How To Claim Your $1400 Stimulus Check In 2022

- 10:37 ET, Dec 29 2021

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but havent yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

The Stimulus Had Big Economic Benefits But It Also Fueled Inflation

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty beyond merely keeping people afloat during the early days of the pandemic.

According to the U.S. Census Bureaus supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute. We dont know yet whether this came to fruition, but Laura Wheaton, a senior fellow at the Urban Institute and one of the analysts behind the 2021 numbers, told us that it was clear from their analysis that the stimulus checks were driving a dramatic decline in poverty.

More broadly, the stimulus checks also cushioned workers during one of the worst economic crises in modern history, which likely helped the economy bounce back in record time. In April 2020, when Americans were receiving the first round of checks up to $1,200 with the CARES Act the unemployment rate was at a disastrous 14.7 percent. But two years later, its almost returned to its pre-pandemic levels, with many job openings. I hope we dont forget how awesome it was that we supported people so well, and that we recovered as quickly as we did, said Tara Sinclair, a professor of economics at George Washington University.

Read Also: When Was The 3rd Stimulus Check 2021

First Stimulus Payments Expected To Go Out Week Of April 13

People with the lowest incomes will get their checks first.

Paper checks would start going out in May to people who dont have direct deposit information on file with the IRS, which includes nearly 100 million Americans. | Bradley C. Bower, File/AP Photo

04/02/2020 03:01 PM EDT

The IRS expects to start sending an initial wave of economic stimulus payments, worth up to $1,200 apiece, to some 60 million Americans the week of April 13, Treasury Department and IRS officials have told the House Ways and Means Committee.

But it could take up to five months for the payments to land in the mailboxes of millions of other people who have to be paid by check.

Taxpayers in the first wave have direct deposit information on file with the IRS from their 2018 or 2019 tax returns. Paper checks would start going out in May to people who dont have direct deposit information on file with the IRS, which includes nearly 100 million Americans. About 5 million checks will be sent weekly, and it could take up to 20 weeks to distribute all of them.

People with the lowest incomes will get their checks first.

The timeline, first divulged by Rep. Steven Horsford , is still subject to change, according to a committee source.

Neither the IRS nor Treasury have responded so far to a request for comment on the timeline.

That form is expected to ask filers for their names, Social Security numbers, information on dependents and deposit information.

CORONAVIRUS: WHAT YOU NEED TO KNOW

Read Also: Who Qualified For Stimulus Checks In 2021

Can I File My Taxes With A Paper Return

Yes, however it is not recommended. If you have not filed your taxes yet and still need to, file electronically if possible. IRS processing of paper returns is delayed due to COVID-19. You can use GetCTC.org if you arent normally required to file taxes, and get support from the chat function on the site, where you can communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

If you must file a paper return, you can download the tax forms from IRS.gov or use an online tax software program to complete your return and print it instead of filing electronically. If you need to file a paper return and do not have internet access, ask a trusted friend or relative for help.

Can My Bank Take My Stimulus Check

It may. While the CARES Act does not allow your stimulus payment to be garnished for federal or state debts , it doesnt explicitly prohibit private debt collection.

If you are receiving your payment through direct deposit, it can legally be seized by your bank to pay offset a negative account balance caused by things like delinquent debt or overdraft charges, according to a report from the Prospects David Dayen.

While the New York Times reported that some people banking with have had their stimulus payments taken, it also said the four biggest US banks JPMorgan Chase, Wells Fargo, Citi Bank, and Bank of America are pausing their collections on negative account balances to give customers access to the stimulus.

Heres some advice on what to do if your bank takes your stimulus payment.

Read Also: When Are They Sending Out Stimulus Checks

Also Check: Do I Have To Claim Stimulus Check On 2021 Taxes

This Article Talks About:

Andy Meek is a reporter who has covered media, entertainment, and culture for over 20 years. His work has appeared in outlets including The Guardian, Forbes, and The Financial Times, and hes written for BGR since 2015. Andys coverage includes technology and entertainment, and he has a particular interest in all things streaming. Over the years, hes interviewed legendary figures in entertainment and tech that range from Stan Lee to John McAfee, Peter Thiel, and Reed Hastings.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: Haven’t Got My Stimulus

How Much Will I Get In My Stimulus Check

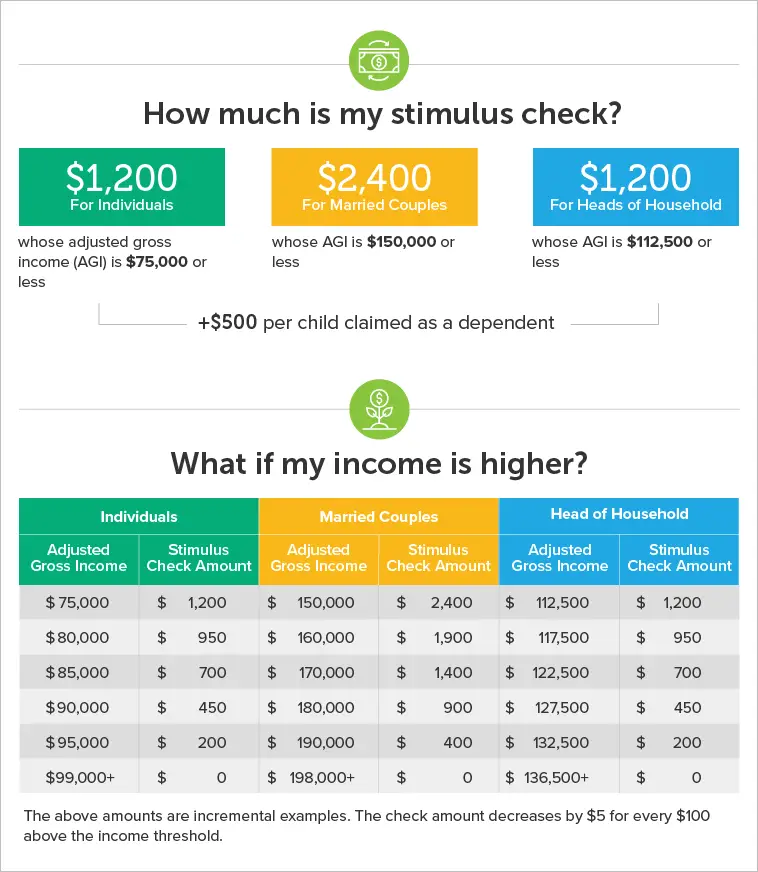

The IRS bases the amount of your payment on the adjusted gross income listed on your most recent tax return: 2018 or 2019.

The maximum payment is $1,200 for single filers with an AGI below $75,000 or single parents with an AGI below $112,500. Married couples who file jointly and have an AGI below $150,000 will get a total of $2,400.

Payments will begin to phase out at a rate of $5 for each $100 over the AGI threshold before ceasing at an AGI of $99,000 for single filers, $136,500 for heads of household, and $198,000 for married filers. Theres also an additional $500 allotted to parents who have an AGI within the phaseout range for each child younger than 17.

You can use an online calculator to figure out how much your check will be if youre unsure.

What If I Get My Check And Its Too Small

While it wont help you today, experts say the IRS will allow taxpayers to reconcile underpayment on next years tax return.

If you should have gotten a check and didnt, or if you should have gotten more than you did because the IRS didnt know something important , you should get more money next tax season, Kelly Phillips Erb, a tax lawyer, wrote for Forbes.

Also Check: Extra Stimulus Money For Social Security Recipients

What If I Owe Child Support Payments Owe Back Taxes Or Student Loan Debt

If you are overdue on child support or owe back taxes or student loan debt, you could see your stimulus check reduced or eliminated based on the amount you owe. The Bureau of the Fiscal Service will send you a notice if this happens.

Your payment will not be interrupted if you owe back taxes or have student loan debt you will receive the full amount.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

Feds Regulation Changes And Policy Updates

The Fed made regulation changes to further add liquidity to the markets. For instance, the Fed made a number of technical changes to hold on to less capital so that it could lend more. It temporarily removed the asset restrictions placed on Wells Fargo after its fake-accounts scandal, so that Wells Fargo could lend more.

On Dec. 16, 2020, the Fed announced that its QE policy would continue âuntil substantial further progress has been madeâ toward inflation and employment goals. The Fed expects this progress to take years, based on projections it also released that day.

On March 19, 2021, the Fed announced that it was letting its policy of relaxing bank reserve requirements expire on March 31, 2021, as scheduled. The policy, originally announced on May 15, 2020, temporarily allowed banks to exclude Treasuries and deposits with Fed banks from their balance sheets for the purpose of calculating reserve requirements, allowing them to lend more.

On March 25, 2021, the Fed announced that the temporary restrictions on dividends and buybacks that it placed on banks in 2020 would end after June 30, 2021, for banks that meet capital requirements during the 2021 stress tests. Restrictions were extended for banks that fail to meet capital requirements.

You May Like: How Much Was The 3rd Stimulus Check Per Person

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Read Also: Was There Any Stimulus Checks In 2021

If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

You May Like: Oregon Stimulus Check Round 2

Fourth Stimulus Check Possible Timeline

Right now, there is no fourth stimulus check timeline or fourth stimulus check release date. Until legislation is in motion, we cant say how soon more relief money might arrive. We cant say whether more relief money is coming, at all.

That said, the third stimulus check timeline happened rather quickly following Bidens inauguration Jan. 20. It only took a few weeks for Congress to debate his American Rescue Plan. Once the president signed the bill on March 11, $1,400 checks were put in motion.

The IRS can begin sending out possible fourth stimulus checks in the same manner it sent the previous stimulus payments. Since the framework is already in place, Americans could begin receiving the fourth stimulus checks about two weeks after a relief bill allowing another round of direct payments is approved.

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

Recommended Reading: Income Limits For Stimulus Checks 2021

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Also Check: When Was 3rd Stimulus Check Mailed

You May Like: How Many Economic Stimulus Payments Have There Been

Golden State Stimulus I

California will provide the Golden State Stimulus payment to families and individuals who qualify. This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit or file with an Individual Taxpayer Identification Number .

The Golden State Stimulus aims to:

- Support low-income Californians

- Help those facing a hardship due to COVID-19

For most Californians who qualify, you dont need to do anything to receive the stimulus payment.

The GSS I payment is a different payment than the Golden State Stimulus II .