If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

How Do I Get My Stimulus Check

Stimulus checks will be based on information from your most recent tax filings, either tax year 2019 or 2018. If you have not filed your 2019 taxes, the IRS will use information from your 2018 tax return. The IRS will use your adjusted gross income information in the most recent tax return filed to determine the amount of your stimulus payment and will deposit your stimulus payment based on the latest direct deposit information. If your tax return does not indicate a direct deposit account, you will receive a paper check.

If you are not required to file and you dont receive Social Security income or Supplemental Security Income you can provide the IRS with the information they require to issue a stimulus payment using TurboTax Stimulus Registration Product.

Read Also: Where’s My 1st And 2nd Stimulus Check

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Also Check: Stimulus Checks Gas Prices 2022

Will There Be A Recession Stimulus Check

Well, in case you missed the news, the U.S. economy is in a mild recession . So, will Uncle Sam start sending out recession stimulus checks? The answer is, maybe one daybut not now.

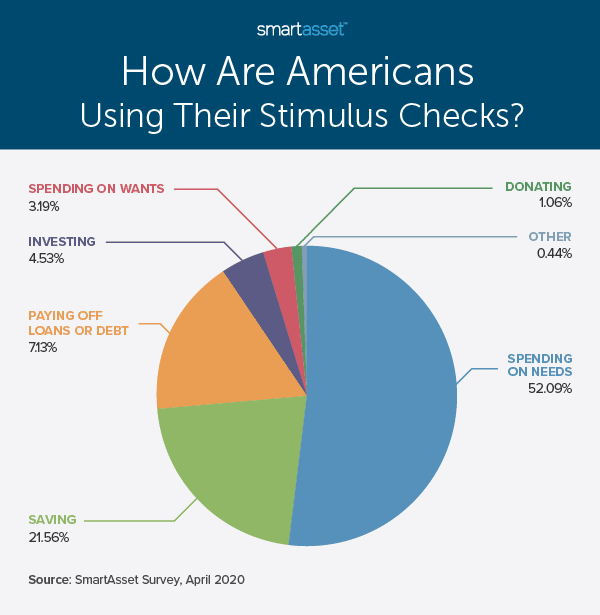

It might surprise you, but stimulus checks were actually a thing way before COVID! The government sent out stimulus checks during the 2001 and 2008 recessions to try to boost consumer spending. Most people got $300which is nowhere close to the three big stimulus checks people got during the pandemic.

The idea behind a stimulus check is to help people who are struggling to pay their bills and kick-start consumer spending. But that really wouldnt make sense right now, because giving consumers more money to spend would boost inflationand thats already out of control.

Congress currently isnt considering any recession stimulus check bills, but you never know what those guys are up to.

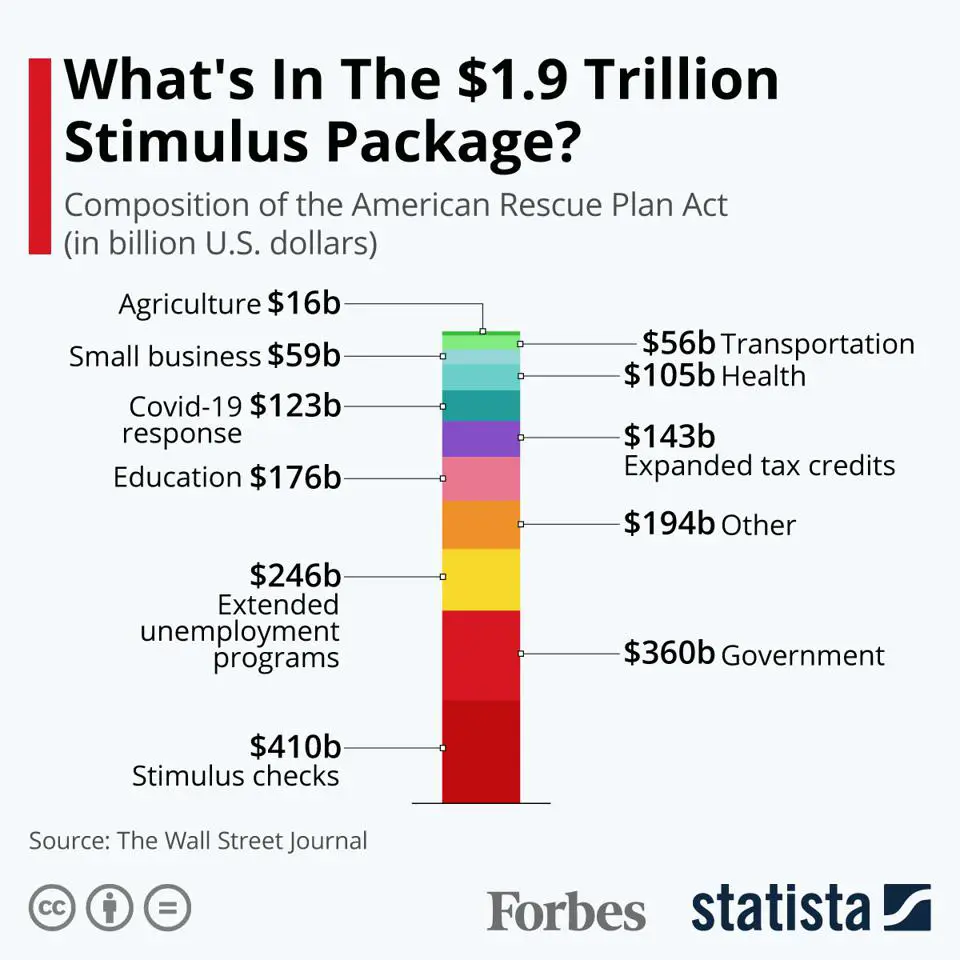

Child Care: $56 Billion

The pandemic had a devastating impact on child care providers, faced with increased costs and a decline in enrollment. But many parents need them to be open so that they can return to work.

About $56 billion in grant money is making its way to child care providers so that they continue operating. They can spend the money on a variety of uses including cleaning products, staff wages, rent and mortgage payments, utility bills, and providing financial assistance to families.

You May Like: Sign Up For Fourth Stimulus Check

How Did The Irs Know Where To Send My Check

The IRS used the information it already had to issue stimulus payments.

If you had direct deposit information on file with the IRS, you should have received your payment via direct deposit.

If you didn’t have direct deposit information on file with the IRS, you should have received your payment as a check or debit card in the mail.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Don’t Miss: How Do I Claim My Third Stimulus Check

Alert: Highest Cash Back Card Weve Seen Now Has 0% Intro Apr Until Nearly 2024

If youre using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Are Stimulus Checks Considered Taxable Income

The stimulus checks were paid based on information from your most recent tax return and will be reconciled in tax year 2020 to ensure you received the correct rebate amount.

- If you are underpaid based on your 2020 income you may receive more tax credit when you file your 2020 taxes.

- If you are overpaid, you dont have to pay it back.

For example, if you received $700 as an individual based on your 2019 return but when you file your 2020 tax return, it shows your income took a hit and you should have received a $1,000 stimulus check. You would receive an additional $300 credit on your 2020 return.

Let TurboTax keep you informed on the latest information on how taxes are impacted by COVID-19 relief including the most up-to-date information on tax filing deadlines, visit our Coronavirus Tax Center.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Don’t Miss: Are We Getting More Stimulus Money

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Read Also: Can You Claim Stimulus On 2021 Taxes

Financial Crisis Of 2008

One example of the use of stimulus checks occurred when the U.S. economy entered a severe recession after the financial crisis of 2008. The incoming Obama administration estimated that sending out checks would prevent unemployment rates from going beyond 8%.

The payments were part of the Economic Stimulus Act of 2008, which was enacted during the administration of President George W. Bush. The government sent out checks to those with at least $3,000 in qualifying income from, or in combination with, Social Security benefits, Veterans Affairs benefits, Railroad Retirement benefits, and earned income. The checks amounted to:

- Eligible Individuals: Between $300 and $600

- Between $600 and $1,200

- With Eligible Children: An additional $300 for each qualifying child

What If I’m Missing A Stimulus Payment

Most people who were eligible already received their stimulus payments.

If you are missing a stimulus payment or got less than the full amount, you may be able to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return, depending on which payment you are missing.

Missing first and second payments may only be claimed on a 2020 tax return.

Missing third payments may only be claimed on a 2021 tax return.

You need to file a tax return for the correct year to claim a missing payment, even if you dont usually file a tax return. If your return was already filed and processed, you will need to amend it to claim the credit.

You will need the total payment information from your online account or IRS letter to accurately calculate your Recovery Rebate Credit.

Check with the IRS to learn more about the Recovery Rebate Credit and claiming it on your federal tax return.

Read Also: What To Do If I Never Got My Stimulus Check

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Recommended Reading: I Never Received Any Stimulus Check

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

“Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,” the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency’s website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRS’ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2That might sound like forever, but the clock is ticking here.

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

You May Like: Where’s My Stimulus Check 2021 Tracker

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Will I Get A Stimulus Payment For My Spouse Who Died Last Year

A spouse who died in 2020 is not eligible for a stimulus payment under the American Rescue Plan. According to the IRS website, a payment made to someone who died before they received the payment should be returned to the IRS.If the payment was issued to both spouses, and one spouse has died, the check should be returned, and the IRS will issue a new Economic Impact Payment to the surviving spouse.

You May Like: Free File Taxes For Stimulus

Don’t Miss: What Is Congress Mortgage Stimulus Program