Who Qualifies For Receiving A Stimulus Payment

Anyone with a Social Security number, who meets the income requirements, is eligible.

The income limits are:

- Eligible individuals earning between $75,000 and $100,000

- Head-of-household filers earning between $112,500 and $150,000

The amount is based on your adjusted gross income on your 2019 tax return, unless the IRS processes your 2020 return by the time payments are sent.

Also different from the previous stimulus payments, is taxpayers with an adjusted gross income less than $75,000 to get the full $1,400 payment, including dependents of any age. Previous payments did not include money for dependents age 17 and older, but rather included smaller amounts for children.

Those who are not required to file income tax returns could receive payments. The IRS has a non-filers tool to gather information for these recipients. In addition, Social Security retirement, disability beneficiaries, and Supplemental Security Income recipients are likely eligible for payments.

What Happens If You Dont Receive Your Payment Or Only Receive A Partial Amount

If you havent received your payment yet, dont panic, although its easier said than done. Compared with the first round of stimulus checks, the IRS and Treasury Department have significantly shrunk the delivery timeline by weeks, if not months. However, the text of the American Relief Plan still gives both agencies until Dec. 31, 2021, to distribute all funds, meaning the last round of checks might not hit consumers mailboxes until January 2022.

Consider signing up for the U.S. Postal Services informed delivery service, so you know in advance of any mail youll be receiving on a given day. If the IRS says it already mailed your check but you didnt receive one, down the road you might also decide to order a stimulus check payment trace. You can arrange one by calling a hotline at the IRS or submitting a completed Form 3911, Taxpayer Statement Regarding Refund by mail or fax. But be prepared: This process can take weeks. The IRS may also ask that you sit tight for the time being in some cases, for a period as long as nine weeks.

How Is The Third Stimulus Check Calculated

The stimulus plan mandates the treasury to rely on 2019 and 2020 tax returns to calculate how much you could get for the third round of stimulus checks.

Congress approved limits based on adjusted gross income ranges. This means that taxpayers making less than the minimum threshold could get the full stimulus check, while those earning above it get reduced payments until they are fully phased out at higher incomes.

You can find your AGI on IRS form 1040. This is calculated by subtracting deductions like student loan interest, health savings accountpayments, and contributions to a traditional IRA from your gross income.

By contrast, your gross income is the total amount of money that you made during the tax year, including wages, dividends, capital gains, rental property income and other types of revenue.

Your 2019 taxes had to be filed by July 15, 2020. And your 2020 taxes are due by the extended deadline of May 17. You can read more about when to file your tax returns for the third stimulus check, and other IRS requirements in two tax sections below.

Recommended Reading: Where Is My $600 Dollar Stimulus Check

You May Like: Irs Gov Non Filers Form For Stimulus Check

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

What To Know About Adding Your Direct Deposit Details

You can’t use the Get My Payment tool to sign up for a new account or correct details about your payment. Even if the IRS is unable to deliver your payment to a bank account and the money is returned to the government, you won’t be able to correct the details online — the IRS says it will send the money again by mail.

The extended tax deadline was May 17. With the agency’s delay in processing tax returns, trying to register for a new direct deposit account with your 2020 tax return won’t get you into the system quickly enough. However, if you haven’t submitted your taxes yet, signing up for a new direct deposit account could still get you IRS money faster in the future, such as tax refunds or the upcoming child tax credit.

Read Also: What Was The Amount Of The Third Stimulus Check

What If I Receive Both Social Security And Ssi

If you received Social Security benefits before May 1997, or if you receive both Social Security and SSI, the payment schedule is different. Instead of getting your payments on a Wednesday, youll receive your Social Security payment on the third day of each month and your SSI on the first day of each month.

However, those payment dates change if the first or third day of the month falls on a weekend. For instance, Oct. 1 fell on a Saturday this year, so SSI recipients received their October payments a day early on Sept. 30 and their Social Security payment on Monday, Oct. 3. The same will apply in December for January 2023 payments.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Read Also: I Still Haven’t Gotten My First Stimulus Check

Contribute To A Traditional Ira

If your AGI is a bit too high, contributing to a traditional individual retirement account might be the key to getting a third stimulus checkâif you donât have a retirement plan like a 401 through your job.

You can contribute up to $6,000, or $7,000 if youâre 50 or older, to a traditional IRA before April 15, 2020. If you donât have a retirement plan through work, you can deduct the full amount of your contributions from your taxable income.

If youâre single and took home $81,000 in gross income in 2020, contributing $6,000 to a traditional IRA would lower your AGI to $75,000 and earn you a full stimulus check.

As an added bonus, if your spouse didnât earn income in 2020, they can still contribute to a spousal IRA, which could allow you to deduct up to another $6,000 , depending on your income level.

⢠Potential Income Reduction Amount: $6,000 to $14,000, depending on marital status, age, income level and access to workplace retirement plan.

⢠If youâre self-employed, check out a notes Julie Welch, managing partner and director of taxation at Meara Welch Browne, P.C. This could let you deduct up to $57,000 of your income in 2020 and allows you to contribute up until April 15, 2021, as well.

If You Didnt Get A Third Stimulus Check Last Year Or You Didnt Get The Full Amount You May Be Able To Cash In When You File Your Tax Return This Year

Remember all the excitement last March when a third round of stimulus checks was announced? An extra $1,400 in your pocket, plus $1,400 more for each dependent, was a big deal and made a huge difference for millions of Americans. But the thrill quickly turned to frustration and disappointment for people who didnt get a payment or didnt get the full amount. If thats you, theres some good news. You may still be able to claim the third stimulus check money you deservebut youll have to file a 2021 tax return to get it.

Some people were stiffed because they simply werent eligible for a third stimulus check. However, others were left out or given less than they were entitled to for various other reasons that wont prevent them from getting paid this year. For example, if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return, you can still claim a payment when you file a 2021 tax return. If you had a baby in 2021, you can get the extra $1,400-per-dependent for the child that was missing from last years third stimulus check payment. You could also be entitled to stimulus check money when you file your 2021 tax return if you experienced other recent changes to your family or financial situation .

Read Also: Stimulus Check For Healthcare Workers

Stimulus Check: What Can I See On The Tracking Portal

The online portal is called Get My Payment, which is currently offline but instructs you to check back in a couple of days for an update on your 2021 Economic Impact Payment.

With the first two payments, information was updated once a day. Once the tracking portal is live, all you have to do is plug in your Social Security number, date of birth, street address and zip code. The portal will display a message indicating whether the payment was sent, the payment method and the date it was issued. It will also let you know if there are any errors.

When Will The Third Stimulus Check Be Sent

The goal of Democrats was to pass the bill by this Sunday, March 14. Thats when extra unemployment assistance and other pandemic aid expires.

With Biden signing the plan on Thursday, Democrats have met that goal.

White House Press Secretary Jen Psaki announced shortly after Biden signed the bill that the IRS and Treasury Department are working hard to get payments out. She said some people will see direct deposits hit their bank accounts as early as this weekend.

This is of course just the first wave, but some people in he country will start seeing those direct deposits in their bank accounts this weekend and payments to eligible Americans will continue throughout the course of the next several weeks, Psaki explained.

The IRS said Friday the payments were already being processed and concurred that direct deposits would start arriving this weekend.

During the first round of stimulus checks in April 2020, it took about two weeks for the federal government to start distributing the money. It took around one week for the second round of checks, worth $600, in early January partly because the infrastructure from the first stimulus was in place.

One factor that could complicate things is that this is also tax season. The IRS will be trying to send out stimulus checks while also processing incoming tax returns and calculating refunds.

Also Check: How Much Was The First And Second Stimulus Check

You May Like: How.many Stimulus Checks In 2021

Review Steps To Know When Your Third Stimulus Check Arrives

Many Americans are expecting to receive a third stimulus check as part of a $1.9 trillion COVID-19 relief package in 2021. Some details may change before the bill actually passes, such as who qualifies, how large are the payments, and when will stimulus checks arrive. However, as soon as the bill passes the payment process will begin right away.

Lets review some helpful tips and information you can use to monitor the arrival of your stimulus payment. Well also address a common account question you may have.

Which Years Agi Determines If You Get A Stimulus Check

You generally have until December 31 to utilize deductions available in your particular circumstances to lower your AGI, but a select few are available until April 15, or the federal tax deadline. This year, you may want to take advantage of some of those last-minute deductions and file your taxes now.

Thatâs because the IRS uses your most recent AGI when determining your eligibility for the third stimulus check. Once it starts sending out checks, you could miss out on the chance to use your 2020 AGI to determine your stimulus eligibility.

Why is this? The third stimulus check is technically an advance on a 2021 tax creditâsimilarly to how the first and second stimulus checks were advances on 2020 tax credits. Since you obviously have not earned all of your income for 2021, you couldnât know your 2021 AGI, and thatâs why the IRS uses your 2020 AGI .

Luckily, if you qualify with your 2019 or 2020 AGI, the IRS wonât come back later and check in on your 2021 AGI to see if you made too much money this year to qualify for a stimulus check.

So if your 2020 AGI is close to the limits outlined above but just a bit too high, itâs in your best interest to see what you can do to knock it lower right now. No one knows what the future will bringâyou could get a promotion or strike it rich on GameStopâand itâs better to take deductions while you can. Hereâs how.

Recommended Reading: Is Ohio Giving Out Stimulus Checks

Support For A Fourth Stimulus Check

A group of Democratic Senators, including Ron Wyden of Oregon, Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont, sent a letter to President Joe Biden at the end of March requesting recurring direct payments and automatic unemployment insurance extensions tied to economic conditions.

As the Senators reasoned in their letter, this crisis is far from over, and families deserve certainty that they can put food on the table and keep a roof over their heads. Families should not be at the mercy of constantly-shifting legislative timelines and ad hoc solutions.

An earlier letter to President Biden and Vice President Kamala Harris from 53 Representatives, led by Ilhan Omar of Minnesota, carved out a similar position. Recurring direct payments until the economy recovers will help ensure that people can meet their basic needs, provide racially equitable solutions, and shorten the length of the recession.

Additional co-signers included New Yorks Alexandria Ocasio-Cortez and Michigans Rashida Tlaib, two other notable names among House Progressives. The letter didnt place a number on the requested stimulus payments. But a tweet soon after put it at $2,000 per month for the length of the pandemic.

$2,000 monthly payments until the pandemic is over.

READ MORE:

You May Like: Where To Cash My Stimulus Check

Some New Parents Will Get $1400 In 2022

Parents who had a child in 2021 might have their refunds padded by $1,400 when they do their taxes in 2022. Most people have already received their American Rescue Plan payments in full, according to Newsweek, but those who havent might be able to claim their Economic Impact Payment as the Recovery Rebate Credit.

Provided that they file their tax returns first, parents of children born in 2021 will be eligible for the stimulus check early next year, said Scott McKinney, head of marketing at Debt Bombshell. Like with previous stimulus checks, they would still be required to meet the income eligibility requirements, which means that they need to make no more than $75,000 per year.

You May Like: Were There Any Stimulus Checks In 2021

Recommended Reading: Social Security Beneficiaries Stimulus Check

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

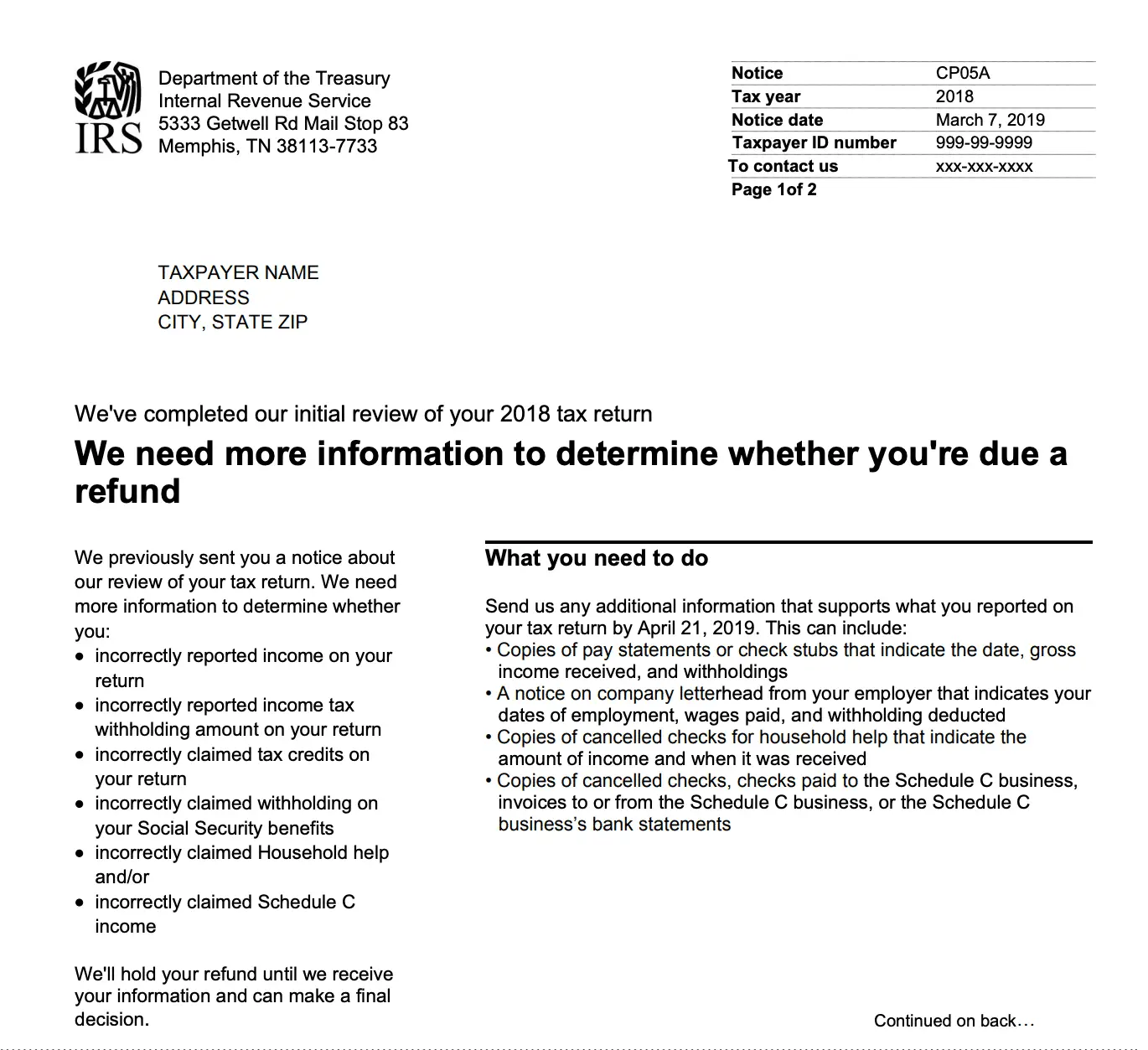

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Here’s How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they don’t usually file taxes, and claim what’s called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the person owes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though it’s a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

Don’t Miss: How To Get Stimulus Check Without Filing Taxes