How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Can Inmates Claim Their Own Stimulus Checks

If you were incarcerated in Delaware during the year of the economic stimulus, you may be eligible to claim your own tax credit. If you did, you must file a tax return for the year of 2020. The IRS offers a website called Tax-Aide to help inmates file their tax returns. However, if you did not receive your stimulus payment, you may still qualify for a refund.

Some incarcerated individuals are unaware that they can claim these checks. The stimulus checks were distributed to all American citizens over the past year, but families of incarcerated individuals have yet to receive them. Many inmates, such as Nassar, are not eligible for most government benefits, but they can receive a stimulus check. However, there are certain hurdles that inmates must jump through to claim their checks.

The Treasury Department has tried to claw back some of the stimulus checks. The office of the inspector general in the Treasury Department has criticized the IRS for distributing the money to prisoners, claiming that it was an illegal deduction. The logic behind the Treasurys actions puzzled legal experts. However, there is no law that says prisons can confiscate stimulus checks, and they have little role in distributing them. While the CARES Act protects the recipients from having their checks seized, the law doesnt give prisons instructions on how to distribute them.

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

Recommended Reading: Stimulus Checks Direct Deposit Date

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Recommended Reading: Apply For Fourth Stimulus Check

Wheres My Second California Stimulus Check The Latest Round Could See 803000 More Payments

It has been close to 2 months since the Golden State started giving out their second round of stimulus check payments of up to $1,100 to eligible residents. Millions have received their payment but for many residents, they have this one common question. Wheres my second California stimulus check?

The Golden State Stimulus Check II began to roll into individual accounts after it was signed into law by Governor Gavin Newsom in the second week of July. Most residents have received their initial stimulus check, but many are eager to know wheres my second California stimulus check?

Over half a billion dollars has been paid under the second round of the Golden State Stimulus payment. It has been a holiday bonus for many to end the year.

On December 10, 2021, alone, around $6.1B were sent out as per the figure released by the tax board.

The latest round has shown that around 794,000 payments were sent that were worth another $568M. they were mailed starting December 13 and went on through December 31, 2021.

Recommended Reading: Telephone Number For Stimulus Check

How A Life Change Affects Your Stimulus Check/payment Eligibility

With the third stimulus check dispersal under way, millions have already received their third stimulus payments. But the more Americans get their checks, the more questions arise specifically about how life changes affect your stimulus payment.

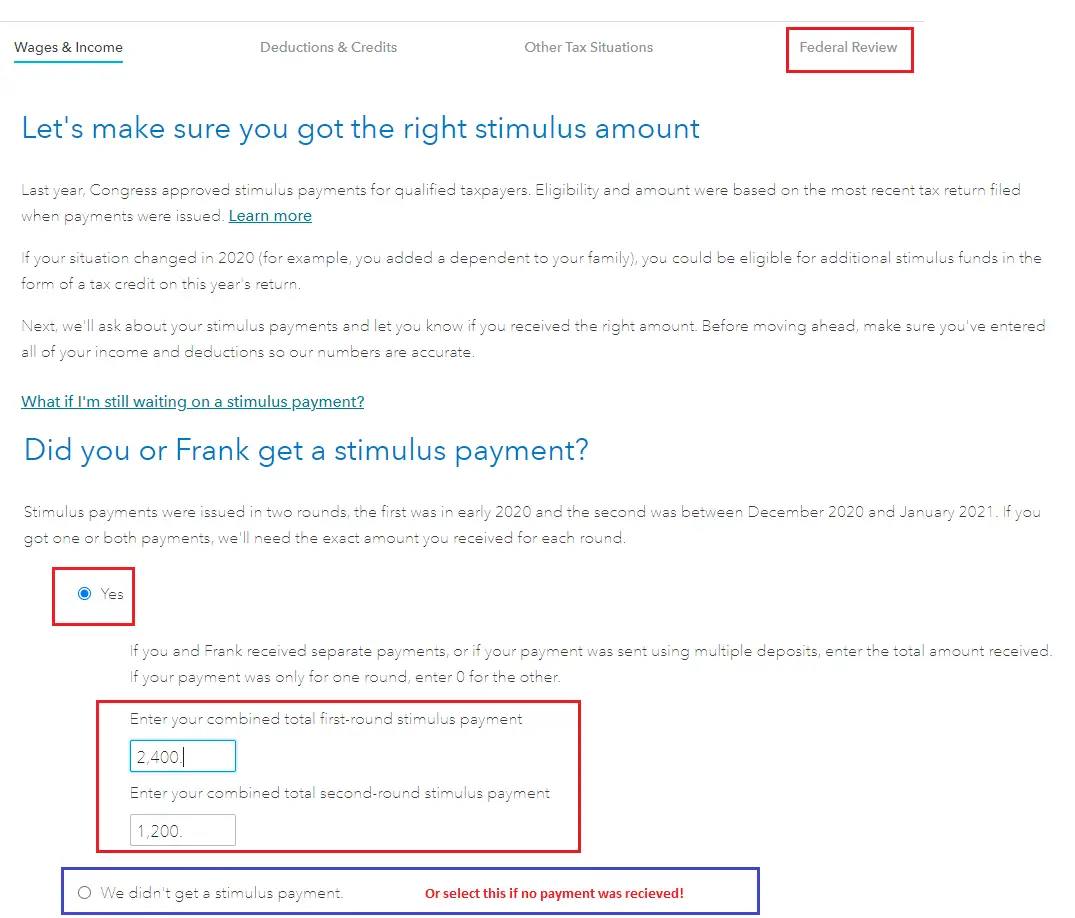

The first, second and now third economic impact payment or stimulus payments can be paid in advance. Your eligibility and amount is based off your most recently filed tax return but what if that information is incorrect?

For example, what if you havent filed taxes yet but got married in July 2020? Or had a baby? What if youre dealing with the aftermath of a divorce or the recent death of a loved one? What if you already received your first and second stimulus checks, but it was for the wrong amount? What if you graduated from college in 2020 and arent a dependent anymore?

For the first and second stimulus payments, if your situation changed, youll claim the rest youre owed through the Recovery Rebate credit on your 2020 return. For the third , youll wait to claim the credit on your 2021 tax return.

The IRS understood the need to get stimulus payments out quickly. As a result, some taxpayers have found differences in the amount they should have received due to tax filing changes and income changes.

Below, well clear things up about who is eligible for a stimulus checks, payment, and the credit and how life changes affect your eligibility.

You May Like: How To Check If You Received 3rd Stimulus Check

Don’t Miss: Will Social Security Get Stimulus Check

Free Virtual Tax Filing Service

Code for America, in partnership with VITA, has created a fully virtual intake process for free tax assistance. In light of COVID-19, Code for Americas Get Your Refund service is a free and safe alternative to prepare your tax return without the risk of in-person interaction.

Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

Code for Americas Get Your Refund service is free for those who earn less than about $66,000. This is a good option if you are comfortable using technology, including sending pictures or documents electronically.

What Will The Status Report Look Like

For third-round stimulus checks, the Get My Payment tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that mail means either a paper check or a debit card. If you dont recognize the bank account number displayed in the tool, it doesnt necessarily mean your deposit was made to the wrong account or that theres a fraud. If you dont recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesnt have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, youll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you dont provide any account information, the IRS cant reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, theres no reason to check the portal more than once per day.

You May Like: Irs Gov Stimulus Payment Status

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

You May Like: How To Check Eligibility For Stimulus Check

Free Online Tax Software

Online free tax preparation offers a convenient and reliable way to file your taxes.

If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software.

MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through an online chat. Tax filing is free for both federal and state tax filing.

MyFreeTaxes offers a broader range of tax forms than most VITA sites. However, you cannot use this site if you have self-employment income. If youre not comfortable using the website on your own, ask someone you trust to help you.

Another free online option is Free File Alliance, a suite of programs in partnership with IRS. You can find Free File programs on the IRS website. If you choose to use one of these programs, read the fine print carefully. Each program has slightly different criteria for their software. In addition, some companies offer free state tax returns, while others dont.

What If I Need To Change My Bank Account Information Since I Filed

The Get My Payment tool doesnt allow people to change their bank account information already on file with the IRS, in order to help protect against potential fraud, the IRS website says. The Get My Payment tool also does not allow people to update their direct deposit information once their Economic Impact Payment has been scheduled for delivery.

However, people who did not use direct deposit on their last tax return to receive a refund, or when their direct deposit information was inaccurate and resulted in a refund check, will be able to provide that information and speed their payment with a deposit into their bank account, the IRS website says.

If the bank account you used on your tax return has since been closed, the IRS says the bank will reject the deposit and you will be issued your payment to the address we have on file for you.

If you split your tax refund between multiple accounts, the IRS will send your stimulus payment to the first account you listed on Form 888. If your direct deposit is rejected, your payment will be mailed to the address we have on file for you, the IRS says.

If youve had to make an electronic payment to the IRS in the past which includes Direct Debit Installment Agreements the IRS will not use that account information to send your stimulus payment. Instead, the IRS says you must fill out your direct deposit information through the Get My Payment app or wait for your payment to come in the mail.

You May Like: When Is The 3rd Stimulus Check Coming

Missing Stimulus Check You Still Have Time To Claim A Missing Payment

With all three Economic Impact Payments issued and the Get My Payment tool no longer available to track your stimulus checks, it might seem too late in the game to receive any missing payments .

Find: Stimulus Payments Coming to These States in September 2022

However, the Internal Revenue Service has provided information on how you might be eligible to claim a Recovery Rebate Credit for any missing or incorrect payments on 2020 or 2021 federal tax returns.

The first and second EIPs were issued in 2020 and early 2021, and were sent as advance installments of the 2020 Recovery Rebate Credit that could have been claimed on a 2020 tax return, per the IRS.

The third EIP and any eligible plus-up payments were advance payments of the 2021 Recovery Rebate Credit a taxpayer could claim via their 2021 tax return. These stimulus checks would have been received between March and December of 2021.

A taxpayer wanting to claim the Recovery Rebate Credit will need to file either a 2020 or 2021 tax return, depending on whether they missed the first, second or third stimulus check. As the IRS explains, missing or incorrect first or second stimulus checks can only be claimed on a 2020 tax return. For unaccounted third Economic Impact Payments, they can only be claimed by filing a 2021 return.

Letter 6475 is a statement of confirmation for third EIPs and any plus-up payments you received for the 2021 tax year. It will be sent to your address on file by the end of March 2023.

$1800 Recovery Rebate Credit: Which College Students Should Apply

The CARES Act and late sent two total stimulus checks to each qualifying low- and middle-income adult worth a cumulative $1,800 and then $1,100 for each of their dependent children younger than 17. With most college-aged students older than 17, they were excluded from both checks by design, along with other adult dependents, including individuals with disabilities.

Its only for those under the age of 17, and again, the eligibility will be for the parents taxes and not for the dependents tax return information in order to receive that stimulus, says Mark Jaeger, director of tax development at TaxAct. The adult dependents would not be eligible.

But college students want to be particularly careful because they often straddle the lines between independent and dependent taxpayer statuses.

The IRS has a five-part test to determine whether adults are eligible to be claimed as a dependent. If theyre a full-time student for at least five months of the year, they have to be under the age of 24. Most of the time, they have to be related to the adult taxpayer whos claiming them and share the same permanent address. And the biggest qualifier: Dependent college students can have a job, but they cannot provide more than half of their own support.

Read Also: Irs.gov Direct Deposit Form Stimulus Check