How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Whos Eligible To Receive A Second Stimulus Check

Most American adults are eligible to receive a second stimulus check. There are some exceptions, though. Generally, nonresident aliens, anyone who can be claimed as a dependent on someone elses return, and people without a Social Security number wont receive a payment. Anyone who died before January 1, 2020, is not eligible to receive a second stimulus check as well.

When Can I Expect The Check

Payments started going out at the end of December and the IRS is still working on sending all payments out. Treasury Secretary Steven Mnuchin has predicted that most payments will be received by April 17. As with the first round of checks, paper checks may take longer as the government sends those in batches.

You can check on the status of your payment with the IRSs Get My Payment tool. If you havent received your check there are a few things that may have caused the delay.

Recommended Reading: When Will Nc Stimulus Checks Arrive 2021

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Will I Get An Eip Card

For the first and second stimulus checks, the Treasury Department sent millions of taxpayers an economic impact payment debit card. For the first stimulus check, EIP cards were sent to individuals who had not received a tax return by direct deposit in the past and who had their tax returns processed by certain IRS service centers. For the second stimulus check, the Treasury Department sent EIP cards to a majority of taxpayers.

If you received an EIP card for the second stimulus payment, you will probably receive a new EIP card for the third stimulus payment. If you receive an EIP card, read the material that comes with it carefully they come with fees for checking your balance, using a teller for withdrawals, or using an out-of-network ATM.

Recommended Reading: Was There Any Stimulus Checks In 2021

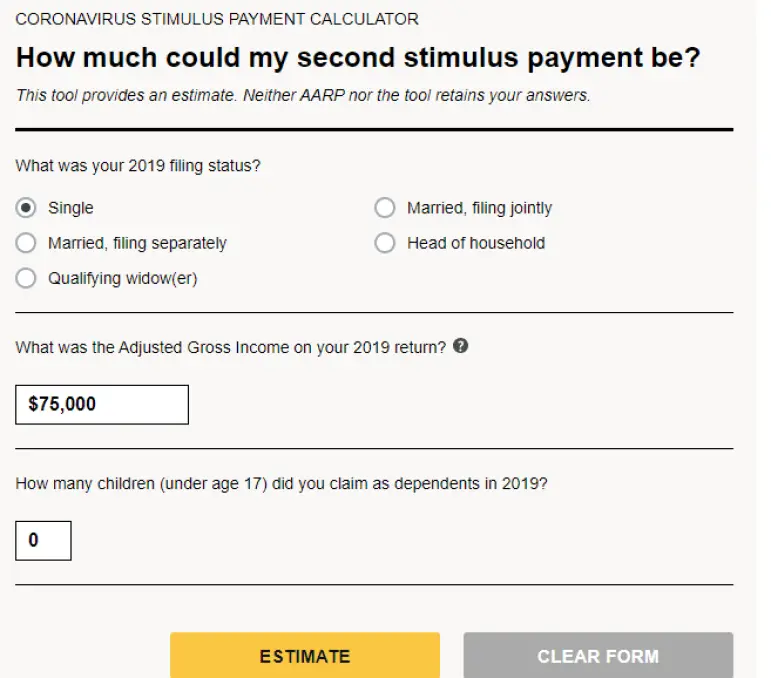

How Is My Second Stimulus Check Calculated

The IRS relies on your tax return to calculate whether you qualify for the second stimulus check. So your eligibility was based on your 2019 tax returns, which you filed by July 15, 2020.

According to the text released by Congressional leaders, the COVID-19 relief bill notes those with an adjusted gross income over certain limits receive a reduced amount of money, with the checks phasing out entirely at higher incomes.

Your AGI is calculated by subtracting the deductions that you made during the tax year from your gross income .

Heres a quick breakdown of the AGI limits for the $600 stimulus checks:

- Single filer checks begin to phase out at AGIs above $75,000.

- Head of household checks start getting phased out at incomes over $112,500.

The IRS reduces stimulus payments by 5% for the total amount that you made over the AGI limit. This means that for every $100 that you make over the limit, your check goes down by $5. At high enough incomes, the checks phase out entirely. So if you earned over $87,000 as an individual taxpayer, $174,000 as a joint filer, or $124,500 as a head of household, you do not get a stimulus payment. The following calculator allows you to calculate your benefit amount:

This second round of stimulus checks is currently half the maximum amount of the first stimulus checks that were included in the CARES Act in March.

Do I Get A Check If Im Retired Or On Social Security

Yes. You will still be eligible to receive a stimulus check. Adjusted Gross Income will be based on your 2019 tax return. If you have not filed a return for either year, the rebate amount will be determined based on Social Security Administration records.

Update: The IRS has announced that those on Social Security DO NOT need to file a tax return to qualify, payment will be automatic. More details can be found here

Also Check: Where’s My Stimulus Money 2021

Who Isn’t Eligible For The Third Stimulus Check

Besides high-income earners, the only other individuals who aren’t eligible for the stimulus check are those without Social Security numbers , those who are claimed as dependents on someone else’s tax return, and possibly those who are incarcerated.

This time, an individual who is married to an immigrant without a Social Security number can get the stimulus check, though the spouse with only an individual taxpayer identification number still will not receive a check.

What about children? Parents should get an extra $1,400 for each child that they claimed as a dependent on their 2020 tax return. This is a change from the first and second stimulus checks, where only children who hadn’t reached age 17 could qualify for the stimulus money.

What about people who don’t pay taxes? There is no requirement that you paid taxes or filed a tax return in 2020. This means that even those people whose only source of income is Social Security retirement or disability benefits, Supplemental Security Income , or veterans benefits are eligible for the $1,400 payment.

Those who receive monthly Social Security benefits, Railroad Retirement benefits, SSI, or veterans benefits should automatically receive the stimulus check whether they filed tax returns or not.

What about people receiving unemployment? Those collecting unemployment benefits are eligible to receive the stimulus payment.

Are More People Eligible Now For A Payment Than Before

Under the earlier CARES Act, joint returns of couples where only one member of the couple had a Social Security number were generally ineligible for a payment unless they were a member of the military. But this months new law changes and expands that provision, and more people are now eligible. In this situation, these families will now be eligible to receive payments for the taxpayers and qualifying children of the family who have work-eligible SSNs. People in this group who dont receive an Economic Impact Payment can claim this when they file their 2020 taxes under the Recovery Rebate Credit.

Recommended Reading: N.c. $500 Stimulus Check

The Second Round Of Stimulus Checks

The second round of stimulus payments were authorized on December 27, 2020 as part of the Consolidated Appropriations Act, 2021. Those payments typically totaled $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child. The payments began phasing out at the same income levels as the current payments, but the maximum income levels to receive a payment were slightly higher. Taxpayers were ineligible for any payment, unless they had a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

As of March 5, 2021, about $135 billion of the second round of payments have been sent out overall, such payments are expected to cost a total of $164 billion according to the Congressional Budget Office.

Important: Make Sure You Have Your Agi

CNET’s stimulus check calculator tool is based on rules from the CARES Act that was passed in March, 2020. It’s intended to give you an estimate of what you should have received in your first stimulus check. To use the tool, you’ll need your adjusted gross income, or AGI, from your 2019 or 2018 tax information. You can find that figure on line 8b of the 2019 1040 tax form and line 7 on the 2018 1040 tax form.

Read Also: I Still Haven’t Received My Stimulus

Payment Status Not Available

Some people were confused to see the message Payment #2 Status Not Available when checking the status of their stimulus check on the IRS website. At the time of this writing, the IRS has stated that those receiving this message will not get a stimulus check by mail or direct deposit. Instead, youll need to claim the Recovery Rebate Credit on your 2020 Tax Return. This will either increase your tax refund or decrease the amount of taxes you owe by however much your stimulus check was supposed to be.

Is There A Second Stimulus Check Coming

WASHINGTON Today, the Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the first round of payments earlier this year.

You May Like: Telephone Number For Stimulus Check

How Much Is The Stimulus Payment

Eligible individuals can receive a stimulus check of up to $1,400. Couples who file joint tax returns can receive up to $2,800. Families with dependents can receive an additional $1,400 per dependent. People who are American citizens but filing jointly with someone who is not a citizen will be eligible for the stimulus check. People without a Social Security number generally cannot get a check. Stimulus checks are not taxable.

Also Check: H& r Block Stimulus Tracker

The Stimulus Had Big Economic Benefits But It Also Fueled Inflation

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty beyond merely keeping people afloat during the early days of the pandemic.

According to the U.S. Census Bureaus supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute. We dont know yet whether this came to fruition, but Laura Wheaton, a senior fellow at the Urban Institute and one of the analysts behind the 2021 numbers, told us that it was clear from their analysis that the stimulus checks were driving a dramatic decline in poverty.

More broadly, the stimulus checks also cushioned workers during one of the worst economic crises in modern history, which likely helped the economy bounce back in record time. In April 2020, when Americans were receiving the first round of checks up to $1,200 with the CARES Act the unemployment rate was at a disastrous 14.7 percent. But two years later, its almost returned to its pre-pandemic levels, with many job openings. I hope we dont forget how awesome it was that we supported people so well, and that we recovered as quickly as we did, said Tara Sinclair, a professor of economics at George Washington University.

Read Also: Never Received 3rd Stimulus Check

What About American Expats

US citizens living abroad who have a valid Social Security number are eligible for stimulus checks. But many expats had trouble obtaining their payments during the first round.

Business Insider spoke with Nathalie Goldstein, CEO and cofounder of My Expat Taxes, about how expats can make the process easier this time around.

If you’re still waiting on your first stimulus check, Goldstein suggested electronically filing your 2020 tax return as soon as possible. You’ll be able to claim the first and second payments on Form 1040 . To get your money quickly, include direct-deposit information for a US bank account. The IRS will not send payments to non-US banks.

It’s unclear at this time whether the IRS will reopen its online tool to collect direct-deposit information if you don’t include it on your tax return. You’ll get a paper check if the IRS doesn’t have your bank details.

Goldstein said any expat who didn’t qualify for the first stimulus payment because their income was too high should consider claiming the Foreign Earned Income Exclusion on their 2020 taxes to lower their adjusted gross income and meet the income limits.

Lastly, expats who haven’t filed US taxes in the last three years can catch up on filing and claim both stimulus payments through the IRS’ streamlining procedure.

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Recommended Reading: Are We Getting Another Stimulus Pay

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

States Giving Stimulus Payments

Although a fourth federal stimulus payment isnt planned, some states are offering aid. California created the Golden State Stimulus payment, which is two rounds of assistance for low and middle-income residents who filed 2020 tax returns. Maryland also has a low-income direct payment of either $300 or $500.

Other states have offered career-specific assistance. According to CNet, Georgia, Colorado, Texas, California, Florida, Michigan, and Tennessee provided bonuses for educators. Vermont offered hazard pay to frontline workers who worked in the first months of the COVID-19 pandemic as well.

Also Check: Irs Stimulus Check Tax Return

Can Creditors Take My Check

Can back taxes or child support be taken out of the checks? The stimulus payments are not taxable and are not subject to garnishment by the government for back taxes or student loan defaults. The same is true for past due child support payments or private debtsfor the second and third stimulus checks.

Can my bank take my stimulus check? If your bank account is overdrawn because of overdrafts or outstanding fees, your bank may take part or all of your stimulus check to bring your account even. However, when the second stimulus check came out, many large banks stated that they would bring customers bank balances to zero, temporarily, so that customers could access their stimulus checks. This includes Bank of America, Wells Fargo, Citigroup, and JPMorgan Chase.

Also Check: Do You Have To Claim Stimulus Check On 2022 Taxes

Who Is Not Eligible For A Stimulus Check

- Dependents. Individuals that can be claimed as a dependent are not eligible. For qualifying children under 17, the taxpayer who claims him/her will receive the stimulus payment.

- Taxpayers without an SSN or TIN. In order to be eligible for a stimulus check, you must have a social security number or taxpayer identification number.

- Individuals who died before the payment was issued.

- Nonresident aliens.

Recommended Reading: How Are Stimulus Checks Distributed

Is A $600 Stimulus Check Enough

While the $600 payments are half the amount Americans received in the first round of stimulus, the legislation also extends unemployment benefits for 11 weeks, and provides funds for the Supplemental Nutritional Assistance Program, emergency rental assistance, childcare providers, and small businesses.

Prominent economists have repeatedly urged Congress to authorize more stimulus checks. In an open letter signed by 125 economists in November, they called stimulus checks an “essential tool” for keeping millions of families out of poverty during the pandemic.

During negotiations, many top Democratic lawmakers said $600 direct cash payments were insufficient. Before a deal was reached, a group of 17 progressive Democrats signed a letter to congressional leadership urging $2,000 stimulus checks, Business Insider’s Joseph Zeballos-Roig reported. Twitter users mocked the smaller check.

“This is just the first step. This is an emergency,” Senate Minority Leader Chuck Schumer said during a press conference after the checks were approved. “We need a second bill to continue dealing with the emergency and to start stimulating our economy so we get back to where we were. That will be job No. 1 in the new Biden administration.”