Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Can I Change My Stimulus Payment Method

The IRS is using information from your last filed tax return to send your stimulus payment.

If you arent sure how the IRS will be sending your stimulus, you can use the IRS Get My Payment tool to check. If they havent sent your stimulus payment yet, you can update your direct deposit information. If they already sent your payment, theres nothing you can do to change your payment method.

Youre A Member Of A Mixed

Under the CARES Act, U.S. adults with a Social Security number werent eligible for a stimulus check if they were in a mixed-status household, meaning one partner was undocumented or didnt have an SSN. A recent law change, however, scraps that rule. Now, individuals would be able to receive both payments retroactively meaning both the first and second stimulus payment for the taxpayers and qualifying children of the family who have work-eligible SSNs.

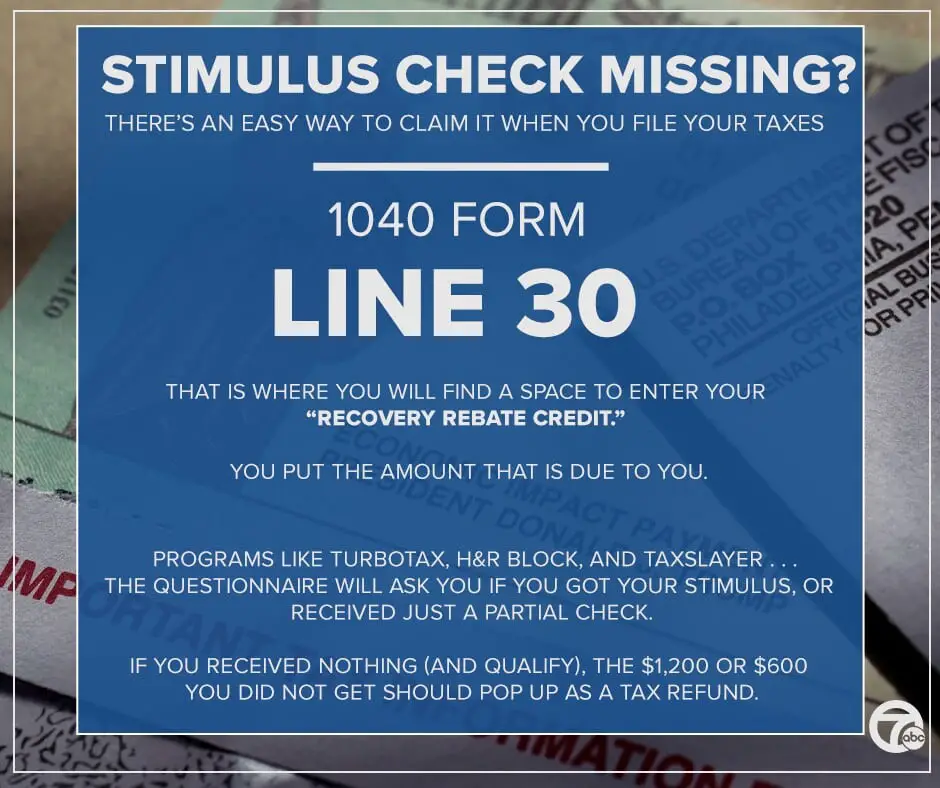

Youll want to reconcile that first amount with your Recovery Rebate Credit, if you didnt receive it.

Read Also: N.c. $500 Stimulus Check

The Irs Didnt Send Me The Right Amount Of Stimulus Money How Can I Claim The Rest

If you use CNETs first stimulus check calculator or second payment calculator and find you may have qualified for a larger stimulus payment than you received, youll likely be able to claim your money this year as a Recovery Rebate Credit.

Unfortunately, the IRS Get My Payment tool is no longer available for the first and second stimulus payments, so you wont be able to find your information there.

Read Also: Stimulus Check 3 Social Security

How Can I Get Help Completing Getctcorg

All first stimulus checks were issued by December 31, 2020. If you didnt get your first stimulus check in 2020 or didnt get the full amount you are eligible for and you dont have a filing requirement, you can use GetCTC.org. GetCTC has a chat box that you can use to communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

Also Check: Irs Phone Number For Stimulus Check 2021

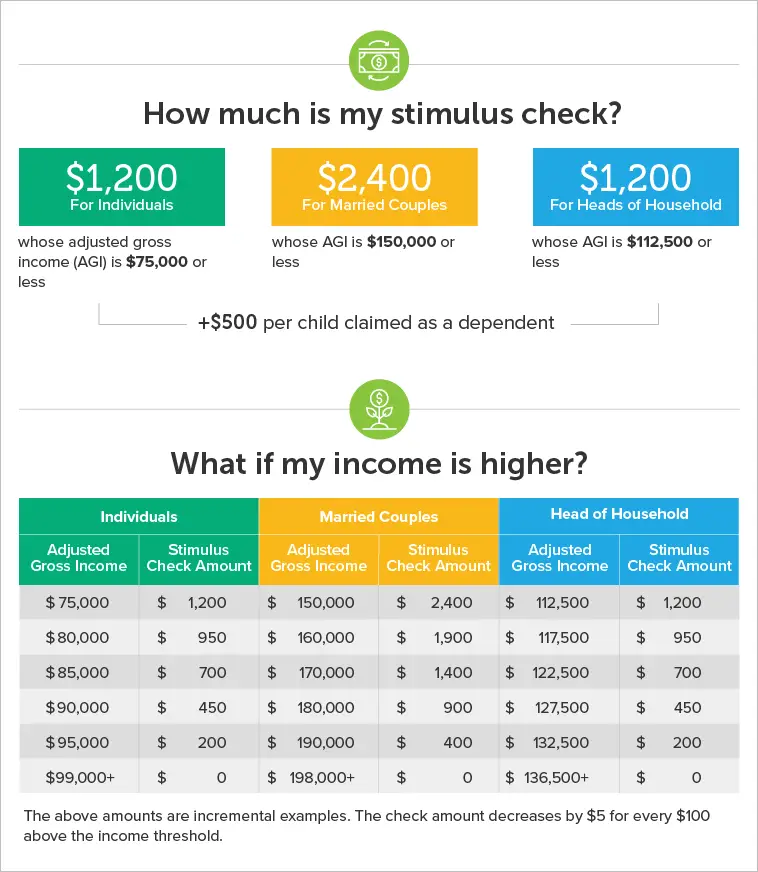

Do I Qualify And How Much Will I Receive

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, the IRS will use information from your 2019 or 2018 tax return or information that you provide to see if you qualify for an Economic Impact Payment.

To qualify for a payment, you must:

- Be a U.S. citizen or U.S. resident alien

- Not be claimed as a dependent on someone elses tax return

- Have a valid Social Security Number . Or if you or your spouse is a member of the military, only one of you needs a valid SSN

- Have an adjusted gross income below a certain amount that is based on your filing status and the number of qualifying children under the age of 17. If you are not required to file taxes because you have limited income, even if you have no income, you are still eligible for payment.

You may be eligible based on the criteria below, even if you arent required to file taxes. If you qualify, your Economic Impact Payment amount will be based on your adjusted gross income, filing status, and the number of qualifying children under age of 17. You will receive either the full payment or a reduced amount at higher incomes.

If I Work And Earn As A Dependent What Will Happen In This Case

The dependents may not sit idle but they also work and earn to meet their spending. In case these dependents meet half of the spending and have to depend on their parents for another half of the spending, they also will fulfill the requirement to be dependent. In the case of their income, the dependents have to file taxes which can be categorized by earned income and unearned income. For their income, they will have to file a tax return or their parents should file a tax return for them,

Read Also: Update On Fourth Stimulus Check

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

The IRS now offers an online tool to track the status of your stimulus check.

The IRS has not yet issued a new FAQ about the third round of stimulus checks but the old FAQs, linked below, are still up.

Remember that if you did not get your first or second stimulus checks, you can still claim them by filing a 2020 tax return.

What is the stimulus check?The CARES Act of March 2020 ordered money to be paid directly to most people in the U.S. to help the economy. The CARES Act called the payment a Recovery Rebate. The IRS calls it an economic impact payment. This website, and others, call it a stimulus check.

A second stimulus check was passed by Congress in late December 2020.

For information on the second stimulus check, see the updated FAQ on the IRS website.

Where will my stimulus check go?

For the most up to date information about where the IRS will send the second stimulus check, see the updated FAQ on the IRS website.

Will stimulus checks count as income for benefits eligibility?

Don’t Miss: What To Do If I Never Got My Stimulus Check

How Long Does It Take To Get My Stimulus Checks

The IRS announced on December 29 that it has started sending out the second round of stimulus checks to millions of Americans. Treasury Secretary Steven Mnuchin said that direct payments would go out a few days after the President signed the bill, and paper checks will take the longest.

For a comparison, the first stimulus checks already went out to the vast majority of Americans who are eligible for one. The IRS sent out the first electronic stimulus check payments on April 11, with most having arrived by April 15. The recipients of these initial payments were those who qualify for a check and have filed a tax return via direct deposit in either 2018 or 2019.

The first paper stimulus checks were in the mail as of April 24, 2020, with President Donald J. Trump printed on the memo line. This initial round of physical payments is specifically for individuals with an adjusted gross income of $10,000 or less. Each week after this, an additional five million paper checks will be mailed to those with an AGI of $10,000 above the previous weeks limit . Unfortunately, that means that some Americans did not get their checks until late summer or early fall.

Recipients of Social Security retirement benefits, Social Security survivor benefits, Social Security disability benefits, Supplemental Security Income , Railroad Retirement benefits and VA benefits who have their bank account on file with the IRS will automatically get their second stimulus check via direct deposit .

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

You May Like: Irs Sign Up For Stimulus

When Will I Receive My Stimulus Check How Do I Track The Status Of My Stimulus Check

Eligible taxpayers who filed a tax return in 2019 or 2018 and chose to receive their refund through direct deposit into their checking or savings account will automatically have their stimulus payment deposited into that account.

To find out when your stimulus check is coming, visit the IRS Get My Payment tool.

If the Get My Payment site says, Payment status not available its for one of the following reasons:

- The IRS hasnt finished processing your 2019 return, Stimulus Registration, or IRS Non-Filers entry.

- Get My Payment doesnt have your data yet.

- If you receive Social Security, VA benefits, SSA or RRB Form 1099 and dont typically file a return, your information isnt available in Get My Payment yet.

- Youre not eligible for a payment.

Get My Payment information is only updated once per day, so if you receive a Payment status not available message check back the following day to see if your status has changed.

How Will You Get The Payment

People who are eligible for the payment will get it either via a direct deposit to their bank account or by mailed debit card, according to the tax board. Generally, people who filed their 2020 tax return online and received their state tax refund via direct deposit will get a direct deposit. Most other people who are eligible will get debit cards in the mail. The envelope will be clearly marked with the phrase Middle Class Tax Refund.

Recommended Reading: How Do I Apply For The 4th Stimulus Check

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

Should I Hold Off On Filing My 2020 Tax Return And What Happens If The Irs Uses 2019 Tax Information

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

Don’t Miss: Do You Pay Taxes On Stimulus Checks 2021

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

Stimulus Checks: What You Need To Know

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The United States swiftly responded. Individual states put a series of lockdowns in place to slow the spread, and as unemployment climbed, the federal government sprang into action. It passed relief bills that included an Economic Impact Payment — better known as a coronavirus stimulus check.

Following the first stimulus payment, demand grew for more direct relief to American families as the pandemic raged on. In December 2020, the U.S. government again took action to provide a second stimulus check.

However, many on the left felt the second check was insufficient, leading numerous Democrats to campaign on providing additional stimulus funds. Voters delivered Democrats control of the White House, the U.S. House of Representatives, and the U.S. Senate.

As a result, shortly after taking office, President Joe Biden signed a bill authorizing a third stimulus check. The American Rescue Plan Act was signed into law on March 11, 2021. The legislation passed on a partisan basis with no Republican support. It’s widely expected to be the last direct payment Americans receive.

Here’s what you need to know about these direct payments, including who is eligible, how much money was available in the stimulus checks, and how to check the status of your payment.

Recommended Reading: $1 400 Stimulus Check When Is It Coming

Will I Receive My Stimulus Payment On A Debit Card

The IRS started depositing stimulus payments on some debit cards, including the TurboCard, for taxpayers that chose to receive their refund through that method in tax year 2019 or 2018. If you received your refund on a TurboCard during your most recent tax filing , here is what you need to know.

If you have access to your debit card, there is nothing more you need to do. If the IRS deposits a stimulus payment onto your debit card, you will be able to immediately use the stimulus funds upon deposit.

If you selected a refund transfer or a debit card when you filed your taxes and a stimulus payment is sent from the IRS to that account, you will receive your stimulus payment without delay or fees into the account you received your tax refund.

If you received a notification that you will be receiving your stimulus payment from the IRS on your debit card and no longer have access to it, you can request a replacement card by either signing in to your Turbo Visa Debit Card account or calling 888-285-4169 and reporting your card lost/stolen. Well waive or refund standard replacement fees so theres no cost to you.

If You Don’t Usually File Taxes How To Estimate Your Stimulus Money

With the first checks, the IRS automatically sent stimulus checks to many who normally aren’t required to file a tax return — including older adults, Social Security and SSDI and SSI recipients and railroad retirees. Some who didn’t file taxes may be eligible for a payment but haven’t yet claimed it.

If this is the case for you, enter your best guess where it asks for your adjusted gross income.

You May Like: Is It Too Late To Apply For Stimulus Check