First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Stimulus Checks: $804 Billion

The US government has sent $804 billion directly to low- and middle-income individuals and families via three rounds of stimulus payments that were delivered via direct deposit, checks or debit cards.

Each round had slightly different qualifying parameters, but lawmakers purposely didnt put too many limitations on the checks in order to get the cash out as quickly as possible. The lowest-income Americans got the full amount and the value gradually phased out for those earning more. The first round, which sent payments worth up to $1,200 per person, cost taxpayers the most $388 billion. The second round of payments were worth up to $600 per person and cost $142 billion.

Lawmakers narrowed eligibility for the last round so that it excluded individuals who earn at least $80,000 a year and families who earn at least $120,000 a year. The IRS has sent $1,400 per person this year, at a cost of $274 billion to date.

Some states, like California and , have issued their own stimulus payments to some residents in addition to the federal money.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

Recommended Reading: How Much Is The Last Stimulus Check

What About Social Security Beneficiaries

Many federal beneficiaries who filed 2019 or 2020 returns or used the Non-Filers tool last year were included in the first two batches of payments, if eligible, according to the IRS.

For federal beneficiaries who didnt file a 2019 or 2020 tax return or didnt use the Non-Filers tool, the IRS said it is working directly with the Social Security Administration, the Railroad Retirement Board and the Veterans Administration to obtain updated 2021 information to ensure that as many people as possible are sent automatic payments.

Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits, according to the agency.

More information about when these payments will be made will be provided on IRS.gov as soon as it becomes available, the IRS said.

Contributing: Kelly Tyko, USA TODAY

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

Don’t Miss: How Many Stimulus Checks Do We Get

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Dont Miss: Amount Of Third Stimulus Check

How Did The Irs Know Where To Send My Check

The IRS used the information it already had to issue stimulus payments.

If you had direct deposit information on file with the IRS, you should have received your payment via direct deposit.

If you didnt have direct deposit information on file with the IRS, you should have received your payment as a check or debit card in the mail.

Read Also: Is There Going To Be Anymore Stimulus Checks

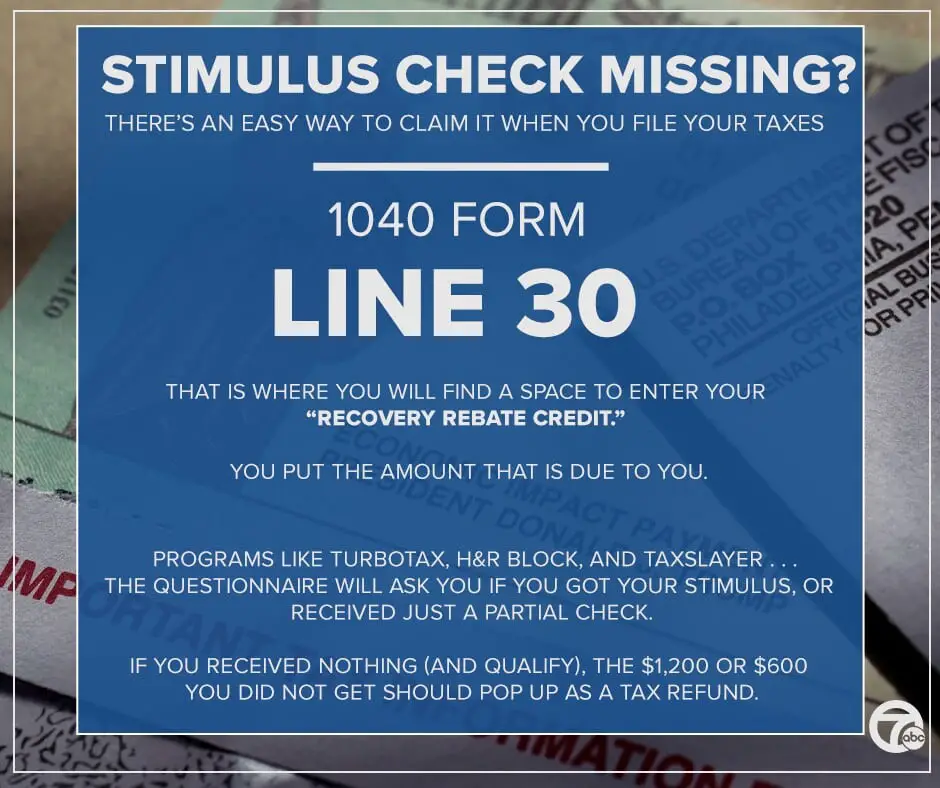

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

How Much Is The Third Economic Impact Payment

Those eligible will automatically receive an Economic Impact Payment of up to $1,400 for individuals or $2,800 for married couples, plus $1,400 for each dependent. Unlike EIP1 and EIP2, families will get a payment for all their dependents claimed on a tax return, not just their qualifying children under 17. Normally, a taxpayer will qualify for the full amount if they have an adjusted gross income of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household and up to $150,000 for married couples filing joint returns and surviving spouses. Payment amounts are reduced for filers with incomes above those levels.

You May Like: When Was Stimulus Check 3

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

How Much Was The Second Stimulus Check

The second stimulus check was $600 per adult and $600 per child.

$600 , plus

an amount equal to the product of $600 multiplied by the number of qualifying children ) of the taxpayer.

-SEC. 6428A. ADDITIONAL 2020 RECOVERY REBATES FOR INDIVIDUALS.

The second stimulus checks got sent out starting around December 29th, 2020.

Also Check: Social Security Stimulus Checks Update

Who Else Is Eligible To Receive A Stimulus Payment

As with the previous pandemic-related stimulus payments, gig economy workers, self-employed individuals and Americans on unemployment, disability, Social Security or other federal aid are also generally eligible for stimulus checks, provided they filed federal income taxes in 2020 or 2019 and meet the income thresholds.

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Recommended Reading: How To Find Out How Many Stimulus Checks I Received

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Recommended Reading: Criteria For Stimulus Check 2021

Do You Report Stimulus Check On Tax Return 2021

They letter explains that if you received advance CTC payments, you’ll need to report that amount in your tax return. … If you’re eligible for RRC, you’ll need to file a 2021 tax return to claim your remaining stimulus amount. You can check the Economic Impact Payment amounts by logging into your IRS online account.

How Do I Find The Stimulus Payment Amount I Received

Refer to your Notice 1444 for the payment amounts you were issued. If you don’t have this notice, you may be able to find it in your bank account history.

Most people receive their payments automatically. If you used a bank account for your refund or taxes due on your most recent tax return, your payment was most likely sent by direct deposit to that account. If you chose to receive your refund on a TaxSlayer Visa® Debit Card issued by Green Dot Bank, you may have received it on that card.

Otherwise, they should have been mailed to your last known address.

You May Like: How To Claim Stimulus Check 2021

How Do I Know If Im Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, youre due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

You May Like: 3rd Stimulus Check 2021 Amount

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.