Do I Need To File A 2019 Tax Return To Get This Stimulus Payment

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Last spring, one of the big questions was what did people who did not file a 2019 tax return need to do to get their stimulus payment, especially people for whom Social Security benefits were the primary source of income. Now that the government has been through the process of issuing payments once already, things might run more smoothly.

If you did file a 2019 tax return, the Treasury Department has all of the information it needs to determine your eligibility for a stimulus payment. But if you didn’t file a return last year, there are still several ways the government can send the payment to you automatically. If you used the non-filer portal the government set up last spring on IRS.gov for the first round of economic impact payments, you should get this second payment without having to take any additional steps.

Timeline If Payments Increase To $2000

If the newly-seated Congress somehow bows to pressure and agrees to raise the amount on checks, it wont change the delivery timetable.

The IRS already is sending out the $600 in direct payments approved by Congress and signed by President Trump.

The IRS says if legislation passes raising the total to $2,000, the additional money will go out as quickly as possible.

For Payments By Direct Deposit

If you already signed up to receive IRS payments via direct deposit, there is no need to go back and register again. Youre in the system and can expect to receive it that way again, as long as your banking information hasnt changed.

To track progress of your check, visit the IRS website Get My Payment.

Read Also: Stimulus For People On Disability

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Check If You Qualify For The Golden State Stimulus Ii

To qualify, you must have:

- Filed your 2020 taxes by October 15, 2021

- Had a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year. For this information refer to:

- Line 17 on Form 540

- Line 16 on Form 540 2EZ

- Had wages of $0 to $75,000 for the 2020 tax year

- Been a California resident for more than half of the 2020 tax year

- Been a California resident on the date payment is issued

- Not been claimed as a dependent by another taxpayer

- A dependent is a qualifying child or qualifying relative. Go to FTB Publication 1540 for more information about a qualifying child and qualifying relative

To receive your payment, you must have filed a complete 2020 tax return by .

If you dont qualify for GSS II, you may qualify for GSS I.

Also Check: Irs Disability Form For Stimulus Check

A Second Stimulus Check Here’s How Much Money You Could Get

By now, most Americans have received the federal stimulus checks directed by the CARES Act in March to help consumers weather the steep economic downturn caused by the coronavirus pandemic.

Four months later, the downturn has been and the official unemployment rate remains in double digits, heightening calls for a second round of stimulus checks.

There’s good news and bad news on the prospects for additional government assistance. The proposed $3 trillion Health and Economic Recovery Omnibus Emergency Solutions, or HEROES, Act would authorize another round of stimulus payments for most U.S. households. While the bill was passed by the Democrat-controlled House in May, it still must get through the Republican-controlled Senate.

Yet there are signs the White House may get behind additional stimulus funding, with the Wall Street Journal reporting that the administration is working on its own plan.

During a press conference in June to discuss unemployment, President Donald Trump said his administration will be “asking for additional stimulus money.” Treasury Secretary Steven Mnuchin also said in June the administration is “very seriously considering” a second round of stimulus checks, according to the Journal.

Second Stimulus Check: Irs Says The $600 Payments Are Now On Their Way But How Soon Is Now

Millions of Americans are eagerly awaiting their second stimulus checks, which provide $600 for each eligible adult and child. The IRS said last Tuesday that it had started to distribute the checks via direct deposit, a process that will extend into this week.

The tax agency added that it started mailing paper checks on December 30 to people who don’t have their bank account info on file with the IRS. But even so, the timeline leaves many people wondering when exactly the check will land in their accounts especially as the IRS’ website for checking one’s payment status is unavailable.

The second stimulus check follows a rocky rollout this spring for more than 160 million stimulus payments directed by the Coronavirus Aid, Relief, and Economic Security Act. That relief effort, which directed $1,200 for each eligible adult and $500 for each eligible child, encountered a number of problems, such as a delay in payment to people who didn’t have their bank account information on file with the IRS, as was the case for some Social Security recipients.

The IRS will use the same method to get the money to people as it did in the first round, said Mark Steber, chief tax information officer at Jackson Hewitt.

“If taxpayers received a direct deposit then, they will again if they received a mailed check or debit card then, they will again,” he said.

You May Like: How To Get Stimulus Check Reissued

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

How Are Social Security Payment Dates Determined

The Social Security Administration sends out payments on three different Wednesdays of each month — the second, third and fourth. On which Wednesday you receive your money depends on your birth date. Payments for SSI recipients generally arrive on the first of each month . We’ll break it down.

- If your birthday falls between the 1st and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Your payment date depends on your birthday and when you started receiving benefits.

You May Like: Can I Still File For My Stimulus Check

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Can You Still Get Your Stimulus Check

Is My Second Stimulus Check Taxable

The IRS does not consider stimulus checks taxable income. This means that you do not have to report them on your tax return or pay income taxes on either check.

Eligible recipients who did not get the first or second stimulus checks can claim a recovery rebate credit to increase their tax refund or lower their tax liability. So if you are expecting to get money back on your 2020 tax return, your refund could get a big boost depending on how much stimulus money the government owes you.

And comparatively, if you expect to owe taxes on your 2020 return, then you can use your recovery rebate credit to offset your tax bill and get a refund for the remaining amount.

Many taxpayers this year are looking to their tax refunds to get extra money for their finances. For reference, the average tax refund in 2020 was more than $2,500. The IRS expects over 150 million tax returns to be filed this year.

The 2021 tax season will begin on February 12. And taxpayers will need to file their 2020 returns by April 15.

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

You May Like: Irs Sign Up For Stimulus

Recommended Reading: Social Security Stimulus Checks For Seniors

Nd Stimulus Check Update: Trump Signs Covid Relief Bill How Much Will I Get When

Blank stimulus checks are seen on an idle press at the Philadelphia Regional Financial Center, which disburses payments on behalf of federal agencies, in Philadelphia, Thursday, May 8, 2008. ASSOCIATED PRESS

A second round of stimulus checks are on the way after President Donald Trump signed a $900 billion Covid relief bill Sunday, but when?

Trump signed the package, which includes a $1.4 trillion omnibus spending bill to fund government agencies through September, at his private Mar-a-Lago club in Florida after days of refusing to accept the bipartisan deal approved a week earlier. The delay led to a brief lapse in unemployment benefits for millions of Americans and raised uncertainty as Trump pushed for direct payments of $2,000 for most Americans, instead of the $600 provided in the bill.

According to the Associated Press, the president said he would send Congress a redlined version with items to be changed under the rescission process, but those are merely suggestions to Congress. Senate Democratic leader Chuck Schumer, D-N.Y., said he would offer Trumps proposal for $2,000 checks for a vote in Senate, but it currently appears unlikely to garner enough Republican support to change.

So how much will I get?

Only children younger than 17 are expected to be eligible, much like the first stimulus check. College students and adult-age dependents were left out in March as well.

When will I get my check?

Is the money taxable?

What About The Second Stimulus Check Amount And Dates

Congress approved another economic relief bill at the end of last year, and the second round of stimulus check payments began sending as early as Dec. 29, 2020. This payment capped out at $600 per person, and another $600 per qualifying child dependent. If you don’t have IRS Notice 1444-B and can’t find anything in your December and January bank statements, check out our handy stimulus check 2 calculator to get an idea of what you were entitled to and then head to the IRS website to get what you need.

Don’t Miss: How To Check My Stimulus Payment

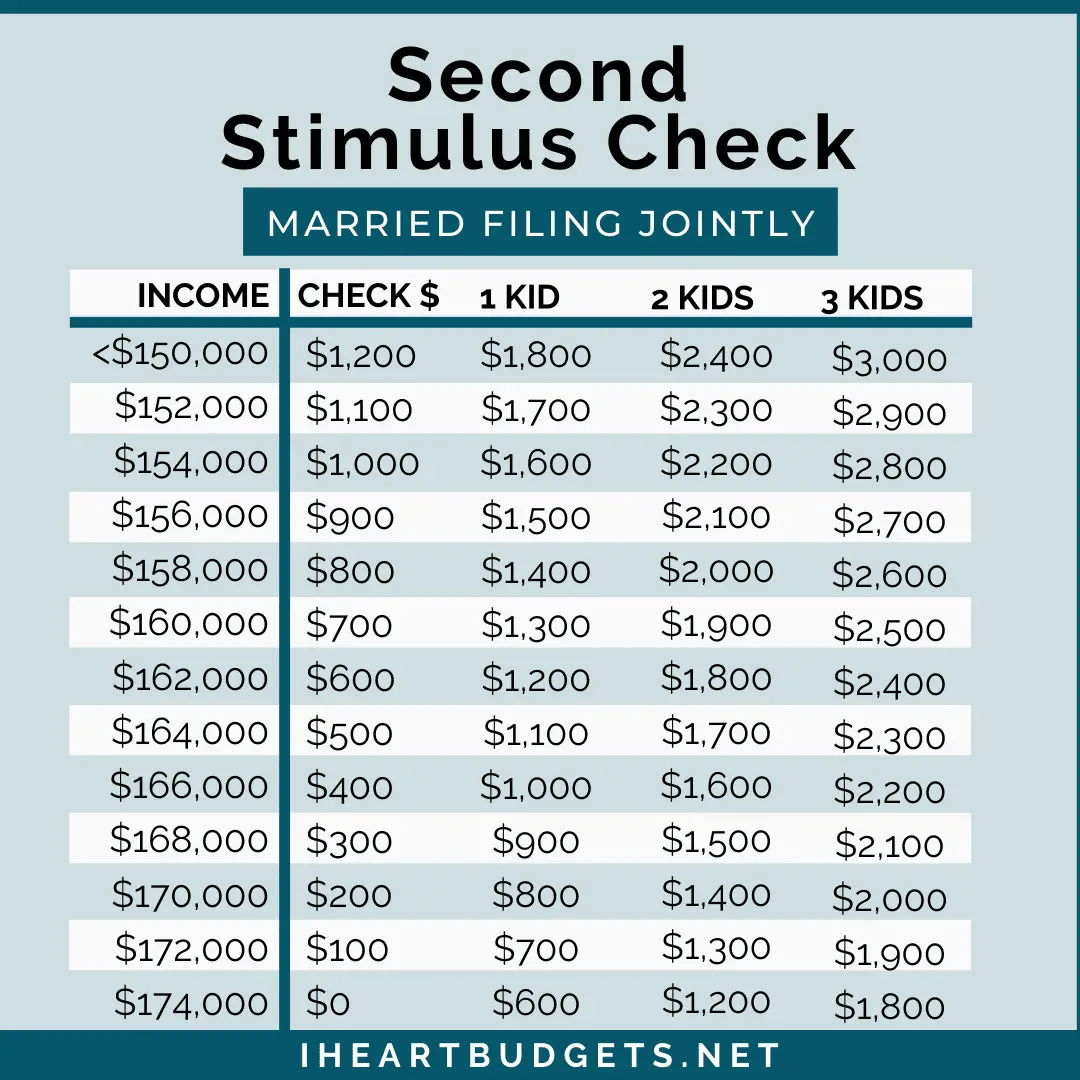

Calculate The Total Of Your Household’s ‘$600’ Stimulus Check

To calculate how much you should get in your second stimulus payment, you’ll need to enter:

- Your adjusted gross income, or AGI, from your 2019 federal tax return. Find that figure on line 8b of the 2019 1040 federal tax form.

- The number of child dependents age 16 and younger that you claim. Remember, a single taxpayer has no dependents, and a head of household does not file jointly with a spouse and claims at least one dependent.

CNET’s stimulus calculator follows the same formula the IRS uses to tabulate your household’s stimulus payment. The result should be considered an estimate, not a guarantee of the IRS’ final check to you. This calculator tool will not store or share your personal information.

What Happened To The $2000 Payment

There will be no $2,000 payment to taxpayers, at least not in the immediate future.

President Trump and Democrats in the House and Senate wanted to raise the direct payment to $2,000 payment, but couldnt find enough support among Republicans to make it happen.

Its possible, though not probable, that Congress could increase the amount of the check to $2,000 at some point, but Senate Majority Leader Mitch McConnell is making it extremely difficult to get a vote on this matter.

McConnell said the proposed $2,000 payment sends thousands of dollars to people who dont need the help and blocked efforts by Senate Minority Leader Chuck Schumer and Sen. Bernie Sanders to hold a vote on the bill, effectively killing it.

Borrowing from our grandkids to do socialism for rich people is a terrible way to get help to families who actually need it, McConnell said.

Instead, McConnell packaged the $2,000 proposal in an omnibus bill alongside repeal of Section 230 of the 1996 Communications Decency Act, which protects social media companies from responsibility for the content on their platforms and appointing a federal commission to investigate election fraud.

That trio of ideas has little or no chance of passing the Senate and House.

Read Also: How Many Economic Stimulus Payments Have There Been

Fourth Stimulus Check Update

Bidens American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. Thats similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a Silver health-insurance plan for six months under the Affordable Care Act, aka Obamacare. Youre eligible for this if you filed for unemployment benefits at any time in 2021, and if you dont currently get health insurance through Medicare, Medicaid or someone elses health plan.

Bidens American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.