How Much Stimulus Money The Average American Has Received

The average amount of stimulus money is $3,450 for Americans with incomes in the bottom 60%. That includes all Americans earning under $65,000 per year. Here are the different types of stimulus money that make up this average:

- Stimulus checks, which were issued both by mail and as direct deposit to bank accounts

- An expanded Child Tax Credit

- An expanded Earned Income Tax Credit

Note that it doesn’t include another tax credit that was expanded in 2021, the child and dependent care credit.

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

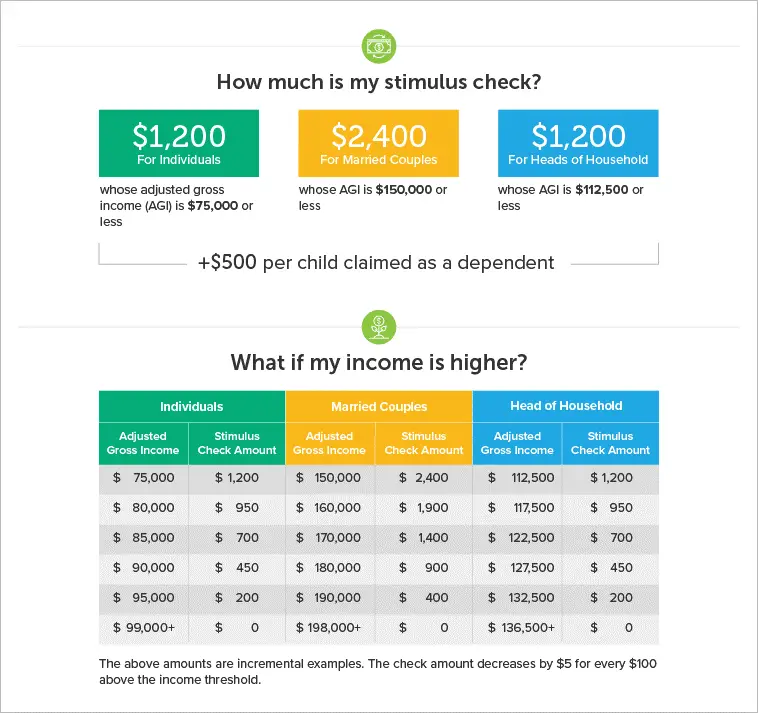

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

Will There Be More Stimulus Checks In The Future

As things currently stand, a fourth federal stimulus round appears to be unlikely.

Currently, Mr Biden’s Build Back Better Agenda does not include stimulus payments.

And last May, White House secretary Jen Psaki told reporters that the stimulus checks were not free and that another round wasnt in Bidens plans.

Along with getting Biden on board, two corporate Democrats Joe Manchin and Kyrsten Sinema would need to get convinced as well.

This is unlikely because the US is dealing with high inflation, as there is huge consumer demand that the supply is not meeting.

Stimulus checks serve the purpose of giving taxpayers a financial boost during an economic downturn.

And that isn’t happening at the moment.

But there has been some mounting pressure to do so.

In fact, 50 Democratic members of the House of Representatives wrote a letter suggesting recurring direct checks, also known as universal basic income.

It read: Another one-time round of checks would provide a temporary lifeline, but when that money runs out, families will once again struggle to pay for basic necessities.

“One more check is not enough during this public health and economic crisis.

It was backed by US Representative for New York Alexandria Ocasio-Cortez and Minnesota’s Ilhan Omar.

Democrats have backed a figure of $2,000, although there aren’t currently any official bills debating a fourth round of checks.

It’s also important to note that stimulus checks have been quite popular among the American people.

Read Also: Taxes On Stimulus Check 2021

How Much Was The First Stimulus Check

The first stimulus check was $1,200 per adult and $500 per child.

$1,200 , plus

an amount equal to the product of $500 multiplied by the number of qualifying children ) of the taxpayer.

-SEC. 6428. 2020 RECOVERY REBATES FOR INDIVIDUALS

The first stimulus check was sent out starting around April 11th, 2020.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Don’t Miss: Amount Of Third Stimulus Check

Comedian Chugs Beer Thrown At Her By Pro

President Trump on Sunday signed a $2.3 trillion COVID-19 relief and government funding bill that includes $600 stimulus checks for most Americans, after refusing to accept the deal for days.

The nearly 5,600-page bill passed the House and Senate by overwhelming margins Monday night, just hours after its text was released.

Trump signed it several days after saying the legislation was a disgrace and calling on Congress to up the relief payments to $2,000 and scale back spending.

In a statement Sunday night, the president said he would ask for millions of dollars in spending to be removed from the bill.

I will sign the Omnibus and Covid package with a strong message that makes clear to Congress that wasteful items need to be removed, Trump said.

While the president insisted he would send Congress a redlined version with items to be removed under the rescission process, those are merely suggestions to Congress. The bill, as signed, would not necessarily be changed.

The bill authorizes direct checks of $600 for people earning up to $75,000 per year. The amount decreases for higher earners, and people who make over $95,000 get nothing.

Theres an additional $600-per-child stimulus payment.

In his statement, Trump said Congress on Monday would vote on a separate bill to increase payments to individuals from $600 to $2,000.

Therefore, a family of four would receive $5,200, the president said about the increase, which would require Republican approval.

Can The Government Reduce Or Garnish My Economic Impact Payment

Your Economic Impact Payment will not be subject to most types of federal offset or federal garnishment as a result of defaulted student loans or tax debt. However, the payments are still subject to garnishment if youre behind on child support.

The payments may also still be subject to State or local government garnishment and also to court-ordered garnishments.

Also Check: Is There Another Stimulus Check Coming In 2022

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

You May Like: Stimulus For Healthcare Workers 2021

Here’s How Much Stimulus Money The Average American Has Received

by Lyle Daly | Published on Aug. 16, 2021

Image source: Getty Images

Americans at almost every income level have collected sizable stimulus funds.

Since the beginning of the COVID-19 pandemic, the U.S. government has offered different types of stimulus money, including checks and tax credits.

But how much stimulus money has the average American received so far? We know the answer thanks to research from the Institute on Tax and Economic Policy. According to that data, most Americans got over $3,000 in federal funds, and lower-income Americans benefited the most.

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household& 1 Dependent |

| AGI |

Read Also: Whats Happening With The Stimulus Checks

Don’t Miss: Who Do I Contact About My Stimulus Check

How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

Dont Miss: What Was The 2021 Stimulus Check

What If Ive Had Changes Since Filing My 2019 Tax Return

The IRS used information on your 2019 tax return to determine your payment amount if you didnt file a 2020 tax return or if it wasnt processed in time.

If you had a child, you will be able to get the additional $500 for them when you file your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you moved and the first stimulus check was not delivered to you, you may need to request a payment trace so the IRS can determine if your payment was cashed . If your payment wasnt cashed, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

If you got divorced and no longer live at the address on your tax return or included direct deposit information for a joint account and you are no longer married, this may be a complex matter that should be discussed with a tax professional.

Unfortunately, if the first stimulus check was issued, the IRS treats the payment as being received by both spouses, even if both people didnt get the money. If the payment went only to your ex-spouse, the IRS views this as a personal legal matter that you should discuss with your divorce attorney. You can also contact your local Low Income Taxpayer Clinic or local Taxpayer Advocate Service for help.

Also Check: How To Cash My Stimulus Check

Recommended Reading: What Is The Homeowners Relief Stimulus Program

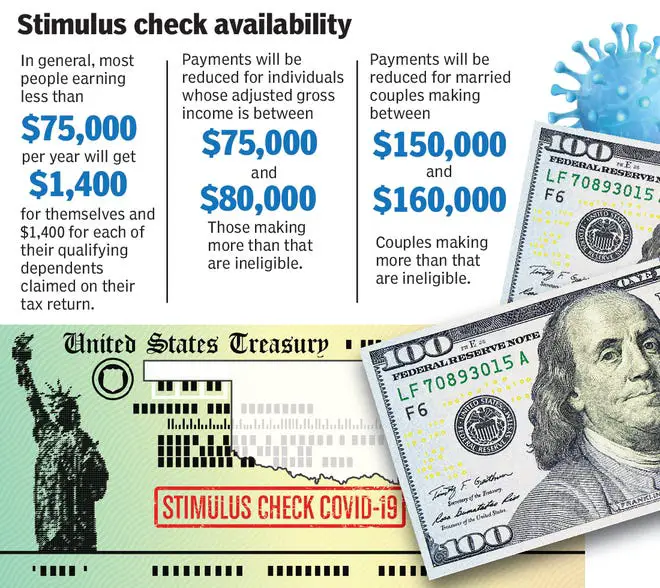

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didnt receive a third stimulus check, or didnt receive the full amount, you can get any money youre entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If youre wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and well give you a customized estimate.

Recommended Reading: Irs Phone Number For Stimulus Check 2021

Understand Inflation And How It Affects You

- Cost of Living: As food prices rise, eating is becoming increasingly expensive. We took a close look at five New Yorkers food and drink habits to see where the effects are most felt.

- A New Playbook: As brands grapple with inflation, they are taking a new approach: being upfront about price increases, hoping that transparency will keep customers loyal.

The arrival of the extra $600 depends on when your state signed an agreement with the Department of Labor. The week ending April 4 or 5 is the first week for which unemployed workers can claim the new federal benefit.

But that doesnt necessarily mean benefits will flow right away. States that are unable to immediately pay the federal pandemic benefit after they sign agreements will pay them retroactively for the weeks youre entitled to receive them.

Are benefits taxable?

Yes. Benefits are subject to federal income taxes and most state income taxes, according to the Department of Labor. The same goes for the $600. You should be able to elect to have taxes withheld.

Child support obligations can also be deducted from your benefits.

Also Check: How Do I Get My First And Second Stimulus Checks

How Do I Get The Stimulus Check

You wont need to take any action to receive the second stimulus check.

According to the IRS, Payments are automatic for eligible taxpayers who filed a 2019 tax return, those who receive Social Security retirement, survivor or disability benefits , Railroad Retirement benefits as well as Supplemental Security Income and Veterans Affairs beneficiaries who didnt file a tax return.

If you registered for the first stimulus using the Non-Filers tool on the IRS website by November 21, 2020, or submitted a simplified tax return that has been processed by the IRS, you will also receive your payment automatically.

Whos Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

Recommended Reading: How Do I Apply For The 4th Stimulus Check

Read Also: Direct Express Pending Deposit Stimulus Check

If You Dont Usually File Taxes How To Estimate Your Stimulus Money

With the first checks, the IRS automatically sent stimulus checks to many who normally arent required to file a tax return including older adults, Social Security and SSDI and SSI recipients and railroad retirees. Some who didnt file taxes may be eligible for a payment but havent yet claimed it.

If this is the case for you, enter your best guess where it asks for your adjusted gross income.

Who Gets The Second Stimulus

The IRS will look at your 2019 tax return to determine if you are eligible for the second stimulus. You must have a Social Security number to qualify. Children can qualify if they are under age 17.

Individuals with an AGI of $75,000 or less per year can receive $600. Married couples who file jointly with an AGI of $150,000 or less will receive the full $1,200.

You May Like: Stimulus Wheres My Payment

You May Like: How To Get 1400 Stimulus Check

Stimulus And Relief Package : American Rescue Plan

On March 11, 2021, President Biden signed into law the American Rescue Plan Act of 2021, implementing a $1.9 trillion package of stimulus and relief proposals. Some facets of the plan, such as raising the minimum wage to $15 an hour, were excluded to pass the plan using budget reconciliation, a Senate procedure that allows bills to be passed using a simple majority.

Roughly $350 billion of the total funding was allocated to state and local governments. The key points of the plan as it was passed are the following: