Are My Dependents Eligible With This Check

As a rule, dependents are not eligible for their own checks, but they do contribute to the total your household can receive. In many cases, it can multiple your familys total.

In the third stimulus check, dependents of every age count toward $1,400. If youre a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments for your new dependent last year. You can also get $1,400 for a baby born in 2021. Note that if your household exceeds the strict income limits, you wont receive any stimulus check money, even if you have dependents.

With the second stimulus check approved in December, each child dependent age 16 and younger added $600 each to the household payment. There was no cap on how many children you could claim a payment. That was an increase in the amount per child from the $500 that was part of the first check approved last March as part of the CARES Act, even as the per-adult maximum decreased from $1,200 per adult to $600 in the December stimulus plan.

The final qualifications for a third stimulus check have been settled.

Read Also: Irs Social Security Stimulus Checks Direct Deposit 2022

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

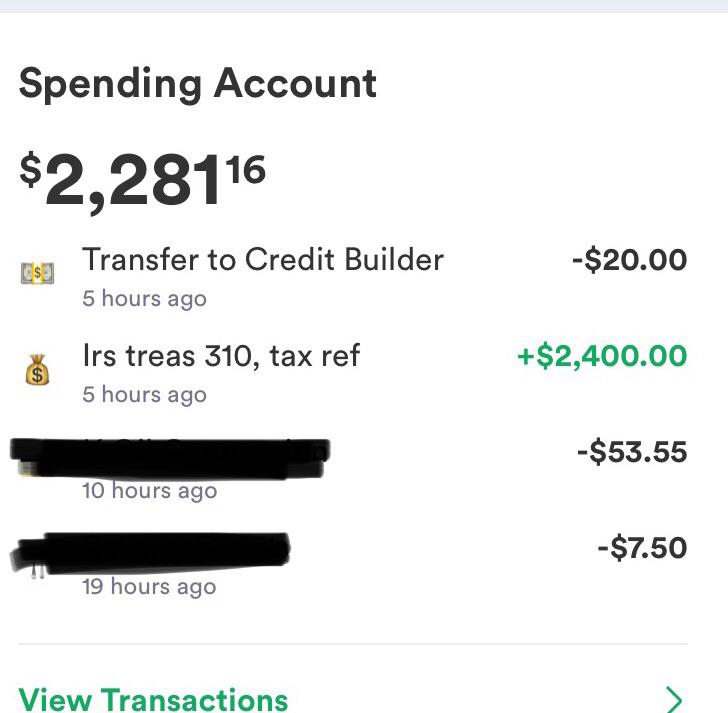

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

How Do I Find Out How Many Stimulus Checks I Received In 2021

Asked by: Mr. Devante West

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

Recommended Reading: New Stimulus Check 2022 Update

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

How Much Is The Stimulus Check Reimbursement

If we qualify, the check can be up to $1,400. This check is only a one-time direct check, so no one should expect a monthly stimulus check, as with Social Security.

Remember that the amount of the check depends on the taxes paid and the money paid in. If you have filed your return on time, the IRS will pay you the check. This process is automatic and always happens in case the citizen really deserves it.

Don’t Miss: Stimulus Check For 18 Year Olds

The Irs Classifies Me As An Older Adult What Should I Know

Many older adults, including retirees over age 65, received a first stimulus check under the CARES Act and were eligible for the second one — and are for the third as well. For older adults and retired people, factors like your tax filings, your AGI, your pension and if you’re part of the SSI or SSDI program will affect whether you receive a stimulus payment.

The third stimulus check makes older adult dependents eligible to receive more money on behalf of the household. Here’s how to determine if you qualify for your own stimulus check or count as a dependent.

How much stimulus money you could get depends on who you are.

How Can You Correct Mistakes

The IRS sends out Notice 1444 by mail within 15 days of making a direct deposit or sending a paper check. That letter will tell you the amount of your stimulus payment and how it was made. The letter also provides instructions on fixing issues with your payment.

Don’t Respond to Telephone Calls or Texts About Your Stimulus Check

The IRS will not call, text, or email you about your stimulus payment. The Federal Trade Commission is warning that thieves are posing as government employees to prey on stimulus payment recipients. These scammers may ask for your personal information or threaten you that if you don’t send the money back in the form of money transfers or gift cards, you’ll lose your drivers’ license. Ignore these communications.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Don’t Miss: Haven’t Got My Stimulus

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Don’t Miss: How Much 2021 Stimulus Check

What You Need To Know About Your 2020 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Can Children Collect Their Own Paychecks From Social Security In The United States

Everyone always celebrates when they receive a cash infusion. That is why the United States government added the stimulus check system last year. Despite this, many citizens did not receive the full amount they were supposed to receive, and that is because the stimulus checks from the third mailing have already run out. However, millions of citizens may not have these checks.

But there is no need to despair about this, as we still have time to claim these stimulus checks. To do so, we must follow a procedure that will help us to finally obtain the amount of money destined. The best thing about these cases is that the IRS has open communication channels to contact them directly.

Even so, many citizens do not know that their stimulus checks received are actually less than they should be. So sometimes it is a good idea to contact an advisor to help confirm that this is not the case. It is surprising how many cases the money a citizen should receive is not sent in full.

Also Check: Get My Stimulus Check Payment

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Don’t Miss: Didn’t Get Stimulus Payment

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Eligibility For A ‘plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending “plus-up payments” to make up the difference. If you don’t get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

You May Like: Direct Express Stimulus Check Deposit Date March 2021

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and youll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didnt seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. Youll be able to claim the rest of the stimulus payment when you file your next tax return.

Claim It On Your 2020 Taxes

The IRS just announced that it would begin processing 2020 tax returns on Feb. 12. If you are due a stimulus check but havent received the money by the time you file, claim it on your return. Line 30 on the 1040 tax form allows you to let the IRS know that you didnt receive your funds.

If youre owed a refund on 2020 taxes, the IRS will add the stimulus money to the amount youre due to receive. If you owe money on 2020 taxes, the IRS will subtract the stimulus money from the amount you need to pay. For example, if youre due $1,200 in stimulus funds but owe $1,500, the IRS will keep the $1,200 as a payment toward your total tax bill, and you will owe $300.

Recommended Reading: Update On The Stimulus Package

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

You May Like: When Did The First Stimulus Check Come Out

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Dont Miss: What Is Congress Mortgage Stimulus Program