Will The Stimulus Affect My Taxes For This Year Or Next Year

None of the three stimulus checks are considered income, and therefore arent taxable. They wont reduce your refund or increase what you owe when you file your taxes this year, or next. They also wont affect your eligibility for any federal government assistance or benefits.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Does The American Rescue Plan Provide Additional Unemployment Benefits

Continuing the expanded unemployment aid established by the CARES Act and the Covid-19 Economic Relief Bill, this new pandemic relief legislation extends unemployment benefits through early September 2021. Those filing for unemployment benefits will remain eligible for $300 in aid per week on top of normal payments. The additional benefits are automatic, and recipients need only to continue filing biweekly claims with their state unemployment insurance agency.

The act also includes a new benefit for unemployed Americans in the form of a significant tax break. Individuals who collected unemployment during the 2020 tax year may waive federal income taxes on up to $10,200 of that money , provided they earned less than $150,000 in 2020.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Dont Miss: What Month Was The Third Stimulus Check

Don’t Miss: What Is The Third Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Recommended Reading: Whats The Update On The 4th Stimulus Checks

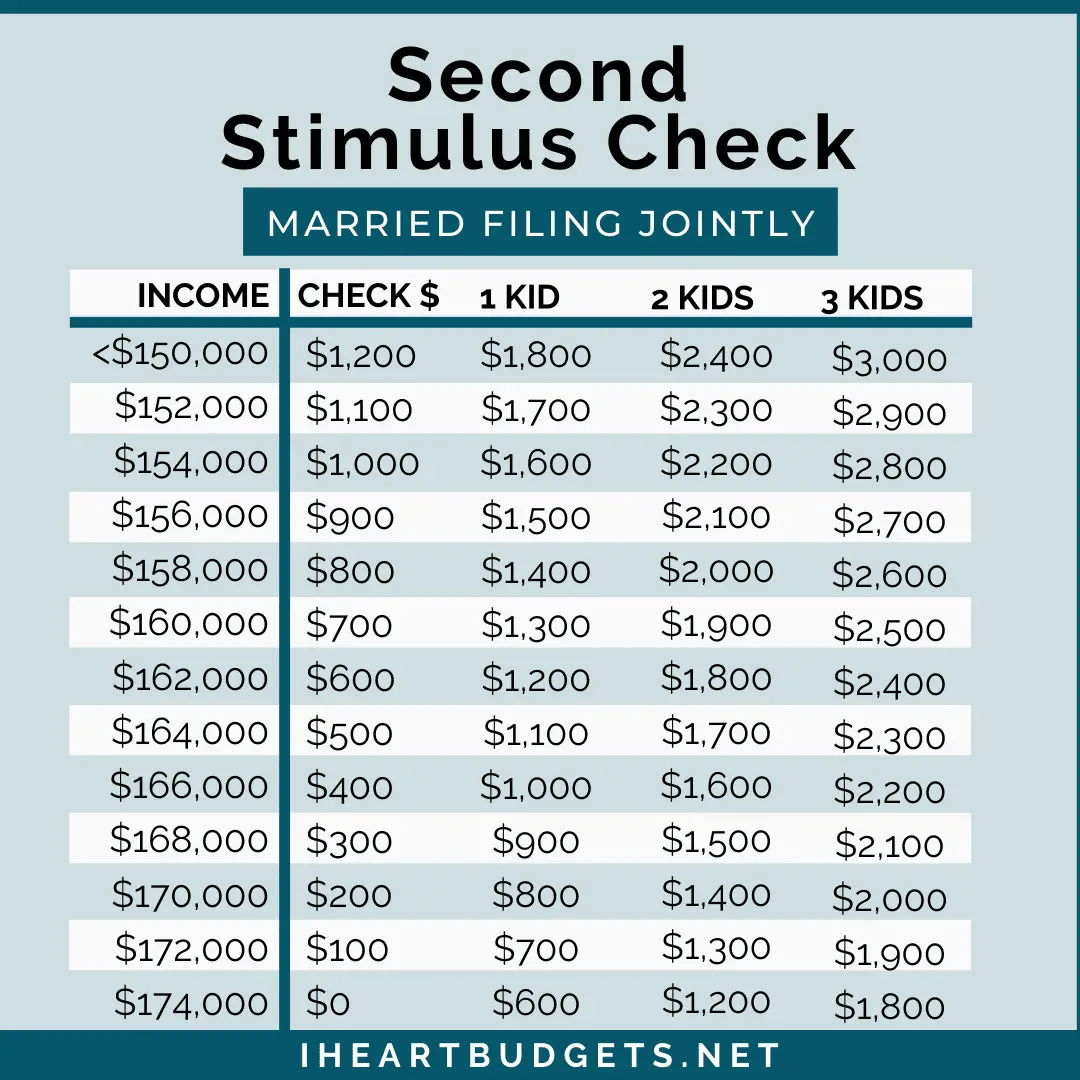

What Income Level Triggers A Payment Reduction

As mentioned above, second stimulus checks will be phased-out for people at certain income levels. Your check will be gradually reduced to zero if you’re single or married filing a separate tax return with a 2019 adjusted gross income above $75,000. If you’re married filing a joint tax return or a qualifying widow, the amount of your second stimulus check will drop if your AGI exceeds $150,000. If you claim the head-of-household filing status on your tax return, your payment will be reduced if your AGI tops $112,500. The Second Stimulus Check Calculator above will do all the math for you!

You May Like: How To Find Stimulus Check History

What About Next Year

Depending on whether or not you had a child in 2021, you will be qualified for more money from the government. You will likely get $1,400 upon filing your 2022 taxes, according to Forbes and Insider. Not only will a $1,400 check come to new parents if they land in a certain income threshold, but there is also an expanded child tax credit that could come into effect. That means more money for you and your family just for expanding your family.

The payments that parents have received in 2021 and will continue to receive are actually advanced payments for 2022. Theres also a reason that youve only received half of the $3,600. Thats because Congress built into the stimulus package that parents would receive some now and some later. That later is in 2022. So youll be getting potentially $1,800 or $1,500 next year.

Hawaii: State Tax Rebates

Many residents in Hawaii have already received their one-time tax rebate but for people who will receive physical checks, those only started in October and are going out slowly in small batches due to a paper shortage, says Hawaii News Now.

Each person in a household is eligible to receive $300, even dependents, so a family of four could get $1,200. The stipulation is that single residents had to earn under $100,000 or under $200,000 for a couple filing jointly. Those above those thresholds will have their rebate amount reduced to $100.

Also Check:

Also Check: Who Qualified For Stimulus Checks In 2021

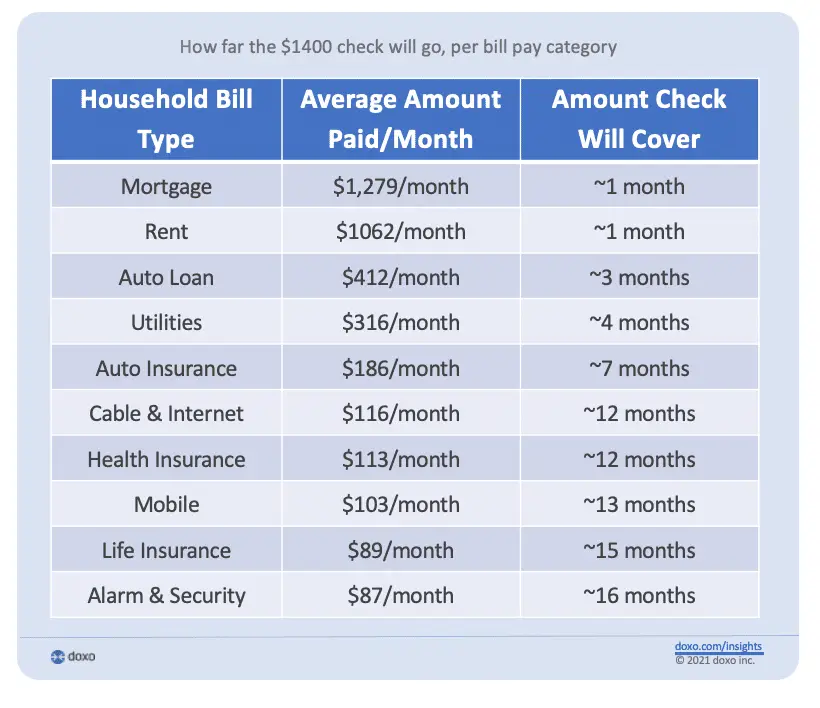

How Much Are The Payments Worth

The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600.

Families are allowed to receive up to $1,400 for each dependent of any age. Earlier rounds limited the payments to dependents under the age of 17.

Generally, low- and middle-income US citizens and US resident aliens are eligible for either a full or partial third-round stimulus payment.

Individuals earning less than $75,000 of adjusted gross income, heads of households earning less than $112,500 and married couples earning less than $150,000 are eligible to receive the full amount of $1,400 per person.

But the payments gradually phase out as household income increases. Individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 are not eligible for any money regardless of how many dependents they have.

Undocumented immigrants who dont have Social Security numbers are not eligible for the payments. But their spouses and children are eligible as long as they have Social Security numbers.

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

Don’t Miss: How Much Was Stimulus Check

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Also Check: How Much Was Second Stimulus Check

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Recommended Reading: How Many Stimulus Checks Have Been Sent

Is There An Income Limit To Receive A Stimulus Check

Yes. An individual with an AGI of up to $75,000 would receive the full $1,400 check a couple filing jointly with an AGI of up to $150,000 would receive $2,800 . A head-of-household filer with an AGI of up to $112,500 would receive the full $1,400 check.

The amount of the stimulus check is reduced once AGI exceeds these limits. An individual with an AGI at or above $80,000 would not receive a stimulus check. A couple filing jointly would not receive a stimulus check once AGI is at or above $160,000. Someone filing as head of household with an AGI at or above $120,000 would not receive a stimulus check.

Stimulus Checks: $804 Billion

The US government has sent $804 billion directly to low- and middle-income individuals and families via three rounds of stimulus payments that were delivered via direct deposit, checks or debit cards.

Each round had slightly different qualifying parameters, but lawmakers purposely didnt put too many limitations on the checks in order to get the cash out as quickly as possible. The lowest-income Americans got the full amount and the value gradually phased out for those earning more. The first round, which sent payments worth up to $1,200 per person, cost taxpayers the most $388 billion. The second round of payments were worth up to $600 per person and cost $142 billion.

Lawmakers narrowed eligibility for the last round so that it excluded individuals who earn at least $80,000 a year and families who earn at least $120,000 a year. The IRS has sent $1,400 per person this year, at a cost of $274 billion to date.

Some states, like California and , have issued their own stimulus payments to some residents in addition to the federal money.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

Recommended Reading: How Much Is The Last Stimulus Check

Read Also: H& r Block Stimulus Tracker

Do The 62f Tax Refunds Favor Wealthy Bay Staters

There has been some criticism and concern that the Massachusetts 62F tax refunds favor high income residents. Thats in part because the refund amounts are based on a flat percentage.

A Massachusetts Budget and Policy Center analysis puts the likely average amount of the tax refund at about $529 for an average Massachusetts taxpayer. However, data from 2018 indicate that lower income taxpayers could receive tax refunds that are less than $10, while 2020 data show that taxpayers with incomes over $1 million could receive more than $28,000, on average.

Overall, the Massachusetts Budget and Policy Center concluded that almost 75% of the nearly $3 billion in tax refunds will go to people whose incomes are in the top twenty percent of Massachusetts income distribution.

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Recommended Reading: How To Apply For Stimulus Check Online

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Can I Use The Calculator If I Havent Filed A Tax Return For 2020

Yes, you can use your 2019 tax return. The IRS emphasizes that if you use your 2020 return to estimate your payment, dont guess your AGI: File an accurate return first. Adjusted gross income, as the name implies, is your gross income minus certain adjustments such as educator expenses, student loan interest, alimony payments and qualifying contributions to retirement accounts. You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return.

If you werent able to claim your earlier $1,200 or $600 stimulus checks, you can do so on your 2020 tax returns. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

Read Also: News On Fourth Stimulus Check

Stimulus Checks 202: These States Are Sending Out Tax Rebates In December

Taxpayers in numerous states are still receiving special one-time refunds. Are you one of them?

Many states decided to give residents a bonus tax refund or stimulus check this year to help with ongoing inflation. Some have finished issuing payments already but, elsewhere, checks are still rolling in.

South Carolina started issuing for up to $800 in October and will continue through the end of December. The income tax rebates were approved by state lawmakers as part of this year’s $8.4 billion budget.

Massachusetts only began returning $3 billion in surplus tax revenue in November. The payments, equal to about 14% of a individual’s 2021 state income tax liability, are expected to continue to be issued at least through about Dec 15.

Your state could be sending out a rebate or stimulus check, too. Below, see if you qualify and how much you could be owed. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Recommended Reading: Who Are Getting Stimulus Checks

Read Also: Sign Up For Stimulus Check 2022

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.