What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments – by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

Who Is Eligible To Receive A Stimulus Payment

Generally, U.S. citizens and green card holders are eligible for the stimulus payments. Also, the new law expands who is eligible for a stimulus payment.

In the first round of payments, joint returns of couples where only one member of the couple had a Social Security number were not eligible for a payment unless they were a member of the military. These families are now eligible to receive a stimulus payment, including the additional payment for their dependent children. The new law also made this expansion retroactive to the first round of stimulus payments. If your family did not receive the first stimulus payment because only one spouse had an SSN you can claim the Recovery Rebate Credit when you file your 2020 federal income tax return.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

You May Like: When Will We Get 4th Stimulus Check

Also Check: Where Can I Cash My Stimulus Check 2021

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced â above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

Donât Miss: Will We Get Another Stimulus Check Soon

Stimulus Checks: What You Need To Know

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The United States swiftly responded. Individual states put a series of lockdowns in place to slow the spread, and as unemployment climbed, the federal government sprang into action. It passed relief bills that included an Economic Impact Payment — better known as a coronavirus stimulus check.

Following the first stimulus payment, demand grew for more direct relief to American families as the pandemic raged on. In December 2020, the U.S. government again took action to provide a second stimulus check.

However, many on the left felt the second check was insufficient, leading numerous Democrats to campaign on providing additional stimulus funds. Voters delivered Democrats control of the White House, the U.S. House of Representatives, and the U.S. Senate.

As a result, shortly after taking office, President Joe Biden signed a bill authorizing a third stimulus check. The American Rescue Plan Act was signed into law on March 11, 2021. The legislation passed on a partisan basis with no Republican support. It’s widely expected to be the last direct payment Americans receive.

Here’s what you need to know about these direct payments, including who is eligible, how much money was available in the stimulus checks, and how to check the status of your payment.

Also Check: Small Business Stimulus Check 2021

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

How And When Will I Get My Stimulus Check

The IRS will either mail a check or deposit the money into your bank account, depending on if you signed up for direct deposit when you last filed your taxes.

According to the Washington Post, paper checks will start going out the week of April 24. Checks for people with an adjusted gross income of $10,000 or less will be sent out around April 24.

From there, the IRS will send out 5 million paper checks a week, moving up the income thresholds in $10,000 increments.

Direct deposit is the fastest way to receive your stimulus money.

Check the IRS website for the latest updates on stimulus payment checks:

Read Also: How Do I Get The $600 Stimulus Check

Recommended Reading: Stimulus Check For Expecting Mothers 2022

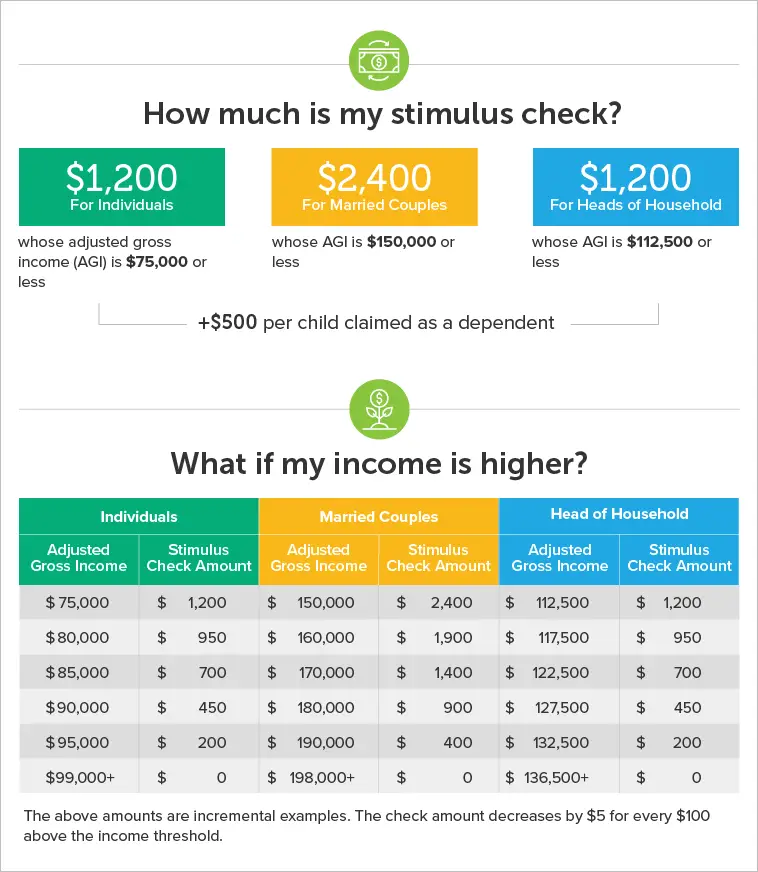

How Much Will My Stimulus Check Be

The amount of your stimulus checks varies depending on your family status and income.

The first stimulus check was worth up to $1,200 per eligible adult and $500 per dependent child under 17. Single adults received as much as $1,200. Married couples with no children got up to $2,400. Married couples with two children received up to $3,400.

If your income exceeds $75,000 as a single filer, $112,500 as a head of household, or $150,000 as a married joint filer, your check amount was reduced at a rate of $5 per extra $100 earned. So if you made $76,000 as a single filer, your check would be reduced by $50.

Eligibility phased out for single filers with incomes above $99,000, heads of household with incomes above $136,500, and married joint filers with incomes above $198,000 for their own payments. However, some still received dependent payments. Married joint filers with two children and $199,000 in income would lose their own $2,400 payments but receive $950 of the $1,000 in dependent payments.

The second check provided $600 per eligible adult and child dependent. The phase-out rules worked the same way. However, because the check was for a smaller amount, eligibility disappeared entirely at a lower income threshold. Singles with incomes above $87,000 received no payment. Nor did heads of household with incomes above $124,500 — unless they received some dependent funds. And married joint filers lost eligibility for their own payments at $174,000.

Changes To Tax Credits

the Earned Income Tax Credit and the Child Tax Credit .

The EITC is a tax credit that provides financial assistance to workers earning around $57,000 or less. The credit is partially refundable , which means it can reduce your taxes or increase your refund.

You may qualify for the EITC with or without children but currently, the credit is fairly small for people without kids. For 2021, you can qualify for a maximum credit of $6,728 if you have up to three children. However, for childless taxpayers, the total amount you can claim is $543.

Biden proposes to temporarily increase the EITC for childless workers for one year, allowing those who qualify to claim a credit of up to $1,500. The EITC will remain unchanged for those with kids.

The bill also contains big changes to the child tax credit although theyre temporary and will only last for one year. Under the current law, a person might qualify to claim a credit of up to $2,000 per child under 17. Bidens plan greatly boosts the credit, increasing the CTC up to $3,600 for children ages under the age of 6. Children ages six to 17 might qualify for a credit of up to $3,000. Another provision in the package would allow the credit to be fully refundable to those who qualify.

You May Like: Who Is Eligible For Stimulus Checks 2021

Also Check: I Still Haven’t Gotten My First Stimulus Check

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the Recovery Rebate Credit. You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds youre owed.

Its possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldnt submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

Youre A Member Of A Mixed

Under the CARES Act, U.S. adults with a Social Security number werent eligible for a stimulus check if they were in a mixed-status household, meaning one partner was undocumented or didnt have an SSN. A recent law change, however, scraps that rule. Now, individuals would be able to receive both payments retroactively meaning both the first and second stimulus payment for the taxpayers and qualifying children of the family who have work-eligible SSNs.

Youll want to reconcile that first amount with your Recovery Rebate Credit, if you didnt receive it.

You May Like: How To Get The 1400 Stimulus Check

Also Check: How.many Stimulus Checks In 2021

What If I Get My Check And Its Too Small

While it wont help you today, experts say the IRS will allow taxpayers to reconcile underpayment on next years tax return.

If you should have gotten a check and didnt, or if you should have gotten more than you did because the IRS didnt know something important , you should get more money next tax season, Kelly Phillips Erb, a tax lawyer, wrote for Forbes.

Also Check: Extra Stimulus Money For Social Security Recipients

If You Dont Usually File Taxes How To Estimate Your Stimulus Money

With the first checks, the IRS automatically sent stimulus checks to many who normally arent required to file a tax return including older adults, Social Security and SSDI and SSI recipients and railroad retirees. Some who didnt file taxes may be eligible for a payment but havent yet claimed it.

If this is the case for you, enter your best guess where it asks for your adjusted gross income.

Read Also: Ssi Ssdi Fourth Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: Havenât Got My Stimulus

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you donât spend it within 12 months, the Social Security Administration will count the money as a resource.

Don’t Miss: When Did I Get My Stimulus Check

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Impact Of The Coronavirus Stimulus Checks On The Economy

The emergence of the COVID-19 virus early in 2020 had a huge impact on this countrys economy, with federal and state agencies, as well as many private companies from different sectors, forced to stop their operations in order to preserve the health of their workforce and to prevent the spread of the virus. As a result, the unemployment rate suffered a substantial increase, reaching 14.7% in April 2020, the highest rate observed since data collection began in 1948. The high unemployment rate disproportionately impacted the nations communities of color and low-wage workers. Many households, mainly those with children, were unable to pay for their basic needs: food, housing, utilities, and transportation.

The second stimulus package, The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, was signed by former President Donald J. Trump on December 27, 2020. It was a $900 billion package that included disbursements of up to $600 per household plus an additional $600 for dependent children ages 16 or under. As in the previous stimulus package, those individuals who earned up to $75,000 in 2019 received the full stimulus check, while a gradually smaller figure was provided to those with higher annual incomes, up to a maximum of $87,000.

Table 1. U.S. Households Spending Priorities with Coronavirus Stimulus Money

| Stimulus Program |

|---|

You May Like: Stimulus Checks For Grocery Workers

Also Check: When Will The $1400 Stimulus Checks Be Mailed Out

Recovery Rebate Credit Topic F: Finding The First And Second Economic Impact Payment Amounts To Calculate The 2020 Recovery Rebate Credit

These updated FAQs were released to the public in Fact Sheet 2022-26PDF, April 13, 2022.

If you didn’t get the full first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit by filing a new or amended 2020 tax return.

Q F1. Who needs to know their first and second Economic Impact Payment amounts when they file tax returns for 2020?

A1. Anyone claiming a 2020 Recovery Rebate Credit needs to know their first and second Economic Impact Payment amounts to correctly calculate the credit. Spouses filing a joint return for 2020 need to know the payment amounts for both spouses in order to claim the credit.

You dont need to claim the Recovery Rebate Credit on your 2020 tax return if you were issued the full amount of that credit through the first and second round of Economic Impact Payments. You were issued the full amount of the 2020 Recovery Rebate Credit if:

- the first Economic Impact Payment was $1,200 plus $500 for each qualifying child you had in 2020 and

- the second Economic Impact Payment was $600 plus $600 for each qualifying child you had in 2020.

The Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040-SR instructionsPDF can help determine if you are eligible for the credit.

Q F2. Where can I find the amount of my Economic Impact Payments to help me calculate the Recovery Rebate Credit?

Q F4. How do I access my online account?

How we process your claim

To start a payment trace: