What If I Filed My Taxes Last Year Under My Previous Name And Have Changed My Name Since I Filed Those Taxes

If you file taxes and have not filed your 2019 taxes, you should file as soon as possible with your new name. Make sure your name is updated with the Social Security Administration.

If your stimulus check is written out to you under your previous legal name, you should still be able to deposit your check. However, you may need to speak with your bank and show your legal paperwork documenting your courtordered name change and old and new ID.

If you are cashing a check outside of a bank, bring your legal documents with you and try to call in advance to make sure that they dont have additional requirements to cash the check.

Will There Be More Stimulus Checks In The Future

As things currently stand, a fourth federal stimulus round appears to be unlikely.

Currently, Mr Biden’s Build Back Better Agenda does not include stimulus payments.

And last May, White House secretary Jen Psaki told reporters that the stimulus checks were not free and that another round wasnt in Bidens plans.

Along with getting Biden on board, two corporate Democrats Joe Manchin and Kyrsten Sinema would need to get convinced as well.

This is unlikely because the US is dealing with high inflation, as there is huge consumer demand that the supply is not meeting.

Stimulus checks serve the purpose of giving taxpayers a financial boost during an economic downturn.

And that isn’t happening at the moment.

But there has been some mounting pressure to do so.

In fact, 50 Democratic members of the House of Representatives wrote a letter suggesting recurring direct checks, also known as universal basic income.

It read: Another one-time round of checks would provide a temporary lifeline, but when that money runs out, families will once again struggle to pay for basic necessities.

“One more check is not enough during this public health and economic crisis.

It was backed by US Representative for New York Alexandria Ocasio-Cortez and Minnesota’s Ilhan Omar.

Democrats have backed a figure of $2,000, although there aren’t currently any official bills debating a fourth round of checks.

It’s also important to note that stimulus checks have been quite popular among the American people.

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

You May Like: How To Apply For My Second Stimulus Check

Will There Be More Stimulus Checks

Over 2.15 million people have signed an online petition started by restaurant owner Stephanie Bonin calling for a fourth stimulus check.

There has been no word on if Congress is planning on passing a fourth check.

In a meeting earlier this week, White House press secretary Jen Psaki was asked whether the Biden administration would support a fourth stimulus check.

Well see what members of Congress propose, but those are not free, Psaki said.

Read Also: Were There Any Stimulus Checks In 2021

Stimulus Update: Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to use it all by the end of 2021, so the clock is ticking here. Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a broader-sweeping stimulus check.2 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

Read Also: Congress Middle Class Mortgage Stimulus

Also Check: Who Qualify For Third Stimulus Check

Alert: Highest Cash Back Card Weve Seen Now Has 0% Intro Apr Until Nearly 2024

If youâre using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Taxation Of Third Stimulus Checks

Question: Will my third stimulus check be taxed later?

Answer: No. As with the first two rounds of payments, your third stimulus check is actually just an advanced payment of the Recovery Rebate tax credit for the 2021 tax year. As such, it won’t be included in your taxable income.

You also won’t be required to repay any stimulus check payment when filing your 2021 tax return even if your third stimulus check is greater than your 2021 credit. If your third stimulus check is less than your 2021 credit, you’ll get the difference when you file your 2021 return next year. So, it’s a win-win situation for you!

Don’t Miss: What Were The Stimulus Payments In 2020 And 2021

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Donât Miss: How Much In Total Were The Stimulus Checks

Amount Of Third Stimulus Checks

Question: How much money will I get?

Answer: Everyone wants to know how much money they will get. You probably heard that your third stimulus check will be for $1,400 but it’s not that simple. That’s just the base amount. Your check could actually be much higher or lower.

To calculate the amount of your check, Uncle Sam will start with that $1,400 figure. If you’re married and file a joint tax return, then both you and your spouse will get $1,400 . If you have dependents, you get an additional $1,400 for of them. So, for example, a married couple with two children can get up to $5,600.

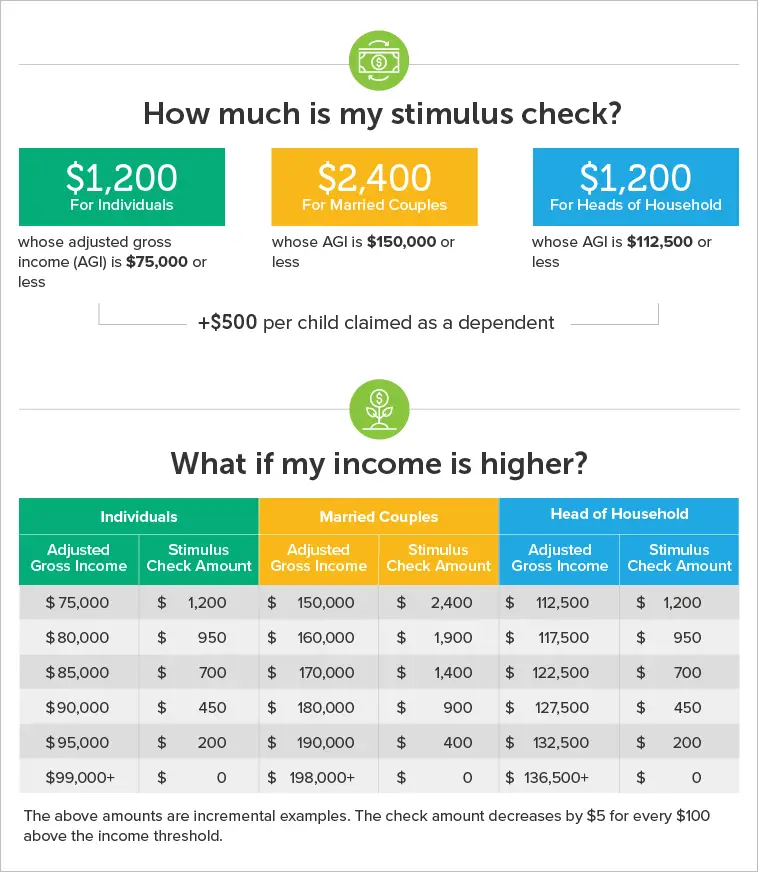

Now the bad news. Stimulus payment amounts will be phased-out for people at certain income levels. Your check will be gradually reduced to zero if you’re single with an adjusted gross income above $75,000. If you’re married and file a joint tax return, the amount of your stimulus check will drop if your AGI exceeds $150,000. If you claim the head-of-household filing status on your tax return, your payment will be reduced if your AGI tops $112,500. You won’t get any payment at all if your AGI is above $80,000 , $120,000 , or $160,000 .

Also note that the IRS, which is issuing the payments, will look at either your 2019 or 2020 tax return for your filing status, AGI, and information about your dependents. Because of this, the amount of your third stimulus check could depending on when you file your 2020 tax return.

Recommended Reading: New Round Of Stimulus Check

Back Taxes Child Support And Other Debts

Question: Can the IRS or other creditors take my third stimulus check if I owe back taxes, child support or other debts?

Answer: Your third stimulus check is not subject to reduction or offset to pay child support, federal taxes, state income taxes, debts owed to federal agencies, or unemployment compensation debts.

However, the American Rescue Plan doesn’t include additional protections that were included in the legislation authorizing the second round of stimulus checks. For example, second-round stimulus checks weren’t subject to garnishment by creditors or debt collectors. They couldn’t be lost in bankruptcy proceedings, either. The IRS also had to encode direct deposit payments so that banks knew they couldn’t be garnished.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

You May Like: Stimulus Checks For California Residents

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

How To Claim Your Stimulus Money

The first step is to figure out how much in missing stimulus payments youll need to claim on your 2020 tax returns.

The IRS, which began accepting tax returns on February 12, calls the checks recovery rebate credits on its tax forms. Thats because, technically, the payments were actually tax rebates paid in advance of filing your taxes. Most taxpayers have until April 15 to file their taxes, although the IRS on February 22 said Texas residents will receive another two months to file, due to the winter storms that battered their state.

To help determine if you are owed more, the IRS published a Recovery Rebate Credit worksheet, which asks questions about eligibility and how much you received in the two stimulus checks so far. If you find that you are owed more, you can enter the amount on line 30 on IRS Form 1040.

If you dont recall how much you received in the first two rounds of stimulus payments, you can create or view your account at the IRS website. Extra stimulus money will be included with your tax refund. Most taxpayers will receive their refund within 21 days, according to the tax agency.

With Congress now working on a third relief package, millions of households could receive a third stimulus check within the next several weeks, which happens to fall in the middle of tax filing season.

Recommended Reading: Did They Pass The Stimulus Check

Don’t Miss: I Never Got Any Of The Stimulus Checks

Will You Have To Pay Back Money From A Previous Stimulus Check

You might. Heres why: Some people were sent stimulus checks by accident. Whoops! We knowimagine the government making a mistake, right? Heres why you might need to send your money back:

- You make more than the income limit required to receive the stimulus money.

- You were given a check for someone who has died.

- Youre a nonresident alien.

- You dont have a Social Security number.

- You were claimed as a dependent on someone elses tax return.

If you know one of these applies to you, the IRS expects you to find the error and send the money back to them.14 So go ahead and be honest . You dont want any surprises when you go to file your taxes.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Recommended Reading: Did I Qualify For The Third Stimulus Check

What If My Stimulus Check Was Lost Stolen Or Destroyed

If your payment was direct deposited, first check with your bank, payment app, or debit card company to make sure they didnt receive it.

You can request a trace of your stimulus check to determine if your payment was cashed. Only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check.

How to start a payment trace: You can mail or fax Form 3911 to the IRS or call 800-829-1954. Click here for specific instructions on how to complete Form 3911 for tracking your first stimulus check.

If the IRS discovers that your check was not cashed, your check will be reversed. You can now claim the payment.

If the IRS discovers that your check was cashed, the Treasury Department will send you a claim package with instructions. Upon review of your claim, the Treasury Department will determine if the check can be reversed. If the check is reversed, you can now claim the payment.

If the check is not reversed, contact the tax preparer who filed your return. If you are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

It can take up to 6 weeks to receive a response from the IRS.

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Read Also: Are There Any More Stimulus Payments Coming

Can My Bank Take My Stimulus Check

It may. While the CARES Act does not allow your stimulus payment to be garnished for federal or state debts , it doesnt explicitly prohibit private debt collection.

If you are receiving your payment through direct deposit, it can legally be seized by your bank to pay offset a negative account balance caused by things like delinquent debt or overdraft charges, according to a report from the Prospects David Dayen.

While the New York Times reported that some people banking with credit unions have had their stimulus payments taken, it also said the four biggest US banks JPMorgan Chase, Wells Fargo, Citi Bank, and Bank of America are pausing their collections on negative account balances to give customers access to the stimulus.

Heres some advice on what to do if your bank takes your stimulus payment.

Stimulus And Relief Package 4

On Dec. 21, 2020, Congress passed the CAA, a $900 billion stimulus and relief bill, attached to the main omnibus budget bill. Then-President Trump signed the bill on Dec. 27, 2020, but urged Congress to increase the direct stimulus payments from $600 to $2,000. Its contents included:

If you were eligible for stimulus payments and missed out on getting them, you can file for a Recovery Rebate Credit. You can claim this refundable tax credit when you file your 2021 tax return, and 2020 as wellâif you havenât yet filed for that year.

Don’t Miss: Set Up Direct Deposit For Stimulus Check

How To Return A Paper Check You Have Not Cashed Or Deposited

If youre one of those folks who has to send the money backand you havent cashed or deposited your check yetheres what you need to do:

- Write Void in the endorsement section of the check, but dont fold or staple itdont even put a paper clip on it.

- On a sticky note or sheet of paper, write down the reason youre sending the check back.

- Mail the check and the explanation back to your local IRS office .