How Will The Stimulus Checks Affect My Taxes

The IRS doesnt consider your stimulus checks taxable income. So you will not have to report them on your tax return or pay income taxes for them.

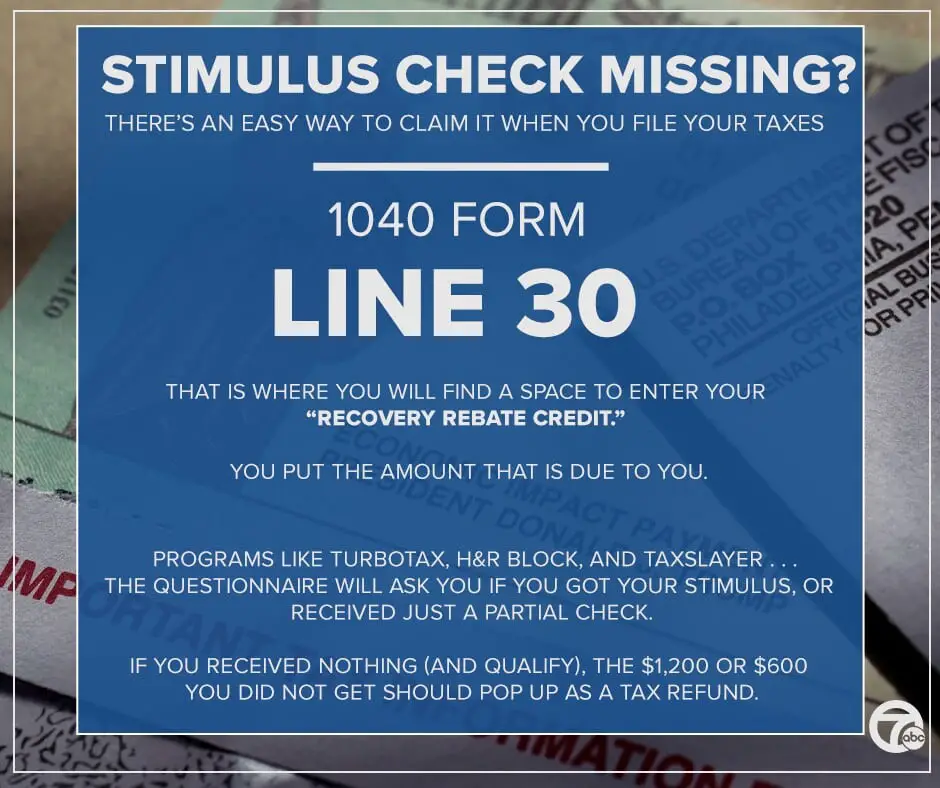

If you are an eligible recipient who didnt get the first or second stimulus check, you can claim a recovery rebate credit to increase your tax refund or lower your tax liability.

This means that if you expect to get money back on your 2020 tax return, you could get a bigger refund depending on how much stimulus money you are owed. And comparatively, if you have to pay a tax bill, you can use the recovery rebate credit to offset it and get a refund for the remaining amount.

Taxpayers this year will look to their tax refunds as another source of extra money during the pandemic. In 2020, the IRS paid out more than $2,500 for the average tax refund. This year, it is expecting over 150 million tax returns to be filed.

The 2021 tax season starts on February 12. You will have to file your 2020 tax return by April 15.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Impact Of The Coronavirus Stimulus Checks On The Economy

The emergence of the COVID-19 virus early in 2020 had a huge impact on this countrys economy, with federal and state agencies, as well as many private companies from different sectors, forced to stop their operations in order to preserve the health of their workforce and to prevent the spread of the virus. As a result, the unemployment rate suffered a substantial increase, reaching 14.7% in April 2020, the highest rate observed since data collection began in 1948. The high unemployment rate disproportionately impacted the nations communities of color and low-wage workers. Many households, mainly those with children, were unable to pay for their basic needs: food, housing, utilities, and transportation.

The second stimulus package, The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, was signed by former President Donald J. Trump on December 27, 2020. It was a $900 billion package that included disbursements of up to $600 per household plus an additional $600 for dependent children ages 16 or under. As in the previous stimulus package, those individuals who earned up to $75,000 in 2019 received the full stimulus check, while a gradually smaller figure was provided to those with higher annual incomes, up to a maximum of $87,000.

Table 1. U.S. Households Spending Priorities with Coronavirus Stimulus Money

| Stimulus Program |

|---|

Dont Miss: Irs Get My Payment 3rd Stimulus Check

You May Like: Stimulus Checks For Grocery Workers

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Also Check: Stimulus For Healthcare Workers 2021

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Don’t Miss: Earned Income Tax Credit Stimulus

What If My Stimulus Check Was Lost Stolen Or Destroyed

If your payment was direct deposited, first check with your bank, payment app, or debit card company to make sure they didnt receive it.

You can request a trace of your stimulus check to determine if your payment was cashed. Only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check.

How to start a payment trace: You can mail or fax Form 3911 to the IRS or call 800-829-1954. Click here for specific instructions on how to complete Form 3911 for tracking your first stimulus check.

If the IRS discovers that your check was not cashed, your check will be reversed. You can now claim the payment.

If the IRS discovers that your check was cashed, the Treasury Department will send you a claim package with instructions. Upon review of your claim, the Treasury Department will determine if the check can be reversed. If the check is reversed, you can now claim the payment.

If the check is not reversed, contact the tax preparer who filed your return. If you are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

It can take up to 6 weeks to receive a response from the IRS.

Will There Be A Fourth Federal Stimulus Check

As of July 2022, the federal government doesnt appear to have any plans to send a fourth stimulus check to all U.S. residents. The Biden administration has not made an appeal to Congress about a fourth stimulus payment, but legislative gridlock as the 2022 midterms approach all but assures any such proposal would be dead on arrival.

Read Also: Who Is Eligible For 4th Stimulus Check

Do I Pay Tax On Stimulus Checks

The third round of stimulus checks was authorized by president Joe Biden as part of his American Rescue Plan in March 2021.

The good news for Americans is that these stimulus checks are not considered as part of a persons income and therefore they cannot be taxed by the IRS.

It will also not affect the amount you may owe or reduce your tax refund when you file your 2021 taxes.

For people who received child tax credit in 2021, they were actually an advance of your 2021 child tax credit payment. For that reason, they are also not classed as income and therefore cannot be taxed.

However, if your total advance child tax credit payment amount is greater than what youre eligible to claim on your 2021 tax return, you will have to repay what is owed. Thats because the payments were based on the IRS estimate of your 2021 child tax credit amount.

You May Like: How To Look Up Previous Tax Returns

Will Anyone Receive A Stimulus Check Who Didnt File A Tax Return In 2020 Or 2019

Some people will. Eligible Social Security beneficiaries and railroad retirees who are not typically required to file a tax return will automatically receive a $1,400 stimulus check. The IRS will use information contained in annual SSA-1099 and RRB-1099 tax forms to generate the stimulus checks automatically. Recipients of Social Security Disability Insurance also receive SSA-1099 tax forms and will receive $1,400 stimulus checks automatically. In addition, Veterans Affairs beneficiaries and recipients of Supplemental Security Income will receive automatic $1,400 checks.

Also of Interest

Don’t Miss: When Will I Get My Stimulus

Will There Be More Stimulus Money

There’s a possibility of more stimulus money, but given that the third relief package passed without Republican support, a fourth stimulus would likely need bipartisan support. Some of the pressure to pass the American Rescue Plan came from the fact that unemployment benefits were set to expire on March 14.

Unemployment benefits are now in place until September and the economy seems poised for recovery. As more Americans get vaccinated and schools and workplaces reopen, Congress might decide that more stimulus money isnt needed.

How Much Was The Second Stimulus Check

The second stimulus check was $600 per adult and $600 per child.

$600 , plus

an amount equal to the product of $600 multiplied by the number of qualifying children ) of the taxpayer.

-SEC. 6428A. ADDITIONAL 2020 RECOVERY REBATES FOR INDIVIDUALS.

The second stimulus checks got sent out starting around December 29th, 2020.

Don’t Miss: Income Limit For 3rd Stimulus Check

What Income Level Triggers A Payment Reduction

As mentioned above, second stimulus checks will be phased-out for people at certain income levels. Your check will be gradually reduced to zero if you’re single or married filing a separate tax return with a 2019 adjusted gross income above $75,000. If you’re married filing a joint tax return or a qualifying widow, the amount of your second stimulus check will drop if your AGI exceeds $150,000. If you claim the head-of-household filing status on your tax return, your payment will be reduced if your AGI tops $112,500. The Second Stimulus Check Calculator above will do all the math for you!

How Do I Check The Status Of My Payment

Get updates on the status of your next stimulus payment using the IRS “Get My Payment” tool.

To use it, you’ll need to enter your full Social Security number or tax ID number, date of birth, street address and ZIP code.

For those who are eligible, the tool will show a “Payment Status” of when the payment has been issued and the payment date for direct deposit or mail, according to the IRS’s frequently asked questions.

Before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS.

“Our phone assistors don’t have information beyond what’s available on IRS.gov, the agency says.

Recommended Reading: 10 40 Form For Stimulus Check

What To Do If Youre Missing Money From The First Two Stimulus Checks

Plus-up payments are going out weekly along with the third round of checks, but they may not be the only money youâre due. For money missing from the first two checks, you need to claim that on your 2020 taxes. We suggest making sure you know how to find out your adjusted gross income. You may be eligible to claim the 2020 Recovery Rebate Credit for claiming missing money from the first two checks.

Also, last week, the IRS launched a new online for familes that donât file taxes called the âNon-filer Sign-up Tool.â Its purpose is to help eligible families who donât normally file a tax return enroll in the monthly child tax credit advance payment program, which is slated to begin July 15. However, the tool is also for those who did not file either a 2019 or 2020 tax return and did not use the previous nonfilers tool last year to register for stimulus payments.

In other words, individuals who experience homelessness or make little or no income can use this tool to enter their personal details for the IRSâ records so as to receive the $1,400 stimulus checks or claim the recovery rebate credit for any amount of the first two rounds of payments that might have been missed. Tax nonfilers may need to be proactive about claiming a new dependent, too.

Also Check: I Got My First Stimulus But Not My Second

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Don’t Miss: Get My Stimulus Check Payment

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Wheres My Third Stimulus Check

OVERVIEW

The American Rescue Plan, a new COVID relief bill, includes a third round of stimulus payments for millions of Americans. Get updated on the latest information as it evolves.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

A third round of stimulus checks is on the way for millions.

The American Rescue Plan, a new COVID relief bill, was signed into law on March 11, 2021. The bill includes a third round of stimulus payments for millions of Americans. We know these funds are important to you, and we are here to help.

If you are eligible, you could get up to $1,400 in stimulus checks for each taxpayer in your family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

The IRS began issuing the first batch of stimulus payments, and they could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks. If youre eligible, check the status of your stimulus payment and the way itll be sent to you by going to the IRS Get My Payment Tool, which will be live on March 15th.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

You May Like: Who Qualified For 3rd Stimulus Check

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

How Will They Send My Stimulus Checks

The IRS will send out the second stimulus checks via direct deposit, paper check and economic impact payment card.

For reference, the majority of the first stimulus check recipients have received their payment via direct deposit. So if you set up direct deposit on a past tax return, you should have gotten your direct cash payment in your on-file bank account by about April 15. That leaves anyone getting a stimulus check in the mail last in line, especially if they have a high AGI.

The IRSs free online portal called Get My Payment allows Americans to track the status of their first and second stimulus check.

If you are required to file a tax return, but you have not done so for 2018 or 2019, then youll need to file a 2019 return to receive a check. But if you were not required to file for tax years 2018 or 2019, the IRS is offering an online tool that allows you to enter your personal and bank account information so that you can get your stimulus check. Those who receive any of the following should not use this tool:

- Social Security Disability Insurance

- Social Security Survivor benefits

- Railroad Retirement and Survivor benefits

Stimulus checks can also come to you via a prepaid debit card called The Economic Impact Payment Card. These cards are backed by the Treasury Departments Bureau of the Fiscal Service. If you receive one, it will arrive in a plain envelope with the sender being Money Network Cardholder Services.

Read Also: Monthly Stimulus Checks For Adults