 202: How To Get A $1400 Payment In 2022

Some people in the United States of America are set to receive a payment of up to $1,400 on top of their tax refund in 2022, but in order to do so certain criteria will have to be met. To stand to receive such a payment, American citizens must either be a parent of a child who was born in 2021, or those who have a new dependent.

Should I Hold Off On Filing My 2020 Tax Return And What Happens If The Irs Uses 2019 Tax Information

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |