Stimulus Check November Update: When To Expect Payments

The latest round of stimulus checks and payments is due to be delivered to households from this week, with millions of Americans eligible for the support.

California has started issuing its Middle Class Tax Refund, with payments of up to $1,050 due to land in bank accounts this week. Thousands more recipients are expected to receive checks in the mail over the next few weeks.

According to the Treasury Department, around 9 million Americans have been sent letters to indicate that they might be eligible.

The Internal Revenue Service said the letters were “sent to people who appear to qualify for the child tax credit, recovery rebate credit or earned income tax credit but haven’t yet filed a 2021 return to claim them.”

The stimulus payment, formally known as the recovery rebate credit, is $1,400.

Around 1.75 million New Yorkers are expecting to receive checks by October 31, according to officials.

Most eligible residents in Alaska should have received their stimulus payments, as direct debit payments were issued on September 20. Checks began to be mailed out on October 6.

In Hawaii, residents who filed their state income tax returns by July 31 should have received their direct debit payments in September. Those who requested paper checks should have them by October 31.

Residents filing their 2021 return in the period from August 1 to December 31 should expect to receive their payment up to 12 weeks after filing.

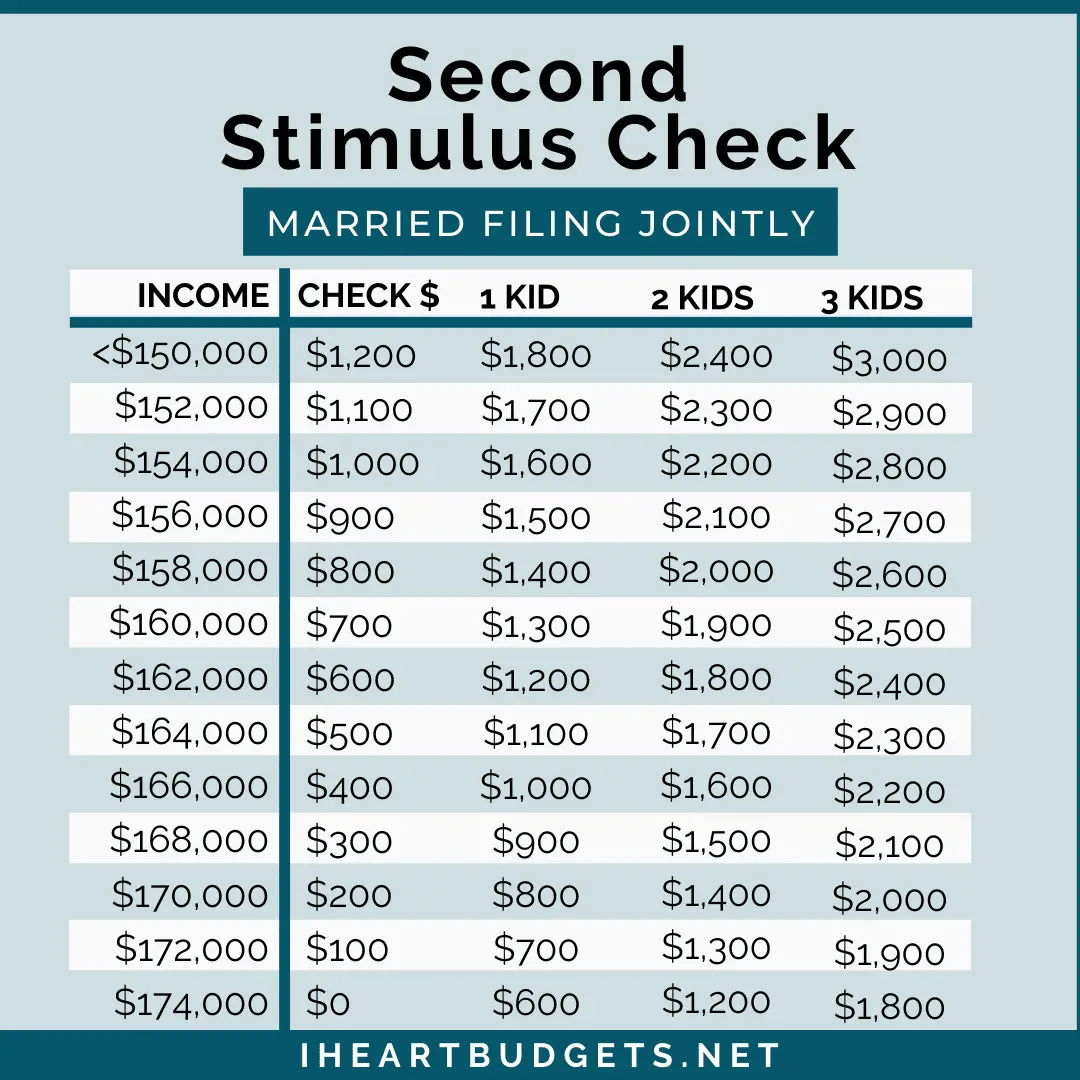

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

The Second Round Of Stimulus Checks

The second round of stimulus payments were authorized on December 27, 2020 as part of the Consolidated Appropriations Act, 2021. Those payments typically totaled $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child. The payments began phasing out at the same income levels as the current payments, but the maximum income levels to receive a payment were slightly higher. Taxpayers were ineligible for any payment, unless they had a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

As of March 5, 2021, about $135 billion of the second round of payments have been sent out overall, such payments are expected to cost a total of $164 billion according to the Congressional Budget Office.

Read Also: File For Missing Stimulus Check

Q How Much Will My Third Stimulus Check Be For

A. Your third stimulus check depends on your 2020 or 2019 income .

| Qualifying group | |

| An AGI of $150,500 or less | An AGI $160,000 or more |

| Dependents of all ages: $1,400 | $1,400 apiece, no cap — but only if caretakers make under the above limits |

| * This framework by the IRS was designed for taxpayers who are living and working in the U.S., so expats should ensure theyre looking at their AGI and not their gross income when determining their eligibility, especially if theyre claiming the foreign earned income exclusion. |

Additional Payments: If your third stimulus payment is based on their 2019 return and your 2020 return makes you eligible for a larger payment, the IRS will redetermine your eligibility and issue a supplementary payment later this summer.

You can estimate your own payment amount with H& R Blocks Stimulus Check Calculator.

Q. Will I have to pay back my stimulus check?

A. No, you will not have to pay back any amount of your Recovery Rebate Credit, even if you experience a pay hike in 2021.

Q. Will this round of stimulus checks affect my tax return this year?

Q. Will I owe tax on this third stimulus check in 2022 or have to pay it back?

A. No, the third stimulus payment is considered a 2021 tax credit , not income, so you will not need to pay taxes on it or pay it back.

Q. Do I need to sign up for the third stimulus check it or sign off on it?

Q. If I live abroad, when will I get my third stimulus check if I qualify?

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Also Check: Stimulus Check For Expecting Mothers 2022

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

Endorse The Check To The Recipient

Find the endorsement area. This is usually located in the back of the check. Some checks make it easier for you by identifying the area with the legend endorse here, but the exact location may vary. Now you must use what is called a special endorsement by writing Pay to the order of in the corresponding line. Generally, you will need to write your recipients full name next to your signature. This serves to indicate to the teller at the receiving bank that the document is authorized to be paid to a third party.

TIP:

Make sure that your recipients name is written exactly as it appears on their national identification document.

Read Also: Social Security Stimulus Checks Update

Recommended Reading: New Round Of Stimulus Check

How Long Does It Take To Get My Stimulus Checks

The IRS announced on December 29 that it has started sending out the second round of stimulus checks to millions of Americans. Treasury Secretary Steven Mnuchin said that direct payments would go out a few days after the President signed the bill, and paper checks will take the longest.

For a comparison, the first stimulus checks already went out to the vast majority of Americans who are eligible for one. The IRS sent out the first electronic stimulus check payments on April 11, with most having arrived by April 15. The recipients of these initial payments were those who qualify for a check and have filed a tax return via direct deposit in either 2018 or 2019.

The first paper stimulus checks were in the mail as of April 24, 2020, with President Donald J. Trump printed on the memo line. This initial round of physical payments is specifically for individuals with an adjusted gross income of $10,000 or less. Each week after this, an additional five million paper checks will be mailed to those with an AGI of $10,000 above the previous weeks limit . Unfortunately, that means that some Americans did not get their checks until late summer or early fall.

Recipients of Social Security retirement benefits, Social Security survivor benefits, Social Security disability benefits, Supplemental Security Income , Railroad Retirement benefits and VA benefits who have their bank account on file with the IRS will automatically get their second stimulus check via direct deposit .

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Recommended Reading: When Did I Receive My Stimulus Check

Your Daily Dose Of Tech Smarts

Learn the tech tips and tricks only the pros know.

After all, when former President Trump signed the previous relief bill, the IRS sent them out within the next three days. With that kind of precedent, we could expect the same speedy turnaround.

Bottom line: You can expect these checks as early as this weekend, but its more likely that youll get them within the next two weeks. Middle-class Western New York households will be getting a $1,400 check in the mail in about two weeks, Senator Chuck Schumer said. They should get them by the end of March, so itll be a nice Easter present for everybody.

SPEAKING OF BILLSCheck here to see if you qualify for $50 off your internet bill each month

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

Don’t Miss: Is North Carolina Getting Another Stimulus Check

How Do I Find My Stimulus Money What To Do About A Missing $1400 Check

Your third stimulus payment could be delayed for a variety of reasons. Well help you track down your IRS payment.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland As.

To date, the IRS has made 169 million payments for the third round of stimulus checks for $1,400. The agency continues to send weekly batches of payments, so there is still time if you are waiting for your money. However, there could actually be an issue with your payment and the IRS doesnt want you to call them with problems related to a missing check.

Reasons for a delay could include a lag in mail delivery , if the IRS has incorrect direct deposit information for you or if the agency suspects identity theft. There might be other problems if youre a recipient of SSI, SSDI or veterans benefits. Or maybe you received a letter from the IRS saying that your $1,400 payment was sent, but the check never arrived. Then what?

What If I Dont Need To File A Tax Return And Didnt Get My Stimulus Check

If you are a nonfiler and would otherwise not be required to file a tax return, according to the IRS, you will need to file a Form 1040 or Form 1040-SR to claim stimulus payments if you are eligible in the form of a Recovery Rebate Credit.

No matter what your situation or how you want to file, TurboTax has you covered. With TurboTax you can do your taxes yourself, get help from an expert along the way or hand them off from start to finish to a dedicated tax expert.

Read Also: Ssi Apply For Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Example: How Much It Costs To Cash A Government Of Canada Cheque At A Payday Loan Company

Suppose you have a Government of Canada cheque worth $1,000.

It would cost you about $33 to cash it if the payday loan company charges you:

- 2.99% of the value of the cheque, plus

- $2.99 for each item you cash

This means that after fees, youâd only get about $967 instead of the full $1,000.

Before using a payday loan company or other cheque-cashing service to cash your Government of Canada cheque, make sure you understand all the conditions, including the fees that youll have to pay.

Also Check: Why Have I Not Received My 3rd Stimulus Check

Also Check: Amount Of Stimulus Check 2021

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Sending Your Cerb Payment Back

You may want to return or be required to repay the CERB if you:

- returned to work earlier than expected or received retroactive pay from your employer

- applied for the CERB but later realized you were not eligible

- received a CERB payment from both Service Canada and the CRA for the same period

You May Like: Free File Taxes For Stimulus

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

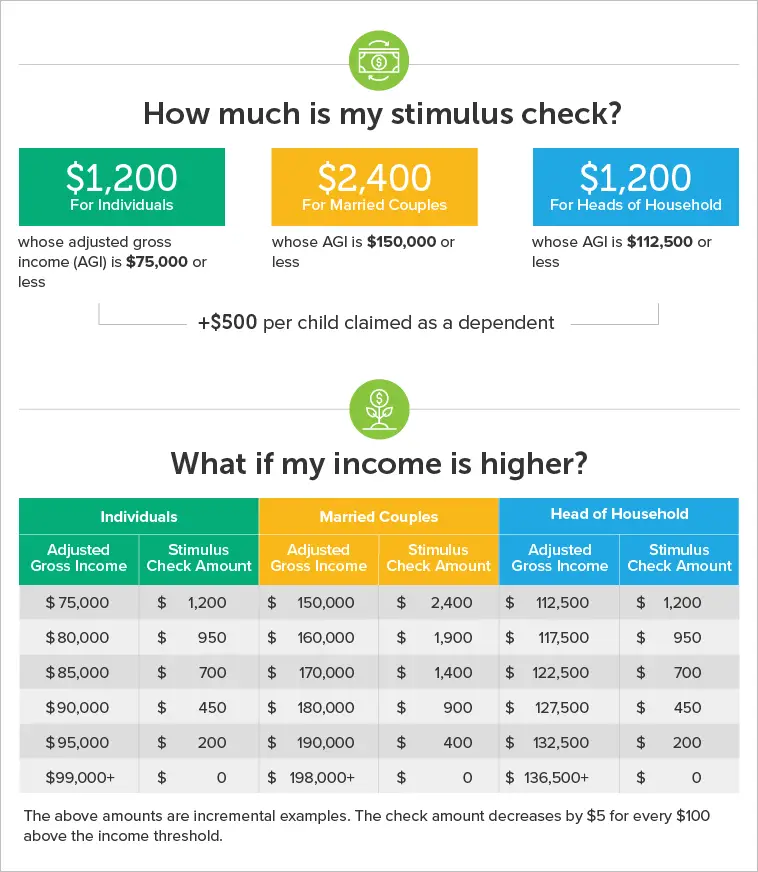

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.