Stimulus Checks 202: Which States Are Still Sending Payments

The final federal stimulus checks were sent in 2021. However, for more recent economic burdens facing Americansmost notably, high inflationthere hasnt been any such relief from Uncle Sam.

Luckily, several states stepped in and helped their residents with their own stimulus check payments in 2022. So here comes the question: Will states do the same in 2023? Well, were here to give you some good news.

Yes, a handful of those states will still be sending stimulus checks in 2023. Who could still get a check, when will the check arrive, and how large will the check be? All these answers vary from state to state.

Check out the basic details listed below to see if a check with your name on it could be arriving soon!

Covid + Credit: 4 Things To Know About Stimulus Checks & The Cares Act

Reading Time: 7 minutes

The $2 trillion Coronavirus Aid, Relief, and Economic Security Act, approved in late March by Congress, provides relief across the economic spectrum provided you can understand every opportunity the massive piece of legislation offers. With news during the Coronavirus/Covid-19 pandemic breaking at a rapid pace, it can be hard to decipher the legislative efforts aimed at helping you. Were here to guide you through that process. Here are four things to know about the CARES Act.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Don’t Miss: Never Received Any Stimulus Checks

Will My Third Stimulus Check Be Reduced

The number the IRS will look at is your adjusted gross income for 2020, which is your income without retirement contributions but before your standard or itemized deductions are taken out. You can find your adjusted gross income on line 11 of your Form 1040 of your 2020 tax return. If you havent yet filed your 2020 tax return, the IRS will use your AGI from your 2019 tax return.

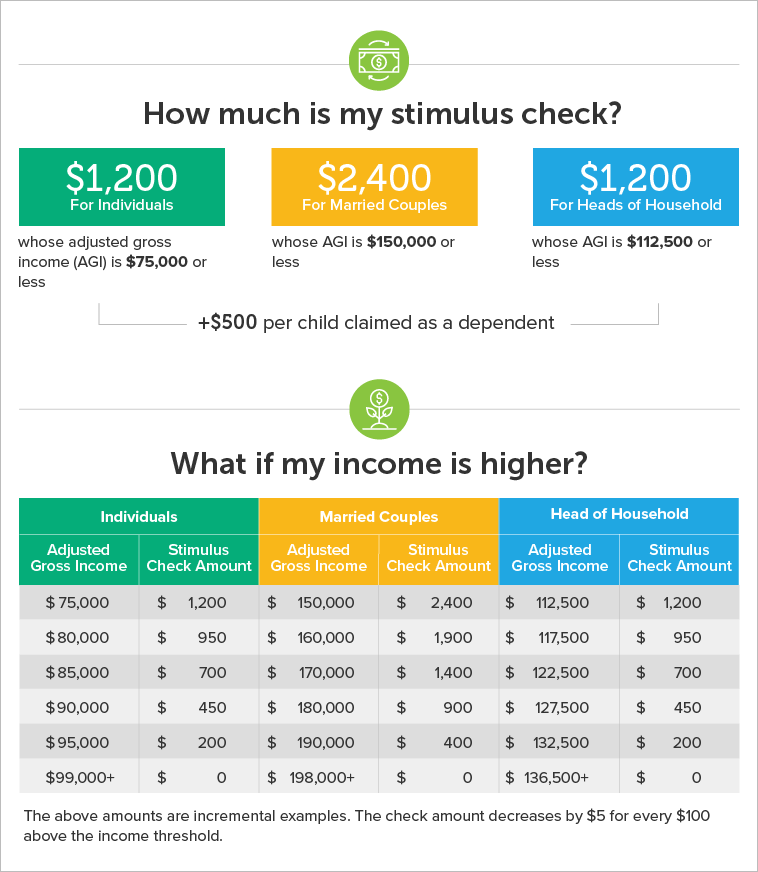

Single people who make between $75,000 and $80,000 will have their checks reduced by 28% of the amount over $75,000, and married people who file joint returns and make between 150,000 and $160,000 will have their checks reduced by the same percentage of the amount over $150,000. Taxpayers who file as head of household and make between $112,500 and $120,000 will have their checks reduced by a similar percentage of the amount over $112,500. The $1,400 that parents receive for each dependent is subject to the same reduction.

This means that single people who earned $80,000 or more in 2020 dont qualify at all for the third stimulus checkcompared with $87,000 for the second stimulus check. Couples who earned $160,000 or more wont get a third stimulus check, down from $174,000 for the second stimulus check. And a family of four that earned $160,000 or more also wont receive a third stimulus check.

How Do You Track Your Payments

You can check the status of your stimulus payment on IRS.gov using the Get My Payment tool. If you receive the notice Payment Status Not Available, it indicates one of the following situations:

- The IRS does not have enough information

- Your payment has not been processed yet

- Youre not eligible for a payment

If you believe you are eligible for a payment, check the Get My Payment tool over the coming weeks, as the IRS continues to process payments.

Also Check: What Was The First Stimulus Check Amount

The Last Of The $1400 Stimulus Checks Will Get Distributed To Eligible Parents This Tax Season

The third round of stimulus checks went out to more than 169 million U.S. taxpayers last year. The consensus on Capitol Hill remains that the $1,400 stimulus checksthe largest payment of the three roundswill be the last of the COVID-19 direct payments.

That said, the IRS hasnt finished sending out that third round: Another $1,400 stimulus checks will go out to eligible parents and guardians of 2021 newborns once the 2021 tax returns are filed this year. Thats because when the IRS sent out the $1,400 checks last year, it used taxpayers last tax return on filewhich, of course, wouldnt have included any children born in 2021. Thats why the check will get applied to parents and guardians 2021 tax returns, according to reporting by Fortune and Insider.

But having a 2021 newborn alone wont score parents and guardians that additional check. They will also need to meet the income eligibility requirements. To get the payment, single filers would need to make no more than $75,000 per year in adjusted gross income, while couples filing jointly would need to stay below $150,000. Parents earning above those levels would see their checks reducedand be completely phased out if theyre a single filer earning above $80,000 or a couple filing jointly earning above $160,000.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.

Also Check: Irs Sign Up For Stimulus

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didn’t get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Also Check: How Much Was 3rd Stimulus Check 2021

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments end at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

Whos Eligible For Child Tax Credit

Most families are eligible for CTC, as long as the children are either a US citizen, US national, or a so-called US resident alien.

The children must also have lived with the person whoâs claiming for more than half of the tax year and be claimed as a dependent on the tax return.

This can be a son, daughter, stepchild, foster child, brother, sister, stepbrother or stepsister, but may also be a grandchild, niece or nephew.

The credit reduces in value depending on how much you earn.

The full CTC will be available to individuals who earn up to $75,000 and couples earning up to $150,000.

From there, the credit will then be reduced by $50 for every additional $1,000 of adjusted gross income earned.

You can check if youâre eligible for the credit by using an IRS online tool.

To use it, youâll need to know your filing status, whether you can claim the person as a dependent and the personâs date of birth.

Also Check: Will There Be Another Stimulus Check In 2020 To

Also Check: How To Check If Received Stimulus Check

Remaining Federal Stimulus Payments

The three stimulus checks, each in a different amount, were available to those who made less than $75,000 annually or joint filers who made less than $150,000 annually. Per Washington Examiner, if you don’t file taxes because of how little money you make, you have until November 15 to determine if you qualify for any relief payments by completing a simple tax return form.

The federal government’s Child Tax Credit, which issued payments from July to December 2021 with the intention of assisting individuals with children avoid financial difficulties and food poverty, was available to the majority of parents. Congress authorized three rounds of stimulus payments totaling $931 billion to help those affected by the coronavirus pandemic in 2020 and 2021.

The final COVID-19 stimulus bill was approved by President Joe Biden in March 2021, and two of the stimulus check payments were signed into law by the then-President Donald Trump in 2020.

Read Also: Missing Arkansas Pregnant Woman Found Dead, Separated from Unborn Child in Missouri

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Also Check: How Many Stimulus Checks Were In 2021

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the Recovery Rebate Credit. You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds youre owed.

Its possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldnt submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

Payments Are Automatic For Eligible Taxpayers

Payments are automatic for eligible taxpayers who filed a 2019 tax return, those who receive Social Security retirement, survivor or disability benefits , Railroad Retirement benefits as well as Supplemental Security Income and Veterans Affairs beneficiaries who didnt file a tax return. Payments are also automatic for anyone who successfully registered for the first payment online at IRS.gov using the agencys Non-Filers tool by November 21, 2020 or who submitted a simplified tax return that has been processed by the IRS.

You May Like: Who Will Receive The Next Stimulus Check

Do I Qualify And How Much Will I Receive

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, the IRS will use information from your 2019 or 2018 tax return or information that you provide to see if you qualify for an Economic Impact Payment.

To qualify for a payment, you must:

- Be a U.S. citizen or U.S. resident alien

- Not be claimed as a dependent on someone elses tax return

- Have a valid Social Security Number . Or if you or your spouse is a member of the military, only one of you needs a valid SSN

- Have an adjusted gross income below a certain amount that is based on your filing status and the number of qualifying children under the age of 17. If you are not required to file taxes because you have limited income, even if you have no income, you are still eligible for payment.

You may be eligible based on the criteria below, even if you arent required to file taxes. If you qualify, your Economic Impact Payment amount will be based on your adjusted gross income, filing status, and the number of qualifying children under age of 17. You will receive either the full payment or a reduced amount at higher incomes.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: When Will I Get My Stimulus

Stimulus Checks Are Tax Credit Advances

According to tax attorney Kelly Phillips Erb, its important to understand that the CARES Act views the economic impact payments as tax credits on your 2020 income.

Basically, the money you received this year, based on your 2019 or 2018 income, is a tax credit paid in advance, Erb says. So, if youve lost income and now you meet the threshold, youre eligible to claim that credit when you file your 2020 tax return.

Before you get worried about the advance tax credit portion of the legislation, though, Erb points out that theres no clawback provision. So, if you received a stimulus check based on your 2018 or 2019 income, but you will earn too much in 2020 to qualify you for the stimulus check, nothing will happen. You still get to keep the money.

You May Like: Still No 3rd Stimulus Check

How Does The Irs Calculate Eligibility For The Third Stimulus Package

To calculate the stimulus payment the IRS will use the information about your income from the 2019 tax return if your 2020 tax return isnt filed and processed yet.

The payment also depends on how many dependents you have, if you file separately or jointly, and on your gross adjusted income .

There is one more thing that the government is trying to do: to target the households that need money the most and to support businesses during the hard times.

What else is new? All dependents can qualify for an additional $1,400 payment. For example, elderly relatives and college students age 23 or younger can qualify for the check.

You May Like: First Second And Third Stimulus Checks

Will Future Relief Efforts Fill In These Gaps

Congress is negotiating the next aid package. Senate Republicans propose $600 billion to refund the PPP. House Democrats would like to include a $60 billion plan to fund community development financial institutions. These are credit unions and community banks that can reach out to the unbanked businesses that dont have a banking relationship.

The bill also includes additional funding for extended unemployment and health benefits. It would add funds for hospitals and community health centers. It would include hazard pay for health care workers and other essential services. The bill would provide more funding for state and local governments. Unlike the federal government, they cannot run a budget deficit. Lower taxes means less revenue, threatening their ability to provide essential services.