What Are The Chances Of A Fourth Stimulus Check

Plans for a fourth stimulus check are gaining support from Congress. A number of Democrats continue to push for a fourth check which would include recurring payments until the pandemic has waned. Newsweek report that 64 lawmakers are urging for a fourth stimulus check with recurring checks to follow. Earlier this month, 11 Senators, including Bernie Sanders and Elizabeth Warren, called for Joe Biden to extend unemployment compensation indefinitely on top of another round of checks.

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

What If Im A Us Citizen Who Lives Abroad

American citizens who live in another country are eligible for a stimulus payment. Unfortunately, the IRS online tools do not support foreign address or non-US banks, so some expats are experiencing delays in receiving their payment by direct deposit, the fastest delivery method.

If you qualify for a payment but the IRS does not have your bank account information from a previous tax return or you use a non-US bank youll be sent a paper check or prepaid debit card to your last known address.

Also Check: Do You Pay Taxes On Stimulus Checks 2021

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

You May Like: Contact Irs About Stimulus Payment

Stimulus Check Round : Is A Second Round Coming

A second stimulus package was officially presented on the Senate floor in late July as the HEALS Act, but the timing of when it might arrive is still in limbo.

In addition to $1,200 direct payments, the HEALS Act continues federal unemployment benefits , offers a Paycheck Protection Program sequel for business loans, and provides more funding to help schools and COVID-19 testing, treatment and vaccine research.

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you dont spend it within 12 months, the Social Security Administration will count the money as a resource.

You May Like: How Can I Apply For Stimulus Check

State And City Stimulus

Some states have also given out extra stimulus payments, including California and Maine, with many using funds from the Rescue Act.

In 2021, California launched two-state stimulus programs: the Golden State Stimulus I and Golden State Stimulus II.

These stimulus checks are worth up to $1,200 and $1,100, respectively.

Furthermore, the state recently issued about 139,000 stimulus checks.

Moreover, California plans to send out up to another 70,000 stimulus checks starting mid-March.

Those getting paper checks need to allow up to three weeks for them to arrive.

Eligible Maine residents received $285 stimulus payments until the end of 2021, and it’s unclear if this will continue into 2022.

Another city in California, Santa Ana, started sending out $300 payments loaded on prepaid Visa debit cards last year.

“So far about 2,700 have been distributed and we plan to give out up to the full 20,000 cards either in person or notifying qualified residents by mail to pick them up,” a Santa Ana official told The Sun in December.

According to a statement by the city, those with poverty rates above the Santa Ana median of 42% will qualify for the support.

Also, thousands of St Louis, Missouri residents were able to claim a $500 stimulus check in December.

However, applications for the moment are paused and the city will keep the public informed on any potential future reopening of its portal.

Oregon is another state that has launched its own stimulus program.

How Americans Are Using Their Stimulus Checks

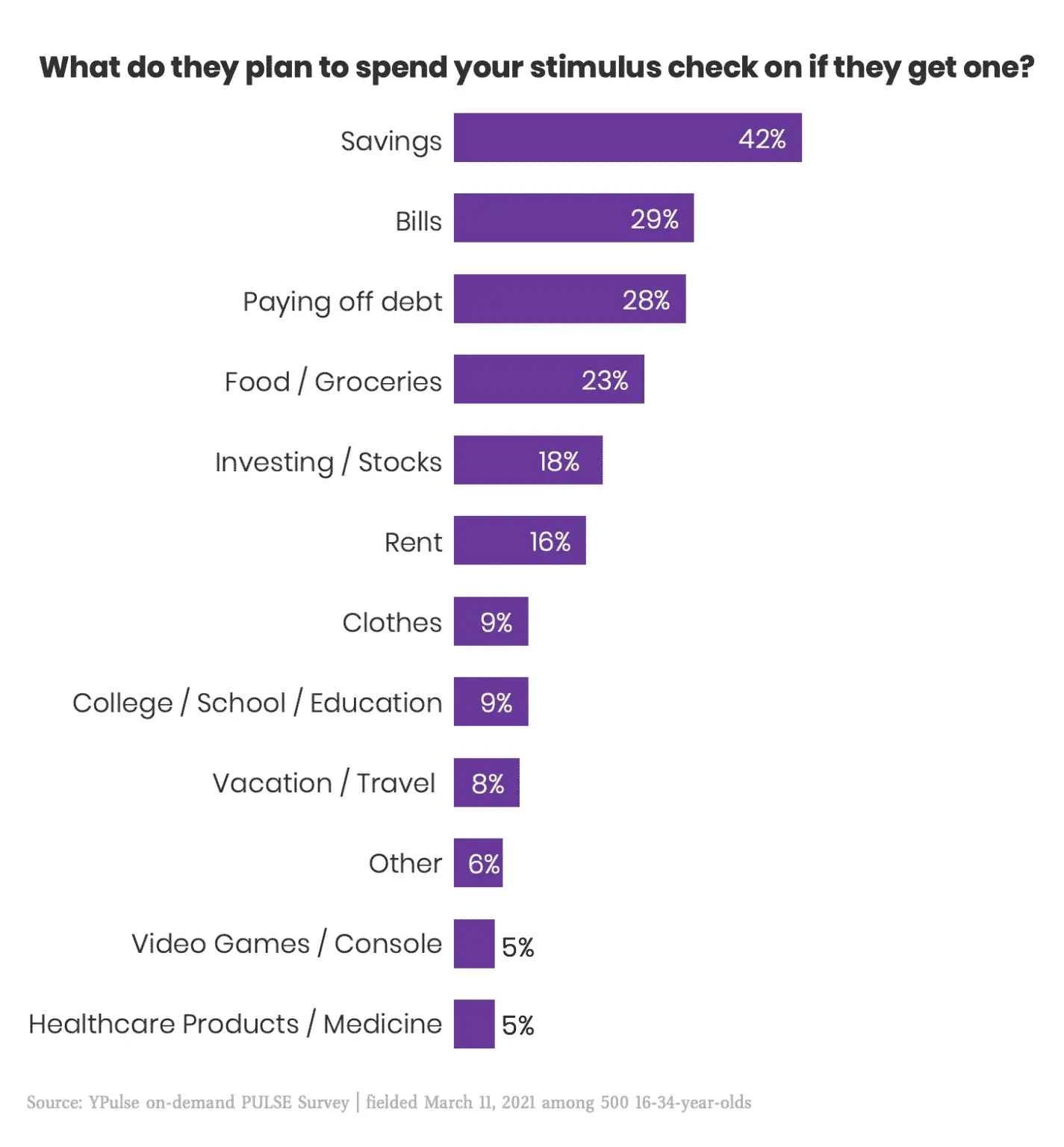

Most people stashed the money from the first round of checks in savings or used it to pay off debt, according to data from the Federal Reserve Bank of New York. Less than one-third of US households used the cash for essential and non-essential purchases.

“The first impact payment this past April touched off a savings windfall,” said Anand Talwar, deposits and consumer strategy executive for Ally Bank. “The banking industry saw consumer spending dip and deposit growth skyrocket more than five times its normal rate in the second quarter and remain elevated well into the fall,” Talwar added.

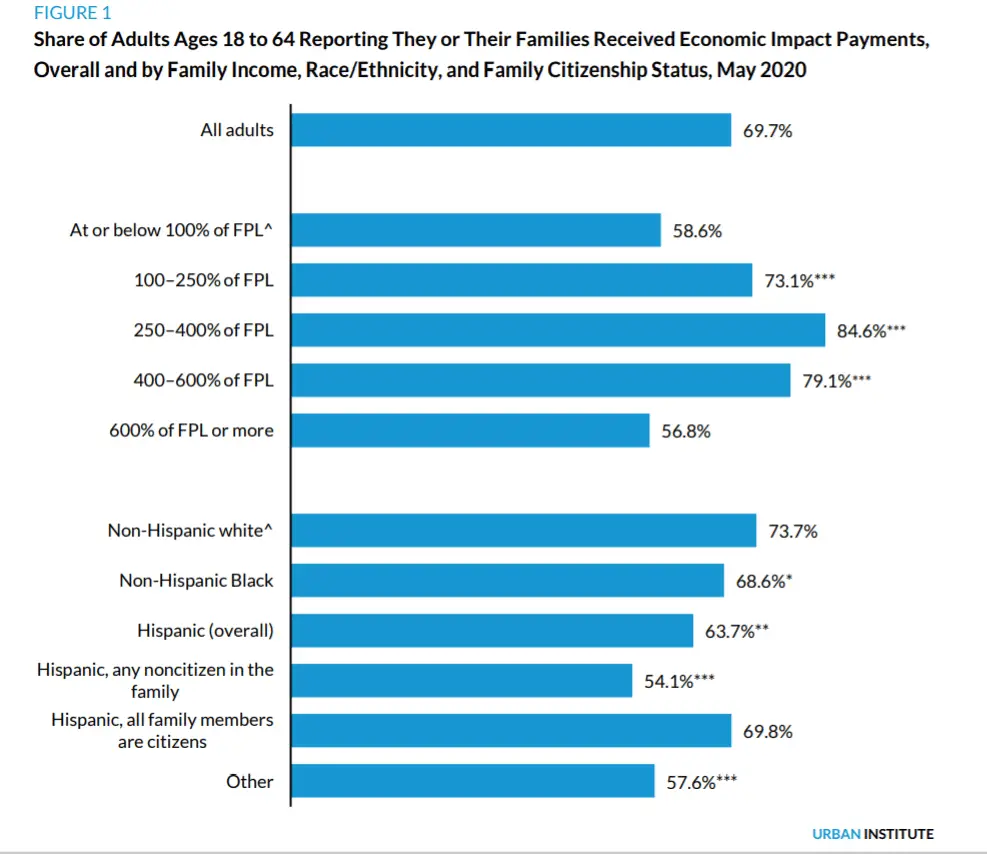

The eligibility requirements for receiving a second stimulus check were slightly different than the first. While fewer households qualified based on adjusted gross income , mixed-status families couples with one citizen spouse and one non-citizen spouse became eligible for first- and second-round payments under the December legislation.

Talwar said that, so far, the spike in savings activity after the initial distribution of payments doesn’t seem to be repeating itself this time around.

“It’s still early, but it seems some people may actually be using their small stimulus windfall as the government intends, to stimulate spending and investment,” he said.

Don’t Miss: Irs Phone Number For Stimulus Check 2021

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

If I Still Need To File My 2018 And 2019 Taxes Can I Still Receive The Economic Impact Payment

Yes. The IRS urges anyone with a tax filing obligation and who hasnt yet filed a tax return for 2018 or 2019, to file as soon as they can to receive an Economic Impact Payment. When you file your taxes, include your direct deposit information on the return so that the IRS can send you your payment quickly.

If you are required to file a tax return, there may be free or low-cost options for filing your return. If you need someone to help you to file, its important to choose a reputable tax preparer that will file an accurate return. Mistakes could result in additional costs and complications in the future.

If your 2019 adjusted gross income was less than $69,000, you may be able to find one or more online tools to file your taxes for free. Review each company’s offer to make sure you qualify for a free federal return. Some companies offer free state tax returns, but others may charge a fee.

Keep in mind that the IRS has extended the deadline for filing your 2019 taxes until July 15, 2020. If you are concerned about visiting a tax professional or local community organization in person to get help with your tax return, the IRS indicates the Economic Impact Payments will be available throughout the rest of 2020.

Recommended Reading: Get My Stimulus Payment 1400

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

Also Check: Who Is Getting The New Stimulus Checks

Which $600 Stimulus Checks Are In The Mail Still

For the second round of direct payments the IRS used the information the agency had on file from taxpayers last return processed either in 2018 or 2019. For several filers who had gone through one of the popular tax filing software tools, the IRS had the wrong bank account.

Payments to approximately 13 million accounts were misdirected to temporary accounts used when customers choose to have their preparation fees deducted directly from their refund by the preparer. However the IRS and the tax preparers worked to get the issue solved and the payments have been rerouted.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Don’t Miss: Stimulus Checks Status Phone Number

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

You May Like: When Should I Expect My Third Stimulus Check

How To Know If Stimulus Check Has Been Sent

Use the IRS Get My Payment tool to track stimulus money For the third stimulus check: Its worth visiting the IRS online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how youll receive it: for example, as a paper check in the mail.

You May Like: Stimulus Checks Status Phone Number

Don’t Miss: When Is The Latest Stimulus Check Coming

How Many More Stimulus Checks Will I Get In 2020

US Federal Reserve Chairman Jerome Powell gives a press briefing after the surprise announcement the … FED will cut interest rates on March 3, 2020 in Washington,DC. – The US Federal Reserve announced an emergency rate cut Tuesday, responding to the growing economic risk posed by the coronavirus epidemic and giving President Donald Trump the stimulus he has called for. In a unanimous decision, the Fed’s policy-setting committee slashed its key interest rate by a half point to a range of 1.0-1.25.

AFP via Getty Images

The U.S. government tried to soften the financial impact of the Coronavirus and associated lockdowns on Americans via direct cash payments that were part of the stimulus package signed into law in mid-March. Now, it appears quite likely that another round of stimulus checks could be in the offing, as economic conditions remain weak, with political leaders also hinting at another sizable stimulus package. Below, we detail the status of the first round of stimulus and why we believe another round of direct cash payments looks likely.

For a detailed breakdown of the components of the CARES Act signed in March 2020 view our analysis A Breakdown Of The $2 Trillion Coronavirus Fed Stimulus

Stimulus Payments Under CARES Act

Slow Economic Recovery Makes Case For Another Round Of Checks

That said, there is widely acknowledged dissonance between the stock market performance and the broader economy.

Political Considerations