What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Will There Be Another Stimulus Check

As of now, there are no concrete plans to send out more cash payments to households, but lawmakers are pushing for it.

Correction: This article has been updated to correct the age for which an additional $500 is allotted to parents: That payment is for those who have an AGI within the phaseout range for each child younger than 17, not 16.

Also Check: How Can I Apply For Stimulus Check

Don’t Miss: I Havent Received My Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Recommended Reading: Irs Stimulus Check Sign Up

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

Will You Have To Pay Back Money From A Previous Stimulus Check

You might. Heres why: Some people were sent stimulus checks by accident. Whoops! We knowimagine the government making a mistake, right? Heres why you might need to send your money back:

- You make more than the income limit required to receive the stimulus money.

- You were given a check for someone who has died.

- Youre a nonresident alien.

- You dont have a Social Security number.

- You were claimed as a dependent on someone elses tax return.

If you know one of these applies to you, the IRS expects you to find the error and send the money back to them.14 So go ahead and be honest . You dont want any surprises when you go to file your taxes.

Also Check: Track My Golden State Stimulus 2

State Treasurers Office Covid

Note: This section includes historical updates from 2020. For the latest State Treasurers Office updates, visit our Newsroom or sign-up for our quarterly eNewsletter here.

CARES Act Update The state receives its second payment of CARES Act relief funds in the amount of $906,880,279, completing the $1.9 billion allocated for South Carolina.

Maintaining Good Financial Habits in a Time of COVID-19 Treasurer Loftis shares important steps to take during this time to ensure peace of mind and financial well-being.

CARES Act Update A partial payment of $998,234,321 in CARES Act relief funds is received by the State Treasurers Office, properly accounted for and prudently invested pursuant to state law.

Notice of Direct Mail Effective March 30, 2020 Guidance related to the direct mailing of all vendor and payroll checks to payees.

Resources

Read Also: When Did We Get Stimulus Checks In 2021

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Also Check: I Want To Sign Up For The Stimulus Check

The $19 Trillion Stimulus Law

The American Rescue Plan is the official name of that massive stimulus legislation enacted in March. It kicked the nations stimulus response into high gear.

Not only did it make the third round of payments possible. It also expanded the federal child tax credit, with Americans getting half of it this year as an advance payment. That advance will span six checks, which the IRS has started sending out monthly. All of which is to say, the 478 million figure we noted above is also a little incomplete.

It doesnt, for example, take into account the child tax credit checks that are coming once a month through December. In all, those will give millions of families as much as $1,800 this year for each eligible child. And theyll get the second half of the tax credit next year.

Also Check: Do You Pay Taxes On Stimulus Checks 2021

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Recommended Reading: Someone Stole My Stimulus Check

Stimulus Check: How Much Money Will You Get And When

The $2 trillion economic stimulus bill includes help for American families who are hurting financially due to the economic impact of the coronavirus. Most adults will receive $1,200 checks, plus $500 for each of their children. The massive relief package will funnel $290 billion in direct payments to individuals and families. Households are expected to get a check within weeks or months. That could provide a lifeline for the millions of Americans who have already been laid off or seen their income plunge as people hole up to avoid infection.

âLow- and middle-income households would receive about 68 percent of the payments,â noted Tax Policy Center senior fellow Howard Gleckman in a blog post. Hereâs what to know about how the payments will work.

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Don’t Miss: Where’s My Stimulus Check Ca

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Social Security Payments For December: When Is Your Money Coming

Social Security payments for December started going out this week. See when your payment will arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When shes not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration this week started disbursing December payments. In , youll get your first increased benefit amount. For those who receive Supplemental Security Income, youll get your first increase in December. Well explain why below and how the timing of Social Security payments works.

This month, keep an eye out for a letter in the mail about your Social Security benefits increase for 2023. Itll have details about your individual benefit rate increase for next year or you can also check your benefits online using your My Social Security account.

Read Also: Stimulus Money For Small Business

Also Check: How Much In Total Were The Stimulus Checks

Stimulus Update: Inflation Stimulus Check

12 Min Read | Aug 29, 2022

Social distancing, remote learning, stimulus paymentsthe COVID-19 pandemic introduced us all to lots of new concepts.

And while the 6-foot rule has gone out the window , stimulus checks have hung around. But instead of a stimulus for pandemic relief, state politicians are now cutting stimulus checks to help ease the pain of record-high inflation and gas prices. And theres even talk of a federal inflation stimulus check.

So, is more stimulus money coming your way? Lets take a look.

Is More Stimulus Money On The Way

The federal government could issue a fourth stimulus check, but the odds are against it. When the third round of stimulus checks was sent out, there was debate among lawmakers about whether it was necessary and who should qualify. Since then, the economy and unemployment numbers have improved, making another stimulus check a hard sell.

There are, however, some states that are offering their own stimulus programs. For example, California’s Golden State Stimulus program will distribute payments of between $500 and $1,200 to eligible residents in September 2021. Keep an eye on the stimulus news in your state so you don’t miss out on any benefits you’re eligible for.

Reviews have been mixed about the federal government’s COVID-19 relief measures. An average of $3,450 in stimulus money is better than nothing, but it’s less impressive when you compare it to how long the pandemic has lasted. While there could be more relief in the future, it likely won’t be nearly as much as the prior rounds of stimulus checks.

Also Check: Where My Golden State Stimulus

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Also Check: Stimulus For Healthcare Workers 2021

Will Children Get A $500 Check

Yes. Taxpayers with dependent children will receive a $500 payment for each child, which isnât determined by income. In other words, taxpayers will get a $500 payment for each of their children, regardless of how high their income is.

There is a catch on children, however: only kids who havenât yet turned 17 are eligible.

Donât Miss: Was There Any Stimulus Checks In 2021

You May Like: Where Is My First And Second Stimulus Check

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

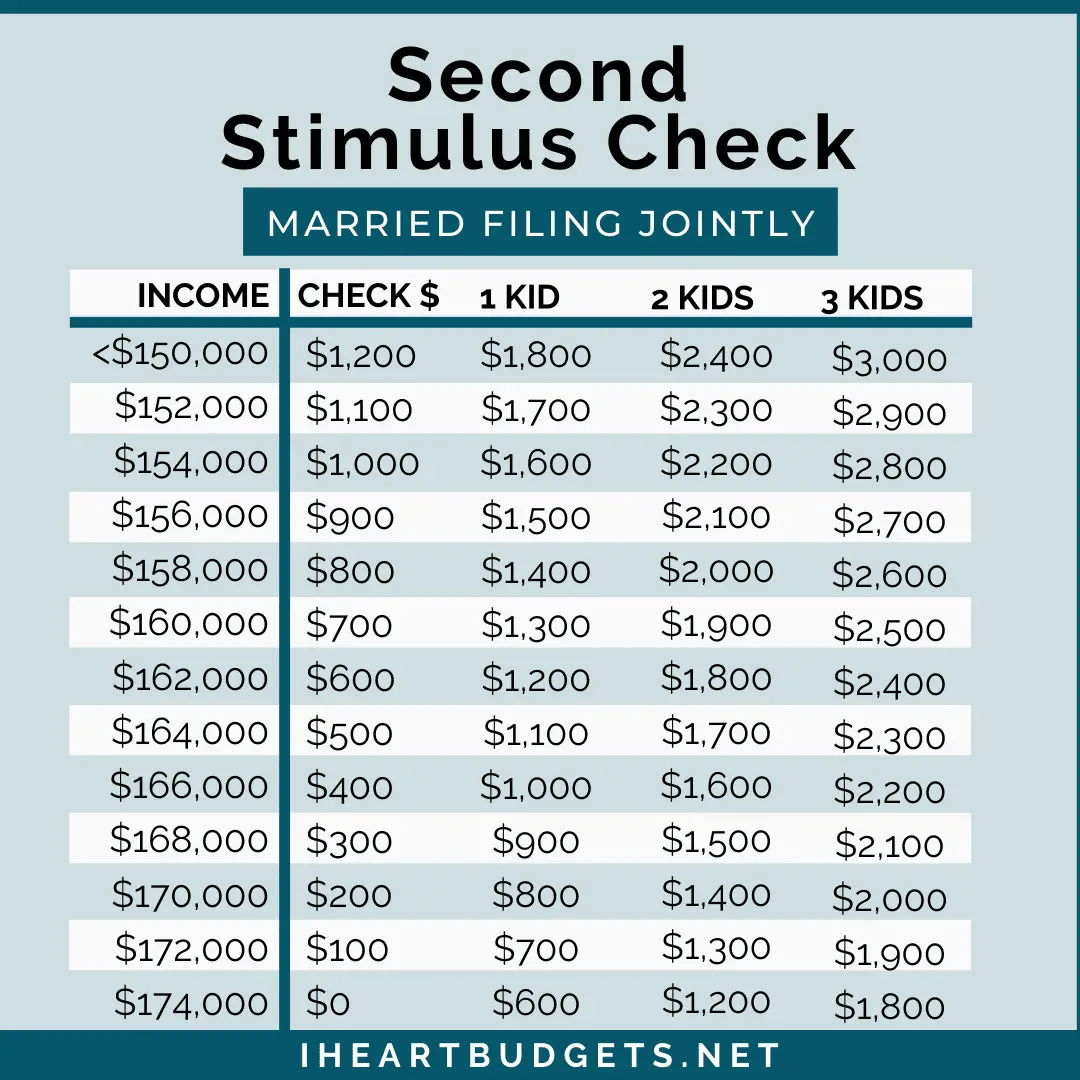

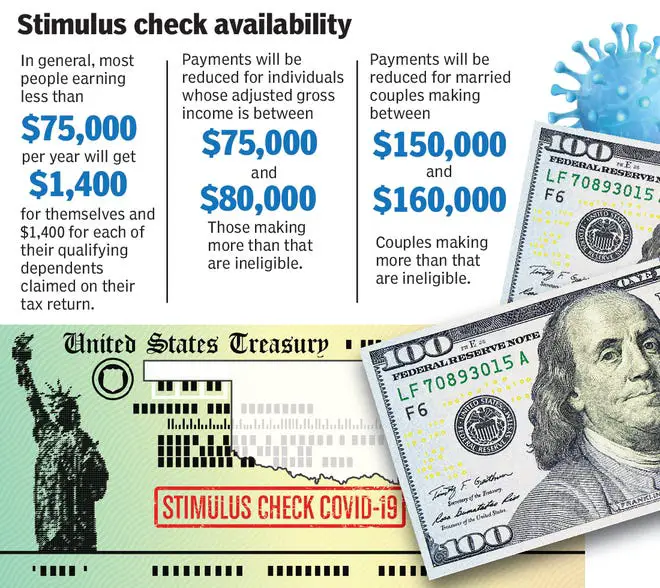

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?