File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How The Former Stimulus Check Portal Worked

The old “Get My Payment” tool that was taken down allowed you to:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

To access the tool, you were asked to provide a:

- Social Security Number or Individual Tax ID Number

- Street address and

- Five-digit ZIP or postal code.

If you filed a joint tax return, either spouse could access the portal by providing their own information for the security questions used to verify a taxpayer’s identity. Once verified, the same payment status was shown for both spouses.

If you submit information that didn’t match the IRS’s records three times within a 24-hour period, you were locked out of the portal for 24 hours. You were also locked out if you previously accessed the system five times within a 24-hour period.

For third-round stimulus checks, the “Get My Payment” tool displayed one of the following:

1. Payment Status. If you got this message, a payment been issued. The status page showed a payment date, payment method , and account information if paid by direct deposit.

2. Need More Information. This message was displayed if your 2020 tax return was processed but the IRS didn’t have bank account information for you and your payment had not been issued yet. It also may have meant that your payment was returned to the IRS by the Post Office as undeliverable.

Third Stimulus Checks Are Being Sent Through 2021 But Be On The Lookout For Scammers

For months, millions of Americans have been wondering if they will receive a fourth stimulus check this year.

The IRS has warned that scammers are sending fake e-mails about the third round of stimulus checks to steal peoples financial and/or personal information.

While millions of Americans have received the third-round stimulus checks worth up to $1,400, which was part of the American Rescue Plan signed into effect by President Joe Biden in March, the IRS will be sending payments through 2021.

CNBC reports some people who qualify still havent received their third stimulus payment, and scammers are sending e-mails to take advantage of this. In the emails, it asks people to click a link to claim their third stimulus check. Cristina Miranda, whos an official in the agencys Division of Consumer and Business Education, says the link is a trick.

If you click it, a scammer might steal your money and your personal information to commit identity theft, she added.

According to CNBC, its regarded as an impersonator scam. Its when scammers pretend to be from the IRS, Social Security Administration, or Centers for Medicare and Medicaid Services.

Close to 12,500 Americans have filed fraud reports during the pandemic due to scams.

Read more at CNBC.

Recommended Reading: How Much Was The Stimulus Check In March 2021

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Sign Up For Stimulus Check

How To Get Your Stimulus Checks If You Still Haven’t Received Payment

While Congress considers whether to issue a fourth round of stimulus checks, some people haven’t received their older checks.

The first and second stimulus check amounts were for $1,200 and $600, respectively. The third was for $1,400. Here’s how to get your stimulus checks if you haven’t received them yet.

Firstly, some people haven’t received checks because not everyone qualifies for them. You aren’t eligible if your previous IRS tax filings show that you’re a single person who makes over $75,000 annually, a head of household who makes over $112,500 annually, or a married couple who jointly reports over $150,000 annually.

Some are also ineligible due to restrictions on age and dependent status. If someone claimed you as a dependent in their previous tax returns and you were 17 years old or older on January 1, 2020, then you weren’t eligible for the first two checks, according to CNBC.

The IRS and the Social Security Administration have also said that people may not have received stimulus checks because they didn’t file their 2020 taxes. They urged them to file for 2019 and 2020 even if they’re not legally required, in order to ensure that all eligible people receive their payments.

Even if you owe the IRS money, you should still receive your stimulus checks or the aforementioned 2020 Recovery Rebate Credit. The IRS won’t withhold those funds.

Who Should Apply For A Recovery Rebate Credit

The IRS has prepared a special worksheet for Americans who think they might be eligible for a Recovery Rebate Credit on their 2020 tax return. Youll have to fill that out when claiming your credit. But there are a few groups of people who might want to pay close attention in particular.

The 2020 tax return is the great corrector for all changes, issues or lost money that you didnt receive with your stimulus check, says Mark Steber, senior vice president and chief tax officer at Jackson Hewitt. You may be due $1,200, $1,800 or $2,400. The skys the limit if youve got three children and are married and havent gotten your payment.

Also Check: How Do I Claim My Third Stimulus Check

Read Also: How Much Was Last Stimulus Check

The Payments Are Still Rolling Out So Dont Worry

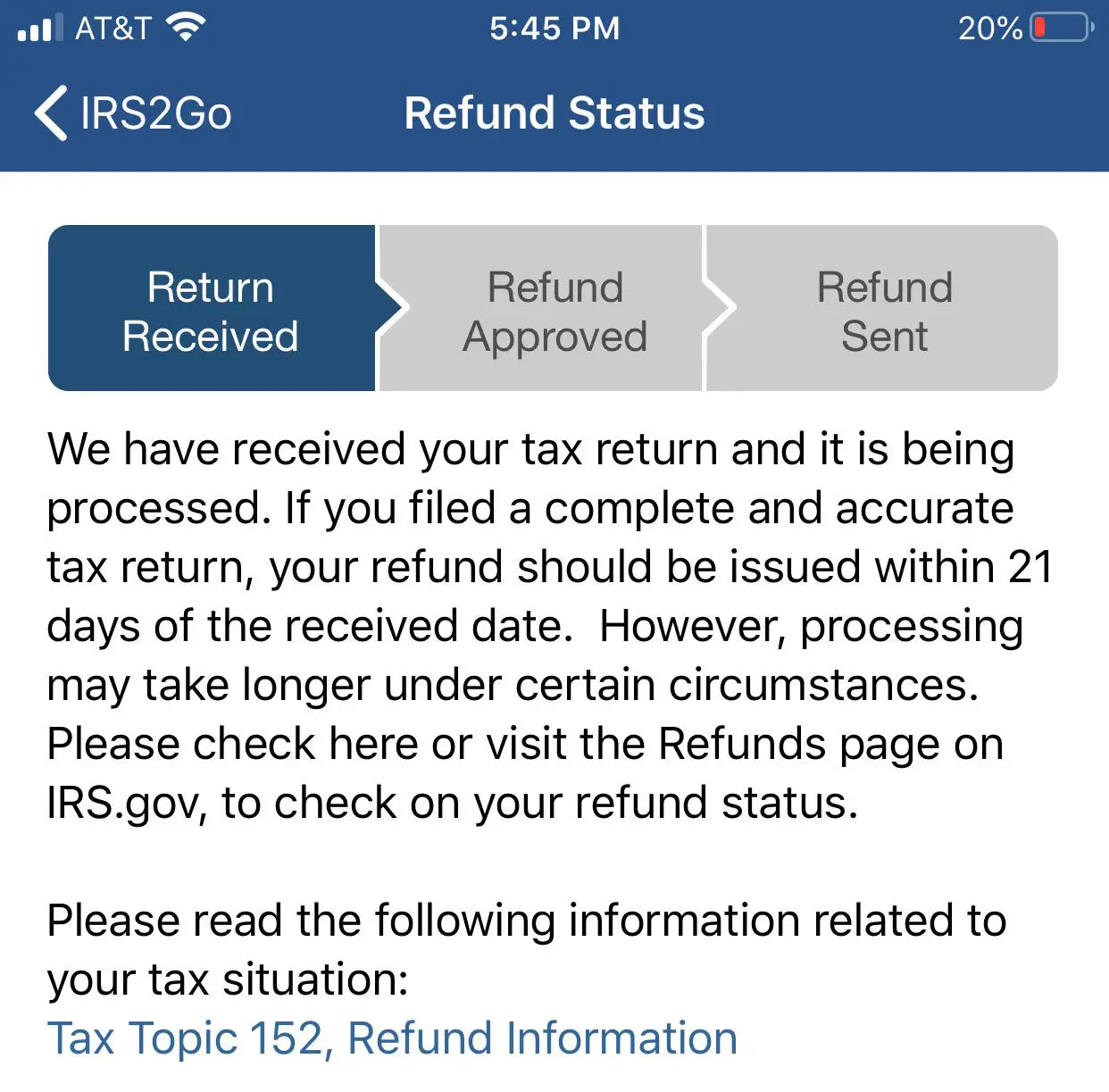

If you havent gotten your third stimulus check yet, dont worry. While the majority of third stimulus check payments have gone out to the people who are owed them, the IRS has until the very last day of 2021 December 31 to send out all of the third checks.

And they are still sending out checks regularly. The most recent payment batch went out on April 21, to over 2 million Americans, in a combined form of direct deposit and paper checks, alongside 700,000 plus-up payments, which are being sent out weekly, per the IRS and other publications.

That way, if the IRS doesnt have someones full information on file, or if you made a mistake while filing your tax returns, they have the time to square away all of the relevant information and send it out to you at the correct amount you owe.

Also Check: Who Qualifies For Golden State Stimulus

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were already approved by Congress in December 2020, and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

Also Check: How Many Stimulus Checks Were There In 2020

Recommended Reading: Netspend All-access Stimulus Check

Third Stimulus Check: How To Claim If I Dont File Tax Returns

On the IRS non-filers tool page, it explains that if the last time you used the Non-Filers tool to register for an Economic Impact Payment , you must complete and print a paper 2019 Form 1040 or 1040-SR tax return, write Amended EIP Return at the top, and mail it to the IRS.

The IRS will use the information they have on file from 2019 or 2020, whichever is the most recent when they get the order to send out the payments. However, there are individuals that will file for the first time in 2020 and those who havent filed in prior years. In the fall, the IRS was trying to locate some 9 million non-filers who were due a stimulus check but hadnt received one yet due to a lack of information. They continue to do this.

How will the American Rescue Plan impact you? Share your story with us:

The White House

If you were due a stimulus check from the previous two rounds or didnt receive the full amount due to you because your economic situation changed in 2020, you can claim those funds through the Recovery Rebate Credit on your 2020 income-tax filing. The filing deadline is 15 April this year, although victims of the winter storms in Texas have an extension until 15 June.

The IRS urges taxpayers to visit IRS.gov the official IRS website to protect against scam artists. The IRS has issued a warning about coronavirus-related scams.

You May Like: Where My Second Stimulus Check

When Can Social Security Recipients Expect The Stimulus Check

There has been a delay getting the third payments to around 30 million people who receive benefits from Social Security, Supplemental Security Income, the Railroad Retirement Board and Veterans Affairs, because the Social Security Administration did not send the IRS the necessary paperwork.

But the IRS should have received the information it needed to send the payments last Thursday, and announced Tuesday that many Social Security beneficiaries and many others who dont normally file taxes will start getting their payments by April 7.

Don’t Miss: Were There Stimulus Checks In 2021

Stimulus Checks Are Being Sent Out In January Find Out If You Will Get A $1400 Payment

- 18:10 ET, Dec 30 2021

STIMULUS checks are being sent out in January with Americans urged to find out if they are eligible for a $1,400 payment.

The third stimulus checks, officially known as Economic Impact Payments, were sent to Americans who earned less than $75,000 as an individual, or $150,000 for a married couple.

Americans who could see a $1,400 payment in 2022 include parents who welcomed a new baby in 2021.

Read Also: Senior Citizens Stimulus Check 2021

When Are Stimulus Checks Being Sent Out

Heres the rough schedule so far, courtesy of a House Committee on Ways and Means memo:

- week of April 13: the IRS will send out 60 million payments to taxpayers for whom it has direct deposit information from their 2018 or 2019 tax returns

- late April: the IRS will do a second run of payments to Social Security beneficiaries who didnt file tax returns in 2018 or 2019 but do have direct deposit on file

- week of May 4: the IRS will start mailing paper checks at a rate of 5 million per week â a process that could last up to 20 weeks

You May Like: Will I Get The Stimulus Check

My Stimulus Payment Went To The Wrong Bank Account

If the Get My Payment tool tells you your check will be direct-deposited, it will also provide the last four digits of the number of the bank account into which your stimulus payment will be deposited. For the initial checks, some individuals saw that their deposit was going to an old bank account, or they even saw bank account numbers that they didnt recognize. Heres what to do:

- If the tool says that your payment was deposited into your bank account but you havent seen it yet, your bank may still be processing it.

- You wont necessarily get the third check direct deposited, even if the first or second one was direct deposited.

- If your third stimulus payment is sent to a closed bank account, the bank is required to transfer the money back to the IRS. The IRS will not redeposit it to you or mail you a paper check. Instead, you will have to file your 2021 tax return to claim your Recovery Rebate Credit. See below for instructions on claiming the rebate on your tax return.

- If H& R Block submitted your last tax return and you signed up for a refund transfer, the IRS might deposit your stimulus payment with H& R Block . H& R Block should transfer the money to your bank account within 24 hours.

- Those who submitted their last tax return with Turbo Tax should receive their payments in the same bank accounts through which they received their tax refunds.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Recommended Reading: How To Check Stimulus Payment History

How To Qualify For The Third Stimulus Payment If You Dont File A Tax Return

If you dont normally file a US tax return and youve missed the cut off to apply for a stimulus payment you can still qualify by entering your Social Security Number or Individual Tax Identification Number onto the non-filer tool on the IRS website.

The tool will require information about your income, your full address, contact details and bank account information. It can take 2-3 weeks for the for the IRS to process the information and send out a rebate confirmation once submitted.

Remember, just because you dont have to file a US tax return, it doesnt mean you cant. You can always file a US tax return and claim your missing stimulus payments.

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

Don’t Miss: Stimulus Checks For Seniors On Social Security