Do I Qualify For The Child Tax Credit

Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with high incomes may receive a smaller credit or may not qualify for any credit at all. For more detail on the phase-outs for higher income families, see How much will I receive in Child Tax Credit payments?

If you have any questions about your unique circumstances, visit irs.gov/childtaxcredit2021.

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

Third Round Of Stimulus Checks: March 2021

Barely a week after the second round of stimulus payments were completed, new president Joe Biden entered office and immediately unveiled his American Rescue Plan, which proposed a third of round of payments to Americans, including some of those who might have missed out on the first two rounds.

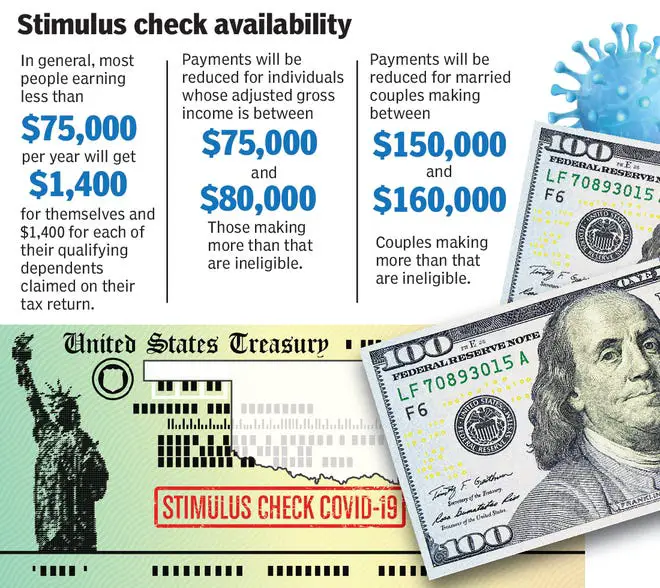

On Thursday 11 March, Biden signed his $1.9tn American Rescue Plan into law. The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800. In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependent’s age this time, there was no limit to the number of dependents that could be claimed for.

The first stimulus payments were issued swiftly – just hours after Biden has signed the bill, the first batch of 164 million payments, with a total value of approximately $386 billion, arrived by direct deposit in individuals bank accounts. Some received their payments on the weekend of 13/14 March 2021. Since then, payments had been sent on a weekly basis including “plus-up” payments until the end of the year. Like before, those who didn’t get all the EPI3 funds in 2021 due to them will be able to claim them when they file their tax returns in the spring of 2022.

Recommended Reading: Free File Taxes For Stimulus

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

You May Like: Why I Didn’t Get My Stimulus Check

Health Care $482 Billion

$18 bil.

$38 bil.

Grants to health providers were intended to help hospitals and other facilities stay afloat as they lost revenue, in part because elective procedures were not being performed and patients avoided seeking other routine care. Funds were also used to accelerate the deployment of vaccines, expand testing and advance Covid-19 treatments.

The American Rescue Plan broadened health insurance subsidies available under the Affordable Care Act for two years, one of the most substantial changes to the law since its passage nearly 12 years ago. And billions were set aside to ensure that people enrolled in Medicaid throughout the pandemic were not at risk of losing coverage.

What was the impact?

Even though coronavirus tests were in short supply during different waves of the outbreak, leaving many Americans to wait hours in line over the holidays last year, the nation most likely would have been even less equipped to handle the spike in demand for testing without the stimulus packages, experts say.

The distribution of grants to health providers, however, has been fraught with challenges. Some of the funds have been given to wealthier hospitals while smaller, poorer hospitals have received significantly less federal aid in comparison. Some larger hospital chains also used federal aid as they bought up weakened competitors during the pandemic.

You May Like: If You Didnt Receive Stimulus Check

Biden Coughs Through Omicron Speech After Exposure To Official With Covid

As with previous payments they would still need to meet the income eligibility requirements.

To get the check, single filers would need to make no more than $75,000 per year in adjusted gross income while couples filing jointly would need to stay below $150,000.

Read our stimulus checks live blog for the latest updates on Covid-19 relief

Parents earning above that threshold would see their checks reduced or completely phased out if theyre a single-filer earning above $80,000 or a couple filing jointly earning above $160,000.

The number of families still owed a $1,400 stimulus check is not yet known but it is estimated to be in the millions.

The figure wont be known until the total number of births for 2021 is revealed.

In 2020, there were 3.61million births in the US down from 3.75m in 2019.

If there was baby boom in 2021 this wont be apparent until the figure for births is in.

Recommended Reading: What Was The Third Stimulus Check Amount

Six Stimulus Checks And Direct Payments Worth Up To $1700 Going Out This Month

The latest round of cash begins to be phased out for individual taxpayers who earn $75,000 a year.

But once you hit the $80,000 annual gross income limit, you wont be eligible for the help at all.

Like the single-taxpayer cut-off, theres a $120,000 AGI cap on how much heads of households can earn to be eligible for the help.

A head of household is a single taxpayer who claims a dependent.

What About Next Year

Depending on whether or not you had a child in 2021, you will be qualified for more money from the government. You will likely get $1,400 upon filing your 2022 taxes, according to Forbes and Insider. Not only will a $1,400 check come to new parents if they land in a certain income threshold, but there is also an expanded child tax credit that could come into effect. That means more money for you and your family just for expanding your family.

The payments that parents have received in 2021 and will continue to receive are actually advanced payments for 2022. Theres also a reason that youve only received half of the $3,600. Thats because Congress built into the stimulus package that parents would receive some now and some later. That later is in 2022. So youll be getting potentially $1,800 or $1,500 next year.

Recommended Reading: How To Get Your Stimulus Checks

What You Need To Know About Your 2021 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief will be taking many shapes over the coming months, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Let’s take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

Also Check: Track My Golden State Stimulus 2

When Will The Payments Be Distributed

Payments are being distributed now. The first batch of direct deposit payments was delivered on March 17, and the first round of mailed checks were dated March 19.

Read More: Why Are Payments for Social Security Recipients Delayed? And Other Third Stimulus Check FAQs

The IRS has been sending payments in weekly batches. The seventh batch of payments began processing on April 23 with an official payment date of April 28. The agency also says this batch includes more than 730,000 plus-up payments, totaling over $1.3 billion.

Hawaii: State Tax Rebates

Many residents in Hawaii have already received their one-time tax rebate but for people who will receive physical checks, those only started in October and are going out slowly in small batches due to a paper shortage, says Hawaii News Now.

Each person in a household is eligible to receive $300, even dependents, so a family of four could get $1,200. The stipulation is that single residents had to earn under $100,000 or under $200,000 for a couple filing jointly. Those above those thresholds will have their rebate amount reduced to $100.

Also Check: Sign Up For Stimulus Check 2022

Who Else Is Eligible To Receive A Stimulus Payment

As with the previous pandemic-related stimulus payments, gig economy workers, self-employed individuals and Americans on unemployment, disability, Social Security or other federal aid are also generally eligible for stimulus checks, provided they filed federal income taxes in 2020 or 2019 and meet the income thresholds.

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

Read Also: What’s The Latest News On Stimulus Check

How Do I Know If Im Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, youre due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

You May Like: Did The Third Stimulus Check Get Approved

More Money For Certain Families

One big change with third stimulus checks was that an extra $1,400 was tacked on to your payment for any dependent in the family. For the first- and second-round payments, the additional amount allowed $500 for first-round payments and $600 in the second round was only given for dependent children age 16 or younger. As a result, families with older children, including college students age 23 or younger, or with elderly parents living with them, didn’t get the extra money added to their previous stimulus payments. That’s not the case for third-round stimulus checks.

You May Like: How Much Was All The Stimulus Checks

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

When Is The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline for claiming your money depends on if you’re required to file a tax return or not. You’re generally not required if you file single and earn less than $12,550 per year.

You have until Tuesday, Nov. 15, to complete a simplified tax return to claim your missing stimulus or child tax credit money if you’re not typically required to file taxes. That’s roughly one month away. To help, the IRS is keeping the free file site open until .

If you filed a tax extension earlier this year or haven’t filed yet, your deadline to submit your tax return if you’re required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until Feb. 15, 2023, to file. If you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, you have until to file.

You could soon miss out on your stimulus and child tax credit money.

You May Like: Track My Second Stimulus Check