Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Who Qualifies For Stimulus Checks How Much Will The Stimulus Checks Be Worth

This third stimulus payment will go out to fewer households than the two rounds sent in 2020.

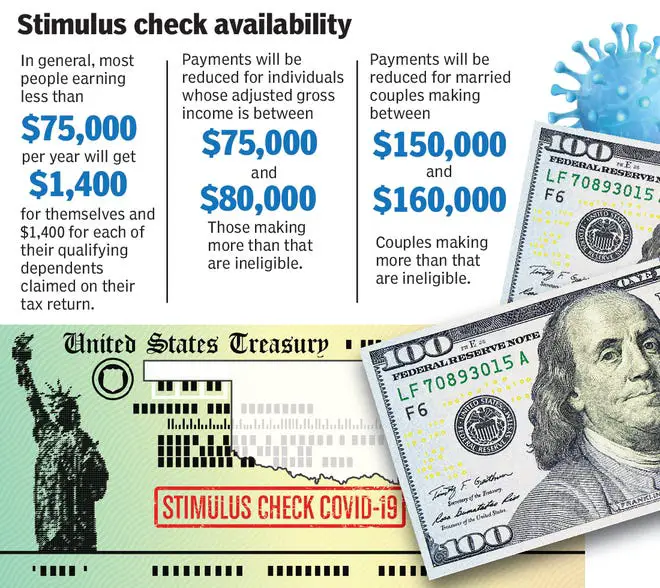

Single filers earning up to $75,000 will get a full $1,400 stimulus check, and couples filing jointly with income of up to $150,000 will get a $2,800 stimulus check in the new round. The payments are based on adjusted gross income, which is in your federal tax filing. Additionally, those who qualify would get an extra $1,400 per dependentwhich includes not only children, but for the first time, adult dependents as well.

A family of four making $150,000 or less would qualify for $5,600 in stimulus money.

In the new package, however, checks would begin to phase out faster than those in previous rounds. Single filers making over $80,000 per year and joint filers making more than $160,000 wouldnt receive a check at all. , that could leave out roughly 12 million adults and roughly 5 million children from getting a check this time around.

What Was The Timeline For The Third Stimulus Check

Once the bill moved through all the hoops, eligible people started seeing their stimulus payments before March 2021 was over.7 The IRS and U.S. Treasury have been quick with delivering past stimulus checksDecember 2020s payments reached most folks by direct deposit within a week of then President Donald Trump signing the legislation.8

You May Like: Is There Another Stimulus Check On Its Way

Who May Be Eligible For More Money

Taxpayers who earned less money in 2021 than the previous year may be eligible for more money than they initially received from the third round of stimulus payments.

Those include single filers who had incomes above $80,000 in 2020 but less than this amount in 2021 married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021 and head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021, according to the IRS.

Individuals and families who added a child in 2021 — through birth, adoption or foster care — could be eligible for additional money. Families that added another kind of dependent, such as an aging parent or grandchild, may also be eligible.

How Do You Qualify For Stimulus In 2022

Qualifying for a stimulus check depends on if you live in a state issuing stimulus checks and if you met the stateâs criteria. For instance, Colorado is giving a tax rebate of $750 and $1,500 to filers if they were 18 before Dec. 31, 2021, filed a state tax return for 2021 and were residents for the entire 2021 tax year.

Also Check: 4th Stimulus Check Texas Update

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayerâs latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Stimulus Checks: $804 Billion

The US government has sent $804 billion directly to low- and middle-income individuals and families via three rounds of stimulus payments that were delivered via direct deposit, checks or debit cards.

Each round had slightly different qualifying parameters, but lawmakers purposely didnt put too many limitations on the checks in order to get the cash out as quickly as possible. The lowest-income Americans got the full amount and the value gradually phased out for those earning more. The first round, which sent payments worth up to $1,200 per person, cost taxpayers the most $388 billion. The second round of payments were worth up to $600 per person and cost $142 billion.

Lawmakers narrowed eligibility for the last round so that it excluded individuals who earn at least $80,000 a year and families who earn at least $120,000 a year. The IRS has sent $1,400 per person this year, at a cost of $274 billion to date.

Some states, like California and , have issued their own stimulus payments to some residents in addition to the federal money.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

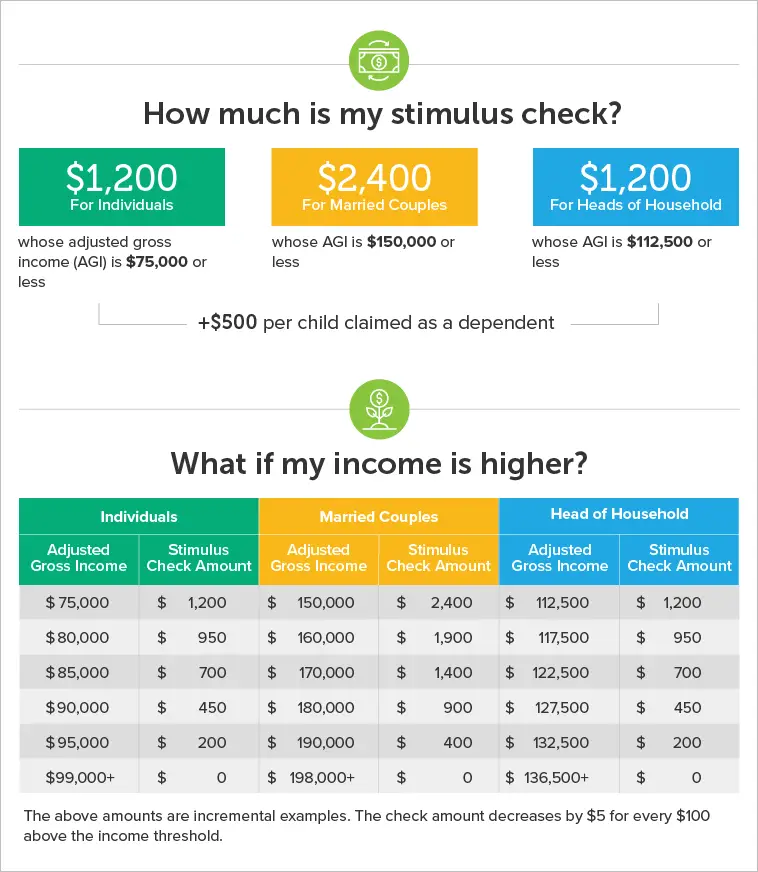

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

Read Also: H& r Block Stimulus Tracker

Read Also: When Did The Stimulus Checks Go Out In 2021

Fourth Stimulus Check Amount

The fourth stimulus check amount depends on several factors. If passed, it would probably look similar to the previous checks, although that’s not guaranteed.

For reference, the first stimulus check amounted to as much as $1,200, while the second stimulus check brought $600 to eligible Americans. The third stimulus check, which the IRS is still in the process of distributing, is worth up to $1,400 per person, although the eligibility requirements are narrower.

All three checks gave the full amounts to taxpayers who made up to $75,000 a year, according to their most recent tax returns. Couples filing jointly got the full payment if they had a joint total income of $150,000 or less.

With the first two checks, those making up to $99,000 alone or $198,000 as a couple received prorated payments. With the third check, individuals who earned more than $80,000 per year or $160,000 per year as joint filers got nothing. Our guide to the stimulus check calculator can show you what your own eligibility looks like.

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Don’t Miss: Where Is My Stimulus Refund

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

When Will I Get My Stimulus Check

The IRS has begun distributing stimulus payments. The first batch of stimulus payments could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks.

For information on when you can expect your stimulus payment, check the IRS Get My Payment tool, which will be live starting March 15th.

You May Like: Will There Be Another Stimulus Package

Are Stimulus Checks Helping The Economy

The U.S. economy continues to struggle with higher-than-normal layoffs and other setbacks. Roughly 730,000 people filed for unemployment benefits in the week ended February 20, a drop of 111,000 from the previous week yet still higher than prior to the pandemic. New economic data released on February 17 indicates that the second stimulus check is working to stoke the economy, with retail sales jumping 5.3% in January, or five times higher than expected.

“Those outsized gains in big-ticket discretionary items suggests the $900 billion fiscal stimulus passed late last year is working as intended with most Americans receiving $600 per person stimulus checks early in the month, while monthly unemployment insurance payments were increased,” noted Michael Pearce, senior U.S. economist at Capital Economics, in a report.

“The economy remains weak, the jobs recovery has lost momentum, and there are nearly 10 million fewer jobs than in February of 2020,” the Center on Budget and Policy Priorities in a February report. It added that millions should be helped by Mr. Biden’s proposed stimulus package.

Here’s what the experts are saying about the next stimulus check and who may be eligible.

Impact Of The Coronavirus Stimulus Checks On The Economy

The emergence of the COVID-19 virus early in 2020 had a huge impact on this countrys economy, with federal and state agencies, as well as many private companies from different sectors, forced to stop their operations in order to preserve the health of their workforce and to prevent the spread of the virus. As a result, the unemployment rate suffered a substantial increase, reaching 14.7% in April 2020, the highest rate observed since data collection began in 1948. The high unemployment rate disproportionately impacted the nations communities of color and low-wage workers. Many households, mainly those with children, were unable to pay for their basic needs: food, housing, utilities, and transportation.

The second stimulus package, The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, was signed by former President Donald J. Trump on December 27, 2020. It was a $900 billion package that included disbursements of up to $600 per household plus an additional $600 for dependent children ages 16 or under. As in the previous stimulus package, those individuals who earned up to $75,000 in 2019 received the full stimulus check, while a gradually smaller figure was provided to those with higher annual incomes, up to a maximum of $87,000.

Table 1. U.S. Households Spending Priorities with Coronavirus Stimulus Money

| Stimulus Program |

|---|

You May Like: Irs Says I Got Stimulus But I Didn’t

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

Also Check: Is There An Additional Stimulus Check Coming

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

You May Like: When Is The Latest Stimulus Check Coming

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

You May Like: When Can I Expect My Third Stimulus Check

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

When Would I Get A $1400 Check

Its possible the checks could arrive as soon as mid- to late March, if the bill is passed by Congress and assuming the relief package directs another round of direct payments to households, analysts say.

Meanwhile, Democratic lawmakers have said they want to pass a new relief bill before the current $300 in weekly additional jobless aid expires on March 14.

Once the relief bill is passed, it must be signed by Mr. Biden. After that, the IRS would direct stimulus checks to eligible households. Based on past payment schedules, checks could arrive via direct deposit within a week of Mr. Biden signing the bill.

However, people who dont have banking accounts or payment information on file with the IRS would likely have to wait longer for paper checks or prepaid debit cards to arrive in the mail.

With reporting by the Associated Press.

Don’t Miss: Updates On The 4th Stimulus Check

Do The 62f Tax Refunds Favor Wealthy Bay Staters

There has been some criticism and concern that the Massachusetts 62F tax refunds favor high income residents. Thats in part because the refund amounts are based on a flat percentage.

A Massachusetts Budget and Policy Center analysis puts the likely average amount of the tax refund at about $529 for an average Massachusetts taxpayer. However, data from 2018 indicate that lower income taxpayers could receive tax refunds that are less than $10, while 2020 data show that taxpayers with incomes over $1 million could receive more than $28,000, on average.

Overall, the Massachusetts Budget and Policy Center concluded that almost 75% of the nearly $3 billion in tax refunds will go to people whose incomes are in the top twenty percent of Massachusetts income distribution.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

You May Like: Where My Golden State Stimulus

Recommended Reading: When Will We Get Stimulus Check