Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

What To Do If The Irs Needs More Information

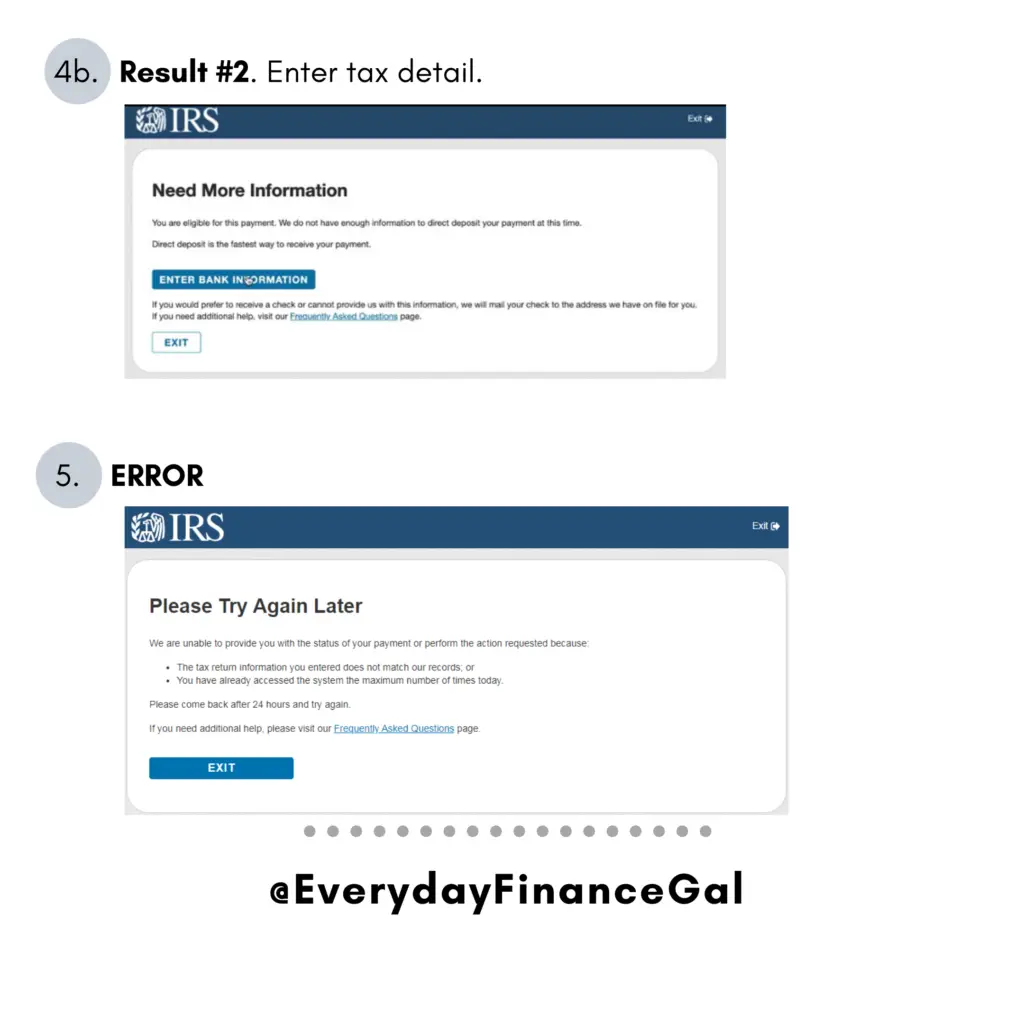

If the Get My Payment tool gave you a payment date but you still havent received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports Need More Information, this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.

Recommended Reading: When Will The $1400 Stimulus Checks Be Mailed Out

What To Do Next

If you havent received a stimulus payment and you feel that you may have been eligible, you may now be entitled to a recovery rebate credit. To claim this, youll need to file a tax return to show your full household income for the previous year, filling in line 30 with your believed rebate amount. This will be processed within 3-5 weeks for a tax rebate.

Spread the word. Please share

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

You May Like: Stimulus Checks Status Phone Number

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Recommended Reading: Why I Didnt Get My Stimulus Check

How To Get Your Stimulus Checks If You Still Haven’t Received Payment

While Congress considers whether to issue a fourth round of stimulus checks, some people haven’t received their older checks.

The first and second stimulus check amounts were for $1,200 and $600, respectively. The third was for $1,400. Here’s how to get your stimulus checks if you haven’t received them yet.

Firstly, some people haven’t received checks because not everyone qualifies for them. You aren’t eligible if your previous IRS tax filings show that you’re a single person who makes over $75,000 annually, a head of household who makes over $112,500 annually, or a married couple who jointly reports over $150,000 annually.

Some are also ineligible due to restrictions on age and dependent status. If someone claimed you as a dependent in their previous tax returns and you were 17 years old or older on January 1, 2020, then you weren’t eligible for the first two checks, according to CNBC.

The IRS and the Social Security Administration have also said that people may not have received stimulus checks because they didn’t file their 2020 taxes. They urged them to file for 2019 and 2020 even if they’re not legally required, in order to ensure that all eligible people receive their payments.

Even if you owe the IRS money, you should still receive your stimulus checks or the aforementioned 2020 Recovery Rebate Credit. The IRS won’t withhold those funds.

You May Like: Is Another Stimulus Check Coming In 2022

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

How To Claim Your Cash

Eligible Americans will be able to request a Recovery Rebate Credit at tax time to get their money they are owed from the IRS.

To be eligible for the full amount on the third round of checks, individuals need to have an adjusted gross income of $75,000 or less and married couples filing jointly need to have an AGI of $150,000 or less.

Those who qualify will be able to claim the child on your 2021 tax return – which will be filed in 2022.

You May Like: How Much Was The Stimulus Checks In 2021

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

How Is The Third Stimulus Check Calculated

The stimulus plan mandates the treasury to rely on 2019 and 2020 tax returns to calculate how much you could get for the third round of stimulus checks.

Congress approved limits based on adjusted gross income ranges. This means that taxpayers making less than the minimum threshold could get the full stimulus check, while those earning above it get reduced payments until they are fully phased out at higher incomes.

You can find your AGI on IRS form 1040. This is calculated by subtracting deductions like student loan interest, health savings accountpayments, and contributions to a traditional IRA from your gross income.

By contrast, your gross income is the total amount of money that you made during the tax year, including wages, dividends, capital gains, rental property income and other types of revenue.

Your 2019 taxes had to be filed by July 15, 2020. And your 2020 taxes are due by the extended deadline of May 17. You can read more about when to file your tax returns for the third stimulus check, and other IRS requirements in two tax sections below.

Recommended Reading: Where Is My $600 Dollar Stimulus Check

Recommended Reading: Who Will Receive The Next Stimulus Check

Why Am I Being Mailed A Direct Deposit For My Covid

Your payment may have been sent by mail because the bank rejected the deposit. This could happen because the bank information was invalid or the bank account has been closed.

Note: You cant change your bank information already on file with the IRS for your first or second Economic Impact Payment. Dont call the IRS, our phone assistors wont be able to change your bank information, either.

What If I Still Haven’t Gotten The First Or Second Stimulus Check

You’ll need to file your 2020 tax return to claim any stimulus money you’re owed from the first two rounds.

There will be a separate worksheet on your tax return with instructions for calculating any outstanding amount owed to you, called the Recovery Rebate Credit. If you file your taxes online, the provider will prompt you to enter the information and do the calculations for you.

If you do qualify for additional stimulus money, you won’t get it right away. It will first be applied to your outstanding tax bill. If your bill is reduced to $0, the rest of the money will be added to your refund. The IRS delivers most refunds within three weeks.

You May Like: How Much Stimulus Money Did I Get In 2021

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Recommended Reading: Recovery Rebate Credit Second Stimulus

Rely On Your 2019 Or 2021 Tax Returns

Canât deduct your way to a stimulus check? Stick to your 2019 tax return or the one youâll be filing for tax year 2021, if either of those AGIs would qualify you.

If your 2019 AGI met the third stimulus billâs criteria but your 2020 AGI doesnât, hold off on filing your 2020 taxes until your stimulus check arrives. You can even file an extension with the IRS to put off filing until October 15.

Once you qualify for a stimulus check and get paid, experts do not expect the government to demand repayment if your AGI rises above the cutoffs in a later 2020 or 2021 tax filing.

And if neither your 2019 nor 2020 AGI will qualify you for the third stimulus payment, but you expect your AGI in 2021 to fall, then youâll still get a payment. Remember: These payments are technically considered a credit for 2021. So once youâve proved your AGI qualifies you for 2021, youâll get this payment after you file your 2021 tax return. It just may be a year after everyone else.

Finally, if times are hard but none of these tactics help you qualify for a stimulus payment, youâve still got options. Though itâs touted by much of the media as a âstimulus bill,â the American Rescue Plan Act includes additional unemployment benefits, tax credits and rental assistance designed to help those most impacted by Covid-19âs economic toll.

Also Check: Haven’t Got My Stimulus

How Will Taxpayers Receive Their Stimulus Payment

Taxpayers with direct deposit information on file with the IRS will receive the payment that way. For those without direct deposit information on file with the IRS, the IRS will use federal records of recent payments to or from the government, where available, to make the payment as a direct deposit. This helps to expedite payment delivery. Otherwise, taxpayers will receive their payment as a check or debit card in the mail. If the direct deposit information is sent to a closed bank account, the payment will be reissued by mail to the address on file with the IRS. The IRS encourages taxpayers to check the Get My Payment tool for additional information.

People Who Dont File A Tax Return

Question: What if I dont file a 2019 or 2020 tax return?

Answer: Some people dont file a tax return because their income doesnt reach the filing requirement threshold. If thats the case, the IRS will send a third stimulus check based on whatever information, if any, is available to it. That information potentially could come from the Social Security Administration, Railroad Retirement Board, or Veterans Administration if youre currently receiving benefits from one of those federal agencies. If thats the case, youll generally receive your third stimulus payment the same way that you get your regular benefits. If you supplied the IRS information last year through its online Non-Filers tool or by submitting a special simplified tax return, the tax agency can use that information, too.

Some people who receive a third stimulus check based on information from the SSA, RRB, or VA may still want to file a 2020 tax return even if they arent required to file to get an additional payment for a spouse or dependent.

Also Check: Any Stimulus Checks In 2022

Read Also: Form 1040 For Stimulus Check

What If My Stimulus Check Is Too Small

Married people whose tax return includes an injured spouse claim may be getting their payment in two installments, the New York Times reported. An injured spouse claim protects one person’s portion of the tax refund from the other’s outstanding debts. Both payments should generally arrive in the same manner, whether by direct deposit or mail, but may not in some cases, the IRS told the Times.

If your stimulus check is too small for other reasons i.e. it doesn’t include all your current dependents or reflect your current income then you should file your 2020 tax return ASAP.

You can get up to $1,400 as an individual and $2,800 as a married couple if you file taxes jointly. Up to $1,400 will be added to your check for each dependent with a Social Security number.

The payments going out right now are largely based on 2019 income since we’re still in the middle of the 2020 filing season. If your 2020 income qualifies you for a bigger check, you’ll be able to get the rest of your money later this year after you file your 2020 return. According to the legislation, to be considered for additional payment you need to file within 90 days of the federal tax deadline, which is now May 17.

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Also Check: Stimulus Checks And Social Security