Most Stimulus Payments Were Saved Or Applied To Debt

US households report spending approximately 40 percent of theirstimulus checks, on average, with about 30 percent saved and another30 percent used to pay down debt.

The Coronavirus Aid, Relief, and Economic Security Act, enacted on March 27, 2020, was designed to bolster household incomes and support consumer spending. It achieved the first goal, but had only a modest impact on consumer spending. Survey data on household behavior suggest that nearly 60 percent of the stimulus spending went to pay off debt or was saved. Of the roughly 40 percent that was spent on goods and services, consumers favored food and beauty products rather than large durables like cars or appliances. The averages mask considerable variation among households. Some 20 percent saved virtually all of their stimulus check another 40 percent spent nearly all of it. Roughly 20 percent used most of their federal payment to reduce their debts.

These findings inHow Did US Consumers Use Their Stimulus Payments? reflect general patterns seen in 2001 and 2008, when the federal government also countered economic downturns with direct transfer payments. The 2020 payments, however, were much larger and the recipients were somewhat less likely to spend than in the past.

Laurent Belsie

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Other Features Of The Bill

How does the aid for small businesses and nonprofits work?

Good news here, as you may be eligible for forgivable loans. Our colleague Emily Flitter covered the details in a separate article. Aides to Senator Marco Rubio, Republican of Florida, also wrote a one-page summary of those provisions.

Will there be damage to my credit report if I take advantage of any virus-related payment relief, including the student loan suspension?

No. There is not supposed to be, at least.

The bill states that during the period beginning on Jan. 31 and continuing 120 days after the end of the national emergency declaration, lenders and others should mark your credit file as current, even if you take advantage of payment modifications.

If you had black marks in your file before the virus hit, those will remain unless you fix the issues during the emergency period.

Credit reporting agencies can make errors. Be sure to check your credit report a few times each year, especially if you accept any help from any financial institution or biller this year.

What if I find black marks anyway?

File a dispute with the credit bureau, but it may take a while to fix them. The Consumer Financial Protection Bureau has told credit bureaus and others that during the pandemic they can take longer than the usual 30 to 45 days to meet the dispute-response deadline, as long as they are making good faith efforts.

Is there any relief for renters in the bill?

You May Like: Do You Have To Claim Stimulus Check On 2022 Taxes

Stimulus And Relief Package : American Rescue Plan

On March 11, 2021, President Biden signed into law the American Rescue Plan Act of 2021, implementing a $1.9 trillion package of stimulus and relief proposals. Some facets of the plan, such as raising the minimum wage to $15 an hour, were excluded to pass the plan using budget reconciliation, a Senate procedure that allows bills to be passed using a simple majority.

Roughly $350 billion of the total funding was allocated to state and local governments. The key points of the plan as it was passed are the following:

The Stimulus Had Big Economic Benefits But It Also Fueled Inflation

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty beyond merely keeping people afloat during the early days of the pandemic.

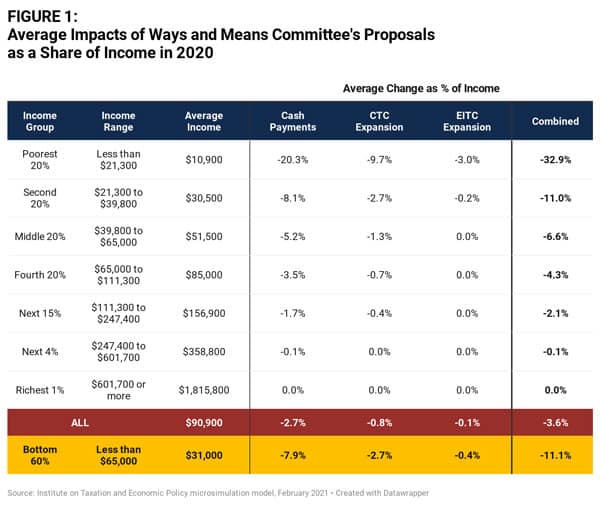

According to the U.S. Census Bureaus supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute. We dont know yet whether this came to fruition, but Laura Wheaton, a senior fellow at the Urban Institute and one of the analysts behind the 2021 numbers, told us that it was clear from their analysis that the stimulus checks were driving a dramatic decline in poverty.

More broadly, the stimulus checks also cushioned workers during one of the worst economic crises in modern history, which likely helped the economy bounce back in record time. In April 2020, when Americans were receiving the first round of checks up to $1,200 with the CARES Act the unemployment rate was at a disastrous 14.7 percent. But two years later, its almost returned to its pre-pandemic levels, with many job openings. I hope we dont forget how awesome it was that we supported people so well, and that we recovered as quickly as we did, said Tara Sinclair, a professor of economics at George Washington University.

Recommended Reading: Track My Golden State Stimulus 2

What Is A Stimulus Check

Stimulus checks are direct payments to American families that the U.S. government provided in response to COVID-19. Three stimulus checks have been paid out during the pandemic:

- The Coronavirus Aid, Relief, and Economic Security Act authorized the first check. It provided up to $1,200 per eligible adult and $500 per eligible dependent child.

- An additional stimulus check was authorized in December of 2020, providing up to $600 per eligible adult and dependent child.

- A third stimulus check of up to $1,400 per adult and dependent was made available by the American Rescue Plan Act on March 11, 2021.

Is There A Deadline To Get The Economic Impact Payment

The IRS must receive peoples information by November 21, 2020 to issue payments this year. For many people, this means completing an online form. See question 7 on how to get payments for more information.

If someone is required to file a tax return AND owes taxes, they must file and pay the amount owed by July 15 to avoid late fees. If more time is needed to file taxes, a person can get an extension until October 15, 2020, but they will need to pay the tax owed by July 15 to avoid penalties.

If people receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, they must send information to the IRS to get their additional stimulus payment for qualifying children this year. They should use the IRS Non-filer tool to add the names and Social Security Numbers for their dependents. Learn more about qualifying dependents here.

If they miss these deadlines, they will be able to get their payment in 2021 by filing a 2020 tax return.

Also Check: I Never Received Any Stimulus Check

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

How Do I Get My Stimulus Check

If youve filed a tax return for tax year 2019 or 2018 or submitted your information to the 2020 IRS Non-filer portal, you dont need to do anything. The IRS shouldve automatically sent your payment. Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security Insurance and Veterans Affairs beneficiaries shouldve also automatically received a check.

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

To use GetCTC.org, youll need a phone number or email address. Youll also need to provide your full name , mailing address, date of birth, Social Security Number, bank account information , 2019 Adjusted Gross Income , and details for any qualifying children you have.

9. What if I dont have an email address?

Also Check: When Will We Get 4th Stimulus Check

If You Provided Information Using The Irs Non

If you provided your personal information to the IRS using the non-filers portal, your money will be direct deposited into the bank or credit union account or prepaid card that you provided when you submitted your information. If you did not provide payment account information, a check will be mailed to you to the address you provided.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, including if you havent received the payment.

What Covid Relief Is Still Available

Among the assistance still available are rent assistance and tax breaks on student loans that were forgiven. Check with your state to see what local programs are available. For example, while the federal eviction moratorium has ended, a few states still have eviction bans in place. Others have allocated funds to help small businesses.

Read Also: How Can I Get My 3rd Stimulus Check

A Breakdown Of The Fiscal And Monetary Responses To The Pandemic

The COVID-19 pandemic, now in its third year, has tremendously impacted the U.S. and global economies. The U.S. government responded to the crisis when it enacted a number of policies to provide fiscal stimulus to the economy and relief to those affected by this global disaster. The Federal Reserve also took a series of substantial monetary stimulus measures to complement the fiscal stimulus.

In this article, we divided stimulus and relief efforts into monetary policy, made by the Fed, and fiscal policy, made by Congress and the Trump and Biden presidential administrations. Although the pandemic persists, many of these programs have since been discontinued.

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

Recommended Reading: Who Qualify For Third Stimulus Check

How Will People Get Their Payment If They Filed Taxes With A Refund Anticipation Check Or Refund Anticipation Loan

The IRS will attempt to deliver the payment to the account information provided on the tax return. Some RALs and RACs are issued through debit cards. If the card is still active, the person will receive the payment on the card. If the account or card is no longer active, the deposit will be rejected, and the IRS will send a paper check to the address on the tax return. A person can check Get My Paymentfor updates on their payment delivery. If the payment has been directly deposited into an account that they dont recognize or dont have access to, they should contact the tax preparer who filed the return. If they are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

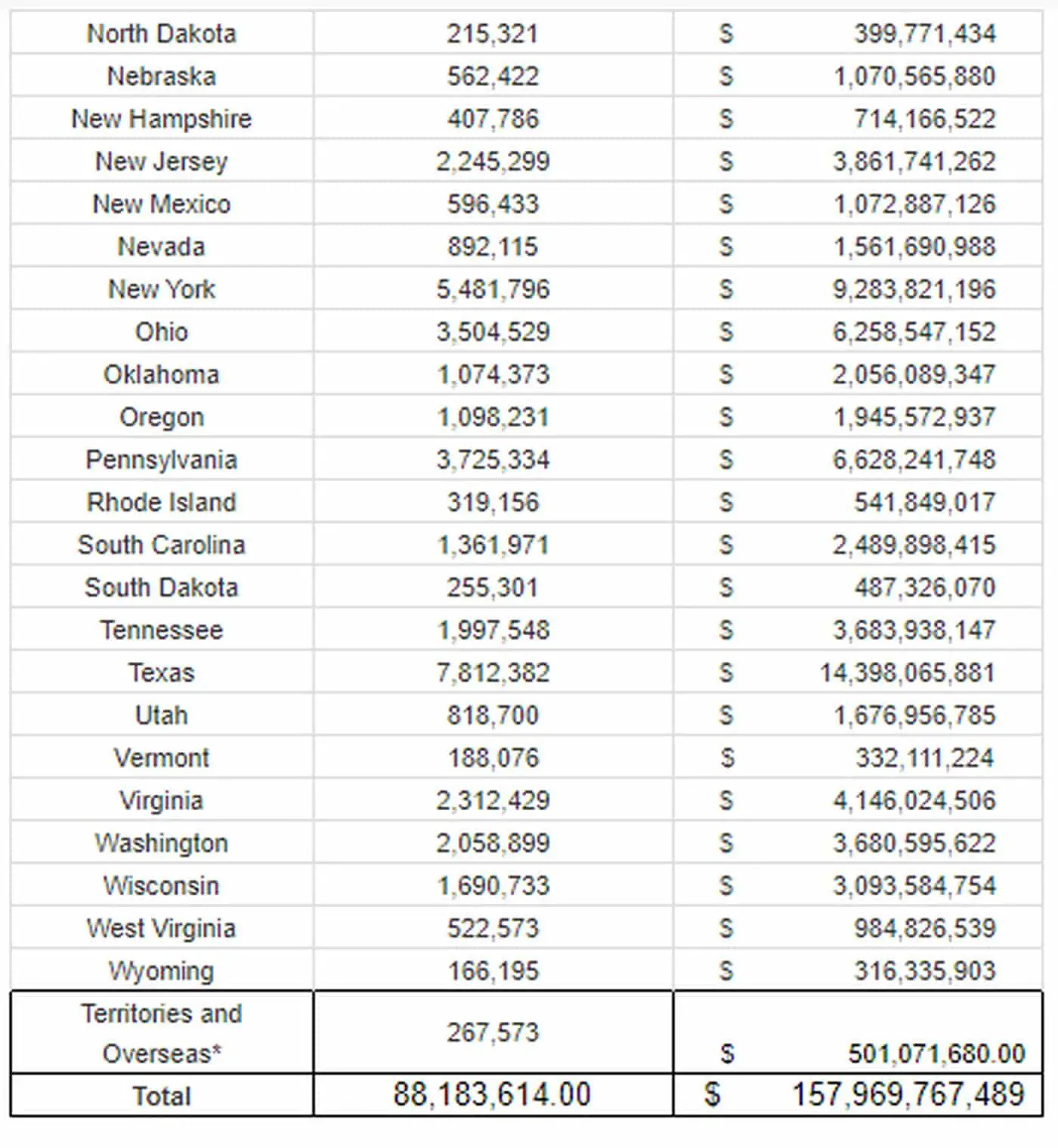

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Don’t Miss: Is North Carolina Getting Another Stimulus Check

Stimulus And Relief Package 35

A supplementary stimulus package, nicknamed Phase 3.5, was signed into law on April 24, 2020. It appropriated $484 billion, mostly to replenish the PPP and the EIDL, and contained additional funding for hospitals and COVID-19 testing.

Another supplementary measure, the Paycheck Protection Program Flexibility Act of 2020, which modified the PPP, was signed into law on June 5, 2020. It made the following changes to the program:

- It allowed businesses 24 weeks to spend the money, up from the initial eight-week period

- It lowered the requirements for loan forgiveness. Businesses now had to spend only 60% of their PPP funds on payroll, instead of 75% previously.

- The payment deferment period was extended from six months to when the borrower finds out the amount of their loan forgiveness

- It allowed businesses that received PPP loans to delay paying payroll taxes

- It allowed businesses loan forgiveness if they didnât rehire workers who refused good-faith offers of reemployment or were unable to restore operations to levels before the COVID-19 pandemic

- It gave businesses until the end of 2020 to restore their payrolls to precrisis levels

- It increased the loan maturity of PPP loans taken out after June 5, 2020, to five years

- It extended the time that borrowers have to pay back unforgiven parts of the loan

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Recommended Reading: How To Recover Stimulus Check