Paycheck Protection Program Liquidity Facility

To help small businesses, the Fed launched the Paycheck Protection Program Liquidity Facility on April 9, 2020, in concert with the CARES Act. This program lent money to banks so they could, in turn, lend money to small businesses through the Paycheck Protection Program . On April 30, 2020, the program expanded the types of lenders that could participate in the program. The program ended on July 30, 2021.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How Can I Get Help Completing Getctcorg

All first stimulus checks were issued by December 31, 2020. If you didnt get your first stimulus check in 2020 or didnt get the full amount you are eligible for and you dont have a filing requirement, you can use GetCTC.org. GetCTC has a chat box that you can use to communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

Read Also: When Were The First Stimulus Checks Sent Out

What Is A Plus

A plus-up payment is basically just a bonus amount that you probably should have gotten the first time you filed your taxes. The IRS actually owes more money to some people based on their tax returns. If the IRS used your 2019 tax information to dish out your stimulus payment but your 2020 taxes show that it underpaid youyou might be in for a plus-up payment based on your income. But remember, this isnt for everyoneonly those who had a change in income or dependents would qualify for more stimulus money.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Also Check: How Much 2021 Stimulus Check

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Dont Miss: Did I Receive Third Stimulus Check

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Donât Miss: File Taxes To Get Stimulus

You May Like: Stimulus Check How To Qualify

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

You May Like: Where’s My Stimulus Money 2021

Will There Be A Fourth Stimulus Check From The Government

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didnt seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

You May Like: When Did The Stimulus Checks Go Out In 2021

Recommended Reading: Are We Getting Another Stimulus Pay

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally dont file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

How Many Stimulus Checks Were Issued In 2021

Throughout the pandemic the federal government has sought to ease the financial consequences of covid-19 and the related restrictions by offering relief to Americans. This has been done in the form of the boosted unemployment benefits and the expanded Child Tax Credit, but by far the most far-reaching of those programmes has been the three rounds of stimulus checks.

First introduced in the CARES Act of March 2020, Economic Impact Payments are a direct cash injection into the bank accounts of individual people. As we approach one year since the last round of the payments was approved, we take a look back at the stimulus checks in 2021

Only one round of direct payments was distributed last year

2021 began with a change in the White House as President Biden was sworn into office, bringing with him an ambitious legislative proposal known as the American Rescue Plan. The bill comprised roughly $1.9 trillion of federal funding in total and while campaigning in the all-important Georgia Senate run-off election last January, Democrats vowed to pass a $2,000 stimulus check if they successfully retook the Senate.

BREAKING: Consumer spending rose 4.2% last month, the fastest pace in nine months, while incomes, boosted by stimulus checks, soared a record-breaking 21.1% in March. The gains offer more evidence the economy is poised for a robust recovery.

The Associated Press

You May Like: Didnt Receive 2nd Stimulus Check

Don’t Miss: Are We Going To For Stimulus Check

Stimulus Checks: What You Need To Know

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The United States swiftly responded. Individual states put a series of lockdowns in place to slow the spread, and as unemployment climbed, the federal government sprang into action. It passed relief bills that included an Economic Impact Payment better known as a coronavirus stimulus check.

Following the first stimulus payment, demand grew for more direct relief to American families as the pandemic raged on. In December 2020, the U.S. government again took action to provide a second stimulus check.

However, many on the left felt the second check was insufficient, leading numerous Democrats to campaign on providing additional stimulus funds. Voters delivered Democrats control of the White House, the U.S. House of Representatives, and the U.S. Senate.

As a result, shortly after taking office, President Joe Biden signed a bill authorizing a third stimulus check. The American Rescue Plan Act was signed into law on March 11, 2021. The legislation passed on a partisan basis with no Republican support. Its widely expected to be the last direct payment Americans receive.

Heres what you need to know about these direct payments, including who is eligible, how much money was available in the stimulus checks, and how to check the status of your payment.

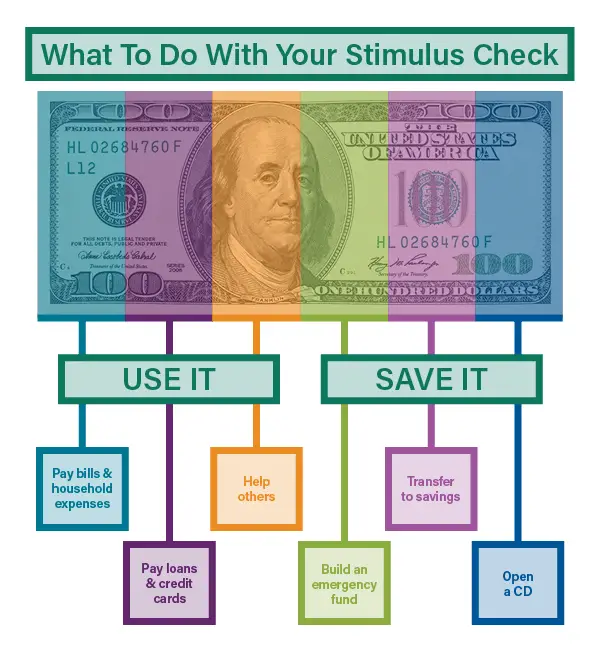

Most Stimulus Payments Were Saved Or Applied To Debt

US households report spending approximately 40 percent of theirstimulus checks, on average, with about 30 percent saved and another30 percent used to pay down debt.

The Coronavirus Aid, Relief, and Economic Security Act, enacted on March 27, 2020, was designed to bolster household incomes and support consumer spending. It achieved the first goal, but had only a modest impact on consumer spending. Survey data on household behavior suggest that nearly 60 percent of the stimulus spending went to pay off debt or was saved. Of the roughly 40 percent that was spent on goods and services, consumers favored food and beauty products rather than large durables like cars or appliances. The averages mask considerable variation among households. Some 20 percent saved virtually all of their stimulus check another 40 percent spent nearly all of it. Roughly 20 percent used most of their federal payment to reduce their debts.

These findings inHow Did US Consumers Use Their Stimulus Payments? reflect general patterns seen in 2001 and 2008, when the federal government also countered economic downturns with direct transfer payments. The 2020 payments, however, were much larger and the recipients were somewhat less likely to spend than in the past.

Laurent Belsie

Don’t Miss: How Much Was All The Stimulus Checks

Third Stimulus Check Calculator

See how much your third stimulus check should have been using this handy tool.

In March 2021, President Biden signed the American Rescue Plan Act, which authorized a third round of federal stimulus checks worth up to $1,400 for each eligible person , plus an additional amount of up to $1,400 for each dependent. The IRS issued all the third-round stimulus checks by the end of 2021, but eligible people who didn’t receive a check last year can still get stimulus money by filing a 2021 tax return now and claiming the recovery rebate credit.

However, not everyone who is eligible for a third stimulus check got the full amount . As with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

When Will A Second Stimulus Check Be Issued

The government began sending direct deposit payments on December 28, 2020. Paper checks were sent out starting on December 30, 2020.

Payments are automatically sent to:

- Eligible individuals who filed a 2019 tax return.

- Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security and Veteran Affairs beneficiaries.

- Individuals who successfully registered for the first stimulus check online using the IRS Non-Filers tool or who submitted a simplified tax return that has been processed by the IRS

There is no action that you have to take to get your second stimulus check. People who provided their banking information with the IRS shouldve received their stimulus checks by direct deposit. Social Security and Veterans Affairs beneficiaries who received the first payment via Direct Express shouldve received the second payment the same way.

The IRS sent paper checks or prepaid debit cards to people who did not provide their banking information. Mailed payments may be delivered in a different format than the first stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Read Also: How Much Was The Second Stimulus Check

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Read Also: Can You Still Get Stimulus Check