Who Gets A Third Stimulus Check Who Doesn’t

If you’re an American citizen or what’s officially called a “resident alien,” you’re probably eligible for the third stimulus payment. This includes incarcerated people and those living abroad, but not taxpayers above a certain income level.

In addition, the American Rescue Plan says people will receive “$1,400 multiplied by the number of dependents of the taxpayer for such taxable year.” Unlike with the first and second round of payments, there’s no age limit for the third stimulus check. College students and adult dependents qualify for the payments, but most won’t receive the deposits themselves. Dependent stimulus checks will be sent to the taxpayer who claims them on their returns.

Basically, anyone who’s not a nonresident alien or someone else’s dependent is eligible to get the direct payment. Deceased people and those without valid Social Security numbers for employment didn’t qualify for previous EIPs, either.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Stimulus Check Qualifications: Find Out If You’re Eligible For $1400 Or More

The rules aren’t the same for who qualifies for a third stimulus check this time around. Here’s how to find out if you’re eligible to receive the $1,400 payment.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Associate Producer

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

The third stimulus checks are hitting the 130 million mark by direct deposit and as paper checks and EIP cards. A third wave of checks is ramping up for this weekend and next week. If your check for up to $1,400 per household member hasn’t come yet, it’s a good idea to triple-check your eligibility. If you do, here’s how to track your payment and what to do if there’s a problem with your check.

The requirements for the third payment have changed significantly from the first and second checks. For example, there are new income limits and rules for age, citizenship and tax status that can affect the size of your payment. We’ll walk you through what those qualifications are to help you determine whether you should expect a check — or whether you’ll be completely left out.

Read Also: Irs Phone Number For Stimulus Check 2021

How Much Were The Stimulus Checks

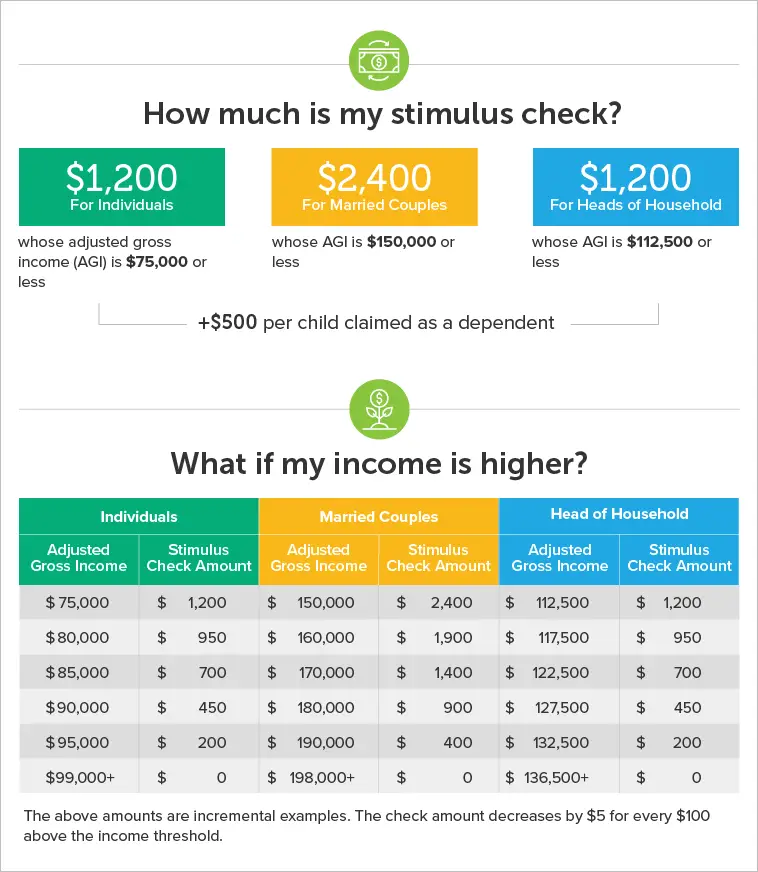

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Recommended Reading: Who’s Eligible For 3rd Stimulus Check

Check If You Qualify For The Golden State Stimulus Ii

To qualify, you must have:

- Filed your 2020 taxes by October 15, 2021

- Had a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year. For this information refer to:

- Line 17 on Form 540

- Line 16 on Form 540 2EZ

- Had wages of $0 to $75,000 for the 2020 tax year

- Been a California resident for more than half of the 2020 tax year

- Been a California resident on the date payment is issued

- Not been claimed as a dependent by another taxpayer

- A dependent is a qualifying child or qualifying relative. Go to FTB Publication 1540 for more information about a qualifying child and qualifying relative

To receive your payment, you must have filed a complete 2020 tax return by .

If you dont qualify for GSS II, you may qualify for GSS I.

Long Beach Social Security Disability Attorneys

If you or a loved one is unable to work due to a disabling injury, medical condition or disease our skilled and experienced Social Security Disability Attorneys are here to help you get the maximum SSDDI benefits for which you qualify.

The Law Office of Cantrell Green is a group of highly qualified and experienced disability attorneys who have obtained millions of dollars in Social Security Disability benefits for thousands of clients in Long Beach, Orange County and the greater Los Angeles. Our attorneys care about every client, and fight tirelessly to obtain the benefits you deserve.

Recommended Reading: New York Stimulus Check 4

State And City Stimulus Checks

Congress has yet to agree on a fourth federal stimulus check, leaving many states to come up with their own programs to help eligible residents.

In California, the Golden State Stimulus II program offers residents over $568million in extra funding through the end of the year.

The program is for residents who have been financially impacted as a result of the pandemic.

Over half a million residents received $285 checks in Maine. In Maryland, qualifying residents can receive a check worth between $300 to $500.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: Contact Irs About Stimulus Payment

Citizenship: Does The Irs Consider My Household Mixed

In the $900 billion stimulus package from December, a US citizen and noncitizen spouse were both eligible for a payment as long as they both had Social Security numbers. This has been referred to as a “mixed-status” household when it comes to citizenship. Households with mixed US citizenship were left out of the first check.

The new stimulus bill includes all mixed-status households where just one member has a Social Security number for a third stimulus check. That potentially includes families with citizen children and noncitizen parents.

In the CARES Act from last March, households with a person who wasn’t a US citizen weren’t eligible to receive a stimulus check, even if one spouse and a child were US citizens.

How To Get Your Stimulus Check

Using stimulus funds can help you manage your entire financial picture, including getting a handle on The guide helps you understand if you are eligible in these cases:

- If you havent filed federal taxes or have no income

- If you dont have a bank account or a pre-paid debit card

- If you have moved since you last filed taxes

- If you receive Social Security Benefits

- If youve already filed taxes and are signed up for direct deposit

The vast majority of Americans will be eligible to receive a third stimulus check from the federal government. Even if you have no income, you are still eligible but need to take action.

Also Check: Get My Stimulus Payment Phone Number

Will My Third Stimulus Check Be Reduced

The number the IRS will look at is your adjusted gross income for 2020, which is your income without retirement contributions but before your standard or itemized deductions are taken out. You can find your adjusted gross income on line 11 of your Form 1040 of your 2020 tax return. If you haven’t yet filed your 2020 tax return, the IRS will use your AGI from your 2019 tax return.

Single people who make between $75,000 and $80,000 will have their checks reduced by 28% of the amount over $75,000, and married people who file joint returns and make between 150,000 and $160,000 will have their checks reduced by the same percentage of the amount over $150,000. Taxpayers who file as head of household and make between $112,500 and $120,000 will have their checks reduced by a similar percentage of the amount over $112,500. The $1,400 that parents receive for each dependent is subject to the same reduction.

This means that single people who earned $80,000 or more in 2020 don’t qualify at all for the third stimulus checkcompared with $87,000 for the second stimulus check. Couples who earned $160,000 or more won’t get a third stimulus check, down from $174,000 for the second stimulus check. And a family of four that earned $160,000 or more also won’t receive a third stimulus check.

Individuals With An Ssn

- Qualified for GSS I and claimed a credit for at least one dependent: $500

- Didnt qualify for GSS I and did not claim a credit for any dependents: $600

- Didnt qualify for GSS I and claimed a credit for at least one dependent: $1,100

- Qualified for GSS I and didnt claim a credit for any dependents: $0

Recommended Reading: Is The Homeowners Stimulus Real

When Will The Second Stimulus Checks Be Delivered

The IRS is already delivering stimulus funds. Some individuals have already received theirs via direct deposit. And more funds go out each day. If you have direct deposit information on file with the IRS, they will deposit funds directly into that account. If you dont have current direct deposit information on file with the IRS but who are eligible, a check or a debit card will be sent by mail. You can claim the Economic Impact Payments on your 2020 tax return in 2021 if you are eligible but dont receive them.

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Read Also: Nc $500 Stimulus Check Update

How Big Are The Stimulus Payments And Who Is Eligible

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The stimulus payments will be $1,400 for most recipients. Those who are eligible will also receive an identical payment for each of their children.

To qualify for the full $1,400, a single person must have an adjusted gross income of $75,000 or below. For heads of household, adjusted gross income must be $112,500 or below, and for married couples filing jointly that number has to be $150,000 or below.

To be eligible for a payment, a person must have a Social Security number.

The Last Of The $1400 Stimulus Checks Will Get Distributed To Eligible Parents This Tax Season

The third round of stimulus checks went out to more than 169 million U.S. taxpayers last year. The consensus on Capitol Hill remains that the $1,400 stimulus checksthe largest payment of the three roundswill be the last of the COVID-19 direct payments.

That said, the IRS hasnt finished sending out that third round: Another $1,400 stimulus checks will go out to eligible parents and guardians of 2021 newborns once the 2021 tax returns are filed this year. Thats because when the IRS sent out the $1,400 checks last year, it used taxpayers last tax return on filewhich, of course, wouldnt have included any children born in 2021. Thats why the check will get applied to parents and guardians 2021 tax returns, according to reporting by Fortune and Insider.

But having a 2021 newborn alone wont score parents and guardians that additional check. They will also need to meet the income eligibility requirements. To get the payment, single filers would need to make no more than $75,000 per year in adjusted gross income, while couples filing jointly would need to stay below $150,000. Parents earning above those levels would see their checks reducedand be completely phased out if theyre a single filer earning above $80,000 or a couple filing jointly earning above $160,000.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.

Also Check: Irs Sign Up For Stimulus

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Also Check: Irs Stimulus Check Sign Up

Do I Have To Do Anything To Get My New Stimulus Payment

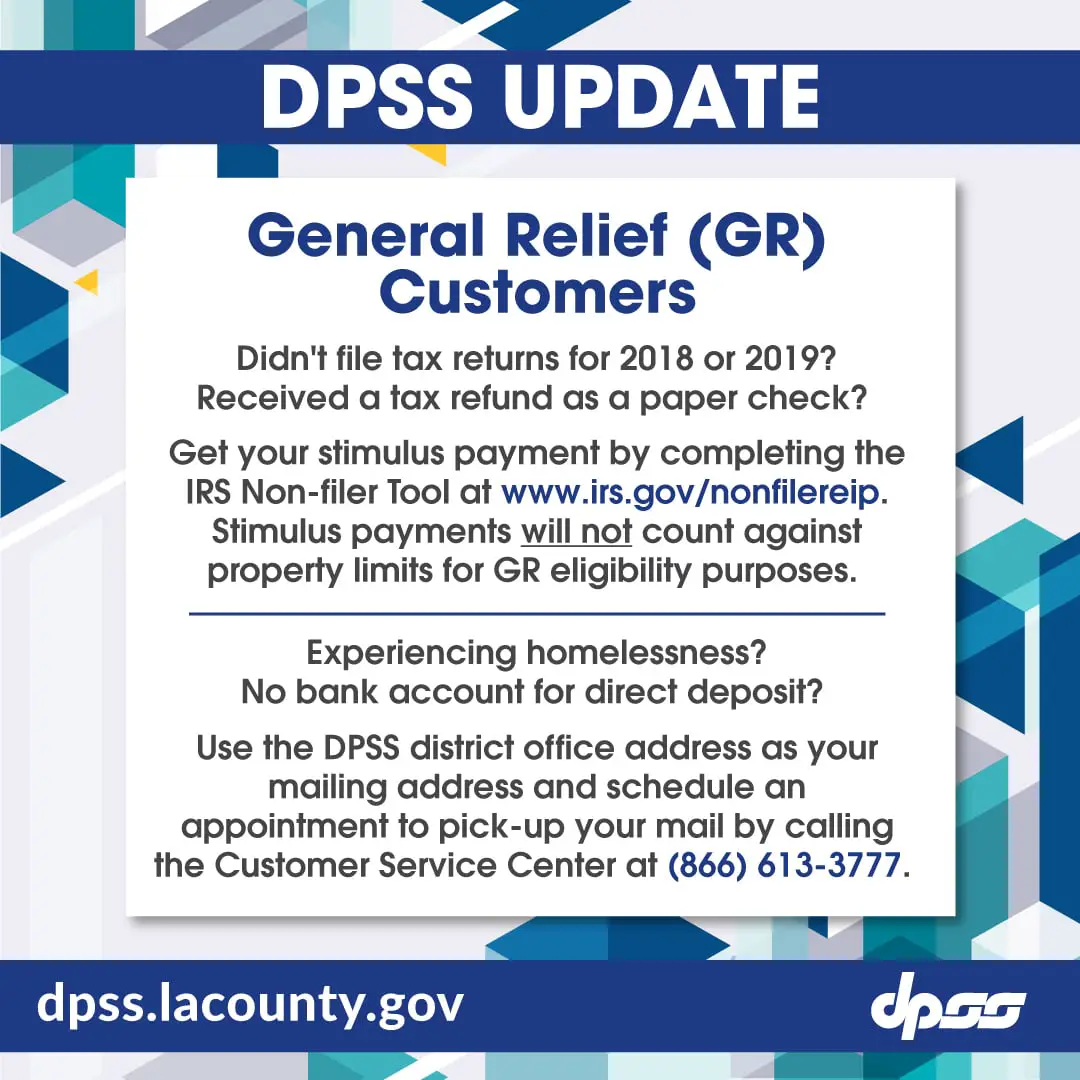

According to the IRS, individuals who receive Social Security Disability, Social Security Retirement, and Supplemental Security Income should automatically receive stimulus payments.

If you receive SSI or SSDI benefits as your only form of income, you are not required to file a federal income tax return in 2018 or 2019 to receive a stimulus check.