Wheres My 3rd Stimulus Check

The IRS is sending stimulus funds throughout 2021. If you havent received your payment yet, dont assume you wont ever get it.

You can check the status of your stimulus check using the IRSs Get My Payment tool, which updates once a day. It will show you when and how your money is being sent, either direct deposit or through the mail .

If you get a not available status message, the IRS says youre either not eligible for a third stimulus check or your payment hasnt been processed yet. If you get a need more information message, you can enter your direct-deposit details to speed up your payment.

If you didnt qualify for the third check based on 2019 income but thats the most recent return the IRS has for you, file your 2020 return as soon as you can. Your payment will be sent once the IRS has processed your return.

If you arent required to file a tax return because your income is too low and you didnt register using the IRS nonfilers tool last year, you will need to file a 2020 tax return to get any of the stimulus checks.

Also Check: N.c. $500 Stimulus Check

I Received A Message From The Irs Asking For My Personal Information Is This A Scam

Yes, this is a scam. With the rollout of Economic Impact Payments, theres an increased risk of scams. Its important to stay vigilant and aware of unsolicited communications asking for your personal or private information through mail, email, phone call, text, social media or websites that:

- Ask you to verify your SSN, bank account, or credit card information

- Suggest that you can get a faster payment if they fill out information on your behalf or if you sign over your check to them

- Send you a bogus check, perhaps in an odd amount, and then ask you to call a number or verify information online in order to cash that check

Be aware that scammers are also able to replicate a government agencys name and phone number on caller ID. Its important to remember that the Internal Revenue Service will never ask you for your personal information or threaten your benefits by phone call, email, text or social media.

If you receive an unsolicited email, text or social media attempt that appears to be from the IRS or an organization associated with the IRS, like the Department of the Treasury Electronic Federal Tax Payment System, notify the IRS at . You can also learn more about coronavirus-related scams.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Recommended Reading: H& r Block Stimulus Check

Income Plays A Role In Social Security Benefits

The Social Security program is primarily funded through payroll taxes. The 12.4% tax rate is typically split between employees and employers, meaning most workers contribute 6.2% of their income to the Social Security trust fund each year. Notably, current law limits the income subject to Social Security payroll tax, though the limit rises each year to keep pace with rising wages.

For example, the maximum taxable earnings limit is $160,200 in 2023, up from $147,000 in 2022. This chart from the SSA shows the maximum taxable limits dating back to the inception of the Social Security program. Notably, the same earnings limits also apply to benefit computation, meaning any worker who exceeds the maximum taxable earnings limit is on track to qualify for the maximum Social Security benefit.

Very few Americans actually meet that criterion, though. In fact, only 6% of workers have wages that exceed the maximum taxable limit each year, according to the SSA. That means only 6% of workers are on track to qualify for the $4,555 monthly benefit in 2023. But there is still one more variable to consider.

Social Security Ssi Ssdi Veterans: What You Need To Know About Eligibility And Your Stimulus Payment

The majority of people who are part of the SSI or SSDI programs qualify for a check â read our guide for details. This time, many will get their payments on their existing Direct Express card, though some may receive stimulus money a different way. Consult our guide for more on what to know and do, including if you need to claim a dependent by filing a tax return for 2020.

Stimulus money for veterans who donât usually file taxes are expected to receive their stimulus checks in mid-April, after many Social Security recipients. Hereâs more to know about veterans and stimulus eligibility.

Recipients of the first check received their payments through a non-Direct Express bank account or as a paper check sent in the mail. In the , these recipients again qualified to receive payments, along with Railroad Retirement Board and Veterans Administration beneficiaries.

Also Check: When Were The Stimulus Payments In 2021

Don’t Miss: How To Get Stimulus If You Don’t File Taxes

What Will The Status Report Look Like

For third-round stimulus checks, the Get My Payment tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that mail means either a paper check or a debit card. If you dont recognize the bank account number displayed in the tool, it doesnt necessarily mean your deposit was made to the wrong account or that theres a fraud. If you dont recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesnt have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, youll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you dont provide any account information, the IRS cant reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, theres no reason to check the portal more than once per day.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Don’t Miss: Irs Get My Payment Stimulus Check

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

How To Claim Your Rebate Credit

To get your money, youll need to claim the 2021 Recovery Rebate Credit on your 2021 return. Filing electronically can guide you through the form. Dont claim any missing first or second stimulus payments on your 2021 return rather, youll need to file a 2020 return or an amended return to get these payments.

The rebate credit does not count toward your taxable income. And be aware that youll need to fill out your tax return accurately and include the precise amount of stimulus payments the IRS has actually paid you to avoid a delay in your returns processing. If you enter the incorrect amount, it can hold up the processing of your return, Greene-Lewis cautions. The agency will not automatically calculate your 2021 rebate. It is on you, the taxpayer, to claim the Recovery Rebate Credit, Steber says.

Adam Shell is a freelance journalist whose career spans work as a financial market reporter at USA Today and Investors Business Daily and an associate editor and writer at Kiplingers Personal Finance magazine.

Also of Interest

Also Check: Amount Of 3rd Stimulus Check 2021

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What If I Already Filed My Taxes

An amended return may be needed to claim the credit if IRS records show no payment was issued.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return , they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return to claim the remaining amount of stimulus money if IRS records dont show that they were issued a payment.

This includes people who think they didnt get the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

People trying to figure out if they should amend their original tax return can use this online tool.

More details on claim the 2021 Recovery Rebate Credit can be found here.

Also Check: Who Gets The 4th Stimulus Check

Age Plays A Role In Social Security Benefits

Eligibility for Social Security retirement benefits begins at age 62, but people who start Social Security before full retirement age are penalized with a reduced benefit, while those who delay Social Security beyond FRA are credited with an increased benefit. However, the delayed retirement credit stops at age 70, meaning it never makes sense to start Social Security any later.

To that end, retired workers hoping to receive the maximum Social Security benefit of $4,555 per month in 2023 must reach age 70 this year, and they must wait until that happens to start receiving Social Security checks. That said, in certain cases, it doesn’t make sense to wait that long. The chart below details the maximum Social Security benefit payable to retired workers of different ages.

Data source: Social Security Administration. Chart by author.

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Don’t Miss: Stimulus Checks Direct Deposit Date

How Much Is The Recovery Rebate Credit For 2021

This tax season, you want to make sure that you’ve received the full amount of the third stimulus that you’re entitled to receive. You need to file a 2021 federal income tax return to claim the Recovery Rebate Credit if you’re owed more money.

The maximum Recovery Rebate Credit on 2021 returns amounts to $1,400 per person, including all qualifying dependents claimed on a tax return. A married couple with no dependents, for example, could qualify for up to $2,800.

Who Is Eligible For The Third Stimulus Check

If youre trying to track your stimulus check, youll first want to know if youre eligible to receive one information that the Get My Payment tool wont explicitly inform you when you go track your check.

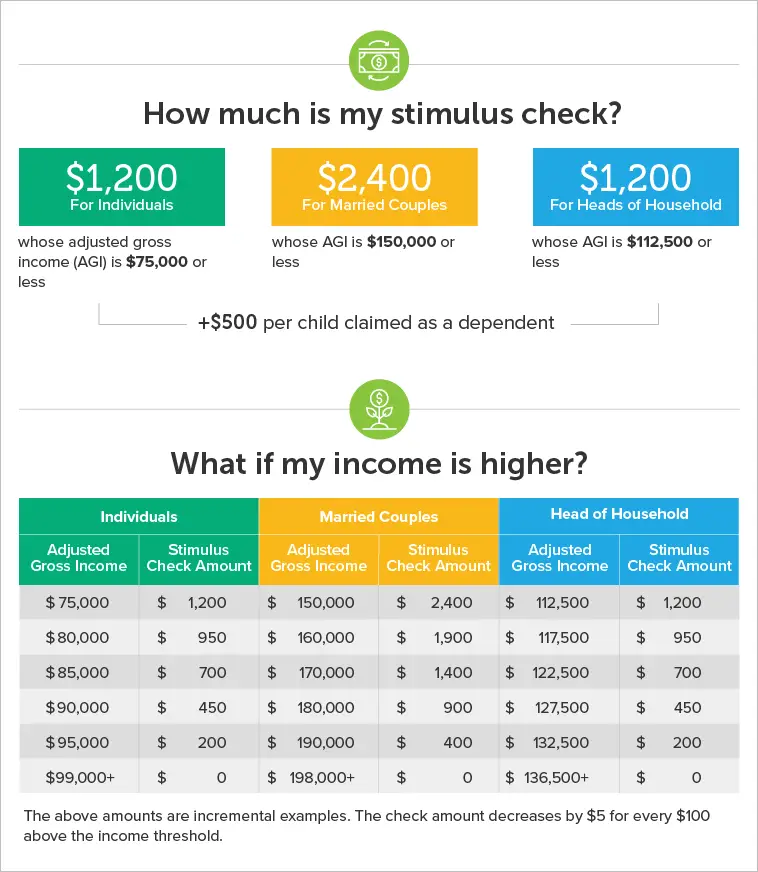

One good rule of thumb for determining if you qualify: If you were eligible to receive the full amount before, youll be eligible again. Income requirements for receiving full stimulus checks are the same for both individual and married tax filers, while income information is based on your most recently processed tax return .

If you earned up to $75,000 youre slated to get the full relief check worth $1,400. Married couples will thus receive $2,800 as long as their combined AGI doesnt top $150,000.

But the point at which payments completely phase out for Americans happens sooner on the income scale, a move meant to appease more deficit-minded lawmakers and shrink the size of the overall relief package.

Individuals total payments decrease by $28 per every $100 over the income threshold. Single filers and married couples who make $80,000 and $160,000 or more a year, respectively, wont receive a check at all.

Eligible U.S. adults will see $1,400 per each individual in their household, including adult dependents, such as college students.

If youre ineligible for a stimulus payment but currently out of work, heres how to apply for unemployment benefits.

Also Check: When Are We Getting The Next Stimulus Check

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

Read Also: Can I Still Get My 2020 Stimulus Check